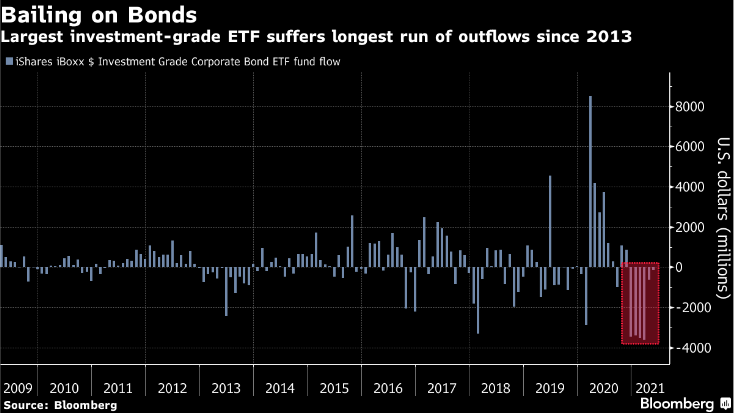

| It's jobs day, Fed warning, and vaccine-maker relief. Payrolls One million. That's how many new positions were added by employers in April, according to the median estimate from economists surveyed by Bloomberg. While trends in weekly jobless claims do point to a bumper month for jobs, employers are becoming increasingly concerned about the lack of people willing to fill lower-paid positions. Fed Chair Jerome Powell has gone to lengths to point to the low levels of employment recovery among lower-paid workers and minorities this year. Fed warning The Federal Reserve said that asset valuations are getting stretched with Fed Governor Lael Brainard warning that a "re-pricing event" could be amplified by high levels of corporate indebtedness. Investors, for their part, are busy repricing the odds of a Fed rate hike, with a huge wager building for a hawkish surprise around the time of the annual Jackson Hole meeting in August. The bet comes as the price of raw materials continues to surge, with copper the latest to hit an all-time high. Vaccines Shares of vaccine makers got some relief after German Chancellor Angela Merkel did not support a U.S. proposal to waive patent protection for Covid shots. The moves come as the European Commission is expected to sign off on a mammoth 1.8 billion dose order from Pfizer Inc. and BioNTech SE as soon as today. Globally more than 1.23 billion vaccine shots have been administered, with the pace in the U.S. falling close to 2 million a day. Markets mixedThe Fed's warning of stretched valuations has not stopped investors stretching them a little more this morning after U.S. stocks ended yesterday at record highs. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 0.3% higher. In Europe the Stoxx 600 Index had added 0.5% by 5:50 a.m. Eastern Time. S&P 500 futures pointed to more gains at the open ahead of the jobs report, the 10-year Treasury yield was at 1.577%, oil was slightly lower and gold rose. Coming up... Canada also reports the employment situation there for April at 8:30 a.m. U.S. March wholesale inventories are at 10:00 a.m., the Baker Hughes rig count is at 1:00 p.m. and the latest consumer credit reading is at 3:00 p.m. Top diplomats from China and the U.S. will present their differing world views at the UN today. DraftKings Inc., Lear Corp. and Nikola Corp. are among the companies reporting earnings. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningInvestors have been shying away from bonds that are most vulnerable to losses from rising interest rates -- that is, longer-dated and higher-quality debt where yields are already anemic. Duration risk on the benchmark Bloomberg Barclays Aggregate Index is close to all-time highs:  This index series shows the worst losses on record for U.S. government bonds at the far end of the curve on record last quarter, at close to 14%. Investors in high-duration bonds have been voting pretty loudly with their feet, as the largest investment-grade exchange-traded fund is on its sixth month of outflows -- the longest string since the taper tantrum year of 2013.  The worst may be over for now, as that exodus has at least slowed. The long end of the curve has steadied in recent weeks as the market appears to have priced in the more-optimistic expectations for growth that sprung up around President Biden's stimulus proposals. And the ensuing buzz over inflation risks has settled. That has emboldened contrarians such as Northern Trust Asset Management to load up on duration, on the view that the U.S. 10-year benchmark is stuck in a range well below 2% for the rest of this year. But the broad trend away from duration risk is still clearly in place. MFS's Gomez-Bravo is among those favoring junk bonds for their lower interest-rate sensitivity. Moreover, she expects they may fare better in a taper if we are indeed the early stages of the credit cycle -- such as you'd typically see in a recovery, when growth is on a sustainable upswing, and defaults are less likely. That said, she warns that the asset class has changed in recent years. And that's not just because high yield is no longer high yielding. "Interestingly, there is a fear of duration in high yield," Gomez-Bravo said, as the last crisis saw ratings down grades plunge more investment-grade issuers -- who tend to have longer-maturity debt -- into the junk bond market. In addition to those fallen angels, the riskier credits have in some cases been able to take advantage of record low interest rates to extend the maturities of their borrowing. Follow Bloomberg's Emily Barrett on twitter @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment