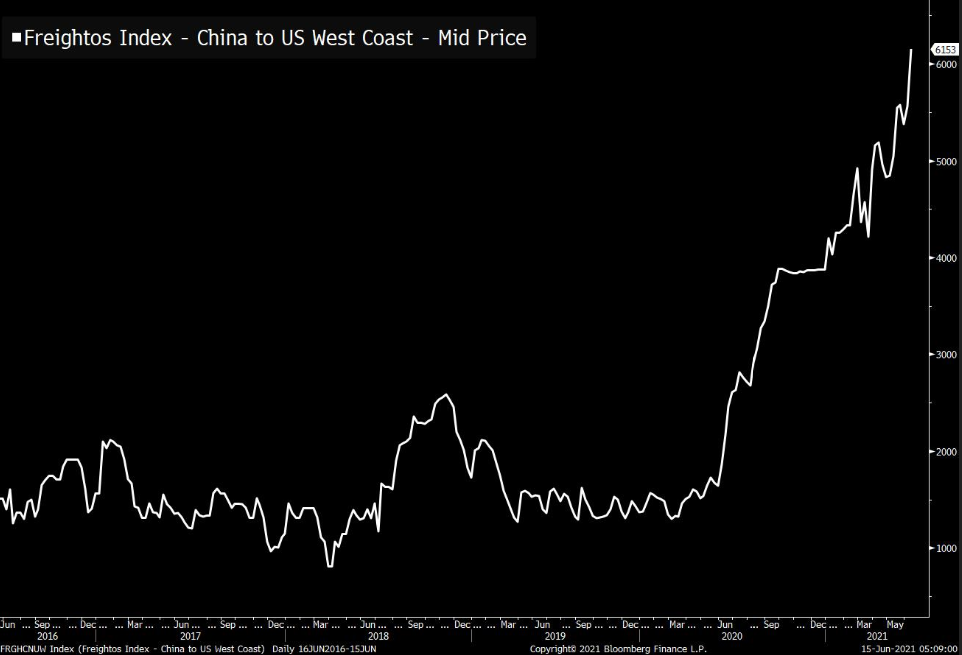

| A big deal, China hits back at Biden, and retail sales data due. Finally The U.S. and the European Union are expected to announce a five-year truce in their 17-year dispute over aircraft subsidies to Airbus SE and Boeing Co. later today. In 2019 the long-running disagreement led the allies to impose tariffs on $11.5 billion of each other's exports. The deal has also been driven by the emergence of Commercial Aircraft Corp. of China, or Comac, as a competitor to the two planemakers. Very illSpeaking of trade and China, the world's second-largest economy hit back at President Joe Biden's efforts to build a coalition to counter Beijing. Chinese Foreign Ministry spokesman Zhao Lijian said "the U.S. is ill and very ill indeed," as he responded to Biden's diplomatic efforts at the G-7 and NATO meetings. In Washington today the House Science Committee will consider two bills that will strengthen U.S. research and development in response to China's rise. Sales Headline U.S. retail sales are expected to have shrunk 0.7% last month. Core sales, stripping out volatile auto and gasoline numbers, are expected to be unchanged from April. The data comes as the Federal Reserve's Open Market Committee begin their two-day meeting in Washington. While there is an update to economic projections at tomorrow's meeting, economists are not expecting any announcement on asset purchase tapering until Jackson Hole in August at the earliest. Markets riseGlobal equities are pushing higher again as investors remain calm over the prospect of any major moves from the Fed tomorrow. Overnight the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 0.8% higher, with shares in Toyota Motor Corp. topping 10,000 yen for the first time. In Europe the Stoxx 600 Index had gained 0.2% by 5:50 a.m. Eastern Time. S&P 500 futures pointed to a small move into the green at the open, the 10-year Treasury yield was at 1.485%, oil held over $71 a barrel and gold slipped. Coming up... As well as retail sales we also get Producer Price Inflation for May and Empire Manufacturing for June at 8:30 a.m. Industrial and manufacturing productions numbers are at 9:15 a.m. April TIC flow data is at 4:00 p.m. Oracle Corp. and H&R Block Inc. are among the companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere are some areas of the economy where it looks like supply chain tensions and bottlenecks and shortages are starting to ease just a little bit. Housing is one area. Lumber, for example, just had its biggest-ever weekly decline in price recently. But some crucial areas, like global freight, are still getting worse. Here's one index used to gauge the cost of shipping goods from China to the U.S. West Coast. It started taking off like a rocket last summer with the recovery, and as you can see it hasn't slowed down at all.  Now there are numerous reasons for the surge in shipping costs, which we discuss on the latest episode of Odd Lots with Anton Posner and Margo Brock of Mercury Resources, but one contributor to all the problems in logistics right now is shoddy or out-of-date infrastructure. Tracy Alloway posted the transcript this morning, and this section really stood out to me: Anton: Should we do a whole other episode guys on infrastructure too, because you know, when Margo touched on it, the size of these container ships, when we first got out of school and I went to work for it used to be Neptune Orient Lines, now it's American President Lines. I was working in Port Newark, working ships that were five, 6,000 TEU container ships. Those are TEU means 20 foot equivalent units. So that means that that ship could hold five or 6,000 20-foot containers right now. And that was like, kind of ship on the little bit of a larger size or medium size at that point, that ship the EverGiven that got stuck in the Suez Canal was what, 20,000 TEUs? I mean, massive. So imagine that ship calling in a port that hasn't been sufficiently upgraded to deal with, not only the actual ship operations, right, but as Margo said also, just the flow of the containers off the ship, out the door, off the dock, onto trucks and the flow of empty containers coming back to those ports. Some ports in the United States have significantly upgraded in some areas they made large improvements to deal with these very large container ships, but nowhere nearly enough. So, you know, it certainly leads into the infrastructure discussion, right? So we're seeing, you know, the I-40 bridge right in Memphis falling apart. And it stopped up the barge traffic on the Mississippi River for days because of chunks of a bridge falling. Not only that, but trucks couldn't transit over it. So we're seeing everything collide. Margo: Anton, no chunks fell off the bridge. Anton: You're right. It wasn't chunks. It was a crack in the steel. Margo: They said it was a crack. It was a crack you could see daylight through. It was kind of massive. Nothing fell into the river. Anton: Either way I don't want to be on a tugboat under it, put it that way.

So the ports in the U.S. haven't kept up with the increasing ship size at all. This creates longer unload times for the ships, which causes delays, slower turnaround times, etc. And then on top of that our internal waterways are crumbling, further impeding the flow of goods domestically. One of the things I like to talk about around here is how our entire conception of "paying for it" is totally off. If we do some big infastructure project, people imagine that we either have to pay for it with taxes now, or "the children" will have to pay for it one day down the road. But the reality is the opposite. What we're paying for right now -- in the form of higher prices on various goods -- is in part the lack of investment in key infrastructure in the years and decades leading up to the crisis. The whole discussion is worth reading or listening to here. I learned a ton from it.

Joe Weisenthal is an editor at Bloomberg

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

|

Post a Comment