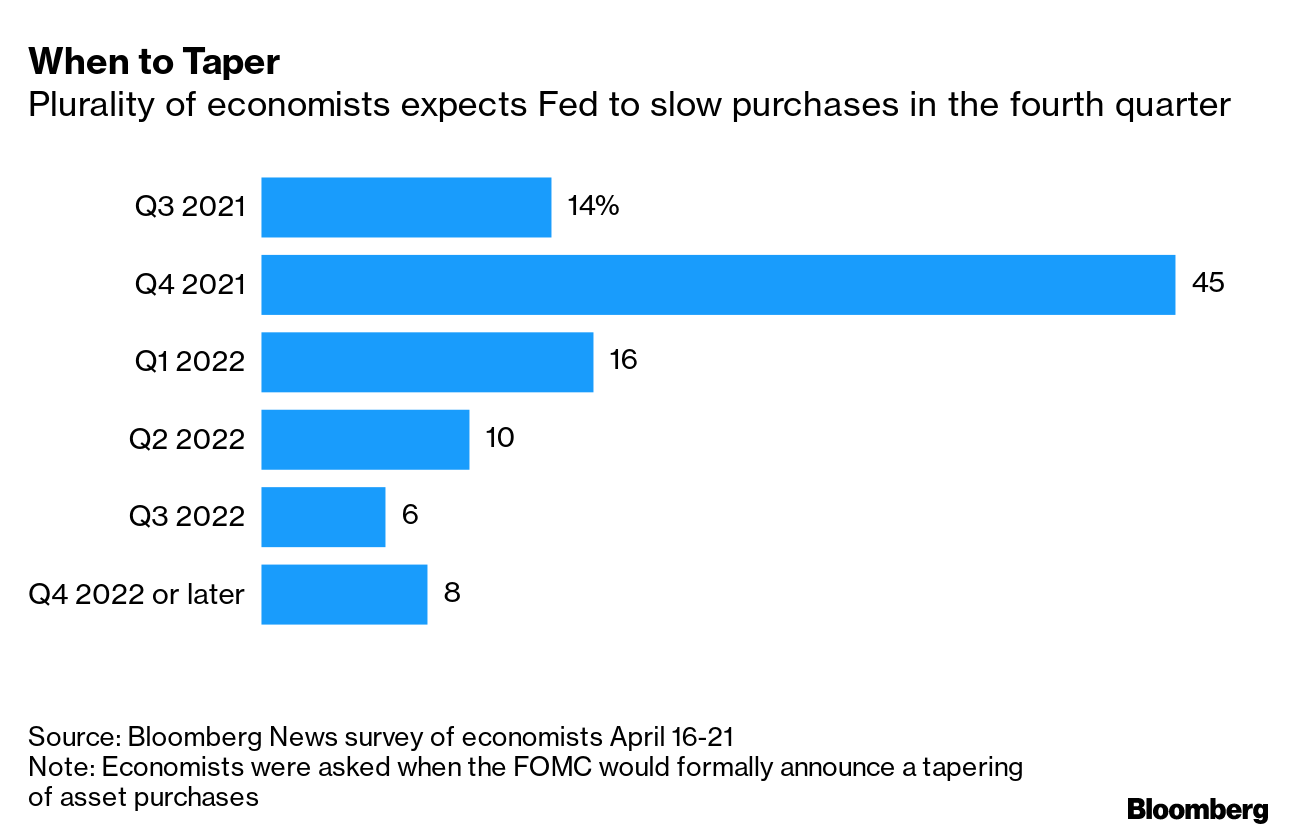

| Hello. Today we look at the Federal Reserve's change in tone, the European labor shortage and the struggles of the Philippines and Taiwan. Time to Taper? The Federal Reserve dealt investors a bit of a surprise on Wednesday. At their April gathering, "a number" of policy makers suggested if the economy continued to heal rapidly "it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," newly released minutes revealed. That's not exactly firing a starting gun for a so-called tapering of bond buying. Indeed, it's not even making the decision to search for the key for the box in which the pistol is stored. But it changes the tone of Fed commentary a bit. Treasuries and stocks duly declined. Some are now wondering when that conversation may begin. A popular date for Chairman Jerome Powell to give the nod is the Jackson Hole meeting in late August. But there are reasons to avoid inking anything into the diary. Remember, Powell said in April that it was still premature to start talking about withdrawing support for the economy. The minutes also showed "various participants" felt it would "likely be some time until the economy had made substantial further progress" toward the central bank's inflation and employment goals.  The minutes also didn't specify which or how many participants favored beginning tapering talks. Some that have spoken publicly about this are not even voters this year, including Dallas Fed President Robert Kaplan. Governor Lael Brainard and others have said the economy still needs aid. The meeting also took place before the disappointing jobs and retail sales reports. As Joe Weisenthal noted yesterday, Citigroup's economic surprise index has been declining recently. Many officials are also keen to run the economy hot in the hope that will help broaden hiring, suggesting a reluctance to withdraw quickly. Black unemployment rose in April to 9.7%. Finally, as Liz Capo McCormick and Rich Miller write today, even if the Fed does scale back, its more than $5 trillion stockpile of assets will make it a major force in markets for years to come. "The Fed is definitely not going anywhere anytime soon with regard to the Treasury market," said Mike Pugliese, an economist at Wells Fargo, which predicts tapering won't begin until January. —Simon Kennedy - Got tips or feedback? Email us at ecodaily@bloomberg.net

- Check out the latest Stephanomics podcast, which examines whether inflationary fears that have gripped the U.S. are just a short-term reaction to surging consumer demand

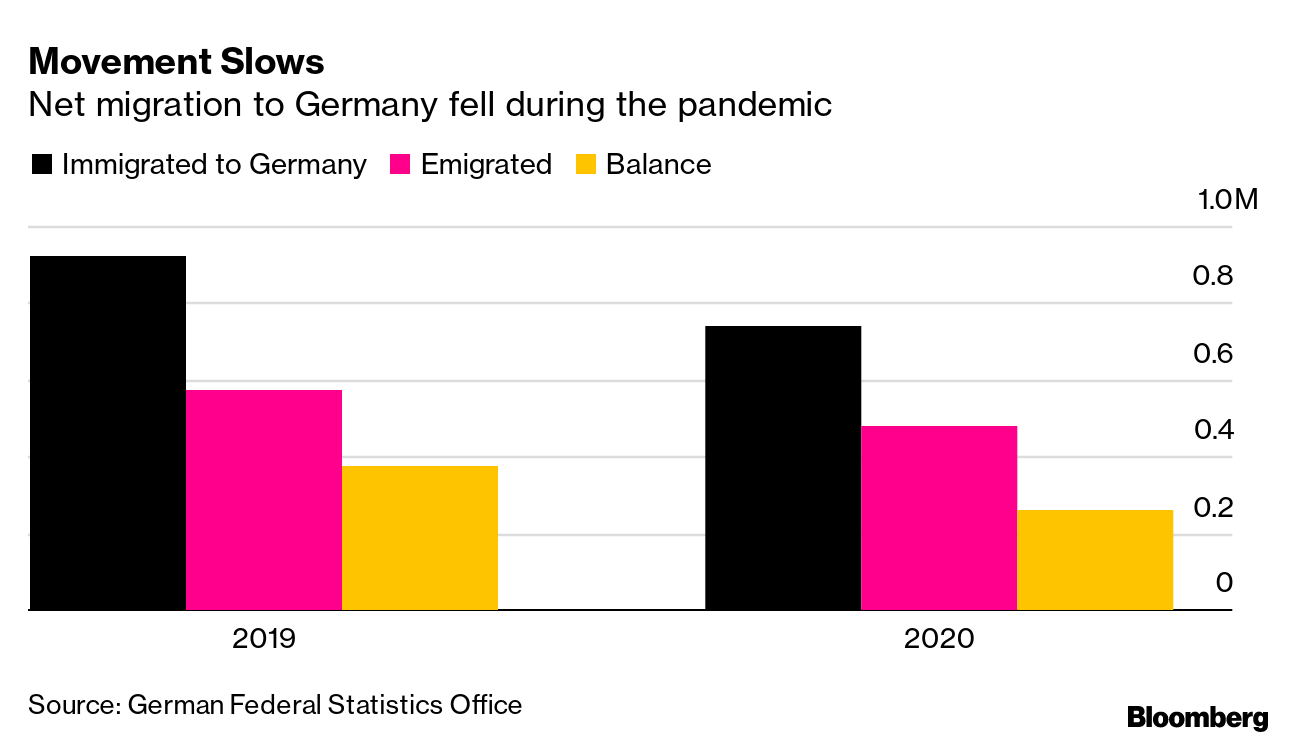

The Economic Scene Europe is on course to face an even deeper labor shortage than the U.S. Coronavirus travel restrictions and Brexit mean workers can't cross borders as easily and the networks and pipelines that provide new workers, such as vocational training programs, have been upended. While governments are set to start dishing out money from a new region-wide recovery fund, that cash is focused on environmental and digital industries that will require specialized workers. Today's Must Reads - Asia's laggard. Having outperformed over the past decade, the Philippines has felt an outsized blow from the pandemic. The virus exposed structural weaknesses that the boom papered over, including a decentralized health-care system and rampant inequality.

- Taiwan stumbles. A surge in coronavirus cases and drought-triggered power outages pose major threats to Taiwan, potentially derailing one of Asia's economic success stories this year.

- Argentina beef. A new ban on exports of Argentina's famed beef won't quell runaway inflation if previous interventions are any guide. Similar restrictions for a decade through 2015 saw ranchers quit, production fall and the pressure on prices resume.

- Colombia cut. The country's credit rating was lowered to junk by S&P Global Ratings after the government's attempt to curb the deficit was blocked by Congress and mass street protests.

- Chinese commodities concerns. China's cabinet increased its rhetoric around surging commodity prices, announcing more specific steps to curb markets in order to keep inflation pressures at bay.

- Inflation flag. Global shortages are driving German producer prices higher at the fastest pace since 2011 — when the European Central Bank last raised interest rates. This time is different, with policy makers determined to keep deploying monetary stimulus to allow the region to heal from its pandemic slump.

- Climate goal. U.K. Chancellor Rishi Sunak is pushing the Group of Seven economies to impose mandatory reporting of environmental risks on their big companies, people familiar with the matter told Bloomberg.

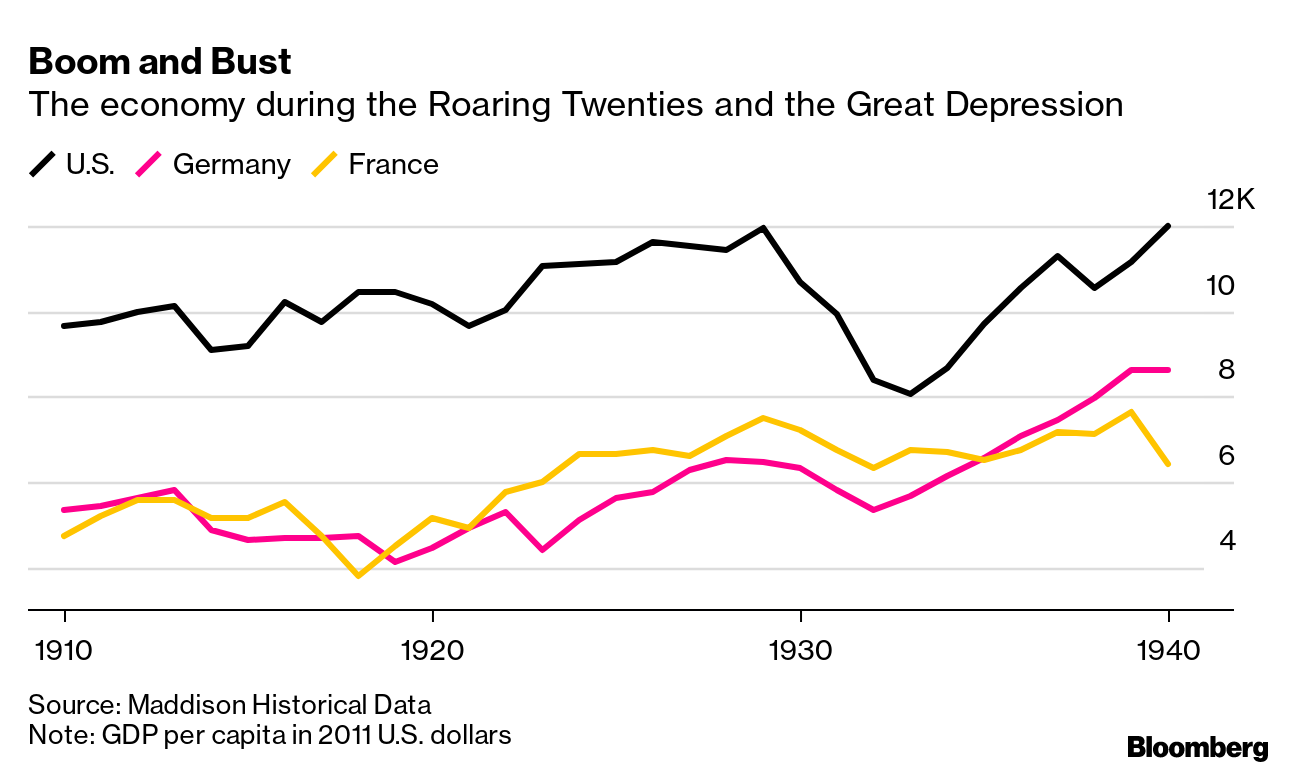

Need-to-Know Research The global economy's bounce-back from the pandemic will echo the so-called Roaring Twenties after World War I, but there's no need for a repeat of the economic collapse that ended that decade, according to German bank Berenberg. Chief Economist Holger Schmieding said in a report that the immediate future will see a release of pent-up demand as leisure and travel reopen, with spending bolstered by excess savings. Beyond that boom, he sees a chance for an extended phase of higher growth rates, based on two "big calls." The long period of balance-sheet repair that followed the collapse of Lehman Brothers is over, and productivity will accelerate noticeably as the crisis and demographic change spur innovation, he said. On #EconTwitterA reading recommendation from a Nobel laureate…  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment