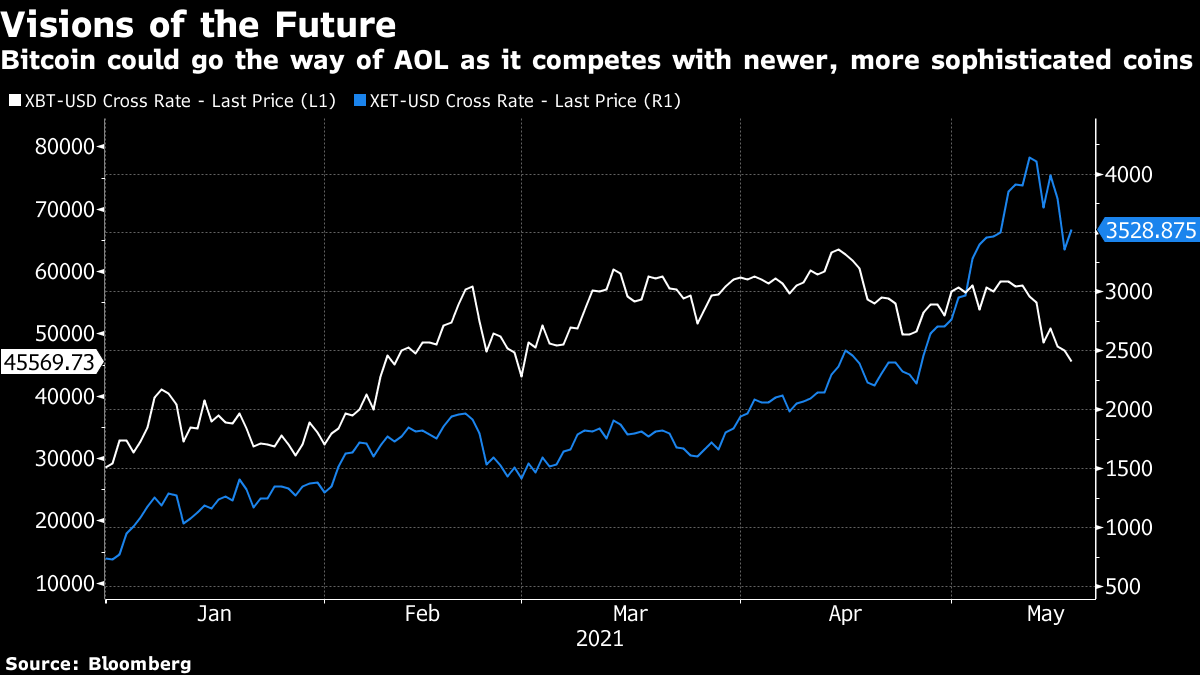

| Singapore and Taiwan are racing to stem spikes in Covid-19 cases. Elon Musk stirs up more crypto controversy. It's time for emerging-market investors to get picky, money managers say. Here's what you need to know to start your day. Singapore plans to close most in-school classes until May 28 after reporting 38 new cases of Covid-19 infection in the community on Sunday, the highest number in more than a year. The city-state may also be facing slower vaccine deliveries over the next couple of months. Taiwan is racing to contain its worst outbreak of the virus yet, with the government calling for more working from home after a record 206 new local cases were reported Sunday. In India, there are signs thousands more are dying every day than government data indicate. Meanwhile, the U.K. is preparing to loosen restrictions on Monday and the U.S.'s rolling one-week average of new virus cases fell to the lowest level since June. Stocks are set to start the week firmer in Asia, as easing commodity prices and slightly softer U.S. data allay investor concerns about excessive inflation. Futures rose in Japan, Australia and Hong Kong. The main threat to a renewed rally is the latest series of lockdowns in the region to curb spiking coronavirus cases. U.S. futures edged higher. Stocks ended in the green Friday after gathering price pressures pushed equity markets globally to their worst weekly loss since February. Currencies were steady in early Asia trading. Elon Musk implied that Tesla may sell or has sold its Bitcoin holdings in a Twitter exchange on Sunday. A tweet from the handle @CryptoWhale said: "Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their #Bitcoin holdings. With the amount of hate @elonmusk is getting, I wouldn't blame him..." The Tesla CEO responded "Indeed." It wasn't his first contentious crypto tweet of the weekend. On Saturday, Musk wrote: "Ideally, Doge speeds up block time 10X, increases block size 10X & drops fee 100X. Then it wins hands down." Here's why the comment is more controversial than it might at first appear. Meanwhile, columnist Eddie Yoon explains why he pays his seventh grader in Bitcoin. Emerging-market investors are turning more selective as last year's everything rally splinters under the weight of higher inflation expectations. Mexico, South Africa and Taiwan rank among the top choices as firms pare back their bullish bets for developing-nation assets, with the MSCI Emerging Markets Index down almost 10% since its mid-February high. "There is still meaningful scope to generate returns within EM as long as investors are able to differentiate," said Tai Hui, chief Asia market strategist at JPMorgan Asset Management in Hong Kong. Read more here about where to look for those returns. For the first time since the Second World War, more Australians are returning home than leaving. The rough count last year: 25,000. And nowhere is the trend more evident than in the finance industry, where Australia's success at containing the virus has coupled with once-in-a-decade disruptions in the country's investment banking market. The migration is adding to the demand for high-priced houses and boosting applications for private school places. In Taiwan, a similar trend is bringing tech entrepreneurs back home. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayThe dot-com bubble is usually remembered as a crazy time. People were so carried away by the prospect of technology changing lives that they bought pretty much anything at pretty much any price. Money poured into new and untested business models. Priceline was valued at almost $10 billion despite consistently losing money. Pets.com spent millions of dollars on an ad campaign featuring a sock puppet and investors loved it. A car dealership in Las Vegas claimed to have discovered a cure for AIDS and reached a market cap of more than $100 million (really). Two decades later we can see that while the dot-com bubble was filled with wacky failures and totally unrealistic valuations, it did contain an undercurrent of truth. The internet did change business forever, and amid all the Pricelines and Pets.coms there were plenty of long-term winners to emerge — think Amazon, Ebay and Google. I bring up the dotcom bubble because it is, in my mind, the time period most analogous to the current state of crypto. Lots of people are excited about the technology's potential to revolutionize the world. There's tons of hype, plenty of scams and projects that will ultimately be doomed to failure. There's nothing to stop Bitcoin from being the AOL of the crypto age — a first-mover that's ultimately replaced by newer and slicker technology.  That possibility is epitomized by the current drama involving Elon Musk and Bitcoin. Musk set off the debate last week by tweeting that Tesla would no longer be accepting Bitcoin for car purchases because of concerns over "rapidly increasing use of fossil fuels for bitcoin mining." He later seemed to double-down on his new attitude toward Bitcoin, musing about making Dogecoin more environmentally friendly. He also revived an old argument about Bitcoin's speeds and appeared to suggest on Sunday that he had, or might, sell his holdings. Bitcoin suffers from a few technological drawbacks, namely it relies on "proof of work" that draws enormous computer power and often means miners are focused on the lowest-cost energy possible (including coal). Bitcoin was also designed to be decentralized and leaderless — no one person or group controls it. That system is fine when everything's going well, but it means Bitcoin struggles to change and adapt, and disagreements about its workings can result in major splits in the community. In other words, Bitcoin might not be particularly effective at responding to being challenged, and that makes it vulnerable. Bitcoin may ultimately end up having been the start of something new, but not the future. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment