| Hello. Today we look at the Federal Reserve's push to ensure as many people as possible benefit from the recovery, prospects for a pick up in productivity and China's aging population. Uneven Recovery

By all accounts, the U.S. employment report will be a blowout on Friday.

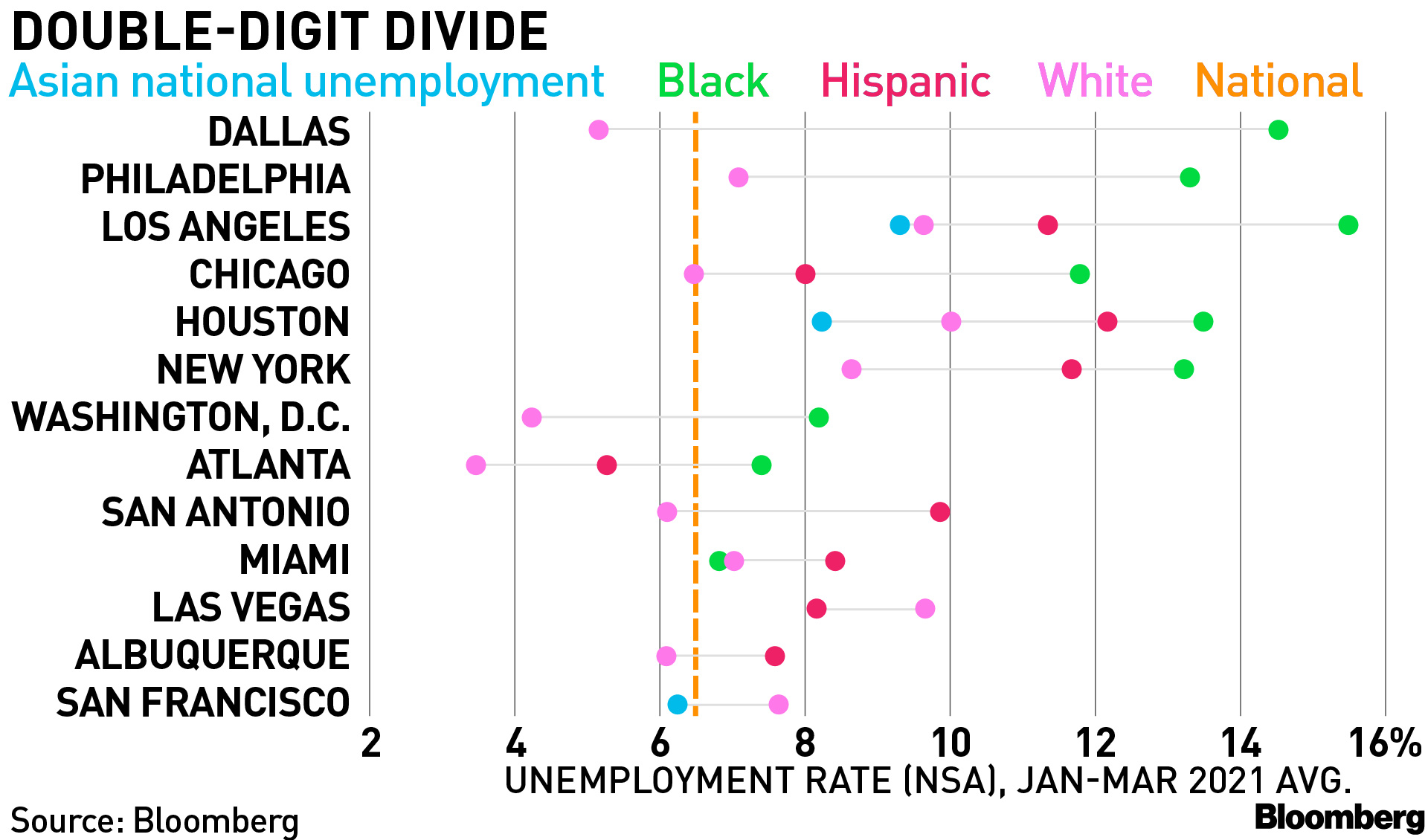

The lowest estimate in Bloomberg's survey is currently for a 700,000 jobs gain for April. Along with a welter of other data showcasing the powerful effects of vaccinations and businesses reopening, it's no surprise some in financial markets are wondering when the central bank will start to consider removing its emergency stimulus. But Federal Reserve Chair Jerome Powell just served a timely reminder about why this is a very different era for monetary policy. Speaking at a conference Monday, he highlighted the disproportionate impact of the pandemic on minorities.

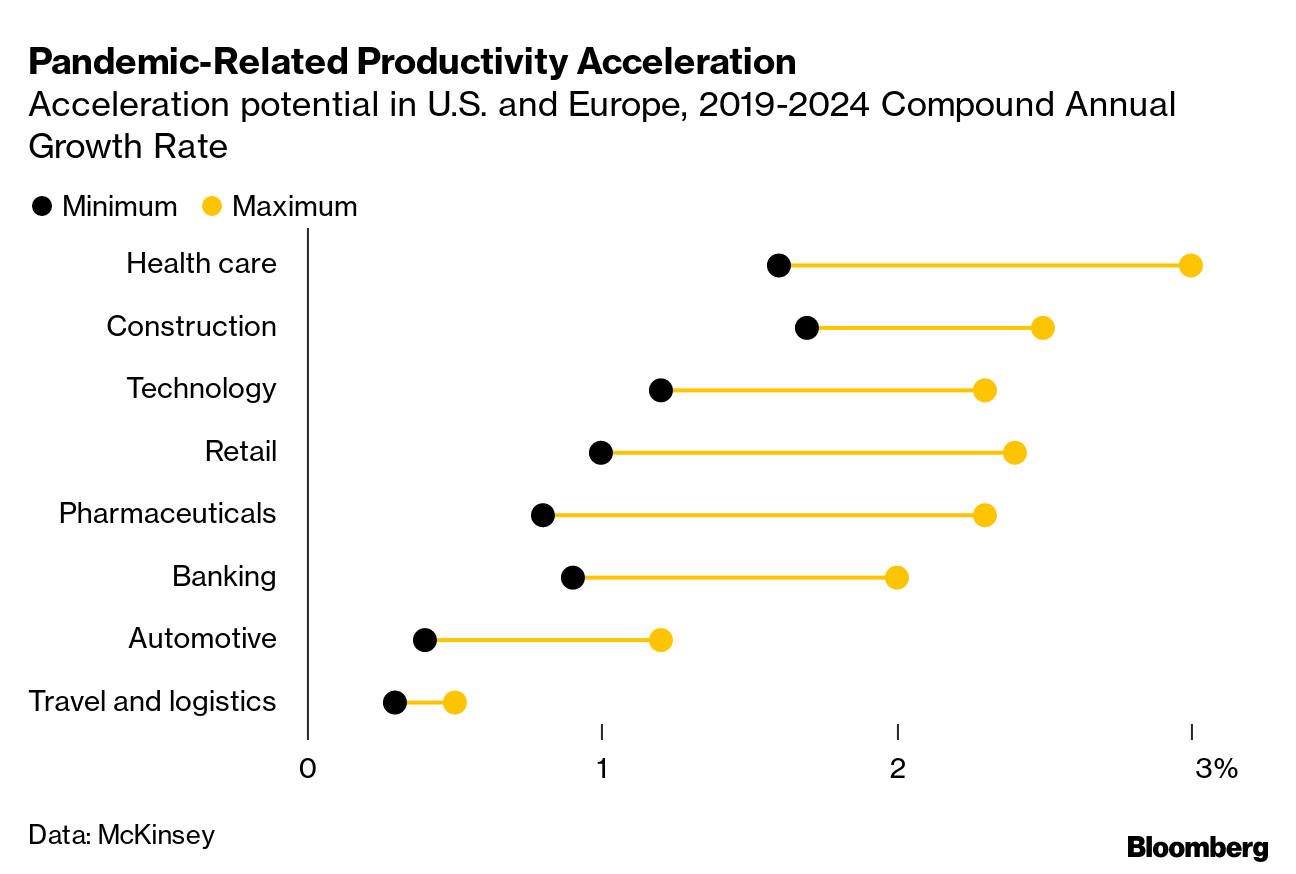

While 22% of parents aren't working or are working less because of disruptions to childcare or in-person schooling, for Black mothers it's 36% and for Hispanic moms it's 30%, he said. "The Fed is focused on these long-standing disparities," Powell said — underscoring how Friday's headlines must be viewed against that context. Bloomberg's Andre Tartar, Olivia Rockeman, Christopher Cannon and Catarina Saraiva delved deeper into that theme, in a data-visual production illustrating just how patchy America's economic recovery is, with large divergences between a dozen odd metro areas and between ethnic groups.  The average jobless rate in the first three months of the year was 15.5% for Black people in the Los Angeles area — well over double the 6.2% national average for all groups. With that region's entertainment and tourism sectors hit hard, services employers remain hard-pressed, imposing disproportionate damage on the workers in those industries. On the other side of the country, the unemployment rate for Whites was just 3.5% in greater Atlanta, the Bloomberg team found. The analysis illustrates how the current recovery is leaving some communities behind, with critical implications for the Fed now that it's embraced a much broader concept of full employment. In the same way the European Central Bank has often had to account for a booming Germany and recession-wracked Italy, the Fed is now attuned to differences across the U.S. That's worth bearing in mind on Friday. —Chris Anstey The Economic Scene The Covid-19 crisis is accelerating a technology boom that has the potential to boost productivity across much of the world, spurring growth even in mature economies such as those of Europe and the U.S. Today's Must Reads - Sold-out ships. Container shipping rates are heading higher again, driven up by unrelenting consumer demand and company restocking that are exhausting the world economy's capacity to move goods across oceans.

- India complacency. Raghuram Rajan, former governor of the country's central bank, said in an interview on Bloomberg TV the latest surge of coronavirus infections revealed a "lack of foresight, a lack of leadership."

- Brighter outlooks. Australia's central bank said it expects to keep interest rates on hold till 2024 even as it upgraded its economic outlook as it tries to reassure investors it won't follow Canada in withdrawing stimulus just yet. Economists see the Bank of England having to grapple with similar questions this week too as the U.K. rebounds.

- Covering the stimulus. The U.S. Treasury more than quadrupled the amount it expects to borrow for the quarter through June as it tries to help pay for President Joe Biden's stimulus programs.

- Crying for Argentina. President Alberto Fernandez is putting politics first, undermining any plans to boost exports, lower inflation and kick-start growth. The result is social unrest, closed schools and a deteriorating business climate.

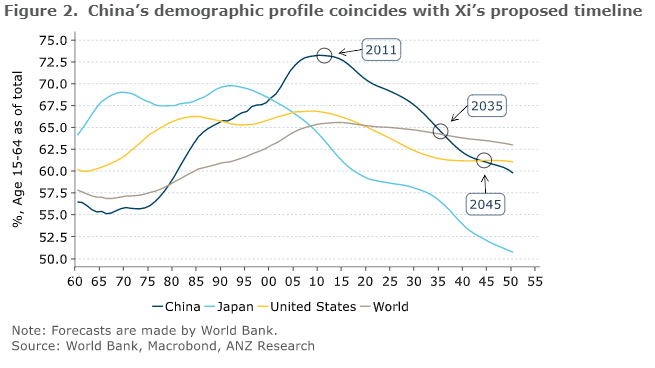

Need-to-Know ResearchChina may soon have to say farewell to its demographic advantage. Research from ANZ Bank projects the proportion of China's working age population will drop below the global average by 2035 and if declining fertility rates aren't arrested by 2045 it'll have a bigger share of elderly than America. "That means by 2050, China's demographic dividend will have all but vanished," ANZ economists wrote in a recent note on the topic.  On #EconTwitterThe Fed is set to become a drama on television not just in financial markets:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click heror more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment