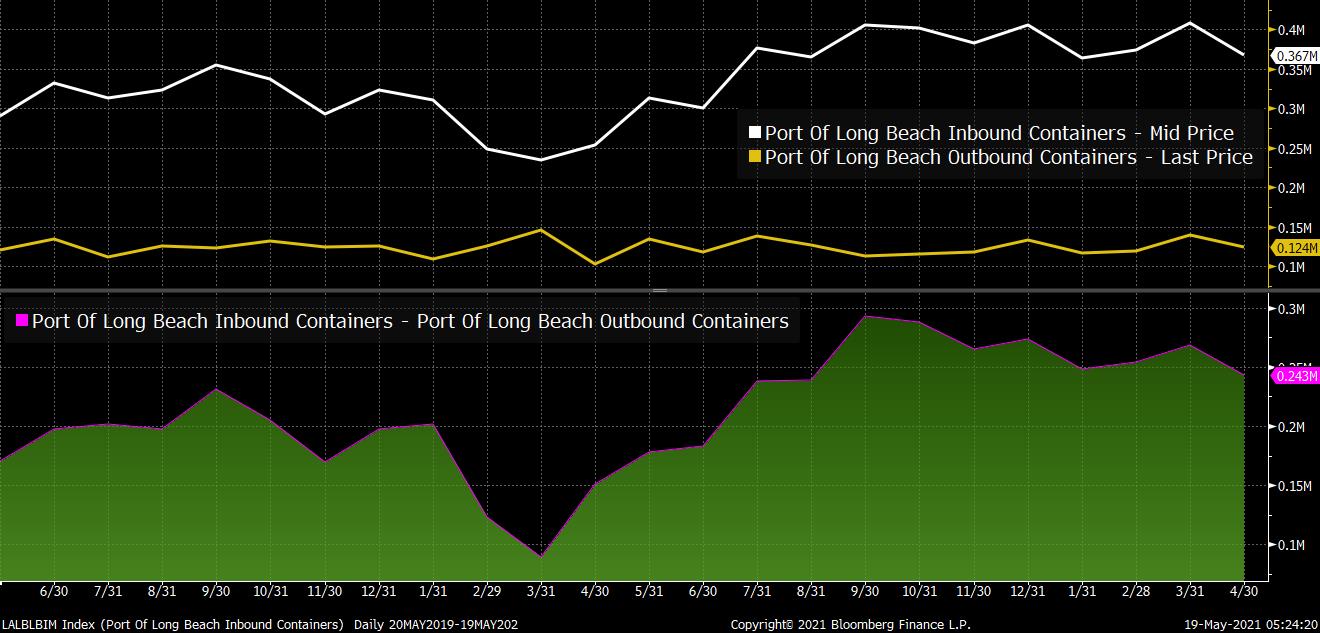

| Trump Organization probe, Bitcoin is over Musk, and inflation concerns mount. Not civil New York Attorney General Letitia James said her investigation of the Trump Organization is now a criminal probe. Donald Trump's company can add this to the criminal investigation it already faces from Manhattan District Attorney Cyrus Vance Jr. Separately, Trump is close to reaching a deal with House Democrats on issues surrounding his financial records from Deutsche Bank AG. The former president is scheduled to be the keynote speaker at a North Carolina Republican party event next month as he begins his return to public life. Under $40k Bitcoin dropped below $40,000 in overnight trading, erasing all the gains since Tesla Inc. announced it had invested $1.5 billion in the digital token. While the Elon Musk-led investment was the catalyst for the rally toward $65,000, the Tesla CEO's recent comments on the environmental costs associated with the cryptocurrency have coincided with the plunge. Comments from the People's Bank of China restating its regulatory position on digital currencies have also hurt sentiment. For Tesla, there are other problems emerging as Chinese demand for its cars slump. Rising While the minutes of the latest Fed meeting, scheduled to be released at 2:00 p.m. Eastern Time today, cover a discussion which happened before the recent surprising economic data, they will be read closely for any signs of rising inflation concerns. Traditional haven plays are seeing price rises, with gold around $175 an ounce higher than its end of March low. While investors are nervous about the possible long term effects, there still is little sign of a major sentiment shift. Markets dropInflation and Covid re-emergence fears are again weighing on investor sentiment. Overnight the MSCI Asia Pacific Index dropped 0.7% while Japan's Topix index closed 0.7% lower. In Europe, the Stoxx 600 Index was down 1.1% at 5:50 a.m. with every industry sector in the red. S&P 500 futures pointed to a fall of almost 1% at the open, the 10-year Treasury yield was at 1.659% and oil dropped. Coming up... Canada's April CPI reading is at 8:30 a.m. The latest EIA crude oil inventory number is at 10:30 a.m. There are three Fed speakers today ahead of the publication of April minutes. Cisco Systems Inc., Lowe's Cos Inc., Target Corp. and Analog Devices Inc. are among the companies reporting results. New York City reopens. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningAs everyone knows, we're seeing delay and bottlenecks across the economy right now. A recent podcast that Tracy Alloway and I did with Ryan Petersen, the CEO of the logistics firm Flexport, offers the clearest explanation for why. It all really starts with this chart. The white line shows the inbound containers coming into the Port of Long Beach, a major destination from goods imported from China. The yellow line shows the opposite, the number of containers sending U.S. exports to China. The green line at the bottom is the gap between the two.  Now of course, there's always a gap. It's just a fact that the U.S. imports more from China than it exports to China. That's been a phenomenon for decades.

But what you can see in the chart above is that after the initial plunge last March, inbound shipments absolutely soared, because Americans stopped spending on services and started spending on, well, stuff. Stuff that's shipped over from China. Exports meanwhile stayed dormant. This proved to be a serious problem with unanticipated consequences, as Ryan explains it. We posted a transcript yesterday, so you can read it, but this is the money section right here that gets to the core of it: Ryan: ...Well, we also ran out of containers. And this is a really interesting second-order effect. Imports have surged. U.S. exports are down like 20% of containers. If you don't have containers being exported, you don't have empty containers to put those imports in coming back. And it needs to run in a loop. So normal days, pre-pandemic, 60% of containers leaving the United States were empty. It's running around 80% right now. But for a while, the ocean carriers weren't on top of this and just shipping back extra empties to make sure that they have enough capacity. So there was a moment a couple of months ago where we were as an industry, as a society, 500,000 shipping containers short in China. Joe: Sorry. I'm sorry. Could you just explain that? Why is the shipment back of empty containers a problem? Ryan: Because normally you have full stuff going. But U.S. exports fell off a cliff. And nobody thought 'Hey, I still need the container. Even if I'm not exporting the goods.' Joe: Oh, so the ships were going back to China, but leaving empty containers. Ryan: The empties were staying here because they would get imported and usually they get exported automatically. And that's like, just a really quick reaction. You know, the industry was not made to change this fast. It's physical goods type of stuff happening in the real world, it's not software.

So basically the ships, after unloading their wares in Long Beach, would race back to China to get more orders from the factories. But because the U.S. had nothing to sell, there were no containers aboard. Or at least there were a lot fewer than normal. And then when those ships got to China to pick up, say, a bicycle, there were no containers to bring them back on, because those were being held stateside.

And voila. There's your seed of the supply chain nightmare. You can have demand in the U.S. You can have supply in China. But if too many of the containers happen to be stuck in the United States, because nobody bothered to send them back -- because they were empty, sitting around waiting for something to export -- there's your trouble. Anyway, the whole conversation with Ryan was filled with gems, and I highly suggest reading it here. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment