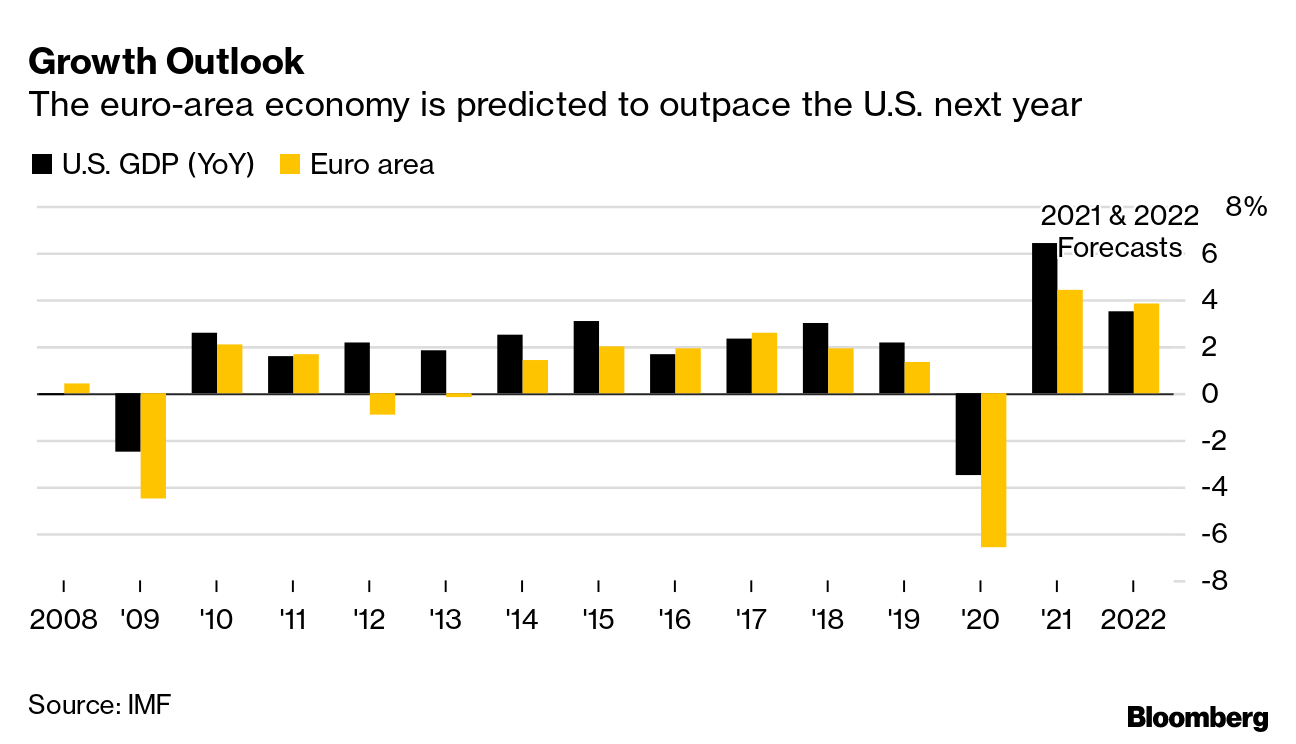

| Hello. Today we look at whether Europe will be the next global growth driver, examine China's census and discuss if inheritance taxes are set for a comeback. A New Leader The European economy just flopped into a double-dip recession, but it already seems to be bouncing back and could even start outpacing the U.S., providing another engine for global growth. Among the reasons for optimism: economies are reopening, the delivery of vaccinations are finally accelerating and the European Union's multi-year joint stimulus fund is set to take off to complement already ultra-loose monetary policy. By the third quarter, economists at Goldman Sachs reckon euro-area output will be accelerating at an annualized pace of 13%. In contrast, they think U.S. growth will peak at 10.5% in the current quarter as the pace of vaccinations slows. "The continent is well-placed for a period of substantially above-trend growth if the path of the virus in coming months resembles what we have seen in other economies with successful vaccination programs," the economists led by Jan Hatzius told clients in a report on Monday. The U.S. and China will remain the leaders over the whole of 2021, according to the most-recent International Monetary Fund forecasts. The 6.4% projected for the U.S. outpaces the 4.4% envisaged for the euro area. But next year, the euro area is seen expanding 3.8% compared to America's 3.5%.  Regardless of which economy is faster, the existence of multiple sources of demand is a good thing. Remember that after the 2008 financial crisis and recession, Europe succumbed to malaise as it was swept by debt turmoil. The transition is already starting to show up in the data. An index of eurozone manufacturing purchasing managers reached its highest level in the survey's 24-year history, while the U.S. equivalent slipped from its recent high.

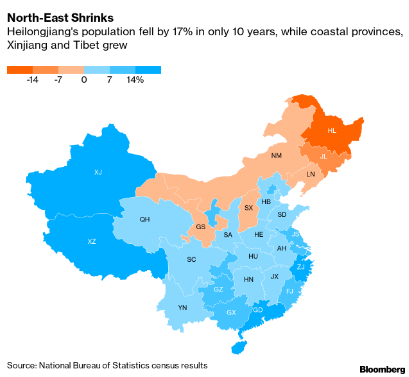

It will be interesting to see how the European Central Bank views any growth spurt. In the post-crisis years it hiked interest rates only to discover the inflation shock it was worrying about was a mirage. This time there is no talk of rate hikes any time soon, though Governing Council member Martins Kazaks did tell Bloomberg last week that it could decide as early as next month to scale back its emergency bond-buying program. —Simon Kennedy The Economic Scene A granular look at China's new 2020 census data shows just how rusty its northeastern rustbelt provinces have become, with populations shrinking over the past 10 years as old smokestack industries faded. The export-orientated coastal provinces saw their populations increase, matching their economic trajectories. Nationwide, the data showed China is getting older, more urban and having fewer babies. Today's Must Reads - Sandwich-nomics. Check out Bloomberg's new Pret Index, a tracker of sales at the ubiquitous British restaurant chain. It suggests London's workers are taking their time returning to the office.

- 'Head scratcher.' That's how one Federal Reserve official described Friday's sub-par employment report. The disappointing data doesn't change the upbeat outlook for the U.S. labor market amid strong consumer demand, policy makers said.

- China's factories. China's factory-gate prices surged more than expected in April, fueled by rapid gains in commodity prices, adding to global inflation concerns as manufacturers pass on higher costs.

- UK deficit. Britain's current account deficit is forecast to reach its widest since World War II this year as it grapples with post-Brexit ties with the EU and an imports-fueled rebound from the pandemic. That's got analysts worried about the pound.

- Pension pain. Chile's privately run pension funds were once viewed as a model for the world. But they are in a battle for survival, reeling under the impact of billions of dollars of withdrawals as politicians and social movements attack.

- Pacific parking lot. Ship congestion outside the busiest U.S. gateway for trade with Asia persisted over the past week amid a steady flow of imports at some of the highest ocean freight rates on record.

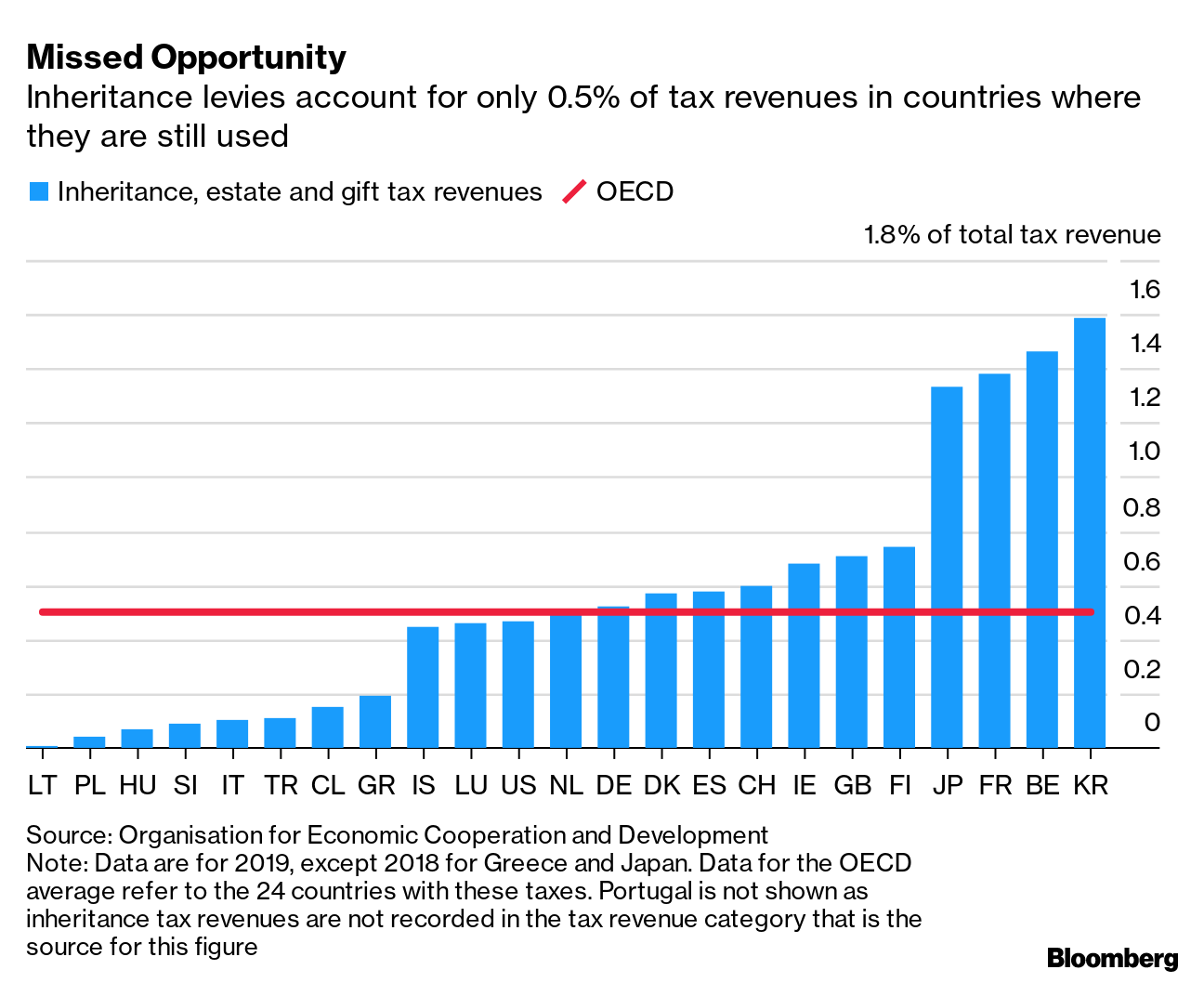

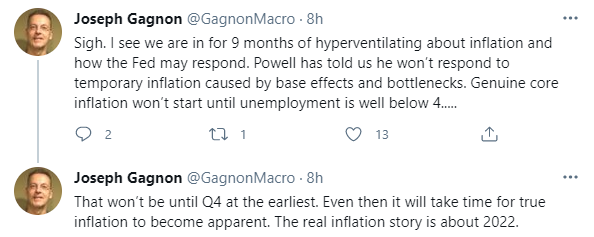

Need-to-Know Research Inheritance tax could make a return to the political agenda after decades of declining use as governments try to repair public finances and address widening inequality after the pandemic. Levies on inherited wealth dropped sharply in the 1970s, and now account for only 0.5% of tax revenues in countries where they are still used, the OECD said on Tuesday. On #EconTwitterAre markets getting ahead of themselves on inflation?   Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment