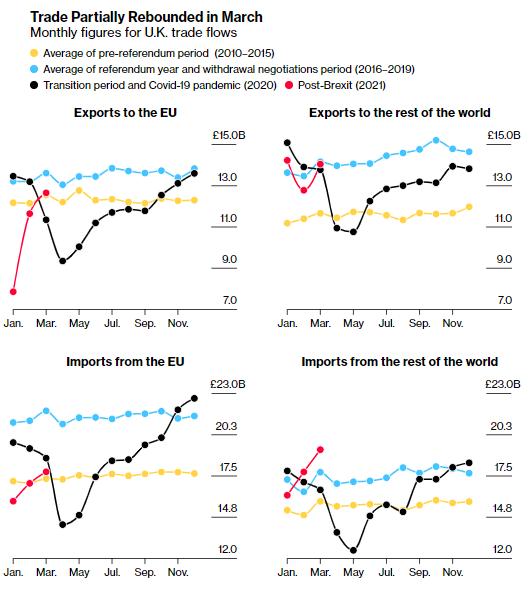

| What's happening? Wall Street won a big slice of London's derivatives trading in March, and a fishing dispute is spilling into finance. Wall Street was the biggest winner from the City of London's £2.3 trillion ($3.3 trillion) loss of lucrative derivatives trades in March alone, according to research by Deloitte and IHS Markit Ltd. U.K. platforms hosted about 10% of euro-based swaps carried out, down from almost 40% in July. Those months were picked as comparisons before and after Brexit. The report follows estimates that more than $1 trillion in assets have moved to Europe, with more expected to follow. U.K. financial firms will have to wait to access the European Union's single market until France determines that Britain is honoring its post-Brexit commitments on fishing rights, people familiar with the matter told Ania Nussbaum and Silla Brush. The idea is to put pressure on the U.K. and defuse unrest in France's northern fishing ports. Britain held up granting licenses to continue access U.K. waters. Jersey is caught in the middle. Joe Mayes, a native of the island, has this handy Quicktake video explaining the issue, which flared up last week with navies from France and the U.K. deployed to calm tensions. Read More: Island Tax Haven Shows Fish Fight Isn't Over  Fishing equipment at La Collette Marina in St Helier, Jersey, on Saturday, May 8, 2021. Photographer: Chris J. Ratcliffe/Bloomberg In a "Super Thursday" of national, regional and local elections, Prime Minister Boris Johnson's Conservative Party won a resounding victory in the U.K. parliamentary seat of Hartlepool, which had voted for the Labour Party every time since it was created in 1974. It was a huge boost for the U.K. prime minister that underscored the strength of local support for Brexit. Pro-independence parties won a majority in Scottish elections, spurring debate over a possible new referendum. Free of the EU rules on procurement, Johnson's administration laid out plans to overhaul state aid, legislation which it aims to introduce by September. The new system will free local authorities and devolved administrations from "bureaucratic" EU controls on taxpayer subsidies, according to the U.K. Department for Business, Energy and Industrial Strategy. Brexit will hold back the government's pledge to "level up" left-behind regions of the U.K. in the long-term, economists from the National Institute of Economic and Social Research said. The influential think tank expects the north of England, Wales and Northern Ireland to remain 2% below pre-pandemic levels of output through the first half of 2023. We aim to keep you up to date on how the U.K. navigates the world after Brexit. Got tips or feedback? Email us at beyondbrexit@bloomberg.net Chart of the Week Source: U.K. Office for National Statistics and Bloomberg analysis Source: U.K. Office for National Statistics and Bloomberg analysis We now have a quarter's worth of official data on the impact of Brexit on U.K. trade, explored in Bloomberg's monthly trade tracker. Goods exports to the EU rebounded 8.6% in March from a month earlier. Imports from the bloc rose 4.5%. "January was a massive train wreck," said U.K. Trade Policy Observatory director Michael Gasiorek. "This is still pretty grim." Don't MissWant to keep up?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share Beyond Brexit: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Get More From BloombergYou can find all of our newsletters here, but here are some we think you'd particularly enjoy: Bloomberg is also tracking the progress of coronavirus vaccines and mapping the pandemic. Sign up here for our Coronavirus Daily newsletter and here for our podcast. Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and expert analysis. |

Post a Comment