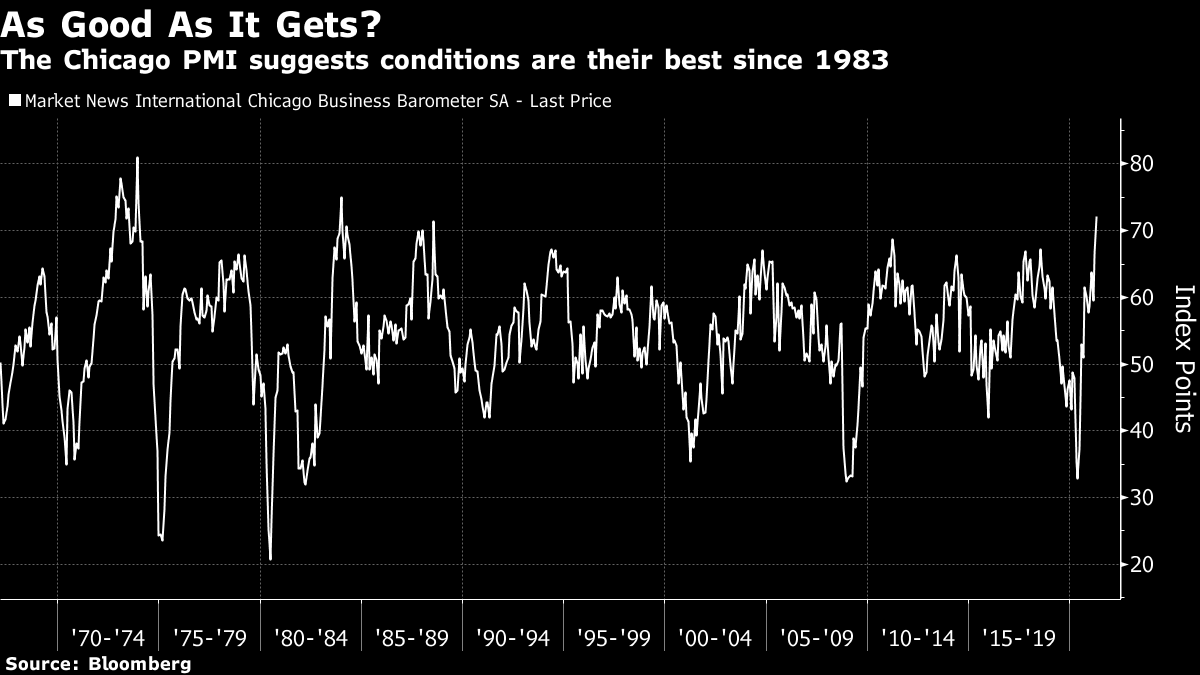

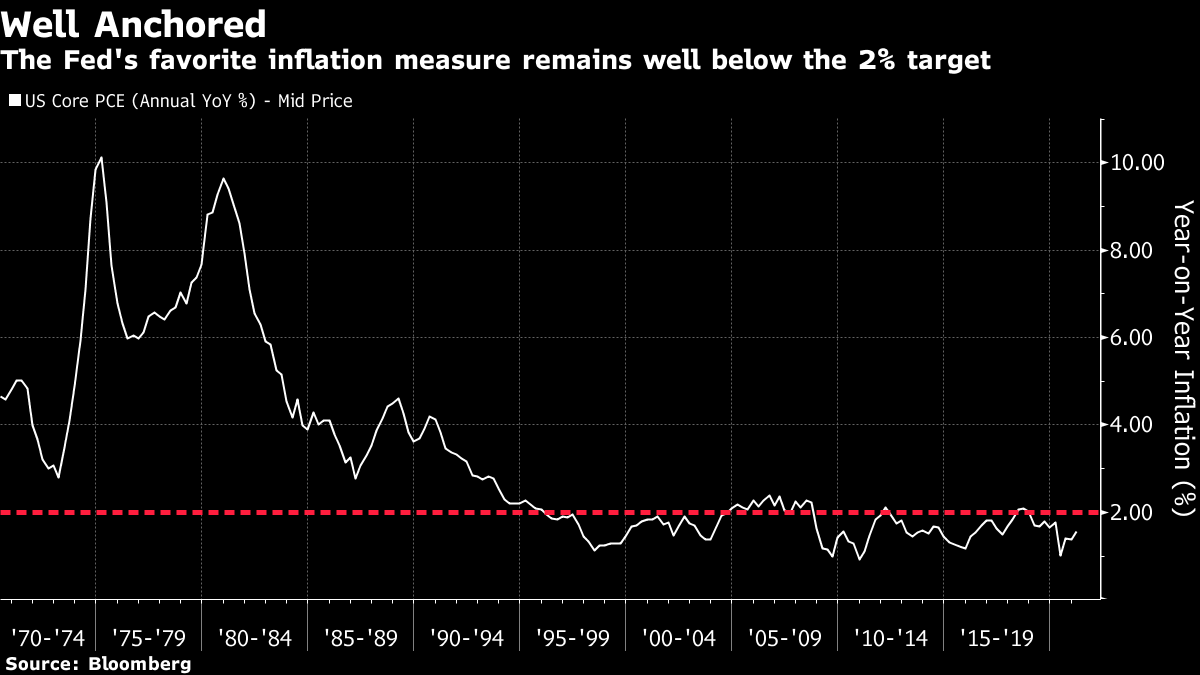

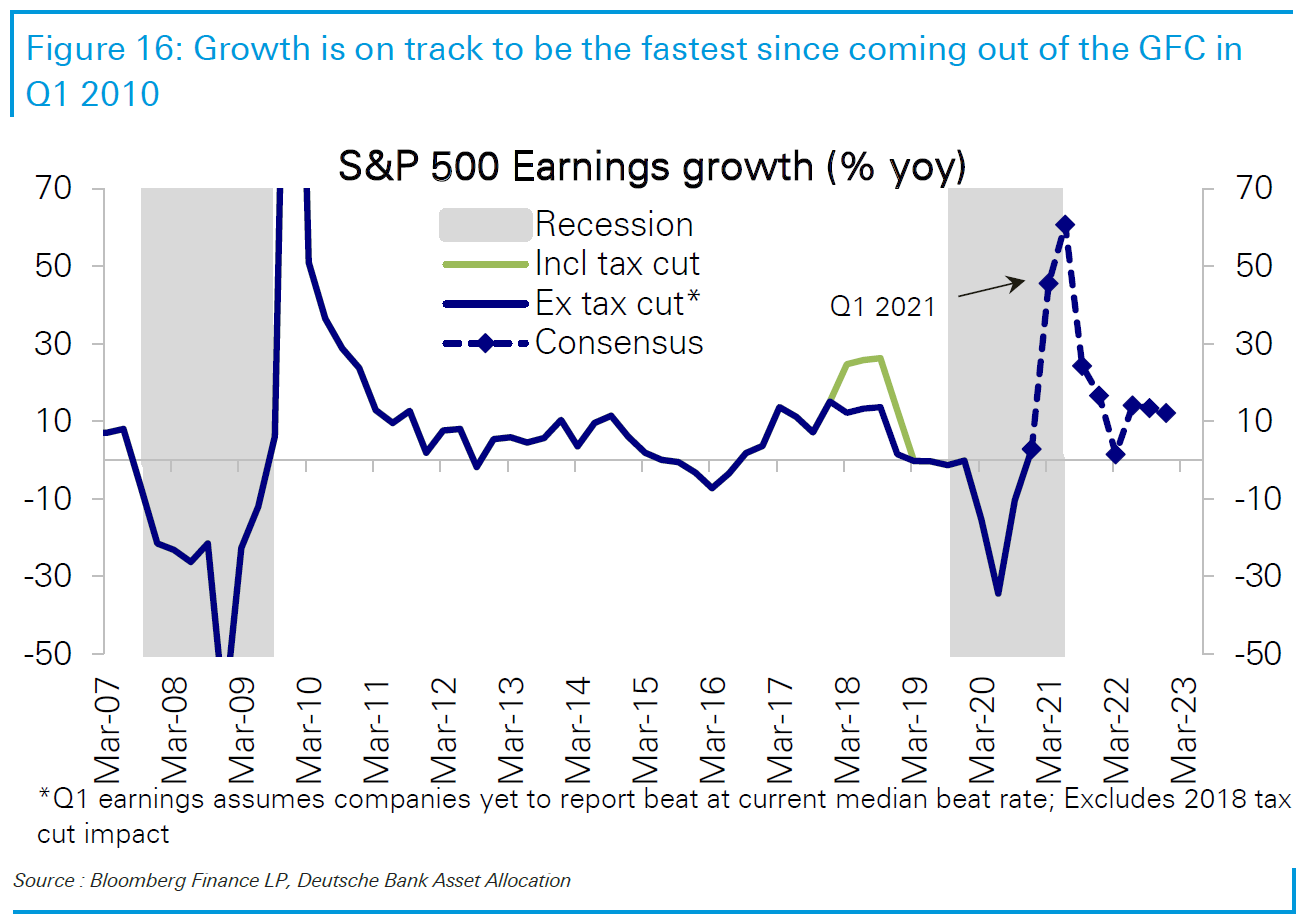

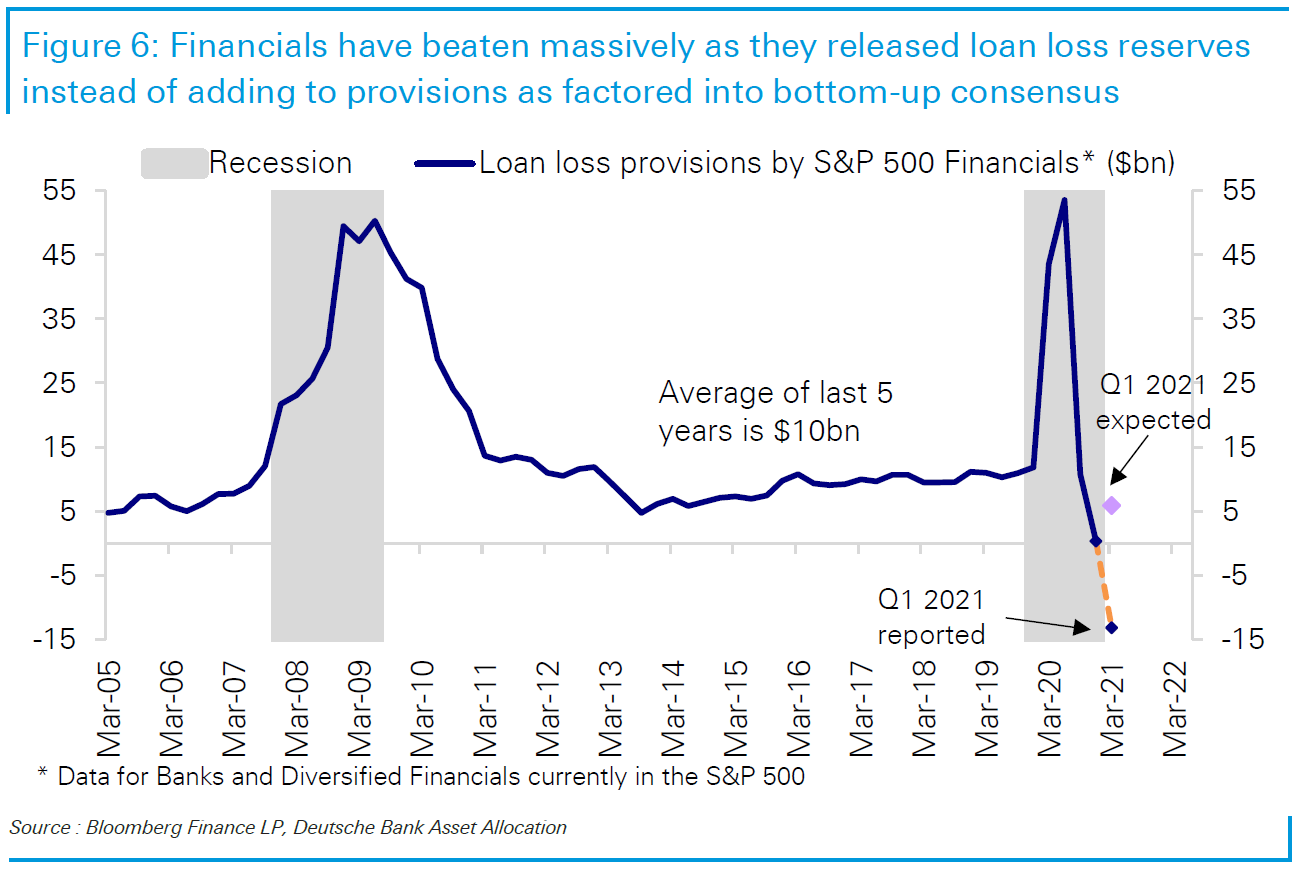

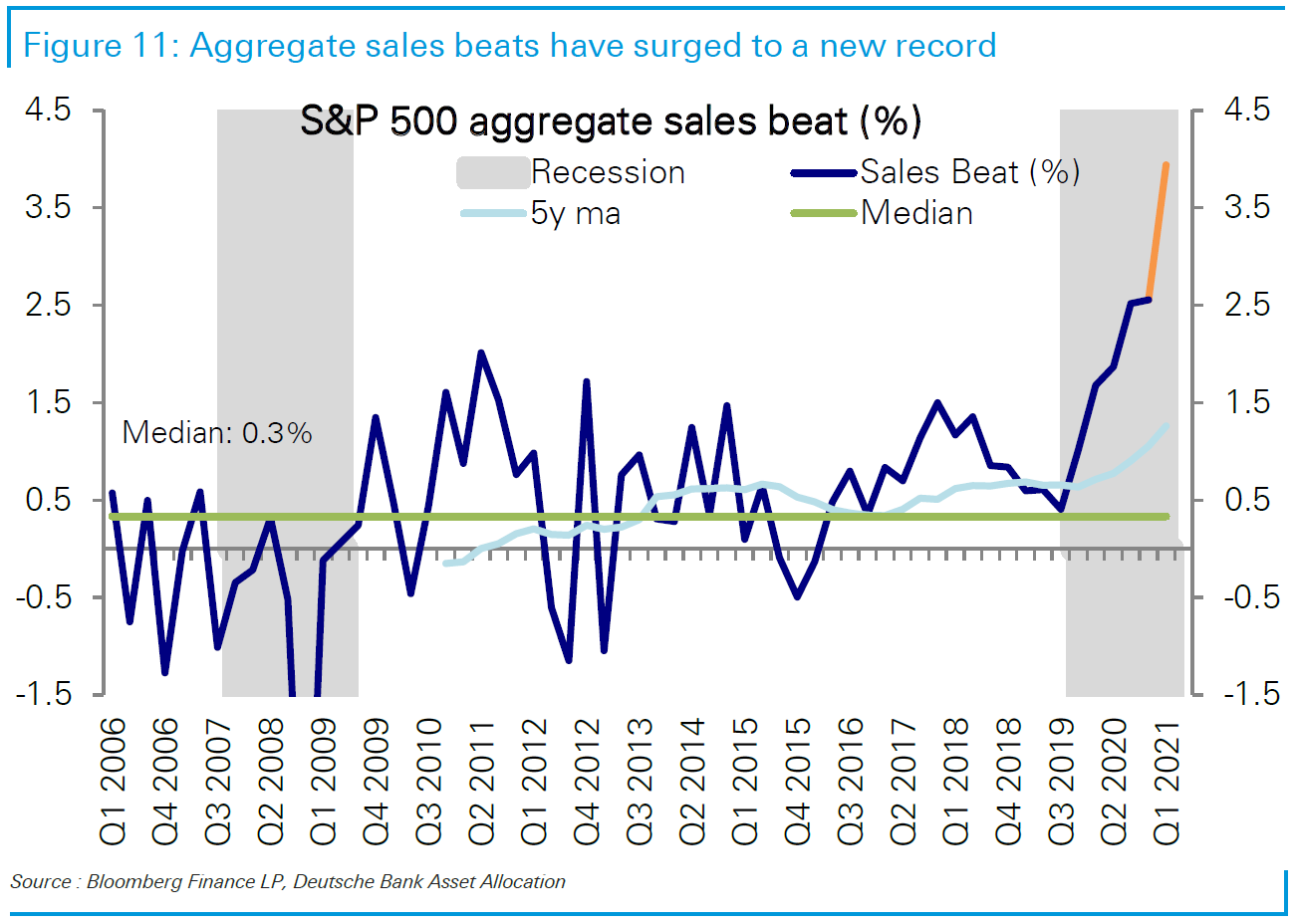

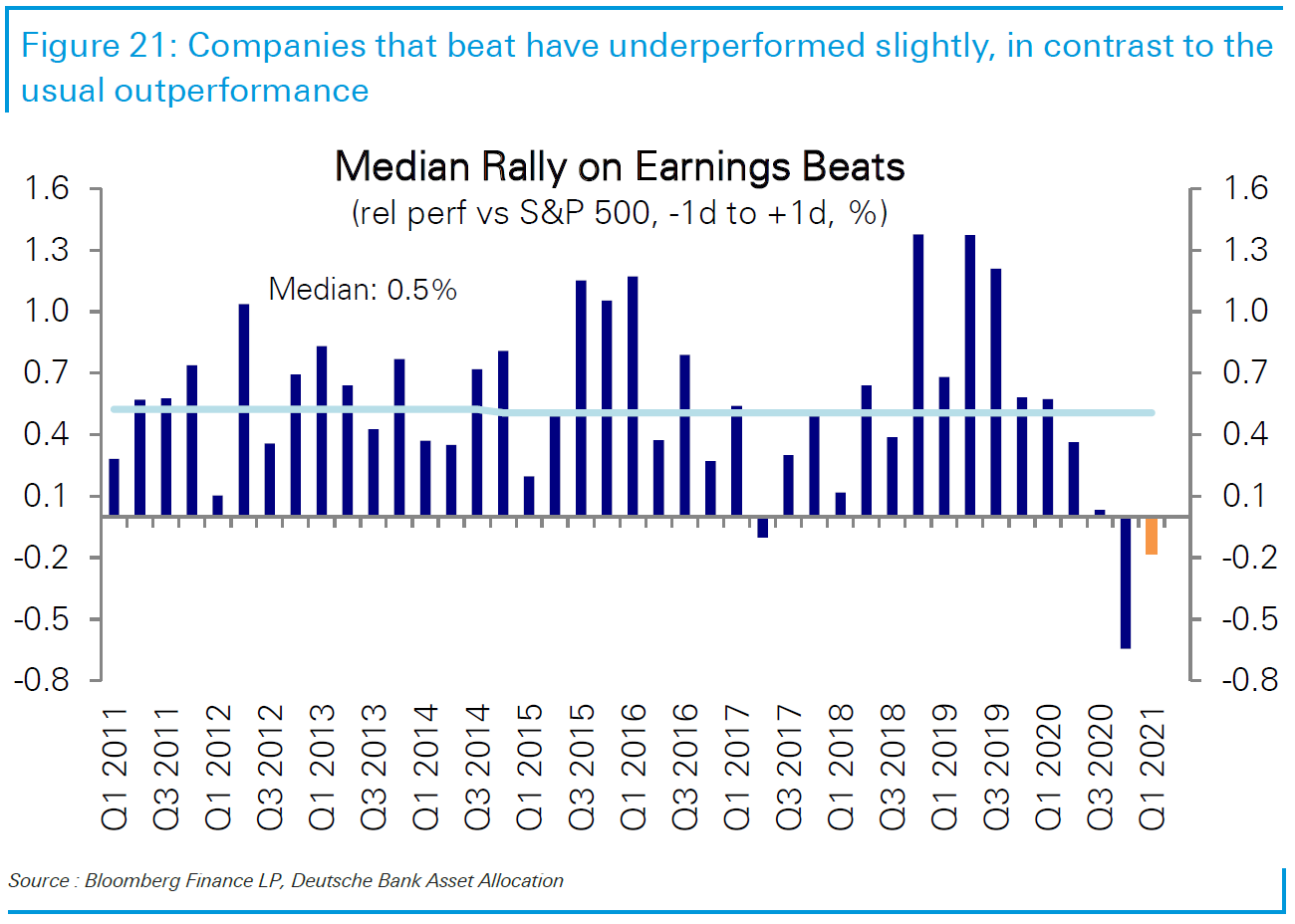

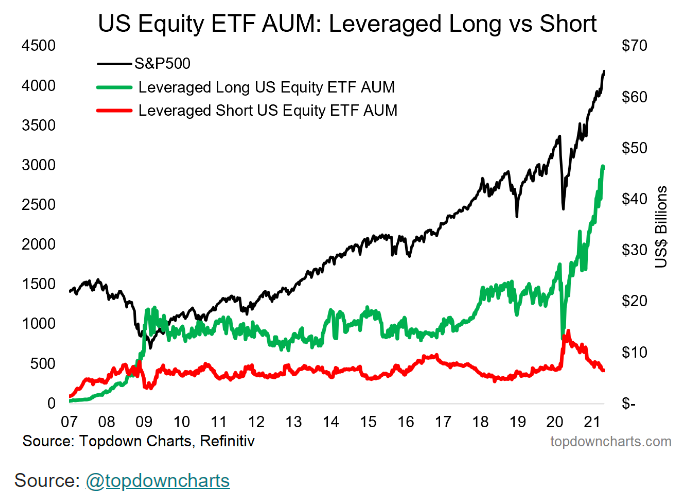

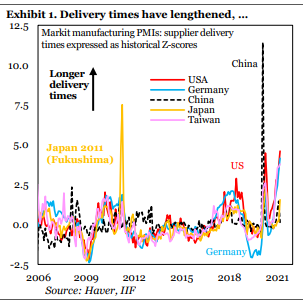

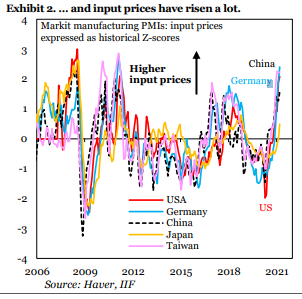

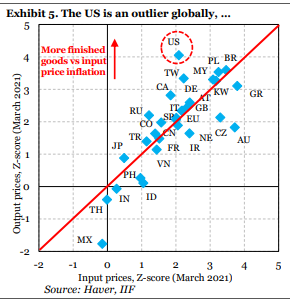

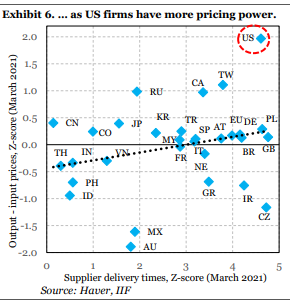

| And so we have reached the month of May, when the most annoying of all stock market cliches says that we have to sell and go away. Valuations have suggested that this might be a good idea for a while. But markets can always get even more expensive; valuations don't help with timing. So, putting this issue to one side, what reason might there be to leave now? Ultimately, it comes down to the notion that things are as good as they're going to get. That could mean overheating (which would trigger a response in terms of tighter monetary policy), or it could mean that economic growth can now only slow down or even go into reverse. For one exhibit of just how good things look, take the Chicago PMI, which came out last week. It was the best reading since 1983. And readings this good tend to be followed swiftly by a slowdown:  But if overheating is the concern, it emphatically doesn't show up in the Federal Reserve's favorite measure of inflation, the PCE deflator compiled when drawing up GDP figures. The core PCE deflator still shows inflation of comfortably less than 2%:  So if inflation is a clear danger, it isn't a present one. As for the data coming in from the corporate sector, it is very, very good. So far, with the reporting season for the first quarter roughly half over, earnings per share for S&P 500 companies are on course for their best annual growth since the bounce back from the Great Recession. The transitory effects of the Trump corporate tax cut were tiny by comparison, as this chart from Bankim Chadha of Deutsche Bank AG makes clear:  It is more or less impossible to complain about these numbers, for shareholders at least. But as current forecasts show, this pace of growth cannot be sustained much longer. If there is any asterisk, it is from the financial sector. Banks (prudently) took big reserves for likely losses as the pandemic took hold and then (possibly not so prudently), released a lot of the money they had put aside during the first quarter. This was quicker than had been expected and took the market by surprise, but does reflect what looks like a much healthier environment for lenders:  What does this tell us about the prospects for the market? Chadha shows that aggregate sales of S&P 500 companies are on course to come in ahead of market expectations in an unprecedented way. The Wall Street brokers whose forecasts create the consensus numbers appear to be as surprised as anyone else by the strength of the U.S. consumer:  This is probably because analysts, like everyone else, are still having trouble getting their heads around the unparalleled level of support coming from the government. All else equal, it suggests the market is still catching up with reality, and so share prices have further to run. Against that, if we look at how companies' share prices have tended to perform after they announce results that beat consensus expectations, we find that they have actually fallen a little. This is very unusual, and suggests the market was at least implicitly expecting to be surprised (if that is possible). If earnings can trounce expectations to this extent without provoking a big reaction, it suggests that all the good news has been priced in, and then some:  Where does all this get us? If you feel like following the ancient advice and selling this month, the case for doing so isn't a lot stronger than it was a month ago. (If you went by valuation alone, you should have sold in April, or March, or February.) U.S. economic data do look to be getting to an inflection point where their rate of improvement will have to slow, which implies much less exciting returns ahead. There are also plenty of signs of potential overheating (of which more below), but it's hard to say the key inflation and unemployment data have got out of hand just yet. If you want a case to sell, it doesn't rest on the calendar or on economic and corporate fundamentals, but on the behavior of your fellow mortals. From the continuing rampant performance of cryptocurrencies, through the excitement over meme stocks to the new celebrity status of Tesla Inc.'s Elon Musk, who will even host Saturday Night Live next week, there are plenty of signs of excess. To offer one beautiful example from Callum Thomas of Topdown Charts, the kind of money pouring into leveraged long exchange-traded funds (which offer you a one-stop shop for leveraged losses if the market goes down) suggests that speculation is reaching a final, dangerous stage:  But leaving the market is risky, just as staying in it can be risky. Rather than getting out altogether, as the "Sell in May" aphorism implies, it's probably best to keep with whatever balanced portfolio you had before, not worry about the calendar, and not attempt to time a bursting bubble. Inflation and OutliersIt's a fair prediction that inflation will continue to occupy plenty of mindspace this month. A central reason to fear an inflation resurgence, in the short run, is bottlenecks. Plenty of suppliers are coming under pressure as demand rises sharply, not long after they cut production during the pandemic. It's straightforward economics that they will aim to deal with this by raising prices. The question is whether companies will pass on these increases to the public. An interesting piece from the Institute of International Finance suggests that in most of the world companies aren't, though the U.S. appears to be a significant exception. The IIF built its argument on ISM supply manager survey data, which are due on the first working day of the month, so this is an important trend to monitor. First, in an unmistakable sign of bottlenecks, delivery times have lengthened more of less everywhere. The disruption suffered by Japan after the Fukushima disaster in 2011 is the only comparison in recent history:  Suppliers have responded exactly as might be expected, by raising prices. This trend is universal. (In all the charts, the IIF uses Z-scores, which measure the number of standard deviations surveys are from their norm — so countries that tend to be more prone to price spikes won't show up as higher):  This is the raw material for a consumer price spike. Now, how do input prices compare to output prices in the ISM survey? The IIF mapped one against the other for a range of countries, and revealed a close relationship. The broadest outlier, with higher output prices than would have been predicted by the prices companies were paying, was the U.S.:  Why is this happening? When the IIF compared the markup, or the gap between output and input scores, with supplier delivery times, the U.S. showed up as an extreme outlier. U.S. companies are suffering some of the worst delays, but they have also passed on far more of a price increase to their customers than anyone else. The relationship isn't tight, though U.S. companies do appear to have strong pricing power. Meanwhile, companies in Australia and Mexico are outliers in the other direction, and have remarkably little pricing power:  Why might this be? The IIF suggests it is due to "the rapid pace of reopening and scale of fiscal impulse, which surpasses anything elsewhere." That would make sense. Meanwhile, nobody else seems to be in a similar state with the partial exceptions of Canada and Taiwan. Supply disruptions are indeed happening the world over, as could easily have been predicted. They haven't yet been enough to generate real inflationary pressure outside the U.S., where these numbers give some force to the idea that the fiscal and monetary response to the pandemic has created a real risk of overheating. The latest ISM surveys should give valuable evidence on whether anywhere else is starting to overheat, and whether the U.S. problem is continuing. It will be one of the most important points to look for. A Word from the OracleWarren Buffett, now 90, gave his annual conference for Berkshire Hathaway Inc. shareholders over the weekend. The whole thing was streamed on Yahoo Finance, and you can watch all five hours of it here. Buffett was accompanied by Charlie Munger, who is several years his senior, and by the executives who currently seem most likely to succeed them. As ever, it's worth watching. Buffett is never boring, and rarely wrong. Anyone with his weight of experience and success must always be taken seriously. That said, there was something different about this year's proceedings. Buffett had to admit to various mistakes. Charges against him included getting out of airlines last year, selling some Apple Inc. shares, and in general not going for a classic bargain hunt last summer when the pandemic had created a buying opportunity for the ages. Those concerned about timing (see above) should note that both Buffett and Munger, as successful as any investors who have ever lived, poured cold water on the notion of trying to time a bottom. But Buffett couldn't reject the charge that he had failed to buy American just when he was expressing confidence in his home country. And he is getting into trouble on ESG issues. Shareholders are annoyed by Berkshire's policy on carbon disclosures (or the lack of them), and also by Buffett's decision to buy shares in Chevron Inc., an old-line oil major that is all about fossil fuels. And on these issues, the Oracle seemed wholly unrepentant: "Chevron is not an evil company in the least and I have no compunction about owning Chevron. If we owned the entire business, I would not feel uncomfortable about being in that business. I think Chevron has benefitted societies in all kinds of ways, and I think it will continue to. "I don't like making the moral judgments on stocks in terms of actually running the businesses. There's something about every business that [if] you knew what, you wouldn't like. If you expect perfection in your spouse or your friends or in companies, you're not going to find it."

These arguments are a tad disingenuous. Nobody expects perfection. They're also out of step with the times, which isn't to say that they're wrong. As Buffett has taken some strong liberal political stances in the past, and endorsed Democratic candidates, he might anger some of his fans — which he can doubtless live with. There is an interesting case for old-line energy companies as what Buffett's mentor Benjamin Graham called "cigar butts." These were companies with little future, but still something left, and priced too cheap — discarded investments that still had a few good puffs in them. Amid the excitement over alternative energy, it is possible that plenty of cigar butts have been left littering the floor. It's not clear that Buffett is immoral in making sure that Berkshire Hathaway takes the last puff. Someone might as well do it. But impressive though Buffett and Munger continue to be in their nineties, I felt a distressing sense that they were out of touch with the zeitgeist. They have had off years and made mistakes from time to time, and they are still treated with the courtesy and respect they deserve; but in the eyes of their followers they can do wrong. That might prove a signal to sell the market rather than Berkshire. And it's disquieting. Survival TipsFirst, a scheduling note. Points of Return didn't appear at the end of last week due to an infuriating technical issue with my computer, for which I apologize. It also won't be appearing for the rest of this week, while I work on a couple of long-term projects which with luck you will see soon. For now, some more songs to celebrate May. The first Monday of the month has long been a time for celebration, as this 1939 British news report shows, and it carries on to this day. Apart from Arcade Fire's Month of May there's Now Is the Month of Maying (a 16th century song performed here by the King's Singers in Nashville), or Maggie May by Rod Stewart (unplugged here), Mayday by Cam or May It Be by Enya. Enjoy May Day, those who get a national holiday. And everyone have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment