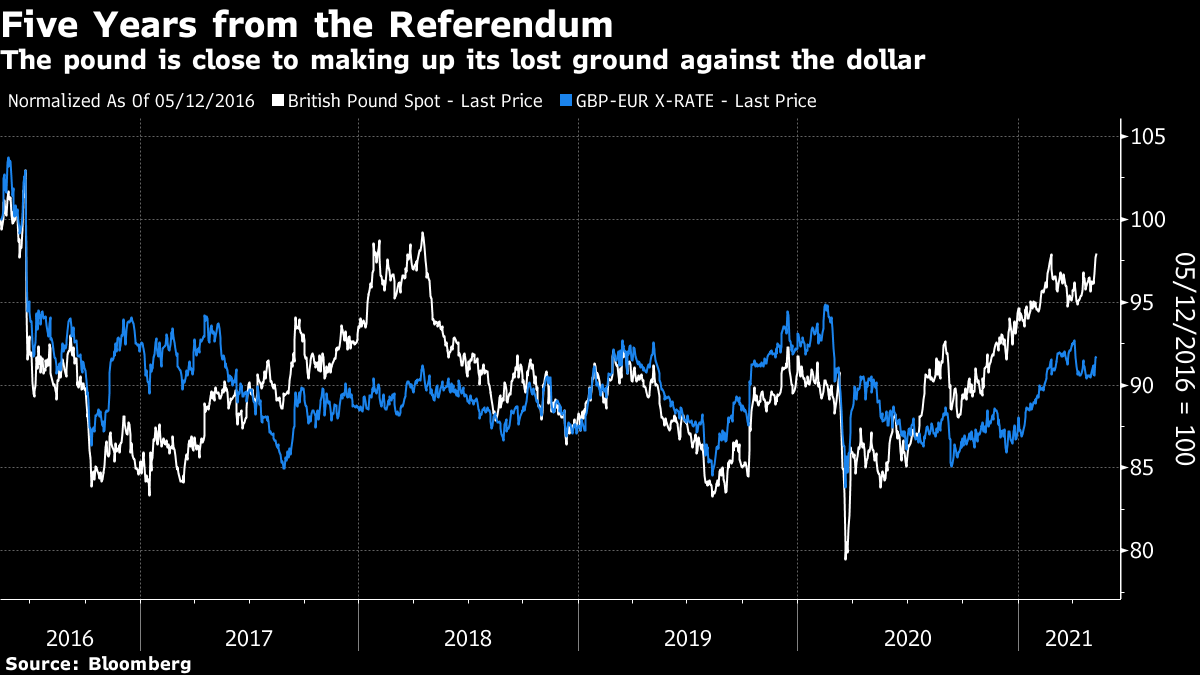

| This is Bloomberg Opinion Today, a consumer price index of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Sum of All Inflation FearsIn "Star Trek," in the 24th century, if people want food, they just yell at a replicator to make some tandoori chicken or something, and out it pops. Here in the dark ages of the 21st century, the food and other stuff we want must be tediously produced and transported to us. And sometimes it gets stuck in the Suez Canal or the Colonial Pipeline or wherever, and then we have to pay a bunch more money to get it. This can be called "inflation," but that's a loaded word these days. There's oh-no-my-tandoori-chicken-is-stuck-in-the-Suez-Canal inflation, and then there's 1970s death-spiral inflation. Right now we appear to be experiencing the Suez Canal kind, with supply unable to meet a surge in demand, pushing CPI to its biggest gain in 12 years last month. The Fed, our inflation doctor, tells us not to worry about this lasting. But Mohamed El-Erian warns that after too many months like this, people might start to think we're going back to the days of Whip Inflation Now buttons and double-digit mortgage rates. Just as the gasoline hoarding we warned you not to do made gas shortages a self-fulfilling prophecy, inflation fears can fuel inflation. The Fed can't let such psychology take root, Mohamed writes. And if inflation is a forest fire, then there's a lot of kindling on consumer balance sheets, writes Brian Chappatta. New Fed data show Americans took a stimulus-enhanced surge in income and paid down credit-card debt, leaving them with massive spending power for when the economy normalizes. That could give businesses pricing power to match. Higher inflation naturally means higher interest rates. Declaring the end of the bond bull market has been a losing game for the past several decades. But Bill Dudley argues it's really dead bull meat this time, with 10-year Treasury yields likely to double from here. Hedge funds have loaded up on higher-rate bets to at least guard against any tantrum the bond market might throw when the Fed starts to cut off its money supply, writes Mark Gilbert. But what if the Fed doesn't mind all this inflation talk at all? How soon we forget roughly two decades of worrying about deflation and how utterly our inflation doctor failed to raise the economy's blood pressure. In fact, the Fed welcomes your inflation fears, Karl Smith writes. It has declared it's targeting an average rate of long-term inflation not seen in years. Sticking to this plan and riding out any Suez Canal inflation will fend off a bond tantrum and, more important, avoid snuffing out the recovery and sending us back to even darker ages. Meanwhile, please remember:  The Next Risk of India's Unchecked PandemicIndia's out-of-control Covid outbreak is already a tragedy of unnecessary suffering and death. But it can still get worse, and not just for India. The virus has had so many chances to multiply in India that there's now a new variant, B.1.617, which might spread more easily, writes Andy Mukherjee. It could also make vaccines less effective. And it's already spreading in Asia, which means it's probably already global. Narendra Modi's government can still mitigate the damage by doing a better job of genomic sequencing to track this and other, potentially worse, variants, Andy writes. Meanwhile, the West must stop fussing over vaccine patents and just get as many shots to India and other developing countries as quickly as possible, writes Bloomberg's editorial board. It will cost more, but the alternative could be a higher cost than we can bear. Further Pandemic Reading: Colleges really should give students discounts for remote learning. — Stephen Carter Israel Slides From Peace Toward WarWhen he signed the Abraham Accords last August, Israeli Prime Minister Benjamin Netanyahu declared "a new dawn of peace" in the region. He even froze the annexation of West Bank territory as a goodwill gesture. You might have mistaken that as a sign this new peace dawn would shine on Israeli-Palestinian relations. Palestinians were less convinced, considering the recognition of Israel by Bahrain and the United Arab Emirates a sellout. As it turns out, Bobby Ghosh writes, Netanyahu had no interest in making nice with Palestinians. This in turn opened the door to Iran, via its proxy Hamas, to pretend to come to the rescue of an abandoned people. This in turn led to the bloodshed happening in Israel and Gaza right now. If Netanyahu doesn't seek help from his new Arab frenemies, then he shouldn't be surprised when Iran gets even more entrenched and the violence gets even bloodier. Telltale ChartsFive years after the Brexit vote, the U.K. is starting to look like an alluring investment, writes John Authers.  High prices aren't enough to slow down surging demand for iron ore, writes David Fickling, thanks mainly to a real-estate boom in China.  Further ReadingPresident Joe Biden's plans aren't welfare but smart investments in America's economic future. — Tim O'Brien and Nir Kaissar Everybody in the U.S. government seems to have given up caring about oversight of its workings. — Jonathan Bernstein FTC chair nominee Lina Kahn's pinned tweet is a very bad sign for Amazon. — Tae Kim The bond-sale process needs to be more transparent and fair. — Marcus Ashworth Turns out Ray Dalio was right to bet China's markets are maturing. — Shuli Ren Turns out Hertz stock was not such a bad bet last year after all. — Matt Levine ICYMIThe CDC backed giving the Pfizer vaccine to adolescents. Two-day-old cryptocurrency is now worth $45 billion. Restaurants are raising pay to attract workers. KickersThere are giant trolls in the Maine woods. Area elephant is pretty good at cricket. (h/t Scott Kominers for the first two) Neural implant lets a paralyzed person type. Yuppie fashion is back in style. Notes: Please send Stratton Oakmont T-shirts and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment