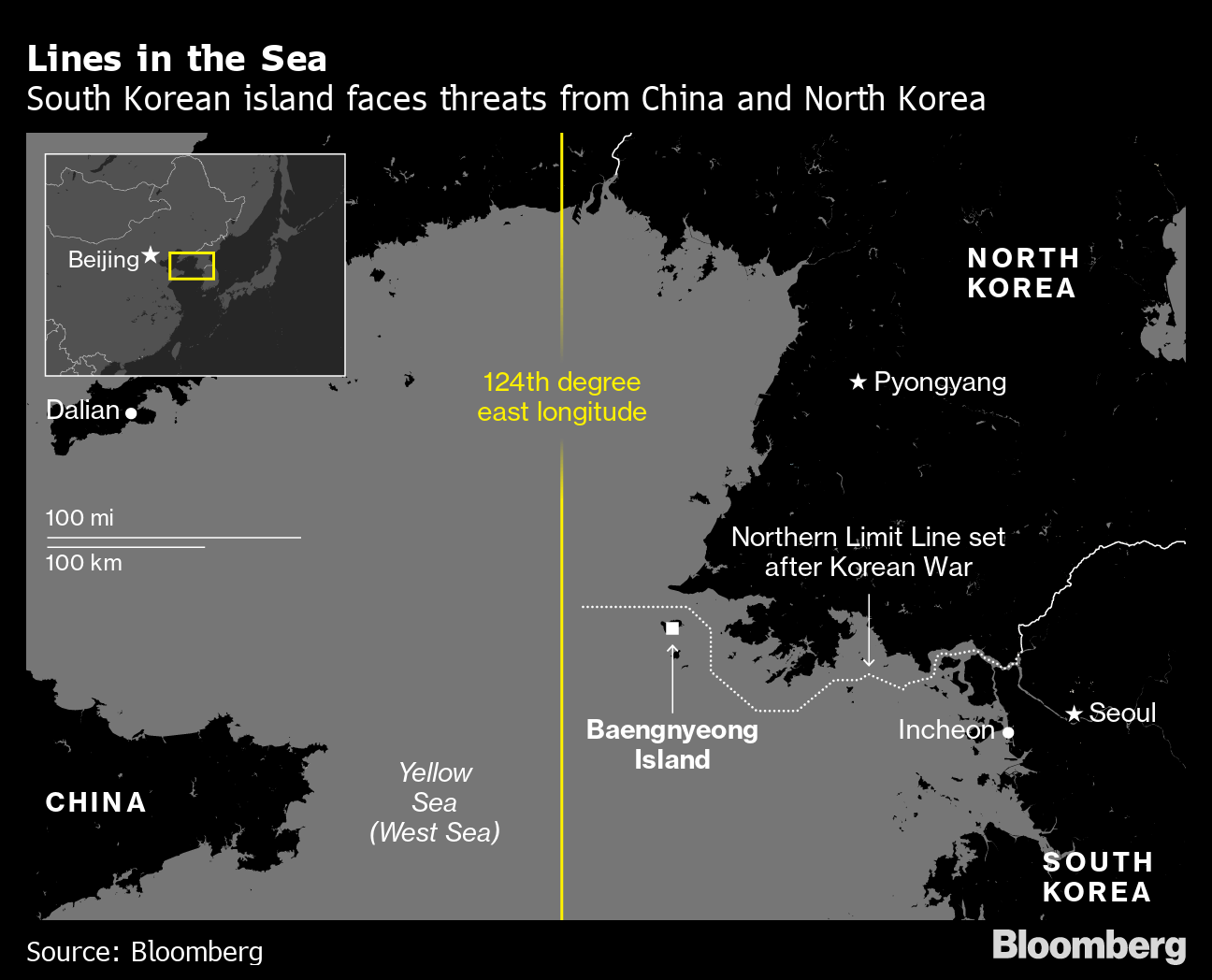

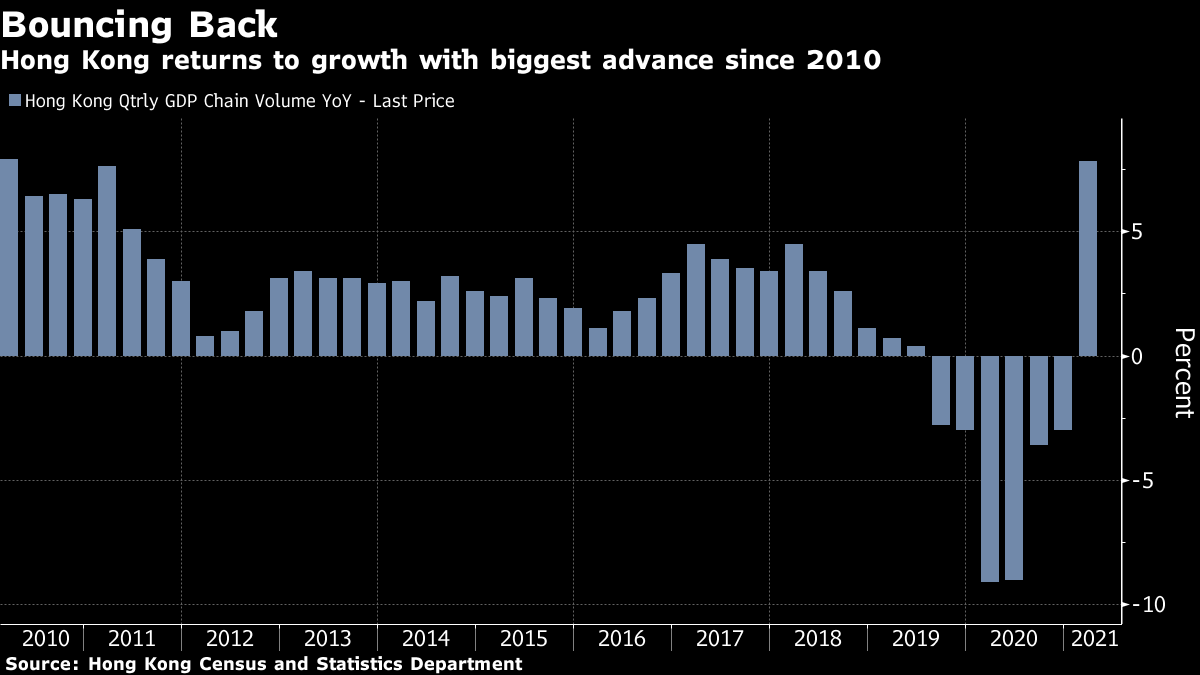

| The first day back from a holiday is often quite a busy one. And Beijing got straight to work after the Labor Day holiday. While much of China was off Monday through Wednesday, top diplomats from the Group of Seven nations aired a long list of grievances against Beijing, ranging from alleged human-rights abuses to cyber attacks. They also jointly backed Taiwan's "meaningful participation in World Health Organization forums," something China has long opposed. By Thursday, the Chinese foreign ministry was quick to fire back, describing the G-7 statement as "clique politics" and calling on members of the group to stop interfering in other countries' internal affairs in a "condescending way." That wasn't the only rebuke Beijing offered. Also during the holiday, Australia confirmed it was weighing whether to force a Chinese company to give up its lease on the Port of Darwin because the facility is used by U.S. Marines. Such a move would further widen the gulf between Beijing and Canberra, which have seen ties descend to their worst state in decades. On Thursday, China's top economic planning agency announced it was suspending a ministerial economic dialogue with Australia that was set up in 2014. While the National Development and Reform Commission didn't mention the Port of Darwin, it did say in a statement that the move was in response to actions by some Australian officials to disrupt "normal exchanges and cooperation" between the countries.  Whatever it was that Beijing meant to communicate, financial markets took it as a bad portend, and traders sharply sold off the Australian dollar. Nothing slows down during a holiday. Trouble at SeaSouth Korean fishermen on the sleepy island of Baengnyeong are complaining about China these days more than they do about North Korea. The island, just 13 kilometers from North Korea, is a key spot for U.S. allies to spy on the reclusive regime — and lately, it's been attracting Chinese warships. Unnerved, the roughly 5,000 residents want President Moon Jae-in to do more, as he balances ties with China, South Korea's biggest trading partner, and the U.S., its main security partner.  Meanwhile in Manila, Philippine Foreign Affairs Secretary Teodoro Locsin fired off an expletive-laced tweet demanding Chinese ships leave disputed areas of the South China Sea, though he later apologized for the profanity. Hong Kong's RecoveryHong Kong this week reported GDP growth that blew past economists' estimates. The 7.8% pace of expansion was the fastest in more than a decade in the first quarter and a rare bit of positive economic news for a city that's seen business activity pummeled by protests in 2019 and the coronavirus last year.  While the data were partly distorted by the low base a year ago, a closer look shows consumption remains subdued, even as exports boom. With hotels and retailers reliant on tourism spending, especially from mainland China, Hong Kong's ability to put its recovery on more stable footing will depend on how quickly it can reopen borders. If the city's long-planned travel bubble with Singapore is any indication, bringing back tourists will mean plenty of ups and downs. Testing Domestic WorkersHong Kong's foreign domestic workers, who make up about 5% of the population, were at the center of the city's latest public uproar. It began when a 39-year old helper tested positive for a more transmissible and elusive coronavirus variant. Officials quickly ordered all 370,000 or so such foreign workers, most of whom are from the Philippines and Indonesia, to be tested and vaccinated. That triggered a wave of criticism about the perceived discriminatory nature of the policy. An earlier wave of infections that began at a gym favored by expats, for example, did not elicit a similar response. The authorities defended their decision at first, but ultimately relented and agreed to rethink the policy.  Migrant workers register for Covid-19 testing in the Central district of Hong Kong. Photographer: Peter Parks/AFP/Getty Images An Ant-Sized ValuationIf Ant Group's IPO had gone off without a hitch late last year, Jack Ma's fintech behemoth would have been valued at about $315 billion. With that listing shelved and a slew of new regulations imposed on big tech, one question that's lingered is how much the company is now worth. Fidelity gave its answer this past week when filings revealed the fund manager lowered its implied valuation for Ant to about $144 billion at the end of February from $295 billion in August. It could go even lower, of course. In a worst case situation, Bloomberg Intelligence sees Ant's value falling to $29 billion. With Beijing's ongoing scrutiny of the country's biggest tech companies, it could be some time before when know how bad bad will be.  Ant Group headquarters in Hangzhou. Source: AFP/Getty Images What We're ReadingAnd finally, a few other things that caught our attention: Want the latest on the fast-changing world economy and what it means for businesses, policy makers and investors? Sign up to get The New Economy Daily in your inbox. |

Post a Comment