| Life-threatening Covid complications appear to be escalating in India. The U.S. proposes a 15% global corporate tax. Israel and Hamas agree to a ceasefire. Here's what you need to know to start your day. The U.S. has proposed that countries agree to a 15% global minimum corporate tax in international negotiations aimed at ending competition to lure companies through cheap rates. The offer, which came in talks held this week, moves the U.S. position closer to the 12.5% rate that had been discussed at the OECD. Lower-tax countries such as Ireland had been skeptical of the U.S.'s proposed 21% rate, and U.K. officials also worry that the rate is too high for the long term. Here's an explainer on the global tax proposal, which columnist David Fickling says would be as much of a shock to international economic order as Trump's trade war with China. Asian stocks look set to climb Friday after technology companies led a Wall Street rebound on economic optimism and easing concern about a scale back of U.S. stimulus. Futures were in the green in Japan, Australia and Hong Kong. Treasury yields and the dollar fell. Gold is around the highest price in more than four months. Oil prices dropped to the lowest in nearly a month as traders assessed the likelihood of a renewed nuclear deal with Iran. Cryptocurrency markets are stabilizing after a $500 billion Bitcoin wipeout snuffed out a slew of speculative excesses that had been building for months. Signals across the virtual-currency complex show leveraged positions are getting flushed out while dip-buyers are emerging — helping fuel a return toward $40,000 for the world's biggest token. Tesla CEO Elon Musk tweeted Thursday that audits of renewable energy used by large Bitcoin miners could help assuage concerns about the cryptocurrency's environmental impact. The crash was actually a big win for cryptocurrencies, argues columnist Jim Bianco. Rare, life-threatening Covid-19 complications appear to be escalating in India, including an invasive fungal infection — mucormycosis — and a dangerous inflammatory syndrome in children. In Singapore, the Shangri-La Dialogue event planned for June 4-5, which draws top military officials and diplomats, has been cancelled following a rise in cases. Taiwan says vaccine aid from the U.S. would help to support its critical semiconductor industry. Protection from vaccines is expected to wane, but no one knows when. Meanwhile U.K. cases of the Indian variant more than double in a week and EU plans for vaccine certificates are boosting hopes of a summer tourism rebound. Morgan Stanley CEO James Gorman has positioned two lieutenants — Ted Pick, the architect of Morgan Stanley's trading revival, and Andy Saperstein, who built the company into a wealth-management powerhouse — as his most likely successors. The change came just after JPMorgan pushed two women, Marianne Lake and Jennifer Piepszak, toward the front of the field to succeed Jamie Dimon. For years, banks have been under pressure from investors and Congress to diversify leadership. But while the top jobs remain held mostly by White men, and at Morgan Stanley it seems that's not about to change.

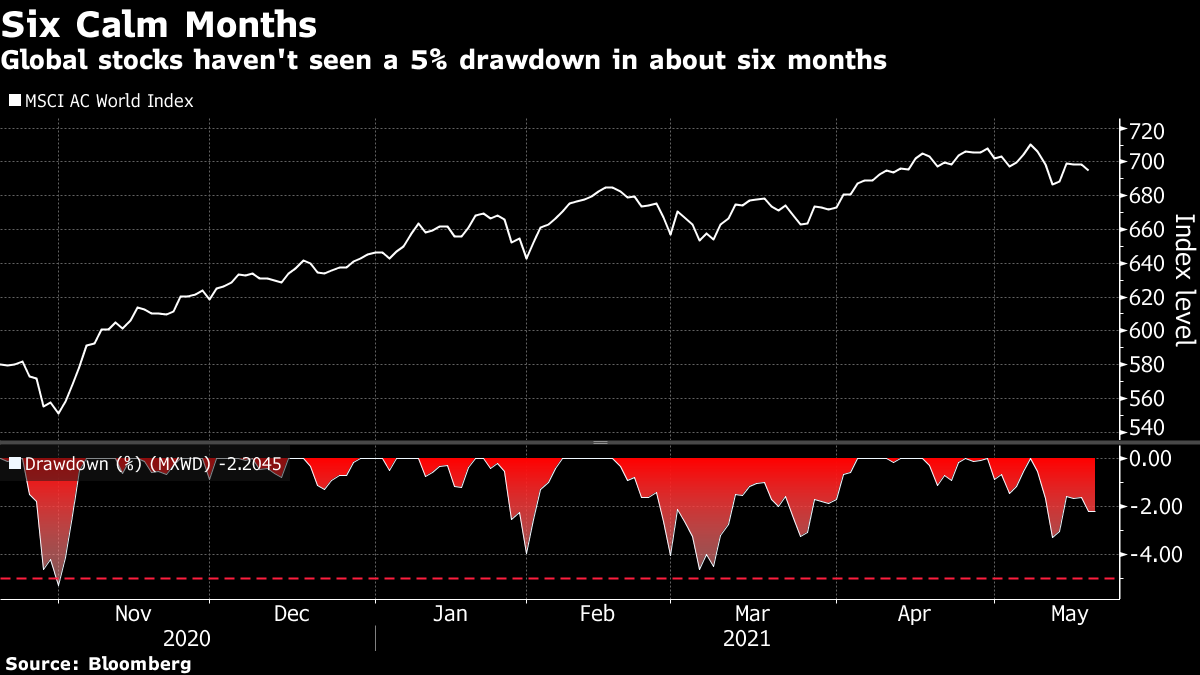

What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in todayDespite recent wobbles in tech stocks and volatility in risk assets like cryptocurrencies, the global stock market has proven remarkably unruffled for more than six months now. The MSCI AC World Index hasn't experienced a 5% drawdown since November, the longest streak of calm since 2017, according to data compiled by Bloomberg. Still, previous stretches of a similar magnitude without a minor pullback — at least in a study of U.S. stocks — have led to poor returns over the following month, wrote Sundial Capital Research founder Jason Goepfert in a recent note. And there's a growing sense among market participants that a modest correction may be overdue.  Last week, Morgan Stanley became the latest investment firm to sound the alarm on the impact of a potentially overheating global economy as concerns mount over rising inflation. Strategists at UniCredit had already suggested risk-off trades will become more likely, while peers at T. Rowe Price said that equities are vulnerable to potential setbacks amid peaking global economic growth. The odds are lengthening on the calm streak lasting through the summer. Cormac Mullen is a cross-asset reporter and editor for Bloomberg News. |

Post a Comment