| Hello. Today we look at how the U.S economic recovery is proving bumpy, examine the shortage of everything and investigate wage inequality. The Grind

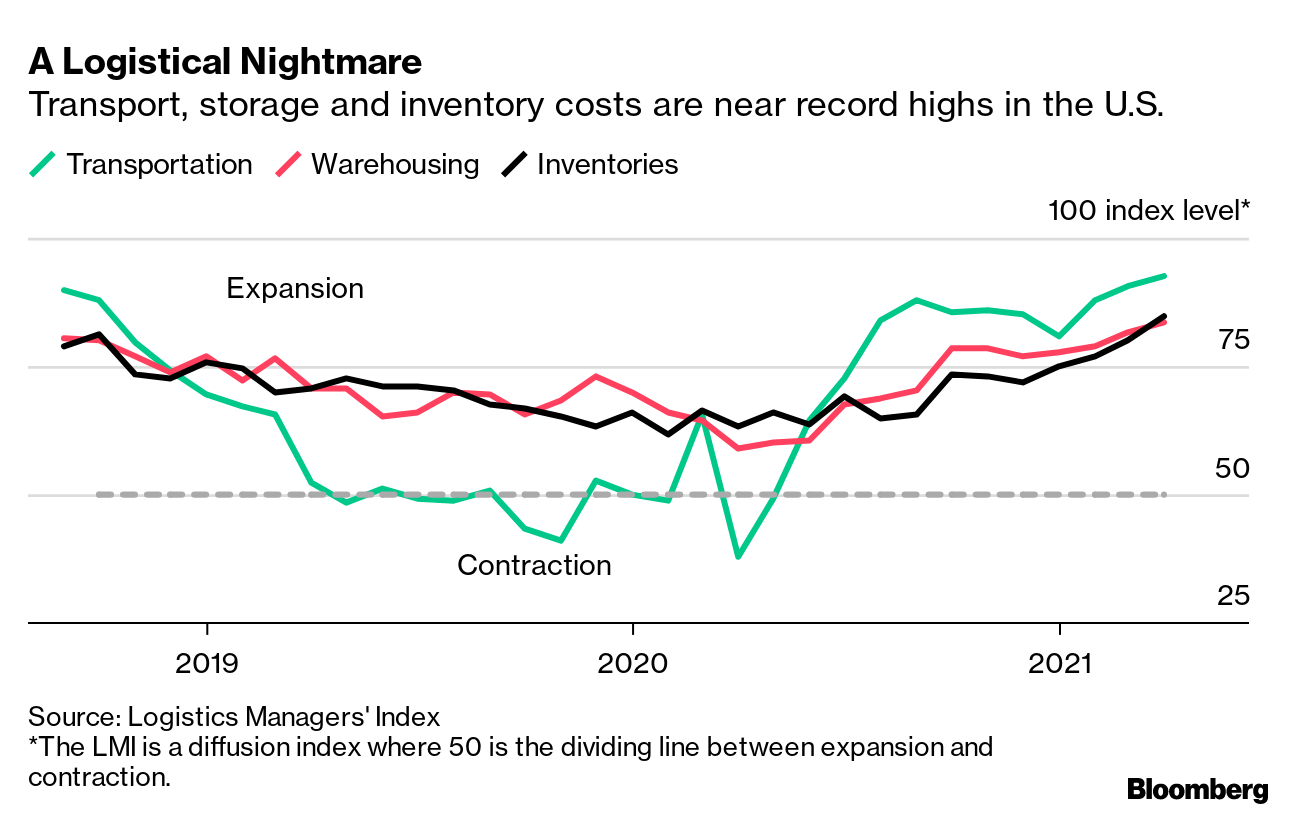

Boom-like conditions in some parts of the U.S. economy are masking a more messy recovery in other corners. The result, as Shawn Donnan and Cecile Daurat write, is an economy flashing messy signals. The past two weeks alone have shown stalling retail sales, rising inflation expectations and major forecasting misses in consumer prices and hiring data. "This will be a chaotic recovery," says Wendy Edelberg, director of the Hamilton Project at the Brookings Institution. At the core of the challenge is a labor market roiled by the pandemic. Ten million need to be re-employed after a third of the workforce changed or lost their jobs during the virus. That's going to take time to shake out, leaving some workers and small businesses struggling even as some big-name employers such as Amazon act to address labor shortages as demand rebounds. Other obstacles include a cyberattack-driven gasoline shortage, surging commodity prices and supply bottlenecks. Where once the worry was of a K-shaped recovery as some won and some lost, now the outlook is for a multi-pronged economy. That's also complicating the political debate. Unemployment benefits are now a hot potato with several Republican-run states announcing they will pull out of federal programs they argue are keeping some out of the workforce. And, as our government team reports, there is a growing challenge to the White House from the inflation spike. —Simon Kennedy Don't Miss On May 17, "The Bloomberg Businessweek" kicks off a week-long virtual experience bringing our "How To" issue to life with influential leaders in technology, finance, economics, healthcare, science, entertainment and more. Speakers include Cynthia Marshall, Anthony Fauci, Nick Jonas, Cathie Wood, Jay Leno, Anjali Sud, Alex Rodriguez, and many more. Sponsored by Deloitte, Intersystems and IEDC. Register here. The Economic Scene Call it the big crunch. Copper, iron ore and steel. Corn, coffee, wheat and soybeans. Lumber, semiconductors, plastic and cardboard for packaging. The world is seemingly low on all of it. "You name it, and we have a shortage on it," says Tom Linebarger, chairman and chief executive of engine and generator manufacturer Cummins Inc. For the full story by Brendan Murray, Enda Curran and Kim Chipman click here. Today's Must Reads - Off the boil. China's economy moderated in April from its record first-quarter expansion as retail sales missed forecasts, suggesting the recovery isn't yet on a solid footing as consumer spending lags.

- British opposition. The U.K. government isn't convinced by President Joe Biden's plan for a global minimum business tax rate of 21%.

- India's stretched states. India's 28 states will have to foot about $5 billion or more in vaccination costs after they were suddenly made responsible for inoculating most adults from May 1. That'll impair their ability to spend on other things to support their economies.

- Hike ahead. Hungary has moved into pole position to implement the European Union's first interest-rate increase since the pandemic as soaring inflation prompts policy makers to act in the bloc's east.

- European outlook. The U.K. will lead the economic recovery among major European nations with its fastest growth in almost half a century before sliding to the bottom of the pack by 2023, according to Bloomberg Economics.

- Africa outlook. Central bankers in eight sub-Saharan African countries are likely to keep interest rates unchanged in the next two weeks as a slow rollout of Covid-19 vaccines means their economies remain vulnerable to a new wave of the virus.

- Return to office. As financial centers like London and New York ease restrictions, companies are debating how to get their staff back in offices. One Singapore firm says creative spaces will help.

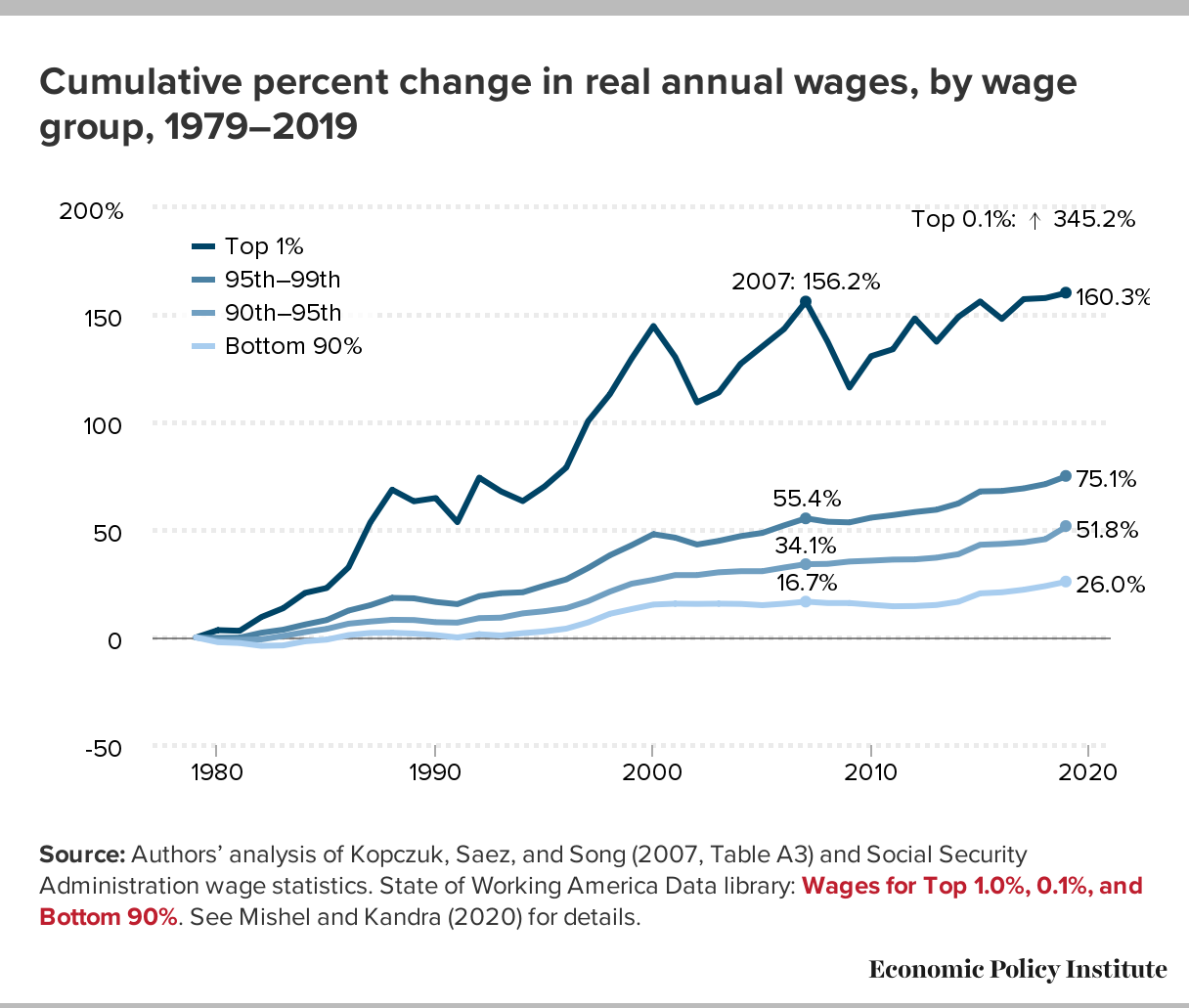

Need-to-Know Research A paper from the Economic Policy Institute finds that the widening gap between what an average worker earns each hour and what they produce has been one of the main drivers of inequality in the U.S. in recent decades. And that's no accident. The paper's authors, Lawrence Mishel and Josh Bivens, argue that's "been generated primarily through intentional policy decisions designed to suppress typical workers' wage growth, the failure to improve and update existing policies, and the failure to thwart new corporate practices and structures aimed at wage suppression." Overly austere economic policies, globalization and less unionization haven't helped either. The solution is more political than economic. Read the full research here On #EconTwitterHere's the latest evidence of "stalled progress" of women in the economics profession.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment