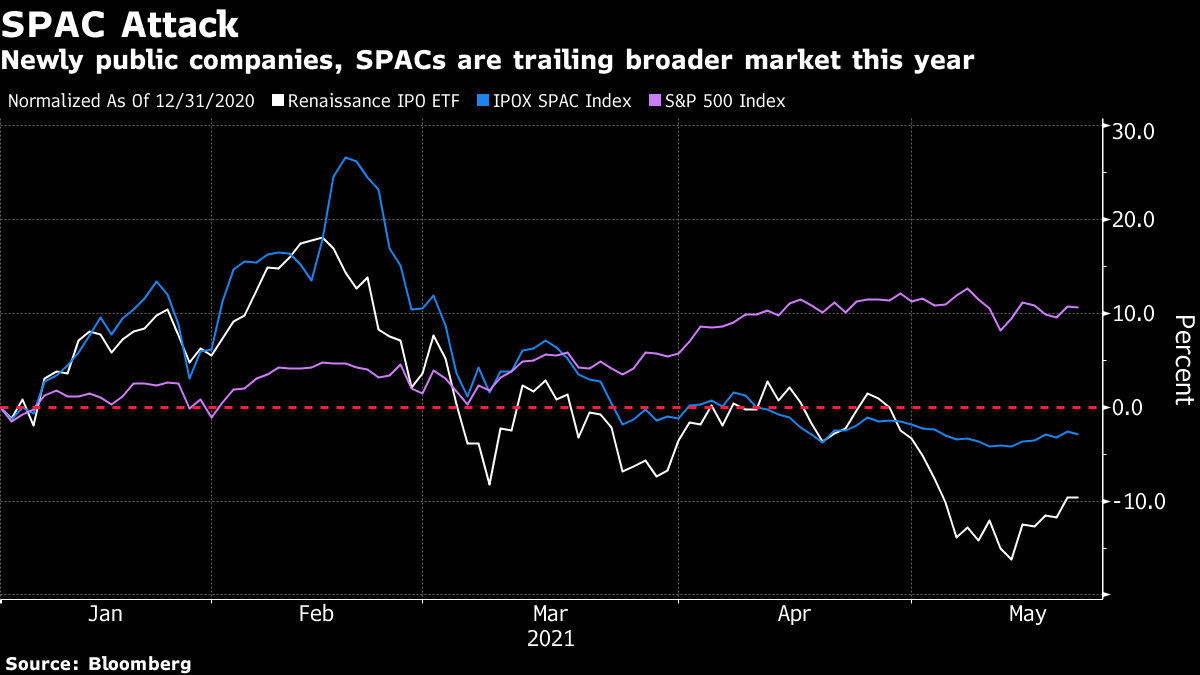

| Good morning. Commodities crackdown, Bitcoin swings, Germany's U.K. restrictions and plane diversion outrage. Here's what's moving markets. Commodities CrackdownChina intensified its campaign to cool a raw-materials boom, pledging severe punishment for violations ranging from excessive speculation to spreading fake news. The government will show "zero tolerance" for monopolies in spot and futures markets, and for speculation and hoarding, it said after leaders of top metals producers were called to a meeting. The efforts were felt in markets, with aluminum slipping, steel dropping more than 5% and iron ore almost tumbling by the daily limit. Bitcoin SwingsBitcoin's extreme volatility carried into the weekend as the world's largest cryptocurrency continued to whipsaw investors. The digital token slumped as much as 18% Sunday, a day after it climbed more than 8% to move back above $38,000 following a tweet of support from Elon Musk. A measure of implied volatility on Bitcoin comparable to the U.S. equity market's VIX indicator sits above 130, higher than the stock version has ever gotten in 30 years. Bitcoin is edging higher again this morning as strategists try to make sense of the price swings. Variant AreaGermany announced fresh restrictions on travelers from the U.K. due to the spread in Britain of the coronavirus strain first identified in India. Travelers from the U.K. will have to spend two weeks in quarantine, even if they test negative, while transport companies will only be allowed to bring German citizens back into the country. Germany now classifies Britain as a "virus variant area," the highest risk category. The update may fuel concern that other countries will follow suit, while also adding to the mountain of complex border rules summer travelers need to decipher. Diversion OutrageThe U.S. and Europe reacted with outrage after Belarus ordered a Ryanair flight to land and arrested a journalist on board. The Boeing 737-800 carrying passengers from Athens to Vilnius was diverted to the Belarusian capital, Minsk, on Sunday under the escort of a fighter jet. The plane's crew was notified by authorities in Minsk of a "potential security threat on board," Ryanair said. However, once on the ground, authorities arrested the journalist, who covered protests against President Alexander Lukashenko, whose election to a sixth term last year was internationally disputed. Here's how the drama unfolded. Coming Up…European stock futures were pointing slightly higher, following gains in Asia as traders weigh China's commodities campaign. For cryptos, prominent voices will have much to discuss at the Consensus by CoinDesk virtual gathering, which kicks off today with speakers including Ray Dalio and Cathie Wood. Elsewhere, Bank of England Governor Andrew Bailey addresses lawmakers in the U.K., while much of continental Europe is out for the Whit Monday holiday. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningAnother speculative bubble may have begun slowly deflating -- the scorching IPO market. As my colleague Katie Greifeld pointed out over the weekend, the Renaissance IPO ETF, which tracks newly public companies, is down almost 10% this year after soaring 107% in 2020. The lagging performance comes amid a boom in listings with over $170 billion raised through initial public offerings on U.S. exchanges in 2021, according to data compiled by Bloomberg. That's on track to top last year's $180 billion haul, the most since at least the 2008 financial crisis. Of course the offerings have been dominated by SPACs -- blank-check listings which account for more than half of this year's market -- and they are particularly under pressure. The IPOX SPAC Index, which tracks the performance of a broad group of blank-check firms, has plunged nearly 23% from its mid-February peak. It seems too much cash has already been raised that can be put to good use and while it's still early days at least two planned listings have been delayed this month amid the volatility.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment