| Hello. Today we look at whether President Joe Biden's investment push is likely to get support from Republicans, the American infation outlook and prospects for an acceleration in the global economy in the second quarter.

The Battle Over Infrastructure It was a running joke during the Trump administration that every week was infrastructure week.This week will provide a good idea as to whether there's political space for a bipartisan deal on a major new U.S. infrastructure initiative now that Joe Biden is president. Biden and congressional Republicans start out far apart. The White House is pushing a $2.25 trillion plan that includes items like money for elderly care the GOP says shouldn't count as infrastructure. A handful of Republicans have floated a $568 billion, more-targeted proposal. The partisan reactions to Friday's shockingly weak U.S. employment report didn't augur well for talks on government spending. - Republicans blamed supplemental unemployment benefits extended in Biden's March pandemic-relief bill for effectively paying Americans to stay at home, leaving job openings unfilled

- Democrats said the undershoot instead showcased the need for more federal help

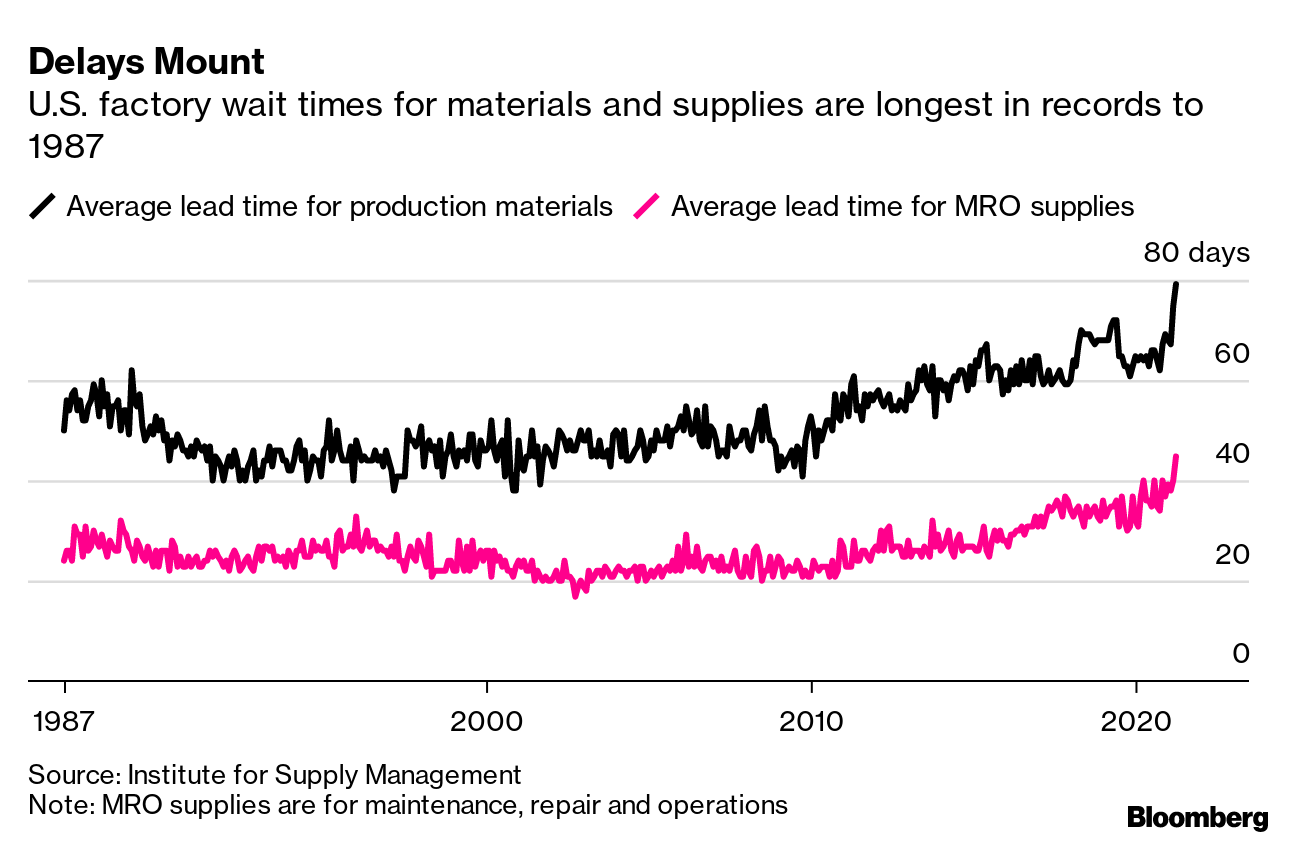

So, what's next? On Wednesday, Biden will host the top Republican and Democratic congressional leaders at the White House for the first time, and it will be important to watch the tone set in that confab to determine how serious the chance is for talks on a bipartisan infrastructure compromise.  GOP leaders Mitch McConnell, left, and Kevin McCarthy. Photographer: Drew Angerer/Getty Images North America The next day, the president hosts GOP senators to talk specifically on a bill. If the two sides remain as far apart as now, Democrats will likely decide to proceed on their own. The bigger the package that starts to shape up, the more intense the debate will be about budding inflationary pressures. Whether policy-driven or not, Friday's unexpectedly small jobs gain showcased the impact of shortages across the economy — from workers to semiconductors. Companies in the first quarter had to shell out the largest quarterly increase in worker pay since 2003. With U.S. consumer and producer price reports looming Wednesday and Thursday, this week could prove influential in setting the course of debate for the rest of the year. —Chris Anstey The Economic Scene As Chris noted above, there will be lots of fresh insights into U.S. inflation this week. Reade Pickert and Vince Golle show price pressures are already picking up in America's industrial heartland, forcing some companies to raise the cost of their products. Today's Must Reads - The calendar. Friday's retail sales report will fight the inflation data for top billing in the U.S. this week in the wake of those disappointing jobs figures. Key emerging market economies also release a string of inflation data. The U.K. publishes its report on gross domestic product on Wednesday.

- Digital yawn. China is getting closer to rolling out the world's first major sovereign digital currency, triggering warnings it could undermine the dollar's role as the world's reserve currency. Talk to people who've actually used it in China, and you're more likely to get a different response: shrugs of indifference.

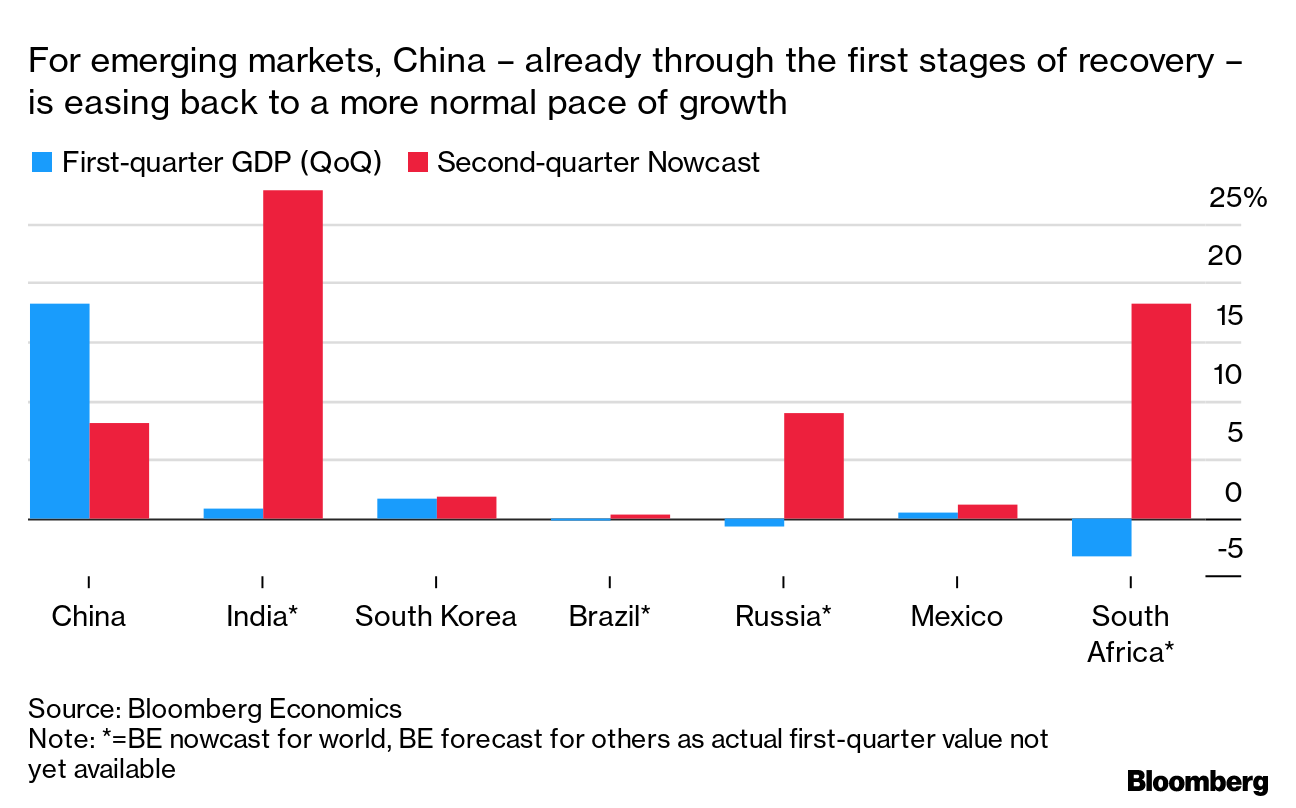

- India double hit. India's poor depleted their modest buffers when coronavirus lockdowns froze the economy last year and were just starting to get back on their feet to drive the recovery. Now, the savage virus wave is hitting them hard again, posing the risk of a double whammy for Asia's third-largest economy.

- Australia budget. Australia's fiscal authorities are taking a leaf out of U.S. Treasury Secretary Janet Yellen's playbook in deploying spending to push the economy toward maximum employment.

- Crisis recovery. Greece is betting its sun and sea can attract Swedish retirees, Saudi businessmen and digital nomads of all stripes to invest far away from home.

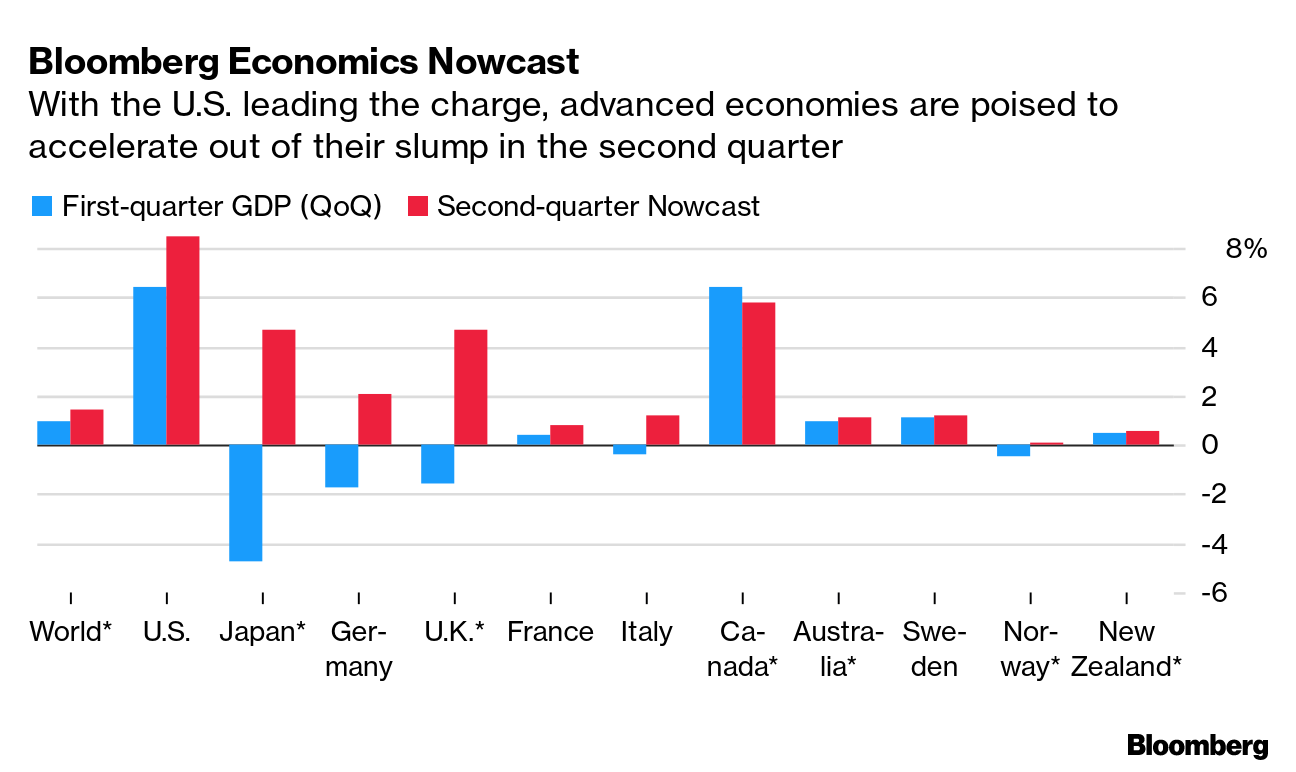

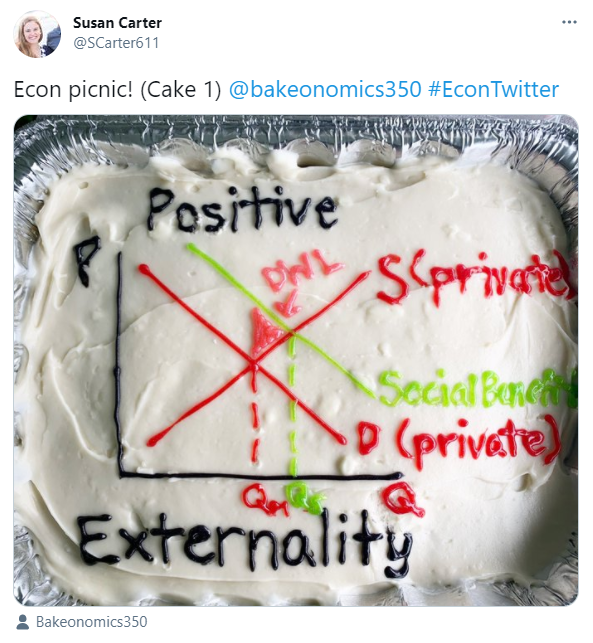

Need-to-Know Research  The world economy pushes into the second quarter with re-opening across the U.S. and Europe set to drive growth to an annualized 5.7%, up from 4.1% in the first quarter. That's the latest signal from Bloomberg Economics nowcasts, which bring together close to 200 data series across 17 countries to provide a high frequency read on the recovery. Read the full research on the Bloomberg Terminal On #EconTwitterThe baking craze knows no boundaries.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment