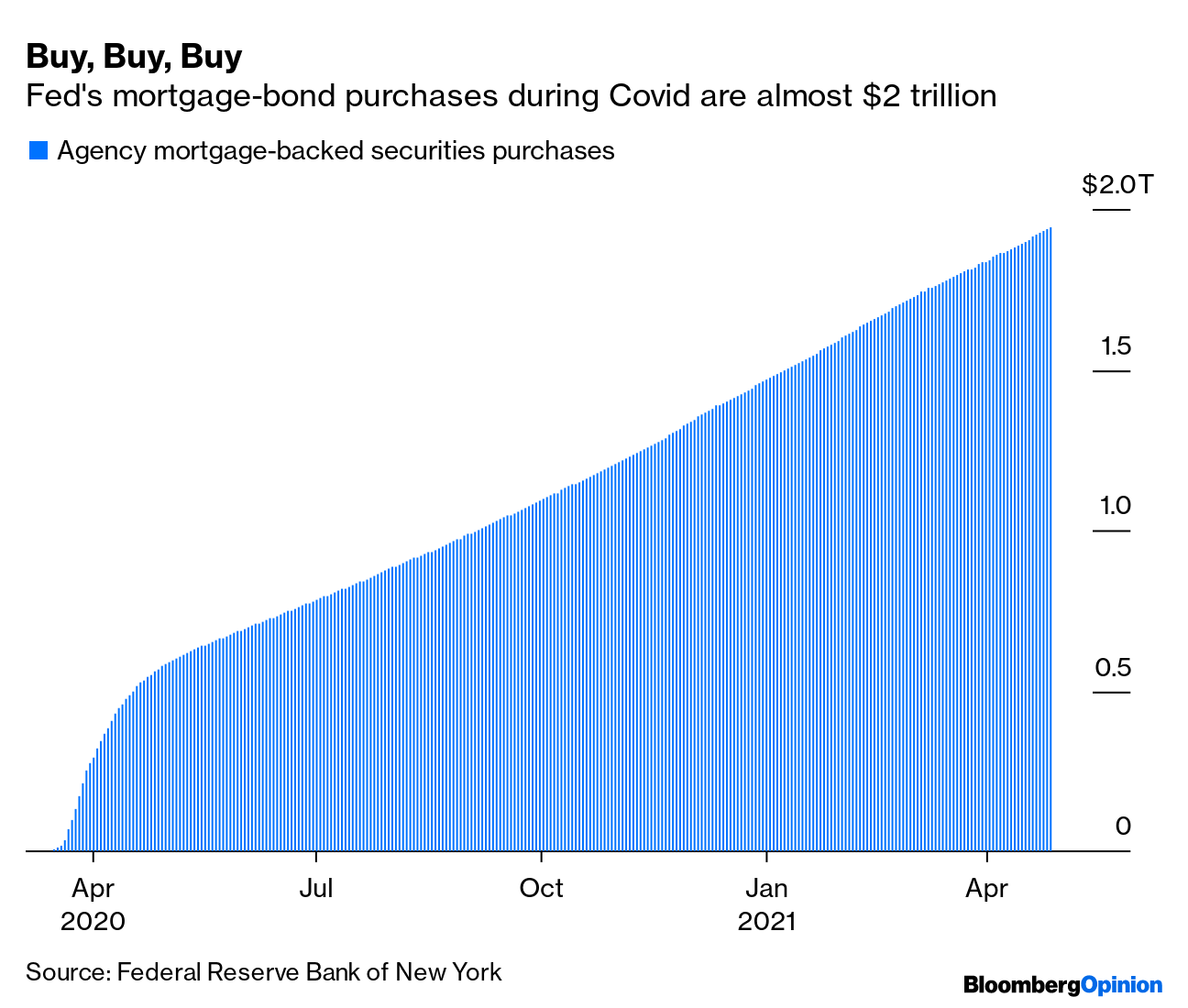

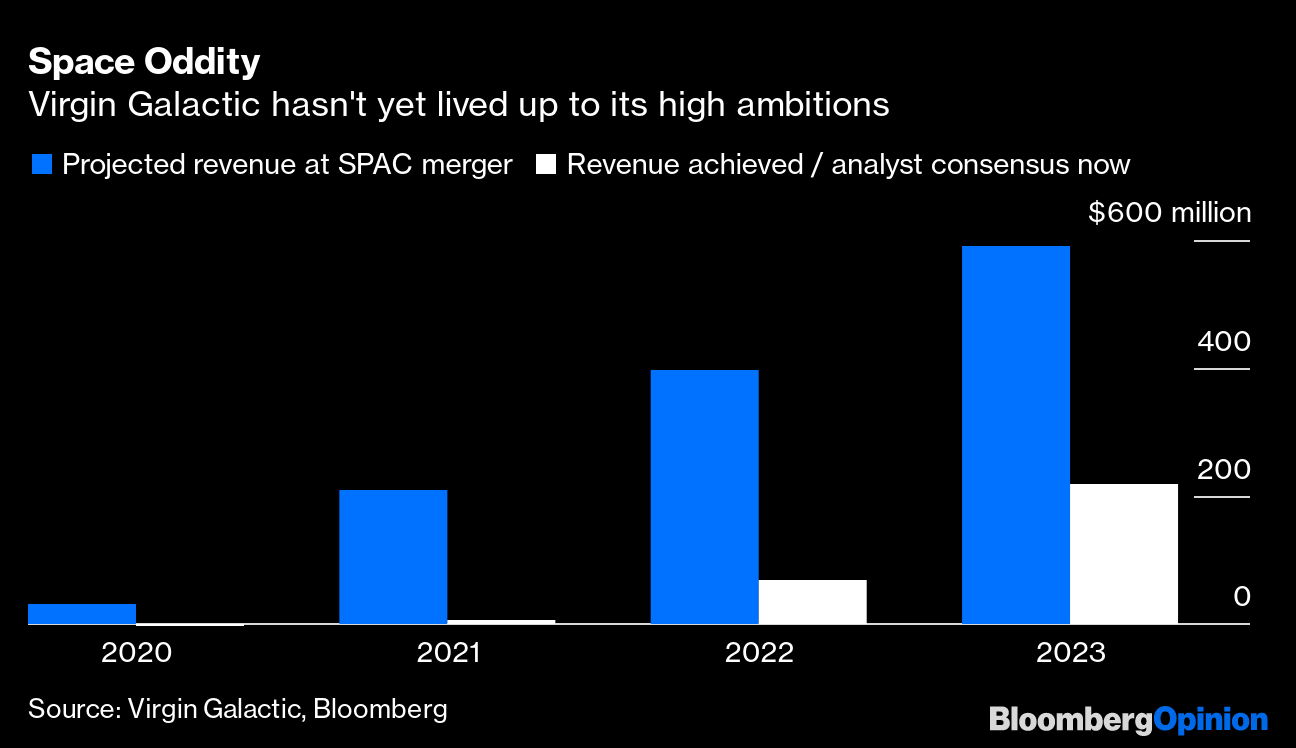

| This is Bloomberg Opinion Today, a gasoline line of Bloomberg Opinion's opinions. Sign up here. Today's AgendaColonial Pipeline Update: Keep Calm and Don't Buy GasLiam Denning tried to warn you not to panic about gasoline shortages while the Colonial Pipeline was shut down by a ransomware attack. But did you listen? Apparently not. And now you might not have any gas for a while. As Liam pointed out, the Southeast had enough gasoline in storage at the end of April to cover more than two weeks of demand. But panic buying is apparently draining that pretty quickly. We still don't know exactly when the pipeline will be fully un-Suezed, but gasoline supplies could be tight for a couple of weeks. Note to readers in New England: You had even less gasoline available when this whole fiasco started. Please don't panic-buy now.  The Fed Doesn't Want You to Buy My HouseIf you have tried to buy a house lately, my condolences. If you're still in the market, you might want to try lovely Springfield, Illinois, which may or may not be the home of the Simpsons, but which is definitely the only metropolitan area in the U.S. where prices fell in the latest quarter. Maybe it's the three-eyed fish. (Which is still not as weird as this fish.) Everywhere else, prices were absolutely bonkers, posting their biggest gain on record. The market is being stoked by mortgage rates that are so low as to be mere suggestions of interest rates, like a fancy restaurant serving a swordfish waft and a gentle touch. Which makes it sort of weird that the Federal Reserve is still frantically shoveling money into the mortgage market like it was 2009 or something. As Brian Chappatta notes, the Fed is buying $40 billion in mortgage-backed securities every month, keeping spreads so low the usual market buyers don't want to go near it.  This might have temporarily made sense in, say, March 2020, when the bottom was dropping out of everything. Now it risks stoking a new housing bubble, while keeping first-time buyers out of the market. That means they won't be buying new fridges and lawnmowers and garden gnomes and all the other junk that comes with owning a home. The Fed could switch to simply buying Treasuries without freaking out the bond market, and you can bet hedge funds and others would be happy to take some MBS off its hands. They say it's never a good idea to fight the last war. The Fed seems to not only be fighting two wars ago, but laying the groundwork for the next one. China's Population Bust Is No CrisisWhile U.S. population growth is slowing, China's is almost going in reverse. On the one hand, this means less economic growth in China, which means less growth for the whole world. It also means less cheap labor, which means less cheap stuff for Americans to buy at Walmart. But this is just what happens when nations develop, writes Dan Moss, and China can actually be just fine with a shrinking population. Japan has been downsizing for a while now, and it's far from a dystopian hellscape. Better yet, a shrinking Chinese population is better for the climate, writes Peter Orszag. Generally speaking, fewer people equals fewer emissions and fewer dystopian hellscapes. Maybe it's time to embrace the population bust. Further Population Reading: If we want more American babies, we must make American society more livable. — Ramesh Ponnuru We Have Fun Here, Billionaire EditionElon Musk can make just about any price rise simply by tweeting about it, and this weekend we learned he can also make prices fall simply by joking about them. But never fear: After briefly hurting Dogecoin, Musk helped it again by vowing to blow up the moon with it, or something. And then he not only helped Dogecoin, but also traffic to Bloomberg dot com, backslash Opinion, by tweeting approval of Tim Culpan's story about how Dogecoin will be fine because it's making the game of pointless finance available to the masses. At least until we are all consumed in a swirling vortex of meta-references.  Meanwhile, looking on wistfully, China's billionaires are smacked down merely for tweeting poetry, writes Shuli Ren. Bonus Crypto Reading: Wall Street traders find crypto to be an unspoiled new playhouse of financial engineering. — Matt Levine Telltale ChartsSpeaking of sad billionaires, Richard Branson's space company is running a very distant third to those of Jeff Bezos and Elon Musk, writes Chris Bryant. This highlights not only the difficulty of space flight — it turns out you need more than cash to escape a gravity well — but also the risk of relying on SPAC projections.  One of the things we'll have to worry about if inflation becomes a real thing is "fiscal dominance," or the federal government being too big to fail, making it more painful for the Fed to raise rates, writes Noah Smith.  Further ReadingPresident Joe Biden's tax plans need fine-tuning to make sure they mesh and accomplish their goals. — Bloomberg's editorial board Republicans have long tried to limit voting rights. What's new is a desire to subvert actual election results. — Jonathan Bernstein The latest violence in East Jerusalem shows how combustible Israeli-Palestinian relations are. — Hussein Ibish Trying to play nice with Yemen's Houthi rebels has only made peace less likely. — Bobby Ghosh L Brands is betting Victoria's Secret will be worth a lot more spun off than sold, now that it's starting to come back. — Andrea Felsted Bond investors applaud Puerto Rico luring the wealthy with tax breaks. But it needs more sustainable growth. — Brian Chappatta Miami probably won't supplant San Francisco and New York as a top tech hub. — Tyler Cowen ICYMITrack returns to the office with the Pret (a Manger) Index. The NRA's bankruptcy case got tossed. Inside Pictet, the Swiss bank for the world's wealthiest people. KickersFestus was one of 2020's least-popular baby names. (h/t Mike Smedley) Scientists find a 273-million-year-old deep-sea relationship is still alive, just like Bennifer. Voyager 1 is picking up the hum of interstellar space. Dracula's castle in Romania is offering free Covid vaccinations. Happy 52nd birthday, Monty Python. Notes: Please send parrots and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment