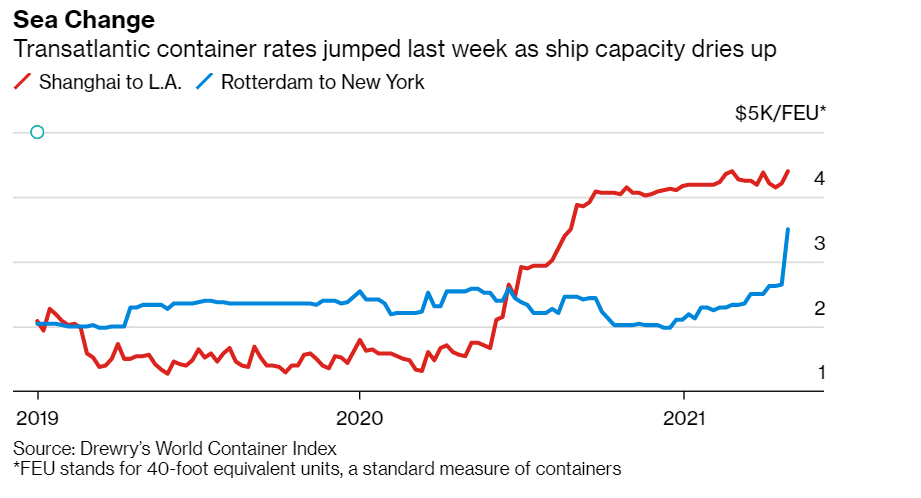

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. After months of pandemic-induced restrictions and a fair number of uncoordinated border closures, the EU's tourist hotspots are getting ready to finally receive visitors from outside the bloc. Just in time for the summer season, Spanish, Italian and Greek beaches along with cities like Paris, Rome and Berlin will be able to welcome travelers who have been fully inoculated against Covid-19 under a proposal by the Commission. The plans, which could be agreed on this month, will likely be front and center at a virtual meeting of G-20 tourism ministers today. Faced with a sector crippled by the pandemic, the ministers representing the world's major economies are expected to approve guidelines on issues including safe mobility and support measures for so-called vaccine passports — including the EU's very own Green Digital certificate — in what's likely to be a boon for airlines, hotels and several of Europe's hard-hit economies. — Viktoria Dendrinou and Nikos Chrysoloras What's HappeningQualcomm Hearings | While Apple's relationship with Fortnite maker Epic Games takes center stage in a U.S. courtroom this week, its relationship with Qualcomm will be part of a different antitrust fight across the Atlantic. For the next three days, the EU's lower court will hear arguments in Qualcomm's challenge to a 997 million-euro EU antitrust fine over payments it made to Apple to ensure only its chips were used in iPhones and iPads. Cross-Border Boost | Europe is seeking a faster rollout of innovative projects that will help the region's fight against climate change and accelerate its digital transformation. The Commission is considering tools to boost cross-border initiatives in areas such as hydrogen, sustainable transport, 5G corridors and blockchain, according to a draft industrial strategy due to be published tomorrow. Spanish Rival | In less than two years, Isabel Diaz Ayuso has emerged from relative obscurity to lead Spain's most important region and become Prime Minister Pedro Sanchez's most combative opponent. Today, the candidate from the conservative People's Party will be seeking to cement her control of Madrid's regional government in a snap election that highlights the dividing lines in Spanish politics. Fishing Action | After 20 years of negotiations, the WTO is accelerating an effort to end $22 billion in government subsidies for fishing industries. The new WTO chief made the issue her top priority, and a conference set for July could help seal an international accord. But bids by several nations for exemptions and loopholes could jeopardize its effectiveness at a critical moment for the planet's oceans. China Tensions | December's EU-China investment deal may end up being the high-water mark for ties that are quickly deteriorating again. Germany, Italy and France are among EU countries signaling a hardening stance on Beijing. The biggest shift could be yet to come, with polls showing the German Greens on course for a significant role in government after September's election, raising the prospect of a more China-skeptic chill from Europe's biggest economy. In Case You Missed ItFrench Stimulus | President Emmanuel Macron will reassess the France's recovery plan in September, possibly adding to the 100 billion euros of stimulus his government is already injecting into the economy. Such a boost would arrive just six months before presidential elections, where management of the health crisis and the growth rebound are set to be key issues. Italian Funds | Italy's plan to kick-start its economy using grants and loans from the EU's recovery fund won't work without significant buy-in from private investors, Infrastructure and Mobility Minister Enrico Giovannini warned us in an interview. To shift the focus more toward a mix of public and private funding, his ministry is exploring ways to use other financial instruments for investment. Supply Shortage | Euro-area manufacturers are battling unprecedented delays in securing raw materials and parts, leading to a record build-up of uncompleted orders and rising prices as the economy starts to recover. Companies reported higher costs for chemicals, metals and plastics and ran down their inventories to cope. No Chips | Ford will halt production at its German plants for several weeks due to a lack of semiconductors, the latest sign of the severity of the global chip shortage. News of outages in Germany comes after Ford last week said the dearth of semiconductors would cut its second-quarter production in half, joining a list of automakers flagging fresh stoppages that could cost them billions in lost revenue. Chart of the Day Container shipping rates are heading higher again, driven to new heights by unrelenting consumer demand and company restocking. After peaking in late 2020 and not budging much through the first quarter, the rate for a 40-foot container to Los Angeles from Shanghai hit $4,403 last week, the highest in Drewry World Container Index data going back to 2011. Cargo shippers on less-traveled transatlantic routes are feeling the sting too: Rotterdam to New York surged to a record $3,500. Today's AgendaAll times CET. - 9:30 a.m. The EU's lower court starts three-day hearings in Qualcomm's challenge against an antitrust fine, levied for payments allegedly made to Apple

- 10:45 a.m. Austria's EU Minister Karoline Edtstadler and Commission Vice President Dubravka Suica speak at CEPS event on the future of Europe

- 12 p.m. Portuguese Defense Minister Joao Gomes Cravinho speaks at German Marshal Fund event in Brussels

- 12:30 p.m. G-20 tourism ministers hold video conference

- EU tech chief Margrethe Vestager participates via video conference in a virtual roundtable organized as part of the Internet Week Denmark festival

- Bank of France presents climate stress-test results for lenders

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment