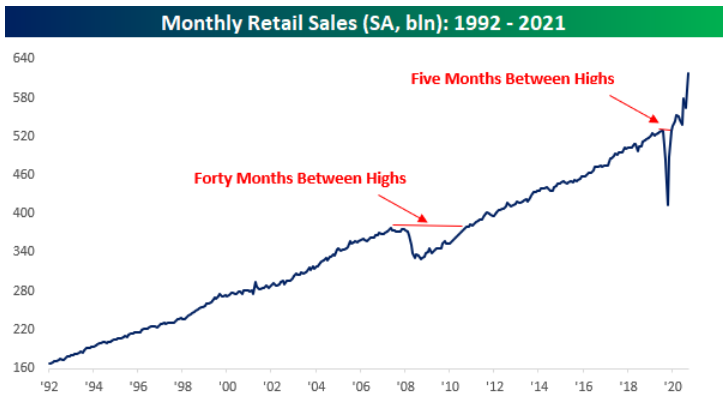

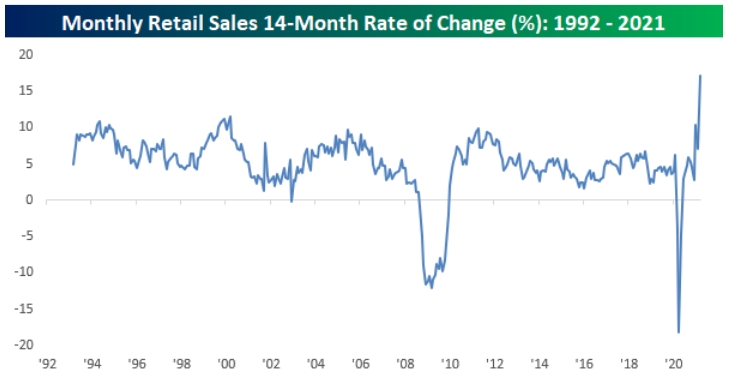

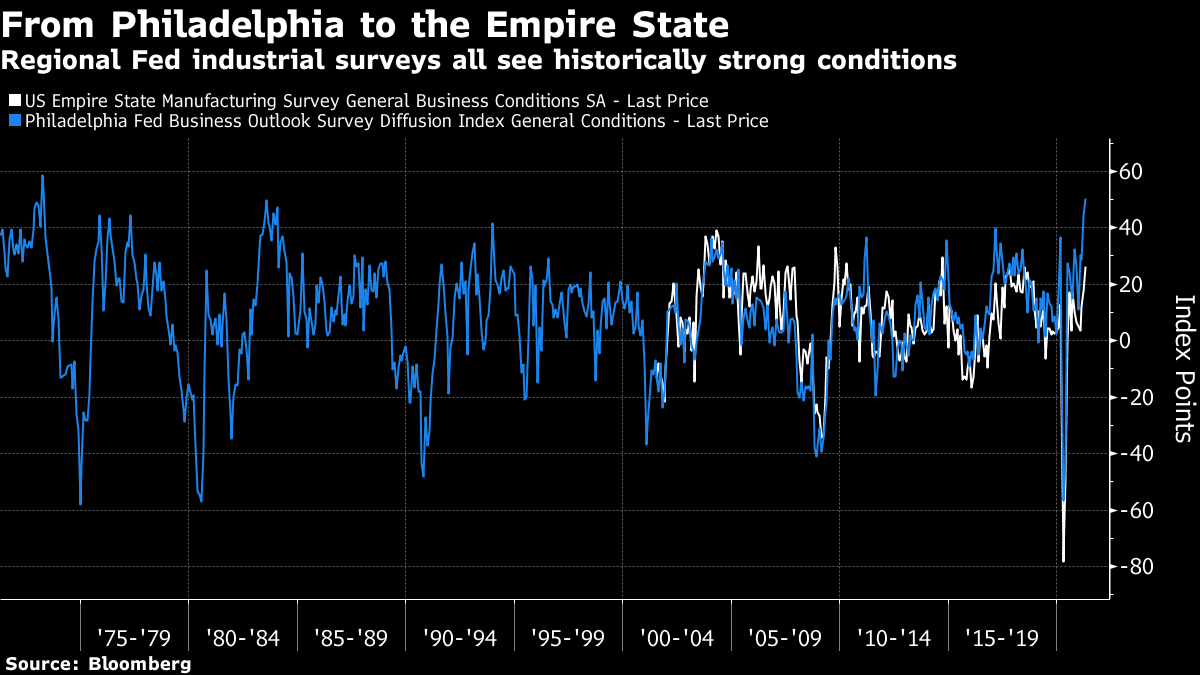

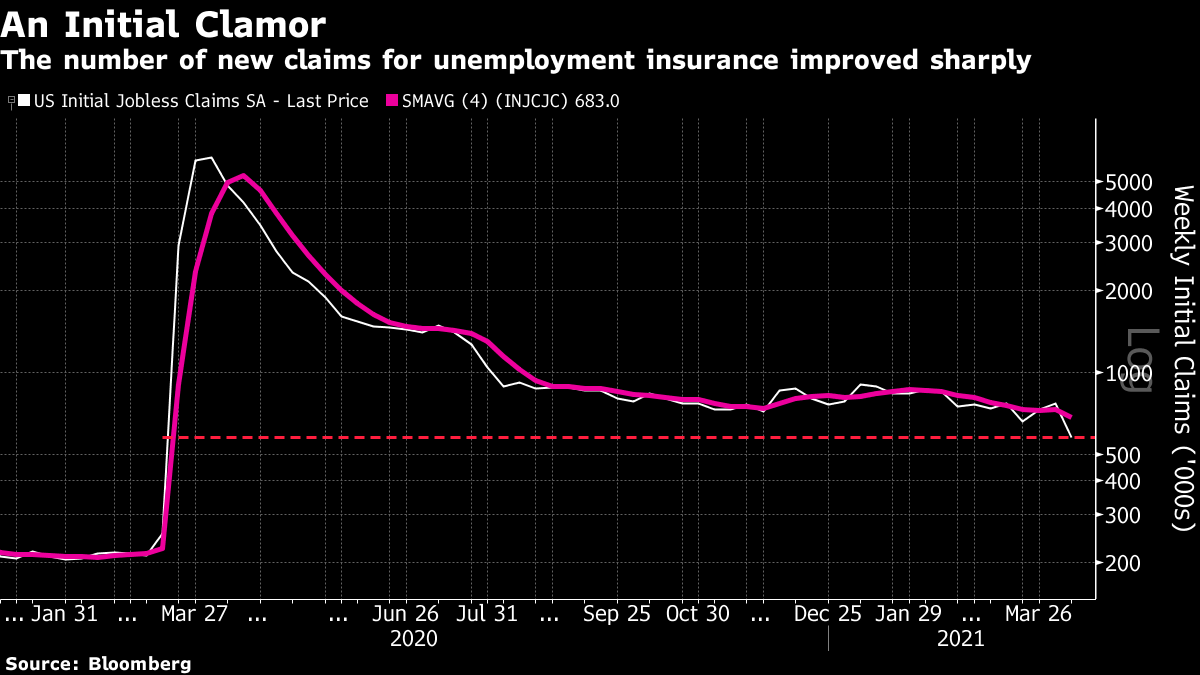

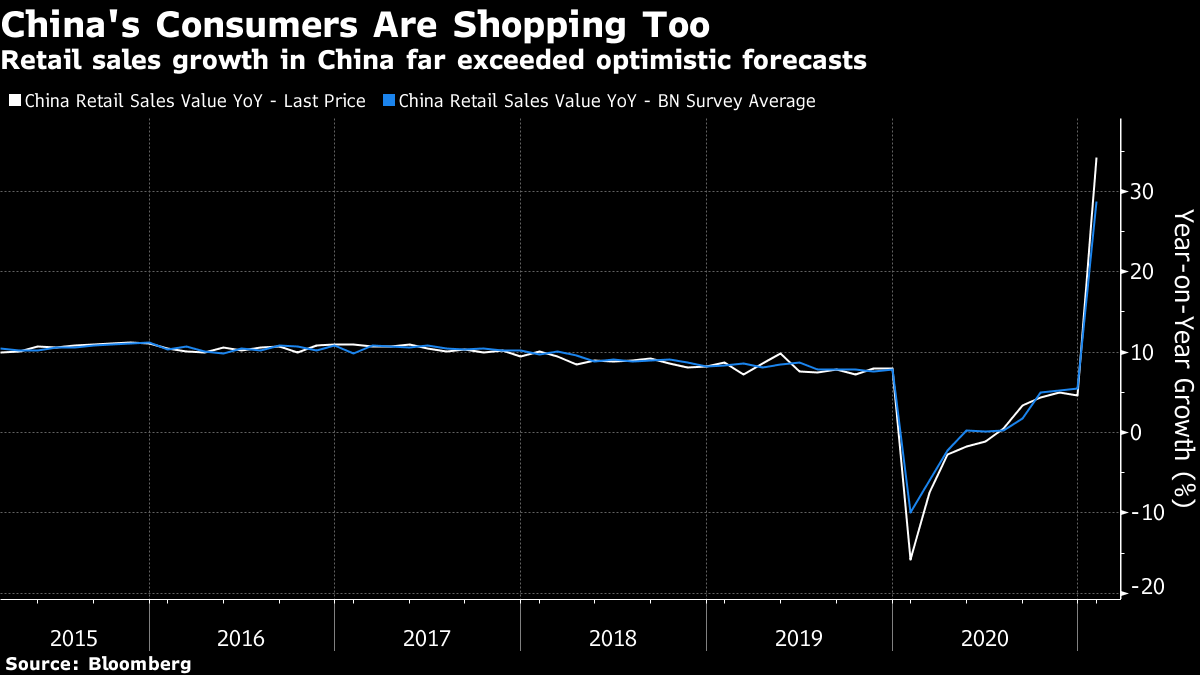

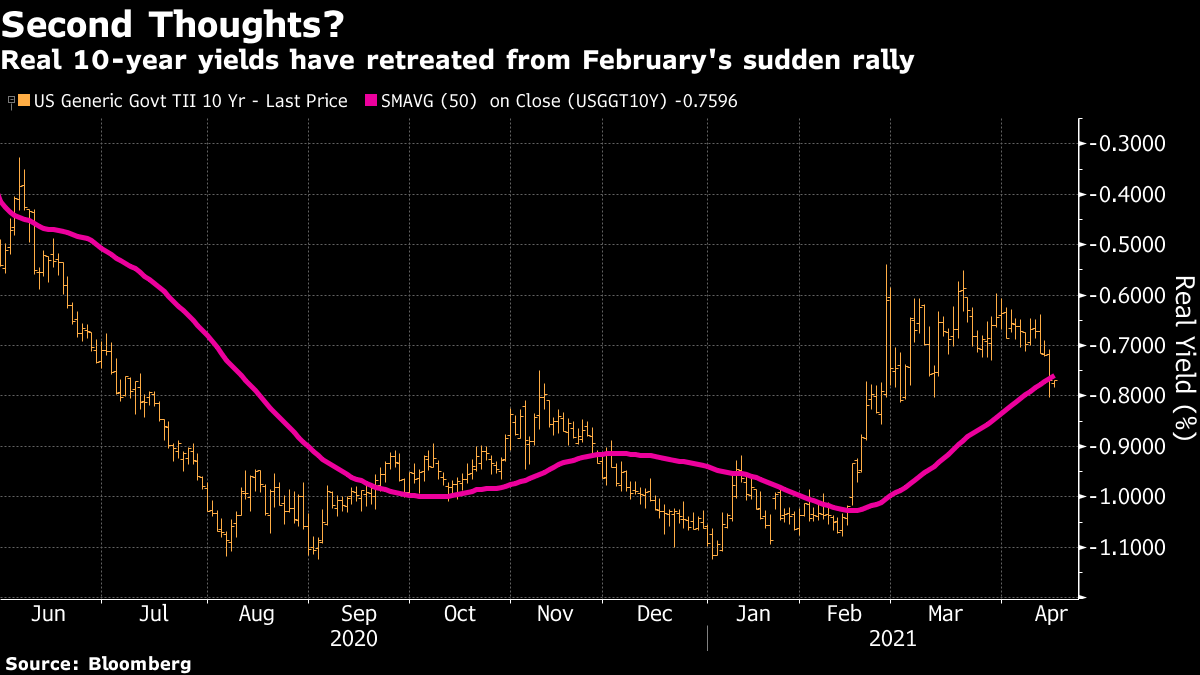

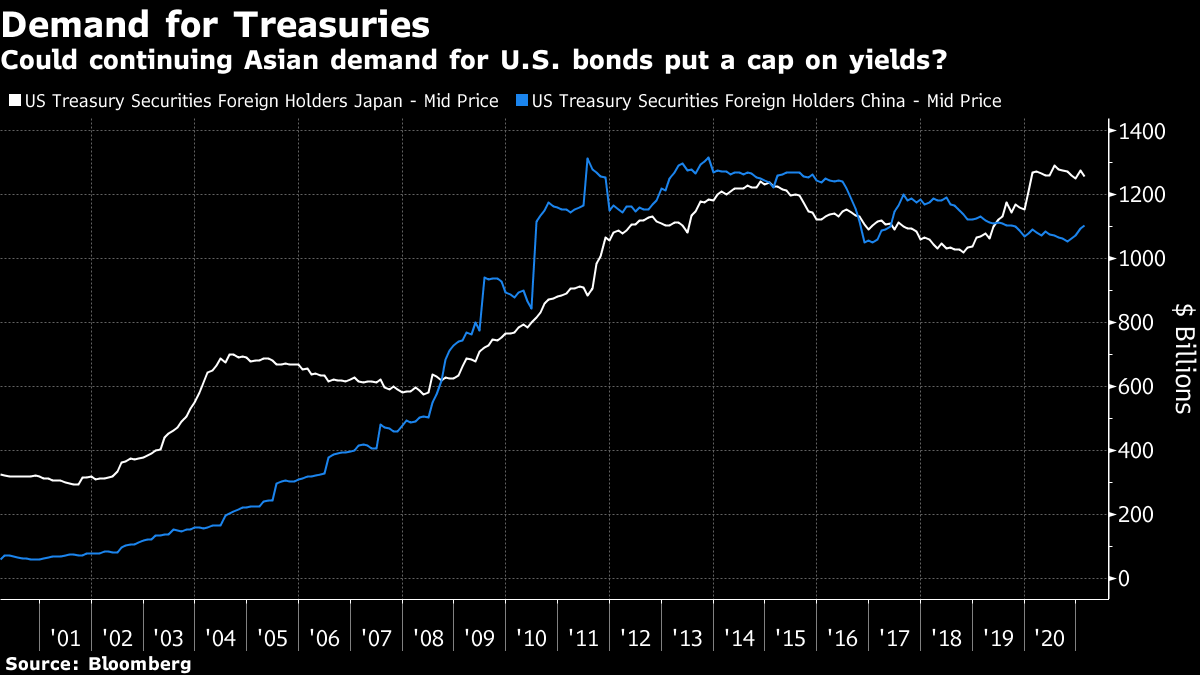

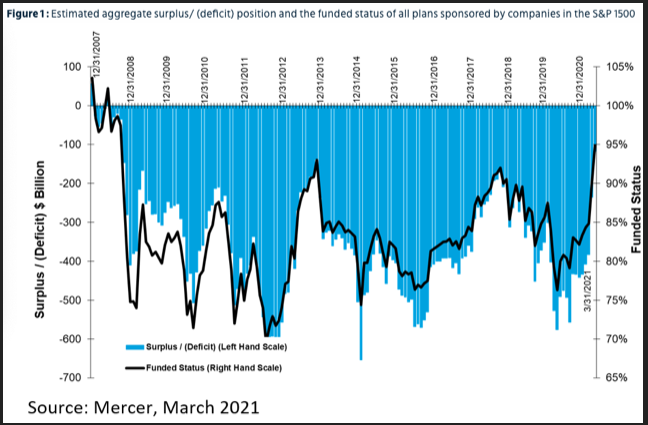

Believe the Hype (This Time, at Least)There's a lot of suspicion of daily economic journalism, much of it justified. People like me have to find something to say about markets and the economy every day. There are moves in markets throughout the working week, and new data most days. When everything else is quiet, there is an inevitable tension to over-hype changes that don't matter that much. This is a temptation that all economic journalists must try to resist. One problem with the over-excitability about daily data is that people might not realize when something astonishing really has happened. So, to be clear: this week's data from the U.S. are something very special. We knew a recovery was going on, and we could guess that repeated stimulus would juice it a bit, but the data confirm an amazing rally. Perhaps most dramatic is retail sales. The following chart from Bespoke Investment Group shows U.S. total retail sales, seasonally adjusted, going back to 1992. What happened during last year's shutdown was unprecedented. But the extent of the rebound since then is even more remarkable. Spending has done far more than return to its prior trend. And it has done this having already fully recovered far more quickly than it did after the previous recession:  If we look at the 14-month rate of change in the following chart, the effect is if anything even more dramatic. This is deliberately chosen to compare last month's sales with the pre-Covid peak. It is no surprise to see a big 12-month improvement a year on from a big shock. It is amazing to see the best 14-month change on record from a month that was itself a peak:  That's the consumer. We also had fresh evidence on manufacturing with surveys from the New York Fed (known as the Empire State), and the Philadelphia Fed (known as the Philly Fed). The Empire State, which is more recent, shows one of the best rebounds in its history. The Philly Fed posted its most positive reading in 48 years. Cycles come and go, and you expect a good reading at the top. But again, this is genuinely impressive:  Then there is the labor market, the Fed's focus of concern. The best "real-time" gauge of progress is the weekly number of people signing on for new unemployment insurance. This week's showed a sharp improvement, and the lowest number of new claimants since the crisis started. I used a log scale because last year's spike otherwise makes it difficult to see what is going on. On the face of it, this is clear evidence that the labor market is recovering:  After the U.S. market closed, more information from China reinforced the same theme. A range of official data confirm a stunning rebound. Of most interest is retail sales. China is anxious to stimulate a consumption-led economy, and it looks like it's getting it:  If anyone wanted confirmation of a "reflation trade," this raft of data, following strong inflation numbers earlier in the week, would seem to provide it. Now, what of the market impact? So Yields Fall????Following such emphatic data, bonds should sell off and yields should rise. A major economic resurgence is no time to hold fixed-income securities. That's obvious. So, of course, yields have fallen this week. The move has been across geographies, and has seen a flattening of the yield curve, declines in inflation breakevens, and — probably most important — a reduction in real yields. Having stayed anchored for months at historically negative levels, 10-year real yields rose suddenly in February. Traders now seem to have seriously cold feet about that rally. At their lowest in Thursday trading, they were 25 basis points below their month-earlier peak. They also broke below their 50-day moving average for the first time since February:  Stocks have gone up, as might be expected, helped by falling bond yields. But why would bonds choose a moment like this to rally? Comments Wednesday by Fed Chairman Jerome Powell that monetary policy would stay lenient doubtless helped. The decision to order a pause in the Johnson & Johnson vaccine, potentially damaging to recovery hopes, might have contributed — although it has had precious little effect in other markets. Strong demand at this week's Treasury auctions may have brought people who had been betting on a bond "tantrum" back into the market. Another explanation comes from geopolitics. U.S. relations with Russia have worsened again; speculation is rife over China's intentions toward Taiwan; Israel appears to have sabotaged Iran's nuclear program. None of this has discombobulated the stock market, but it might make Treasuries more appealing. One last data point might be more important. International purchases of Treasuries show that Asian demand remains strong. Japan has had more Treasury holdings than China for a few years now, and the rally in yields over the last year only makes them more appealing. Yields at home aren't enticing, after all:  The best answer may be "all of the above." The inflation trade had come a long way in a hurry, but proof that that we have entered a new reflationary paradigm will take time. With the auctions revealing that demand remained robust, it seems a lot of people who bailed from the Treasury market prematurely decided to hedge their bets. It's an Ill WindIt's been a year of wonders so far for at least one beleaguered group: defined benefit pension fund managers. Those who have a fixed target to aim for care roughly equally about the value of their assets (which tend to rise and fall with stocks), and of their liabilities (which rise and fall with bond yields). What they really want is higher bond yields, which make it cheaper to guarantee a given level of retirement income, and higher stock prices. That combination had been lacking for years until the rally for stocks relative to bonds that began after the Covid-19 shock. Based on the relative performance of the exchange-traded funds SPY (tracking the S&P 500) and TLT (tracking Treasuries of 20-year maturities or longer), there's been a 123% rally in barely a year:  The effect on pension finances has been dramatic. Mercer, the actuarial group, tracks the deficit of U.S. private sector pension plans (the amount by which their assets lag liabilities) on a monthly basis. The S&P 1500 companies' plans have been in continuous deficit since the start of the crisis in 2008. At one point, assets were as much as 30% lower than liabilities. By the beginning of this month, that had dropped to 5%:  This is one group that won't be happy about the resumed decline in yields, although the effect so far should have been canceled out by the record-breaking rally in stocks. The picture is likely to be similar for public pension plans, which have even more serious deficits. The increase in bond yields has raised perceptions of some important risks. So it's important to remember that it has had a positive effect in reducing one of the scariest of all: widespread failures by pension plans to make their promised payments. Most Surprising Feedback AwardI won't share all my Bernie Madoff feedback, and you should be glad about this. Roughly equal numbers wrote it to say that crypto and alternatively fiat currency was the biggest Ponzi scheme ever. We live in polarizing times. I forgot to mention one of the people who spotted what Madoff was up to; the legendary quant pioneer Ed Thorp, otherwise best known for coming up with a system to beat the dealer at blackjack. This is from my interview with Thorp for my old employers back in 2017: There are still plenty of Ponzi schemes on Wall Street too, he says, and not just Bernard Madoff, whose epic fraud he claims to have spotted more than a decade before it collapsed.

In 1991, Thorp did some due diligence for a consultancy that asked him to look through their hedge fund investments. Madoff's returns instantly looked too good to be true, he says. He tried checking the trades that Madoff had reported making against those reported in the official record. Half of them could not have happened because there was zero volume (the number of shares traded) in those options on the day the trades were supposed to have been made... Nobody took any action. "I waited year after year after year for it all to blow up. One reason it didn't was that he was a pillar of the establishment. And he had all these people steering money to him, charging fees. He wasn't charging fees himself, which was another big red flag."

Thorp's autobiography, A Man for All Markets, is one of my favorite books of recent years. But most interesting was the following. It reminds us that Madoff was very skillful at what he did, and perfectly capable of making a fortune honestly. The hardest question of all to answer remains: Why did he do it?: Dear Mr. Authers,

You are receiving this letter from the only person on earth who loves Bernie Madoff! (me)

I never met Bernie Madoff, talked to him or had any money invested with his firm. Allow me to explain this admiration. I wanted to meet Bernie Madoff; to thank him and tell him what you are about to read. As a young Chicago native I entered into the I.T. world. After having many professional opportunities blocked I decided I wanted to be part of the wonderful world of fast and dirty money. During the early 1990's I had obtained a job at the Chicago Board Options Exchange. Specifically I was hired as an I.T. guy to work on the Cincinnati Stock Exchange. At that time it's claim to fame was that it was the first all electronic stock exchange in the world. The principal member of this exchange was Madoff. There were other minor players but it was Bernie Madoff who got the ball rolling for the development of the N.S.T.S. (national securities trading system). I do believe that it was this effort that led to him being promoted to NASDAQ chairman.

The experience gave me tremendous insight into the exchange world and market making. While at the CBOE I also had a deep curiosity for the wonderful world of options trading. Today I am retired. I trade the markets. I would be liar if I told you that I was wealthy. The world that Bernie Madoff opened up to me has made me more comfortable and secure than most individuals my age. Trading options is a skill that no one can take from you. As I see it, a couple of bucks here a couple bucks there it all adds up! To conclude, there is an old saying for this situation. "The evil men, do lives on forever while the good is interred with their bones" I will not judge Bernie Madoff as evil.

Survival TipsI'm not generally a fan of surrendering my life to huge tech corporations, but in one case I'm beginning to be. Bloomberg recently changed my home computer to an Apple, meaning that as I write this, Apple Music is keenly offering me playlists it has worked out from my listening history. As the weeks have gone by, it has become more accurate and learned to distinguish my tastes from those of my kids. Apple is convinced that I want to listen to the Waterboys and World Party, and it's right. The Waterboys are best known for their 1985 classic The Whole of the Moon, much covered and played ever since. The band were a large troupe built around the duo of Mike Scott and Karl Wallinger. I can't find much live footage of them, but this great song about the sufferings of the Red Army gives a flavor of what they were like. Wallinger left to found World Party, whose most famous song is Ship of Fools (not to be confused with the Robert Plant song of the same name). Their second album, Goodbye Jumbo, is one of my favorites. When the Rainbow Comes, which showed up in the movie Armageddon

a few years later, might be my favorite track. Both bands are great live (or were 30 years ago). A Man Is In Love and How Long Will I Love You by Scott for the Waterboys turned into a hit for Ellie Goulding; while World Party's You're The One was a big hit for Robbie Williams. Have a look at their catalogues. Apple thinks it's a good idea. And have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment