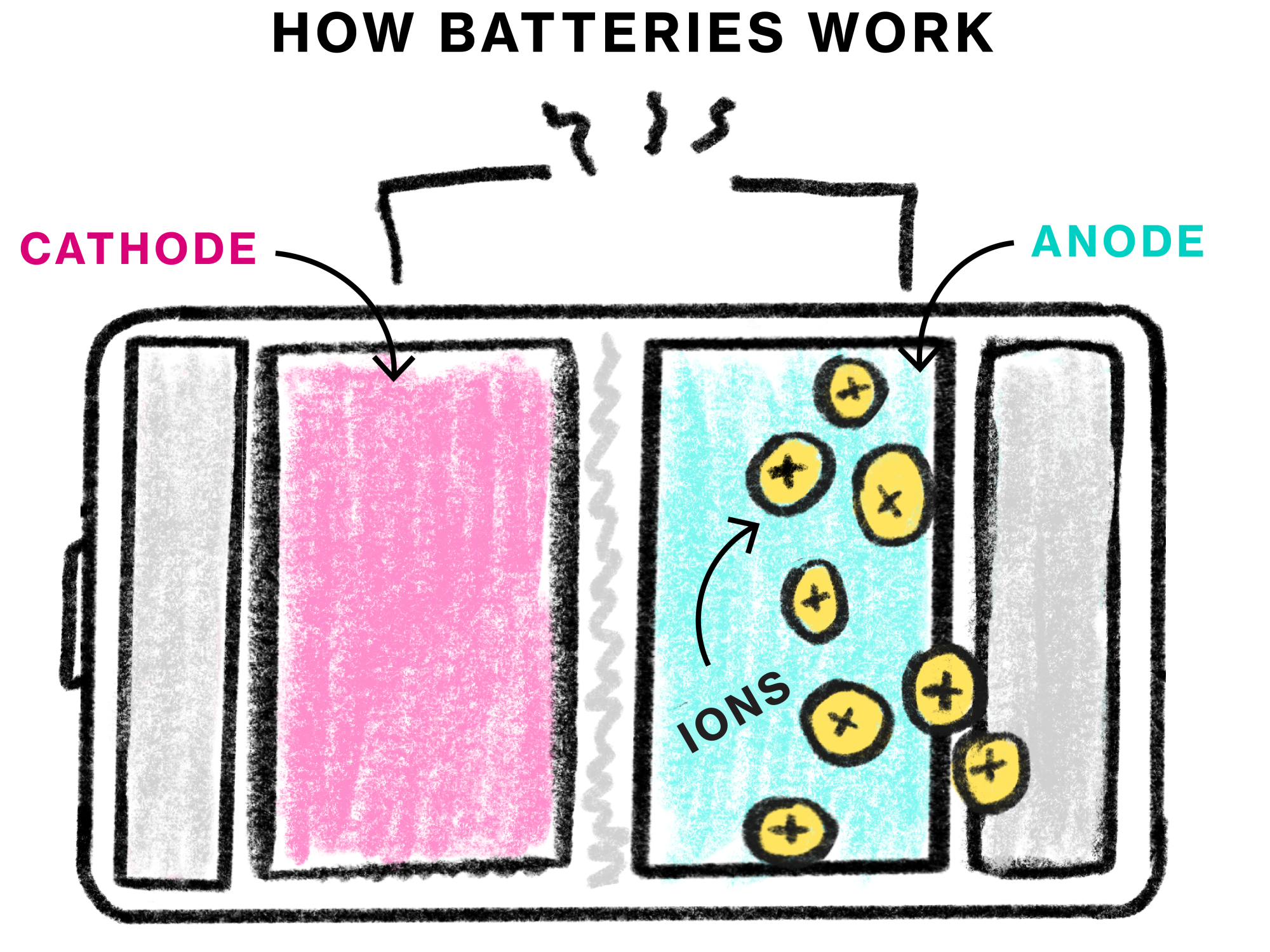

| Welcome to the weekend edition! Every Saturday we'll send you a longer read from other Bloomberg brands, such as Hyperdrive's electric vehicle coverage and luxury lifestyle from Pursuits. You're receiving this because you subscribe to either our Green or Hyperdrive newsletters. If you're a Green subscriber and want to start getting our Hyperdrive newsletter, sign up here. If you're a Hyperdrive subscriber and want to start getting our daily Green newsletter, sign up here. By Kyle Stock Yes, the Porsche Taycan is flying out of dealerships. And yes, it charges faster than a knife fight in a phone booth. But you may not have heard much about the most vanguard feature on Stuttgart's newest electric whip. For $474 up front — or $12 a month — Porsche HQ will remotely switch on what it calls the intelligent range manager, an over-the-air software update that limits the maximum speed and tweaks the car's navigation system to stretch how far it will travel on a single charge.  The interior of a Porsche Taycan Cross Turismo. Source: Porsche The what, in this case, isn't as interesting as the how. Taking a cue from Tesla, Porsche is finally treating its 5,000-pound computer like the SAS platform that it is. It's selling a slightly brighter shade of green like a Netflix subscription or some kind of extra swag in a video game. Get ready to see a lot more of this. "It's a subscription world and we just live in it," says Karl Brauer, executive analyst at iSeeCars.com. "There could be dozens — even hundreds — of unique capabilities that you may or may not have soon, depending on what you pay every month." Most major automakers are fleshing out a strategy for selling upgrades via over-the-air software updates and a rash of them will start popping up in the wild in the next few months, starting with luxury vehicles. "If you don't have digital experiences, you are not on the radar screen," Kjell Gruner, CEO of Porsche Cars North America, recently told Bloomberg. "You're irrelevant." Audi, BMW, Lexus and Mercedes all confirmed that these options will appear on flagship vehicles soon, though nearly all of them said, via e-mail, that it was too early to discuss details. It's "part of a global BMW strategy," said spokesman Phil DiAnni. "When and how the concept gets rolled out in individual markets, and to what extent, is still to be determined." General Motors is all-in as well. On Friday, some 900,000 of its vehicles in the wild got an over-the-air version of Maps+, an app-based navigation tool. Similar software pushes are in the works for the company's Super Cruise autonomous driving function. Underpinning it all is a massive electrical hardware update launched at the end of 2019. Dubbed the Vehicle Intelligence Platform, the system can process 4.5 terabytes of data per hour, a five-fold increase over its predecessor. In truth, GM and its rivals are treading a somewhat fraught path. While drivers are used to paying monthly fees for music, movies and free-shipping, subscriptions for seat warmers, active-safety features or efficiency measures may take some getting used to by the sweaty masses. Indeed, BMW has already learned some hard lessons about what may, or may not, fly in the automotive cloud. In late 2019, the company walked back an $80-a-year fee for Apple's CarPlay after getting throttled on social media. More recently, the company has incited some more sporty Twitter debate with its smart high beam feature, another software-enabled subscription. "Hostageware" quipped one critic. "Cars are like printers, just W-A-Y more expensive," wrote another. "You can easily see a major backlash to all this," said Gartner analyst Michael Ramsay. " And guess what, they're probably going to have to walk back some of these other things they're playing around with." Still, as the auto industry refines a new way to sell it's also coming up with new things to sell, including a range of features that have never been on a vehicle (think: programmable ambient lights, automated driving features and technology tricks to idiot-proof the humbling act of backing up a trailer). Ramsey, who helps car companies craft their tech strategies, has a simple rule: just because you can, doesn't necessarily mean you should. For now, manufacturers should focus their software upselling on things that aren't normally expected in a vehicle, features that have value only at certain times and/or personalized touches. Possibilities include a traction algorithm for people who drive on snow a lot, climate-controlled cupholders and advanced analytics to log certain trips, say, for someone who travels for work and expenses her mileage. A few of the features BMW currently has on offer remotely fits Ramsey's criteria nicely. They include real-time traffic alerts and a drive recorder, which records a 40-second loop from the front of the car and can be used to replay an accident. Crusty consumers aside, the rewards on over-the-air options appear to outweigh the risks. Not only will over-the-air updates provide a healthy revenue stream, they represent a strategic coup, shifting the decision on expensive options away from dealership salesman and extending it indefinitely. The potential to upsell a swanky feature will improve every time an owner gets a raise, every time a vehicle changes hands on the used market. Morgan Stanley reckons that Ford Motor's cloud computing foray, including digital subscriptions, could one day be a $100 billion business, roughly three times the company's current market cap. That's right: Ford Software = (Ford Motor x 3). The math is relatively straightforward: $10 a month from the 75 million Ford's on the road adds up to $9 billion a year — and an extremely profitable $9 billion a year at that. Here's the takeaway from Morgan's team of auto analysts: "We believe the industry is in the early innings of a profound shift to securing revenue measured in data, derived from its hardware 'real estate' and monetized through a range of recurring business models." Every automaker is doing similar math at the moment, giddily crunching what the Silicon Valley software set calls "multiples." However, if they are ham-handed with the cloud, they might not sell many cars at all. Some other reads...If you've ever wondered how the batteries that power electric cars actually work, check out this illustrated guide to the science behind them. Or step inside QuantumScape, the startup cooking up next generation battery tech that's worth billions even before it has a commercial product. Like its peers, the company is secretive about its research, and recently had to defend against a short-seller attack -- raising questions about whether the industry needs more transparency.  |

Post a Comment