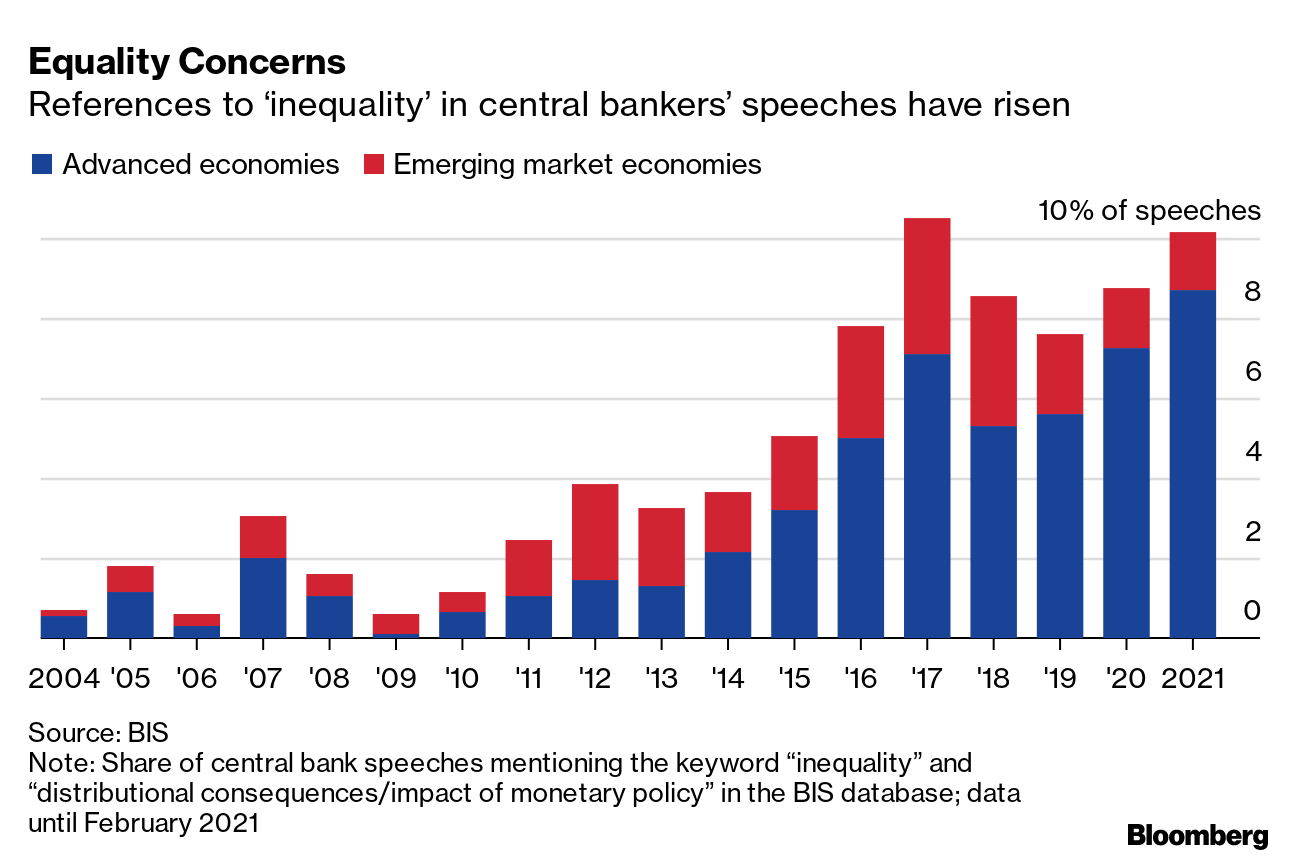

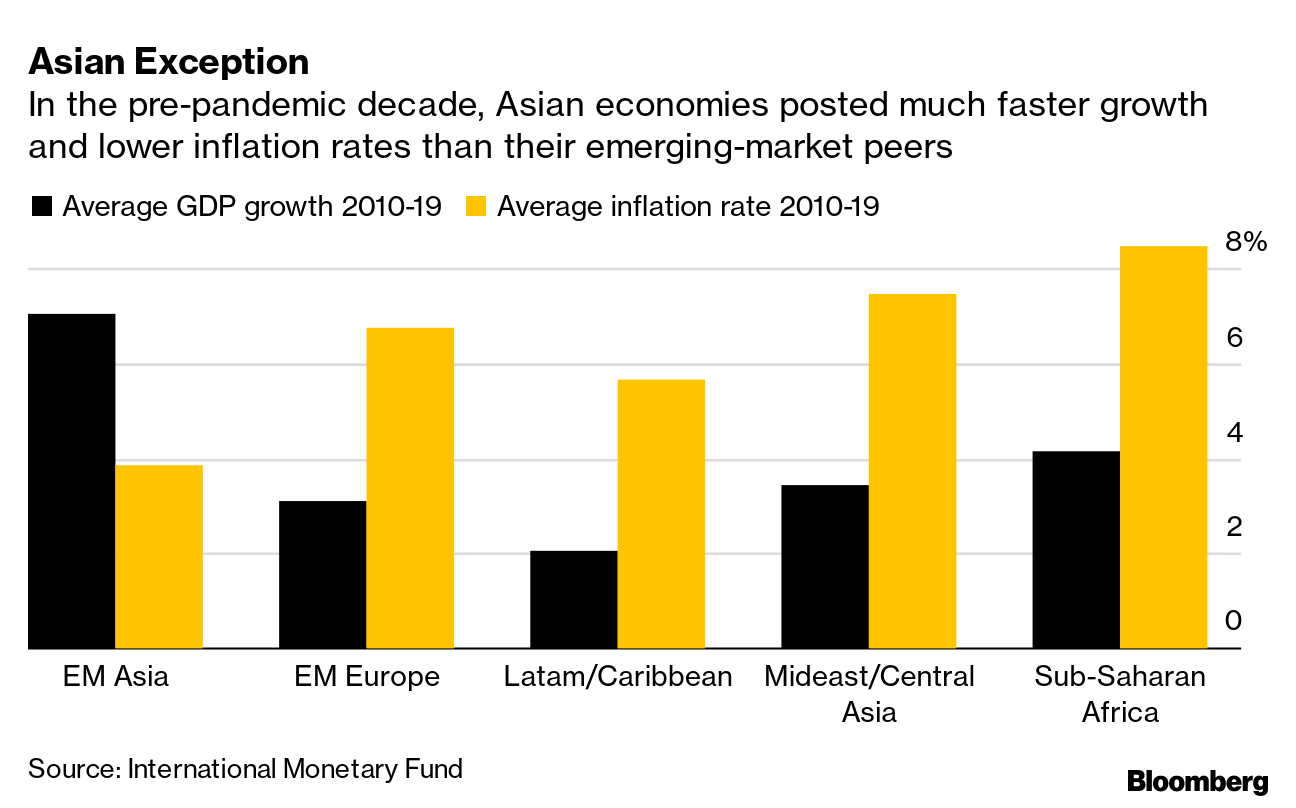

| Hello. Today we look at the debate over central banks' expanding interest in joining the inequality fight, how Asia's emerging economies are outperforming and why women in Korea are losing out in the workforce. Woke Central BanksFederal Reserve Chairman Jerome Powell isn't alone in his newfound focus on economic inequality. This chart from the Bank for International Settlements shows a jump in references to the topic by Powell and his counterparts elsewhere.  This shift has triggered a debate about whether monetary policy can really offer much of a solution for societal disparities. Some even say it's a source of them. One critic is Charles Gave at the research group Gavekal. He argues easy money doesn't ensure stronger growth — think Japan — and it often exacerbates wealth gaps by inflating asset prices. Case in point: the S&P 500 is up 48% over the last year, despite the pandemic. Low interest rates also spur disproportionate price increases for goods that low-income people rely on such as food and energy, Gave says. Since 2002, his "Walmart CPI" measure for the U.S. has risen 77%, compared with 50% for overall consumer prices. Others are defending the central banks. Bank of America's Ethan Harris and his team of economists said in a report Tuesday it's "bizarre and unfair" to criticize the Fed for creating inequality by stimulating financial markets. The point is that policy makers are using the one key tool they have that aids the less well off — fostering easy financial conditions in the hope that buoys the entire economy, they said. Agustin Carstens, head of the Bank for International Settlements, offers a more nuanced defense. Yes, he conceded Thursday, central banks can affect wealth and income in the short term, and prolonged periods of high inflation and recession do disproportionately hurt the most disadvantaged. Policy makers should also be on guard against creating financial imbalances. But "over the long run inequality is not a monetary phenomenon," he said. It's for governments to reduce inequality through targeted fiscal and structural policies. "The best contribution monetary policy can make to an equitable society is to try to keep the economy on an even keel," he said. —Simon Kennedy Save the DateThe fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore this November 16-19, 2021 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. The Economic Scene Classic problems such as rising inflation, capital flight and concerns over bloating public debt are starting to show up in some emerging markets, but less so in Asia.

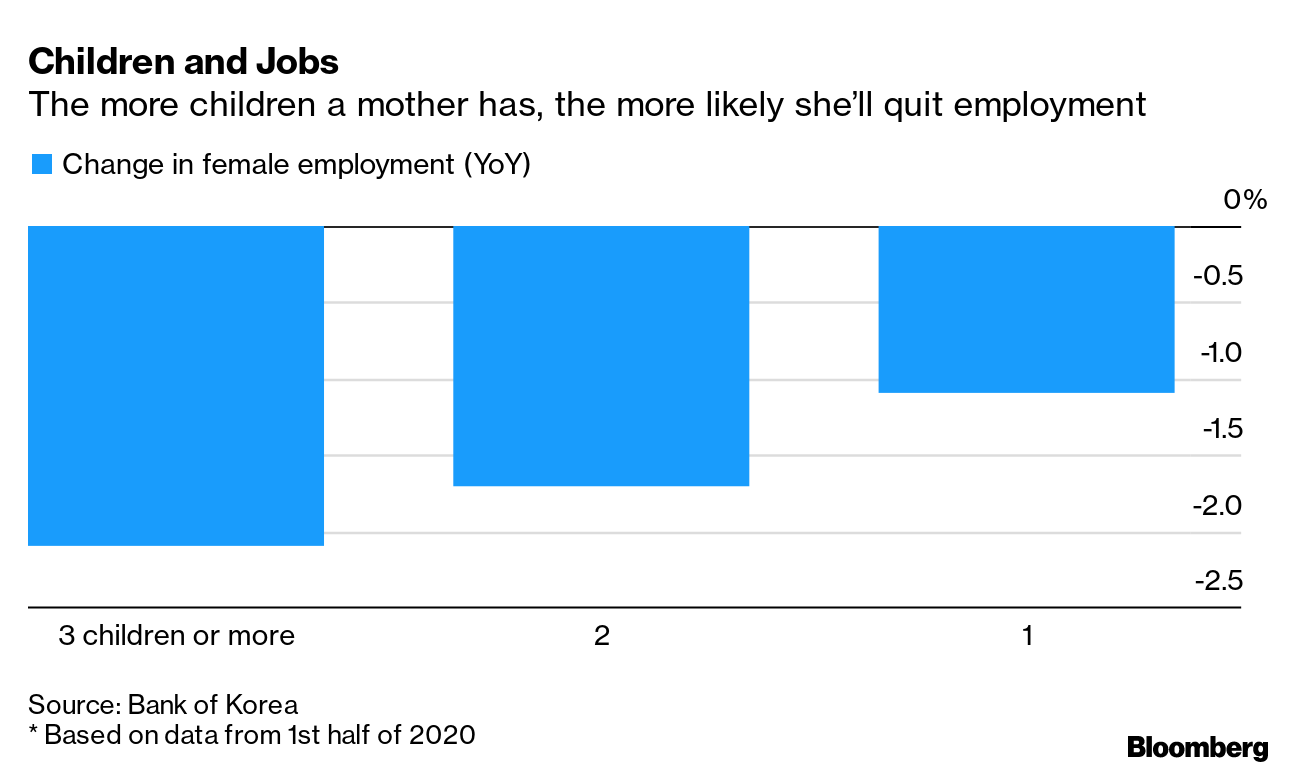

Thanks largely to lessons learned from the traumas of the past three decades — from the late-1990s regional meltdown to the global crash of 2008 and the so-called "taper tantrum" of 2013 — their economies now boast hefty foreign-exchange reserves, stronger financial systems and an unassailable place as the world's manufacturing powerhouse. Indeed, many look increasingly like they've emerged. Today's Must ReadsNeed-to-Know Research Working mothers in South Korea have suffered far greater job losses than single women during the pandemic, according to research by the central bank. Among women aged between 30 to 45, those who were married accounted for 95% of the reduction in female employment in the year through March 2021. While the country has done relatively well in containing outbreaks, schools have often been shut and work-from-home hasn't been as widely applied as in other countries, putting an increased childcare burden on mothers. That sets the pandemic apart from previous recessions when men typically suffered significant job losses. On #EconTwitterThe World Health Organization is convening 11 leading figures in economics, health and development from around the world as the first members of the WHO Council on the Economics of Health for All.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment