| Colonial pipeline still shut, more commodity price surges, and the pandemic latest. Held to ransom Gasoline futures surged as the nation's largest fuel pipeline and critical source of supply for the New York region remains shut this morning. The critical piece of infrastructure was closed by operators on Friday following a ransomware attack. The White House pulled together an inter-agency task force to tackle the problem. The administration, which has a range of powers that can used to counter the effects of the shutdown, has already waived limits on the hours truckers can drive when hauling fuel. There are fears that the shutdown will push the national average price of a gallon of gasoline above $3 ahead of Memorial Day. Iron surge Rising fuel prices are adding to the beat of inflation-sounding news coming through recently. Iron ore prices surged more than 10% in Asian trading, with the benchmark Singapore contract above $220 a ton. Copper keeps hitting new record highs as investors see the metal getting a boost from reopening economies and a shift towards green energy. The raw materials rally has driven the Bloomberg Commodity Spot Index higher for 14 of the last 15 trading sessions. U.S. CPI data for April is published Wednesday. Openings Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said there is "no doubt" the U.S. has undercounted the number of deaths in the country from Covid-19. He also sought to address the increasing problem of "vaccine hesitancy" in comments over the weekend as the pace of inoculation in the U.S. falls. In Europe, there were more reopenings as the number of new cases continues to fall and vaccinations pick up. India continues to suffer a deadly wave of infections, with the capital New Delhi extending a lockdown for another week. Markets mixedGlobal equites are off to a choppy start as earnings season continues while inflation fears mount. Overnight the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 1% higher. In Europe the Stoxx 600 Index was 0.1% lower at 5:50 a.m. Eastern Time with miners outperforming. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield as at 1.581%, oil rose and gold was higher. Coming up... It's a very quiet start to the week on the economic data front with an appearance from Chicago Fed President Charles Evans the only scheduled event of note. Today we have Duke Energy Corp., Marriott International Inc., Tyson Foods Inc. and Occidental Petroleum Corp. among the companies announcing quarterly results. What we've been readingHere's what caught our eye over the weekend. And finally, here's what Joe's interested in this morningLast Friday's Non-Farm Payrolls report came in weak, and immediately that started a debate about whether the expansion of Unemployment Insurance was holding back the pace of hiring in a significant way.

The evidence doesn't seem to be a slam dunk either way. There's certainly a lot of anecdotal evidence that all kinds of retailers, restaurants, hotels and other parts of the service economy are having a hard time hiring. That we know.

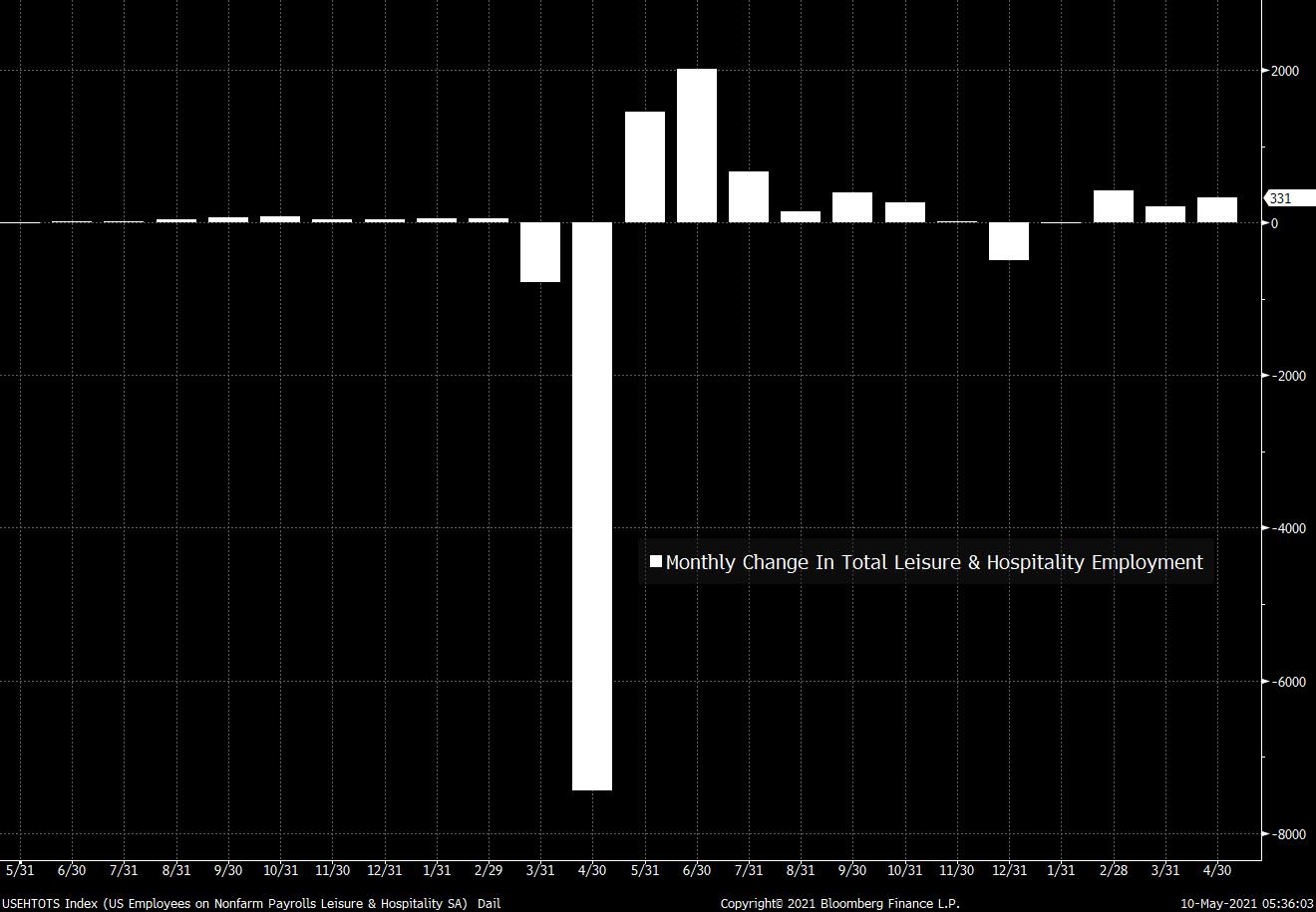

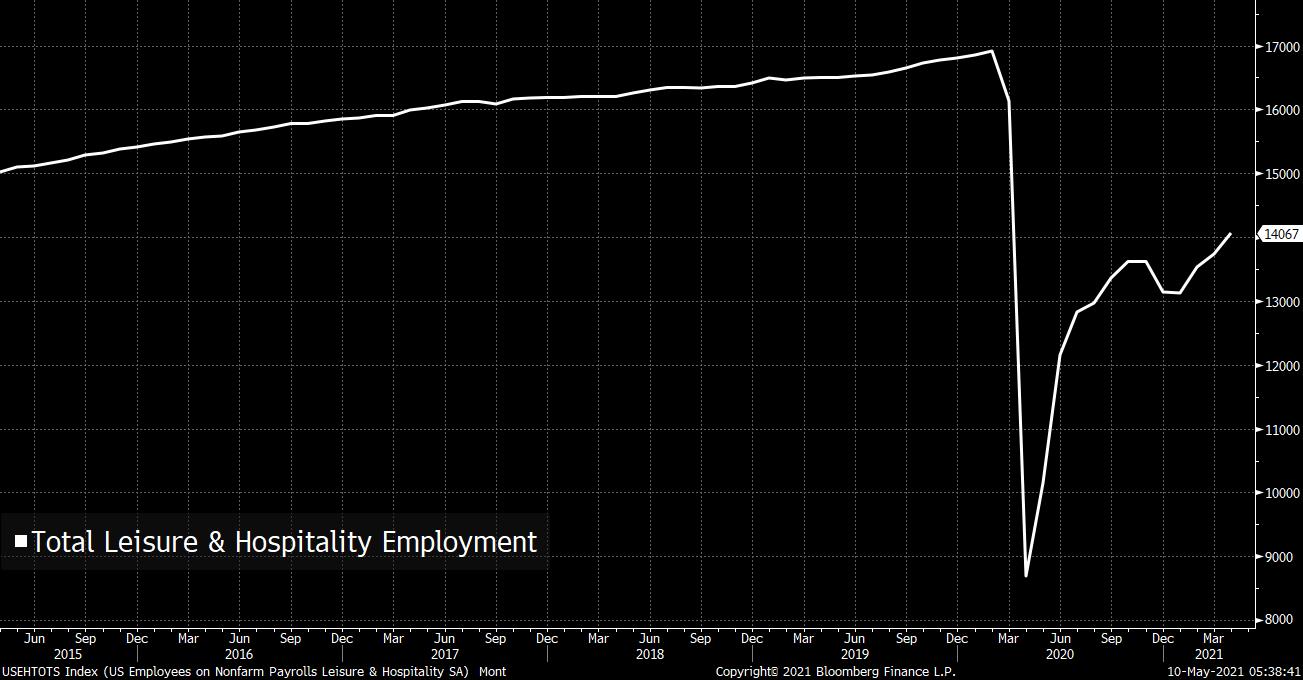

On the other hand, Leisure & Hospitality Employment actually accounted for more than all of the jobs gained in the month, with the sector adding over 330K people. Other sectors, on net, lost jobs. So that doesn't scream tight labor markets caused by UI.  On the flipside, this sector bore the brunt of the job losses. And there's still a big hole to climb out of relative to pre-crisis levels. So you could make the argument that, given the pace of reopening, we would be seeing much faster job growth in the absence of the UI expansion.  It's also a possibility that there are other factors constraining supply besides UI, such as availability of childcare and the ongoing hesitancy to return to workplaces amid a virus. Regardless of what's going on, the whole debate is very revealing. It's obvious that many people (businesses owners, but also economists and general observers of the world) just take it for granted that there's always going to be a virtually unlimited supply of cheap labor. Just like people assume that when you turn a faucet water will come out, people assume that if a restaurant or a store puts up a Help Wanted sign, they will be inundated with applications. When a tech company is looking for an engineer we assume they're going to have to fight tooth and nail to fill the position. People don't make that assumption when a restaurant is looking for waiters.

Acknowledging this reality precedes the whole UI discussion. Alex Press at Jacobin has a report on the litany of allegations of labor law violations against Chipotle in New York City and elsewhere. Among the allegations is that the company didn't comply with laws regarding predictable worker schedules. Even if you take a completely laissez-faire stance towards labor, and believe that any employment contract entered into is voluntary, that doesn't change the fact that numerous modern business models are predicated on there being a pool of precarious workers with minimal bargaining power. Whether it's fast food, gig-workers, e-commerce warehouses, their existence is assumed. So for the first time in awhile -- whether it's due to UI or not -- we might be getting a glimpse of what an economy looks like where that can't be taken for granted, and businesses actually have to scramble to find labor, or in some cases maybe it isn't available at all.

Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment