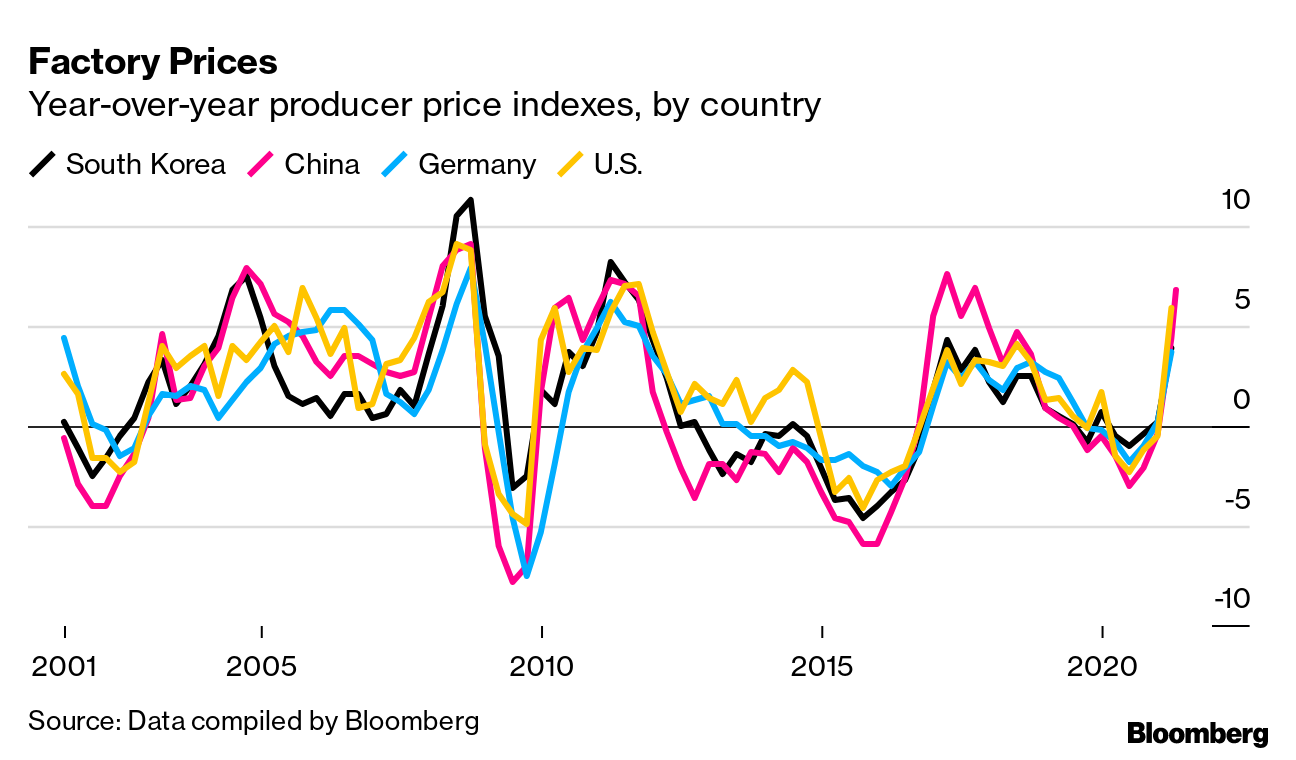

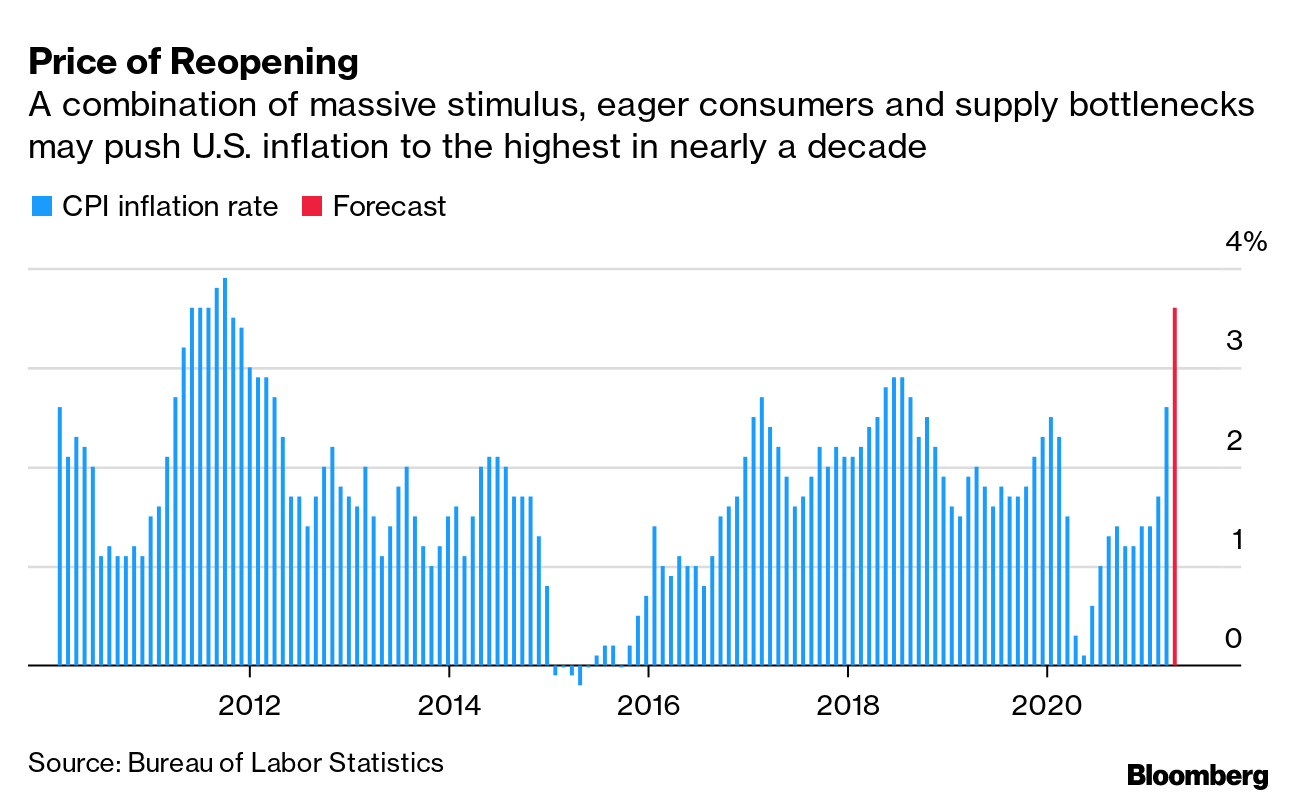

| Hello. Today we look at whether Chinese factories are set to fan global inflation, Republican concerns over rising prices in the U.S. and the demographics of patent-applications. As investors turn increasingly skittish on the U.S. inflation outlook, they'd do well to keep an eye on trends in China too. What they see may not ease their frayed nerves. "Everything has gone up in price," says Bryant Chan, whose factory in China's Guangdong province turns out Nerf guns, LeapPad toy tablets, and other playthings for major American brands. Manufacturers like Chan have been absorbing some of the rising costs of things like paint, screws, metal and packaging for months, providing a buffer for global inflation. But as Enda Curran writes, some are now starting to pass on their rising input costs to overseas customers. The risk then is that China becomes a wholesale exporter of inflation. There's intense competition for orders, so many factory bosses are wary of raising asking prices and will keep taking the hit to margins instead. But there already appears to be some pass through.  China's producer price index climbed by the most since 2017 in April, with everything from big-ticket items like oil and metal to components such as screws and cardboard shooting up. A U.S. gauge of prices for imported goods from China rose 1.8% in March from a year ago, the biggest gain in almost nine years. Economists expect the April U.S. CPI reading due Wednesday to shoot up to 3.6% from a year earlier, magnified by a depressed reading last year. Month on month, the gain is expected to be a far more modest 0.2%. Federal Reserve officials — who were out in force Tuesday to eschew any talk of reducing monetary stimulus — have been downplaying the inflation threat. Still, with President Joe Biden's stimulus and the economy's rebound already fanning price risks, the last thing the Fed needs is imported inflation. Which is why guys like Wilson Lam, whose factories in Shenzhen make packaging for global cosmetic and perfume brands and metal caps and other accessories for whiskey and cognac bottles, are worth listening to. "I don't think we can absorb all of these cost increases," says Lam, director at Chi Kwong (Luen Kwong) Metal Products & Electroplate Factory Ltd. "It's just a matter of time before we pass them on to our customers." — Malcolm Scott The Economic Scene Those inflation jitters are starting to play out in the political realm too. Biden's Republican opponents have begun seizing on jumping prices, the slower-than-expected pace of hiring and even growing fuel shortages from a computer hack of Colonial Pipeline Co. to compare his administration with the "stagflation" era of former President Jimmy Carter.

White House aides say Republican concerns are overblown, but if prices keep ticking higher, Biden's plans for vast new federal spending on infrastructure and social programs will face increasing opposition. Today's Must Reads - China risks. Speculation of a potential debt restructuring by one of China's biggest state-owned financial companies jolted markets recently. That's likely to mean the central bank will take longer than previously expected to wind back its pandemic stimulus.

- Summer lull. With European Central Bank officials debating when they should start slowing asset purchases, a little summer sunshine might provide a middle ground as a market lull allows a reduction in buying that needn't be permanent if the outlook turns gloomy again. Still, new economic forecasts from the EU painted a brighter future for the euro-area recovery.

- British bounce. The U.K. economy gained momentum in March as consumers geared up for the lifting of coronavirus restrictions. Gross domestic product rose a stronger than expected 2.1%. In further good news, disruptions in post-Brexit U.K. goods trade subsided further in March.

- Running hot. Australia unveiled a big-spending budget that aims to run the economy hot. With an election due in the next year, that leaves the opposition Labor party struggling for a narrative when the conservative incumbent is spending so freely.

- Extra charges. Argentina's President Alberto Fernandez urged the International Monetary Fund to suspend so-called surcharges applied by the multilateral lender to countries that use its credit lines extensively.

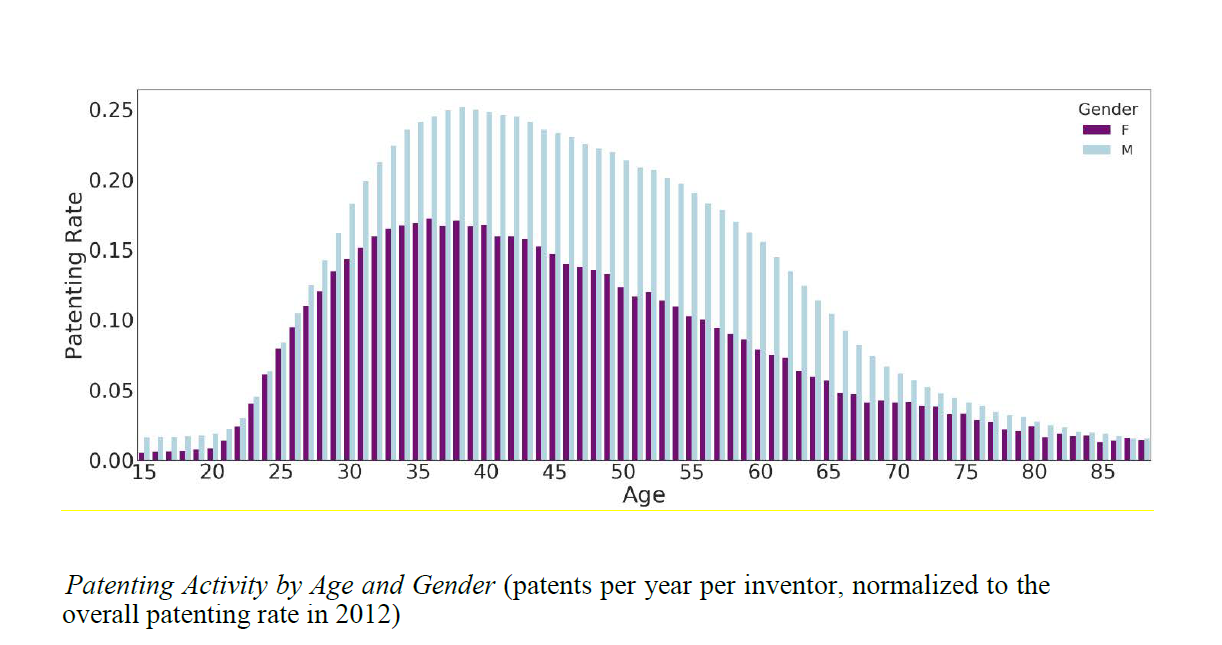

Need-to-Know Research Don't fret if you're entering your 40s without having made a ground-breaking discovery. New research published this week by the National Bureau of Economic Research found patent applications peak for men and women in their early 40s. The research, based on 1.2 million American patents between 1976 and 2017, also found that teams with a range of ages tended to generate slightly more important patents, based on citations. "The findings have the potential to advance scholarship on the life course of innovation with implications for workplace policies," wrote authors Mary Kaltenberg, Adam B. Jaffe Margie E. Lachman. On #EconTwitterWe are excited Shawn Donnan of Bloomberg Economics was recognised for his important "Left Behind" series.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment