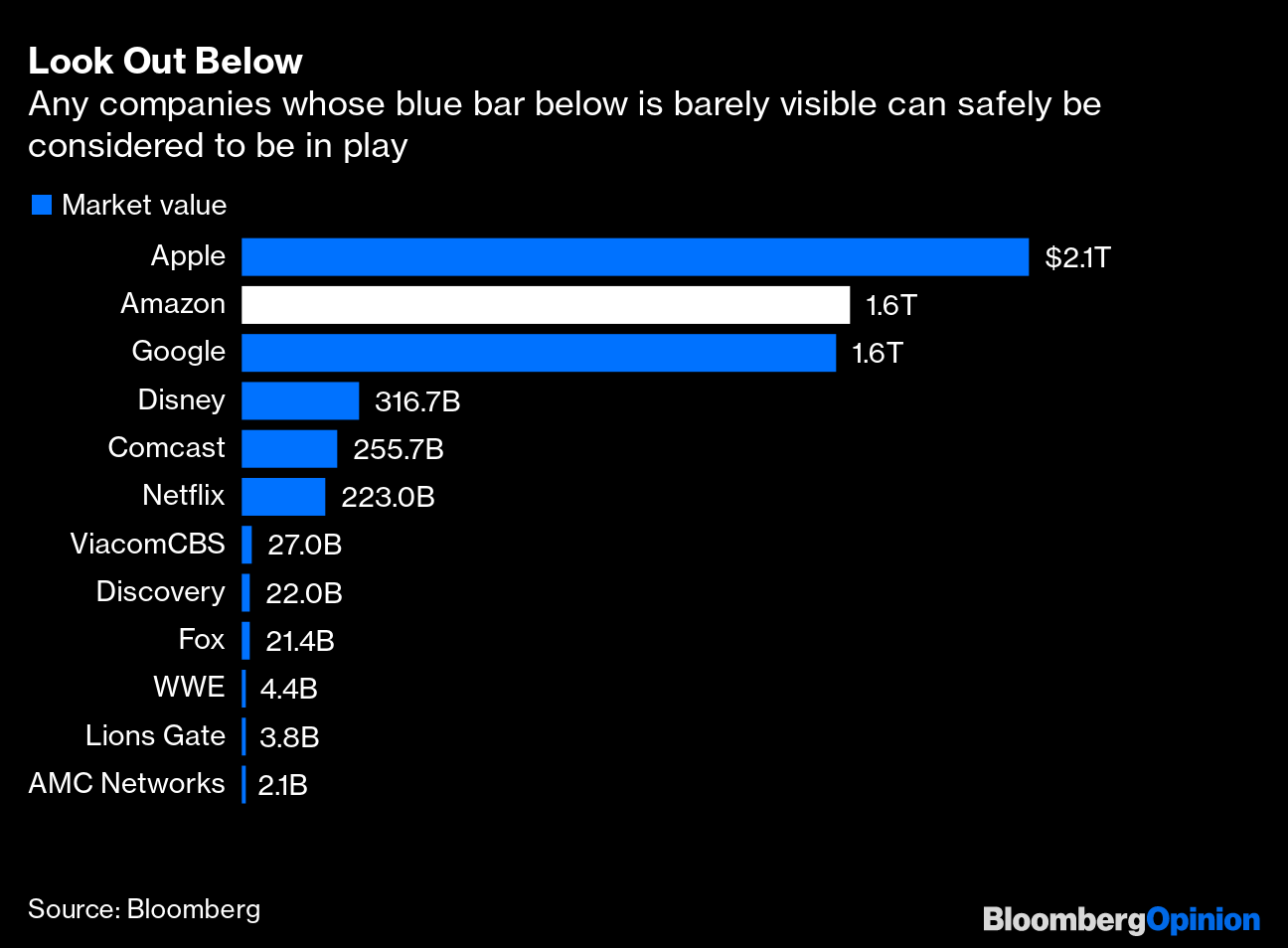

| This is Bloomberg Opinion Today, a central bank of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Sum of All Bitcoin FearsThis tweet is one of the all-time greats. After six years, it still pops into my head every now and then:  That "fearing this outcome above all others" is so poignant, and also relatable, because isn't that the way? The one thing you fear most is of course the thing that happens. Don't want to get mustard on your tie? Buddy, hope you brought a spare tie. The one thing Bitcoin's fanbase fears, or at least loathes, above all others, is centrally managed currency. It's not always clear why. Sure, decentralization makes it easier to buy guns and drugs and extort big, dumb corporations for ransom. And maybe someday fiat currencies will be useless, as Bitcoiners keep warning. Yet the sheer problematic Bitcoin-ness of Bitcoin is motivating the quest for centrally managed alternatives, writes Andy Mukherjee. The U.S., Europe and China are all rushing to mint [YOUR COUNTRY HERE]Coin, each tied to the value of their rock-solid currencies. And every day Bitcoin gives them new reason to hurry. These old-fashioned fiat currencies have the advantage of not swinging 30% in value in a day. They don't help doom future generations by hogging more energy than Norway. And they don't share Bitcoin's many other hidden social costs, as tallied by Lionel Laurent: It's made semiconductors scarce and computing more expensive. It facilitates crimes. And it entices people to blow their life's savings. To name a few. By luring unsuspecting newbies to risk financial ruin, Mark Gilbert warns, we're setting up a new generation to be scarred for life by investing. To be fair, some cryptocurrencies are trying to avoid these drawbacks. Ethereum, for example, wants to slash its carbon footprint almost to zero. But [YOUR COUNTRY HERE]Coin would be there from day one, and also be backed by dollars, euros or yuan, all of which should be good for the foreseeable future. The day they aren't, we will have bigger problems than fiat currency. FedCoin would also make it much easier for the Fed to fine-tune monetary policy, writes Albert Gallo. It could use digital currency to boost the economy where needed, while avoiding some of the harmful side effects of its current blunderbuss approach. Bitcoin devotees fear it. The rest of us don't have to. Everybody's Doing the Least They Can HereGeorge Floyd died a year ago today, murdered in the street by former Minneapolis cop Derek Chauvin. The outcry that followed was so moving that it even penetrated the boardrooms of corporate America. Well, sort of: Companies vowed to change their ways and offer more opportunities to people they've disadvantaged for decades. What they still haven't done, Chris Hughes writes, is truly account for how badly they've failed to promote diversity and equity at work and set quantifiable goals for improvement. Investors must push them to do more. Investors, especially the massive index funds, should also be more open about how they vote in proxy fights about ESG matters, writes Boris Khentov. They could influence other investors and corporate behavior, which sort of seems like the whole point. Then again, ESG investors aren't always so picky about the whole ESG thing, notes Matt Levine. Thus they invent clever ways to pretend stuff like, say, Bitcoin is environmentally sound. Amazon Absorbs ThingAmazon.com, which sells you all the things and has all the money, will probably soon root around in its couch cushions for $9 billion to buy MGM Studios so it can sell you more content on Amazon Prime. This is just the latest in what Tara Lachapelle has identified as a media feeding frenzy kicked off by AT&T's sale of Time Warner to Discover. As such, it probably won't wreck the entertainment business, Tara writes, a thing Amazon has been known to do. In fact, it might not even be that smart of a deal for Amazon — just as its purchase of Whole Foods neither wrecked the grocery business nor helped Amazon very much. But you have to wonder if something is wrong with our capitalism when a company is so huge that it can repeatedly make big, pointless deals with no repercussions.  Further ReadingThe West must send a clear message to Belarus that hijacking a plane to arrest a critic is unacceptable. — Bloomberg's editorial board President Joe Biden's low-key boringness may actually be a bold strategy to get things done. — Jonathan Bernstein It's fitting that somebody named McCarthy is leading the GOP's quest to memory-hole the Jan. 6 insurrection. — Robert George Republicans must rekindle their interest in conservation and back Biden's plans for the ocean. — Jean Flemma, Miriam Goldstein, Ayana Elizabeth Johnson Texas is trying to basically outlaw abortions and use legal flimflammery to avoid going to court, where it would be sure to lose. — Noah Feldman The Fed would be wise to make its emergency bond-market funding permanent to prevent future swings. — Brian Chappatta These were the secrets to David Swensen's success. — John Authers Jane Goodall Update: Here's the full transcript of Sarah Green Carmichael's conversation with the legendary primatologist. ICYMIGOP senators may raise their offer in infrastructure talks. John Cena apologized for calling Taiwan a country. The house-flippers are getting out of hand. KickersIt will take millions of years to restore lost biodiversity. Algae proteins partially restore a man's eyesight. Descendants of a feudal lord hit an Italian town for back taxes. John Steinbeck wrote a werewolf novel. Notes: Please send algae proteins and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment