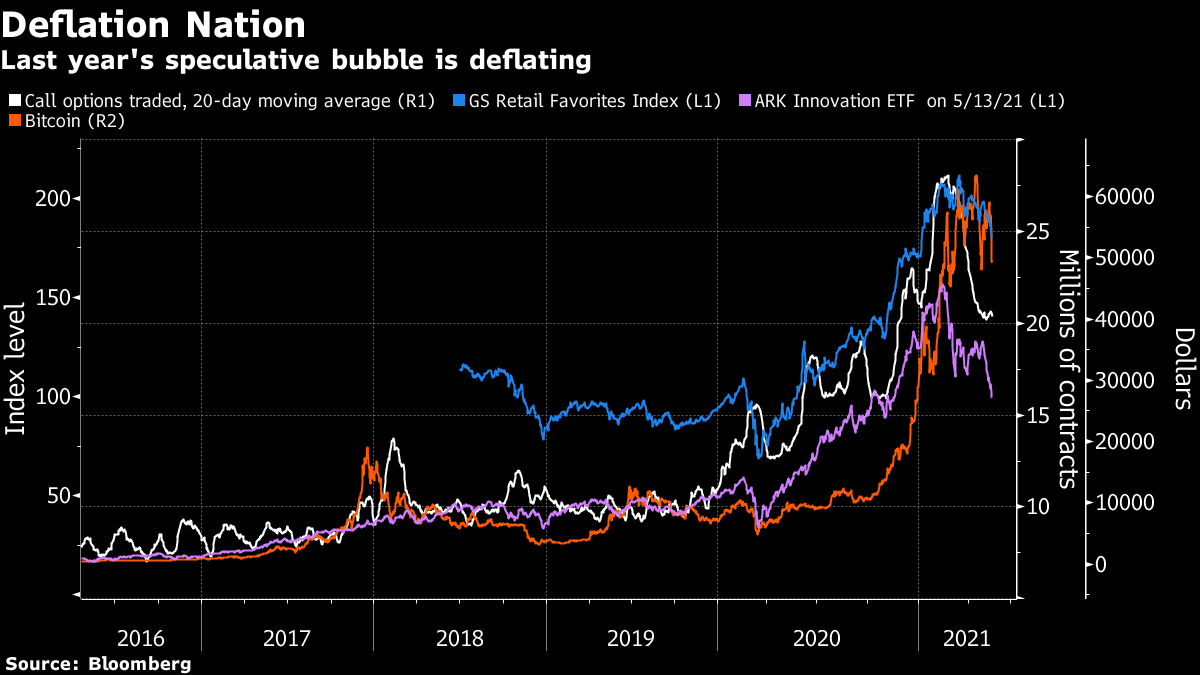

| Good morning. The U.K.'s next stage of reopening, Elon Musk roils Bitcoin again and pressure on Israel. Here's what's moving markets. Next StageThe next key part of the U.K.'s reopening from Covid-19 restrictions takes place on Monday, with indoor dining and drinking to be allowed, even if there is a shortage of chefs. Yet, though the government is pushing ahead with the easing plans, concerns about the transmissible nature of the Indian variant of coronavirus are growing. Early data suggests vaccines are effective against the new strain, but Health Secretary Matt Hancock said the government is closely monitoring the situation and Prime Minister Boris Johnson urged a "heavy dose of caution" as restrictions are lifted. Musk and BitcoinA tweet from Elon Musk is once again dominating the headlines in the cryptocurrency world. The Tesla founder seemed to imply that his electric-vehicle maker may sell or has sold its holdings in Bitcoin. The token subsequently plunged below $44,000. Musk has spent the past few days dueling with critics of his decision to suspend payments using Bitcoin on environmental concerns. Other believers have stepped forward, but don't appear to have the same influence. Jack Dorsey, chief executive of payments firm Square, says his company will "forever work" to make Bitcoin better. Israel PressureIsrael continued airstrikes on Gaza over the weekend, drawing outrage for targeting non-combatants after it brought down a building housing news outlets and residential apartments. Officials representing the U.S., Egypt, Qatar and the United Nations are all putting on the pressure to broker a truce and stop the fighting. Israeli Prime Minister Benjamin Netanyahu, however, signaled the new conflict would rage on. U.S. President Joe Biden ramped up efforts to try to calm the spiraling violence, telling Netanyahu of his "grave concern," but he faces calls from Democratic Party colleagues to condemn Israel's actions more strongly. Northern IrelandThe parts of the Brexit trade agreement governing Northern Ireland are coming sharply back into focus following the election of Edwin Poots as the new leader of Northern Ireland's Democratic Unionist Party. Poots has said he will try to "strip away" these parts of the deal, which effectively keeps Northern Ireland in the European Union's customs area and single market, amid intensifying tensions in the region. The U.K., meanwhile, called on the EU to stop "point-scoring" and to cooperate on finding a solution to issues over the Northern Irish protocol. Coming Up…European stocks were set to open higher, following fluctuations in Asian markets as the virus flared in countries like Taiwan and Singapore. U.S. stock futures, however, are mixed. Budget airline Ryanair tops the European earnings agenda. Iron ore and copper resumed gains, following a pause in their respective rallies last week. And in the U.S. later, watch for news on telecommunications giant AT&T, which is said to be in talks to combine its media business with Discovery. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningForget inflation. Deflation is the most immediate threat facing global financial markets today -- specifically the deflating speculative bubble that fueled much of last year's risk asset rally. Last week's Taiwan selling frenzy should be a warning sign that the tables are turning against the world's leveraged investors. Everywhere you look, the darlings of what some have called the greater-fool theory of investing -- that there will always be someone to sell to at a higher price -- are under attack, largely because that one-last buyer has finally balked at paying up. Bitcoin has tumbled some 30% from its record high, the ARK Innovation ETF is down by closer to 35% and the Goldman Sachs Retail Favorites Index had fallen into a technical correction. The writing was on the wall when the 20-day moving average of call options traded in the U.S. stock market -- a decent gauge of speculative demand -- peaked in February and began to roll over. Of course, dip buyers could soon emerge. But it's hard to see the same speculative fervor taking hold again in an environment where there are legitimate concerns about the impact of inflation on portfolios, regulatory risk haunting big tech and cryptocurrencies and the Federal Reserve paring back its massive stimulus. Fewer speculators leave global markets without a key marginal buyer that helped them climb more than one wall of worry last year, and increases the risk of a disorderly selloff if continued declines in riskier assets trigger more margin calls.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

I-phones are the dream phones for people now a days. Apple’s product is at the top as compared to all other companies of gadgets. There is no doubt that apple produce the latest technology, but nothing is perfect. You can get the iphone 6 accessories from many shops to increase the productivity of the phone.

ReplyDelete