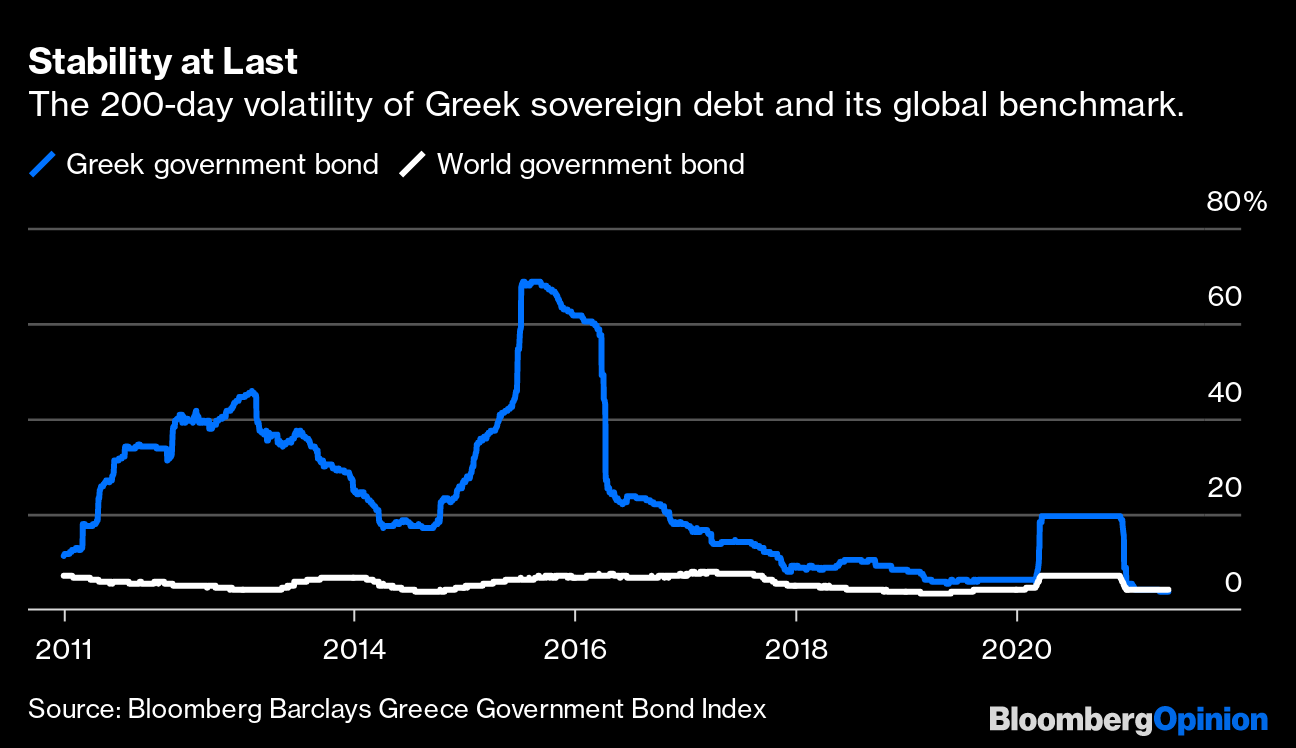

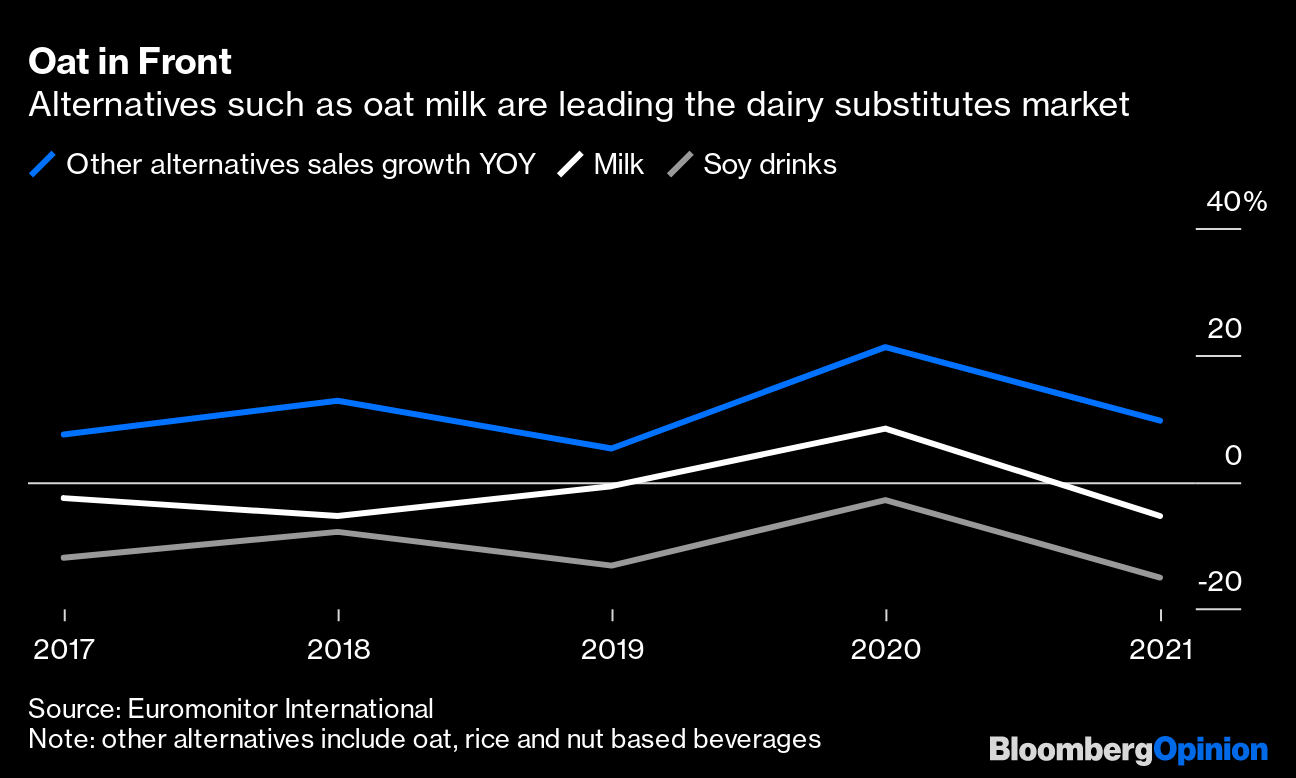

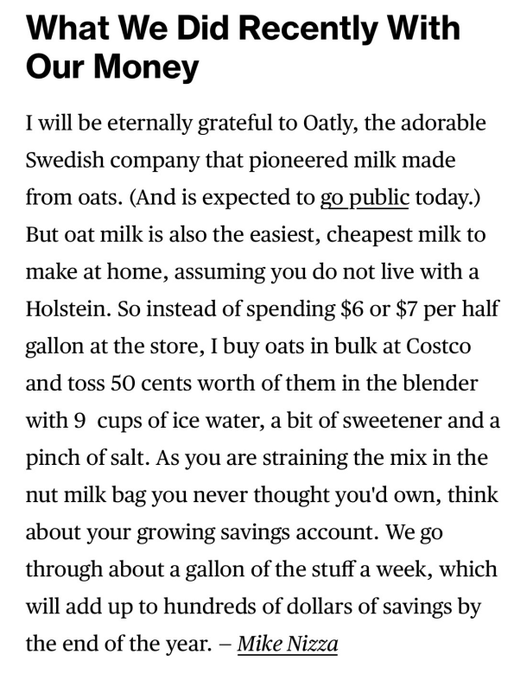

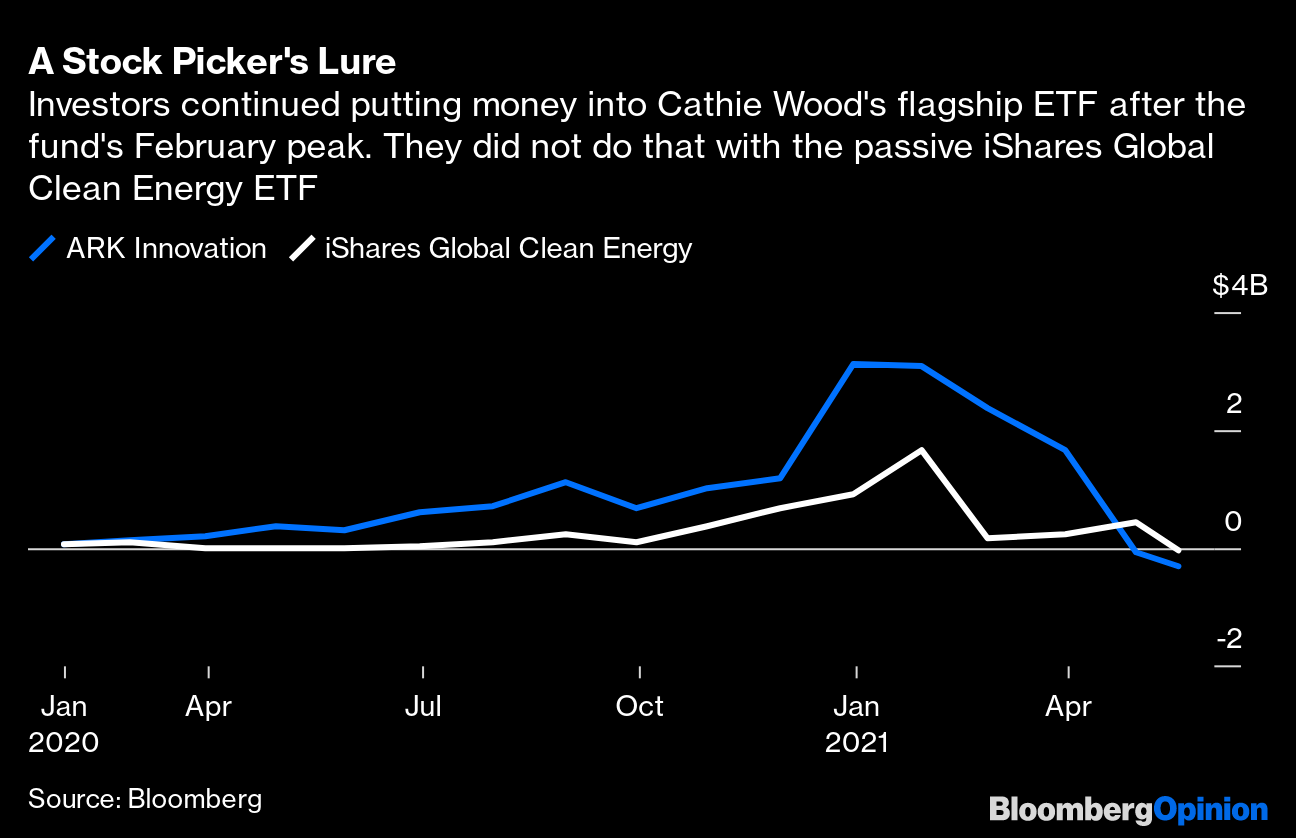

| This is Bloomberg Opinion Today, a housing development of Bloomberg Opinion's opinions. Sign up here. Today's AgendaInflation: Now Slightly More TransitoryReal estate is bonkers these days.  Take it from one New Jerseyan (New Jerseyite?): This is only barely an exaggeration. But, contra inflation-panicked markets, there is hope. High home prices are one of the worst kinds of inflation, given how much of our incomes we sacrifice on them. But in the hot housing market, there is evidence of a cooldown, writes Conor Sen. Instead of passing on exorbitant lumber costs to home buyers, builders are actually slowing down construction in the middle of a boom. Sawmills aren't rushing to expand capacity. You can't have an inflationary death spiral if everybody just goes on a buyers' strike when prices get too high. If you insist on continuing to stress about inflation, or just want a little hedge, as a treat, then you should consider Treasury Series I savings bonds, writes Brian Chappatta. These things have ridiculously high yields — close to junk bonds — and they adjust for inflation. You won't be able to buy a New Jersey house with your winnings, but you will have the financial wherewithal to make amusing memes in your spare time. And remember: The Fed may get stuff like inflation wrong, but markets do too. Remember when Greek debt was poison that was going to destroy the country's economy and all of Europe? Now it's the best-performing sovereign debt in the world, writes Matt Winkler. You just never know.  Crypto Is Fine, ActuallyThis newsletter made fun of Bitcoin's terrifying bungee-jump yesterday. In imitation of the crypto market's maturity and stability, this newsletter will now lavish crypto with praise. Yes, sure, Bitcoin has just suffered yet another epic collapse. But it has done this before and always comes back eventually, writes John Authers. There's every reason to expect it will do so again. Diamond hands to the moon, et cetera. And the series of tubes through which cryptocurrencies trade did not buckle under the weight of all the volume yesterday, notes Jim Bianco. That's more than you can sometimes say for old-timey markets. In this way, wasn't Bitcoin's garbage fire at the disaster factory really kind of a win? Vaccines: More, FasterPresident Joe Biden has taken a few recent steps to get more vaccines to the world. It's not even close to being enough, writes Bloomberg's editorial board. The U.S. must stop futzing around with patent waivers and teensy donations and really just go ham on a vaccination campaign. That means ramping up production around the world, shipping out hundreds of millions of shots and overseeing them getting into people's arms, for starters. Anything less will be a moral, economic and health-care failure. Fortunately, and kind of unbelievably, there are many more Covid vaccines still in development, writes Max Nisen. Several of them could help address the global vaccine scarcity and fight the pandemic. Bonus Vaccine Reading: A lottery encouraged people to get vaccines in Ohio. Maybe lotteries will get people to do other stuff too. — Noah Smith A Cease-Fire Is Only the BeginningIsrael and Hamas have agreed to a cease-fire in their latest battle. This is welcome news, although it should not be the end of the story. Another deadly conflict is inevitable, warns Hussein Ibish, unless both sides face pressure from their allies to make real reforms. Both Israel and Hamas have too much to gain from the occasional bloodshed. For one thing, Biden must make sure the cease-fire includes steps to free Palestinians from Hamas influence, writes Eli Lake. This includes finally holding long-delayed Palestinian elections and keeping aid out of the group's hands. Telltale ChartsOatly's IPO is cashing in on the oat-milk fad, though the stock is already expensive, writes Andrea Felsted.  Oat milk is frankly kind of expensive too, compared to what Bloomberg Opinion's frugal gourmet Mike Nizza cooks up:  "The Nut Milk Bag You Never Thought You'd Own" will be the title of my band's next medieval folk album. Thanks, Mike! With an active manager with convictions like Cathie Wood, at least you know what you're getting, writes Shuli Ren. ETFs may be less volatile and risky, but they're also not always delivering what's on the tin.  Further ReadingMorgan Stanley's reshuffling shows it missed that whole "diversity" trend of the past, oh, decade or so. — Elisa Martinuzzi China hopes to turn its bad debt into good debt. This won't work. — Anjani Trivedi Mario Draghi has restored Italy's reputation and stability. It can't last, given Italy's awful politics. — Rachel Sanderson Dems should threaten to make Republican senators explain their vote against a Jan. 6 commission. — Jonathan Bernstein The wealthy shouldn't rush to switch to Roth IRAs just yet. — Alexis Leondis ICYMITreasury wants to tax big crypto transactions. Some vaccines are helping more than others. New $260 million park just dropped. KickersCement buildings can become batteries. (h/t Mike Smedley) Cicadas are weirdly photogenic. (h/t Scott Kominers) Sperm counts are plunging in the rich world. Or are they? And here for some reason is Angelina Jolie covered in bees for World Bee Day:  Notes: Please send bees and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment