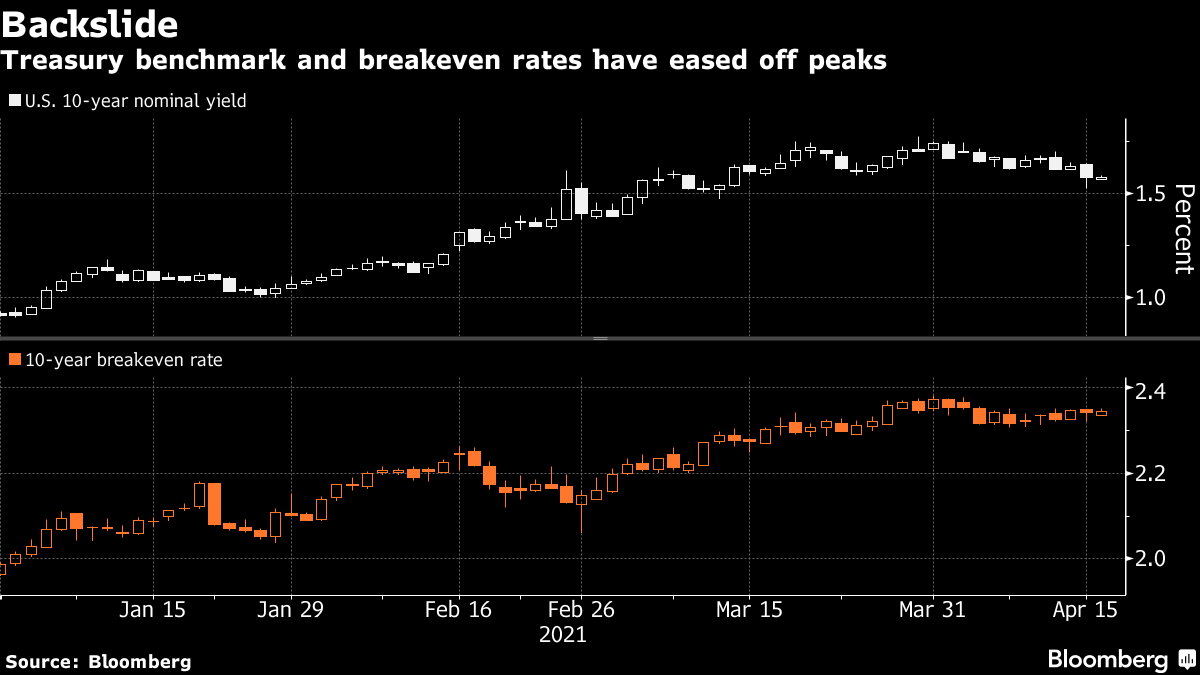

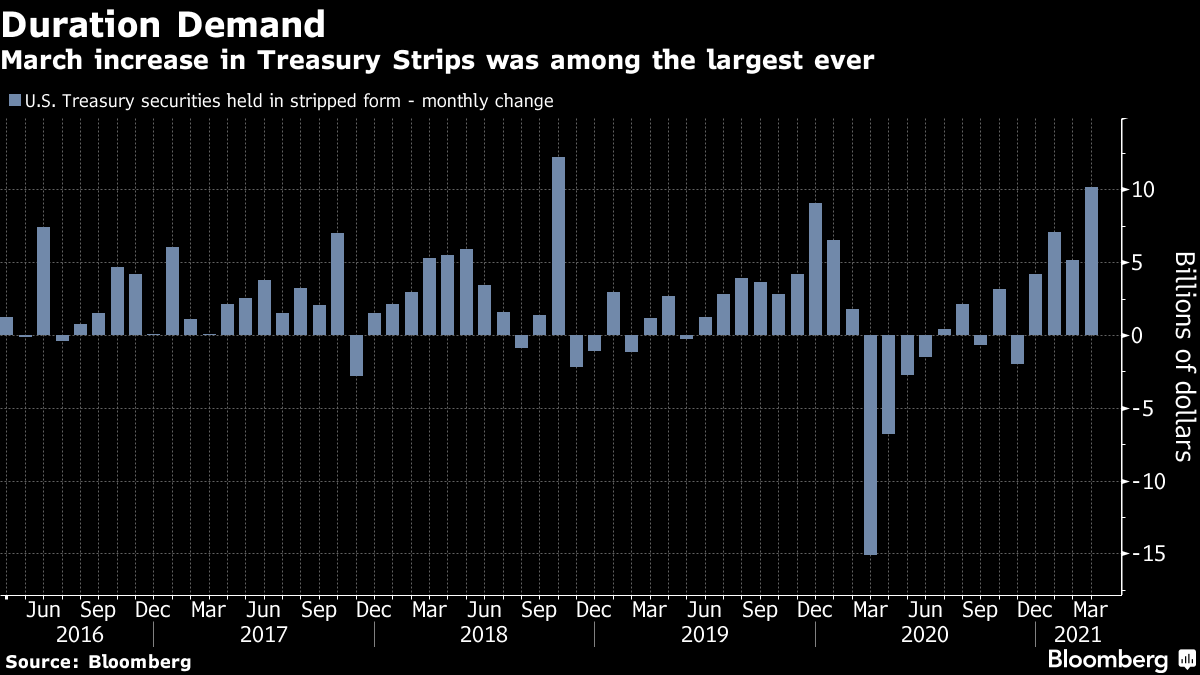

| Welcome to The Weekly Fix, the newsletter that's traveled back in time to stop machines... well, to warn against over-extrapolating macro implications in 10-year yield moves. --Emily Barrett, Asia cross asset reporter/editor ConundrumThe U.S. has just thrown a ton of supply and strong economic data at the bond market and it's had no impact. First it was the U.S. jobs report, then $120 billion of Treasury auctions, followed by consumer price inflation, and now retail sales. The 10-year yield slid to a one-month low. We are in Terminator 2 territory now, where the rewired-good-guy-Arnold Schwarzenegger's bullets make silvery craters in the natty-but-somewhat-intense robot policeman... But the holes close up, and he's after them again with that odd choppy-handed sprint. Just as that cyborg's days are numbered (at least in this installment of the franchise) -- we have reason to suspect the trend of falling yields hasn't far to go. We're going to go out on a limb here and say this bond market reaction isn't macro-driven. That's not for lack of theories, given the crush of analysts' notes today ("It's one of those days where anyone who has a strong opinion is back-fitting pretty hard," was one of the wrier observations.) First, the data are strong. Second, Treasuries aren't rallying because of a dovish Fed (no fresh cues there), and that's clear from the lack of increase in market-implied inflation expectations -- see the rock-steady state of breakevens in the chart below.  Third, it doesn't look like safe-haven trades in response to virus spikes or vaccine setbacks, or the Russian sanctions (for a particularly long bow). All three major U.S. equity benchmarks closed at record highs Thursday. Market flows and technicals offer more reasonable, if less tidy, explanations. The unwind: This one says investors were motivated to take profits on short positions and curve steepening trades after some sharp moves since the start of the year. "Accounts who delayed buying during the 1Q reflation rout may be finally catching up with those duration needs now that rates have clearly stabilized and looking to remain range bound in the near term," wrote NatWest Markets strategist Blake Gwinn. Add to this theory the possibility of increased demand from dealers, who were left with a smaller than usual share of the latest successful Treasury auctions, given healthy takeup among institutional buyers. Hungry pension funds. Gwinn also attributes the rally to recent searing appetite among these institutions for long-dated debt. This is reflected in the surge in demand for stripped U.S. Treasuries, which are ultra-long zero-coupon bonds that deliver maximum interest-rate risk. Last month's jump in Strips outstanding was the largest since October 2018.  Big in Japan. As our Stephen Spratt has pointed out, this month is the start of Japan's fiscal year. That can be a bumper period for global bonds, and the latest figures from the Ministry of Finance show the country's funds scooped up the most foreign fixed-income assets in five months. The life insurance heavyweights release more of their investment strategies in the coming week -- not a great time to be short. Nevertheless, the macro case But taking a step back and deploying some of that 20/20 hindsight that's lamentably so tricky to trade, it's hardly surprising that yields aren't rising in a straight line. The surge in the first months of the year made sense given the market had to build in a sea-change in the outlook for fiscal spending after the Jan. 5 Georgia elections handed unexpected wins to Democrats. And while the success of the vaccine rollout has fired optimism in the U.S., it's stumbling in many parts of the world and the pandemic is still raging. Industries that large swaths of the global economy depend on -- travel and tourism, hospitality etc -- are still nowhere near normal function. Doubts about the stamina of reflation trades that thrived in the first quarter were clearly setting in over the past couple of weeks as breakevens stalled and yields pulled back from multi-year highs. Barclays strategists including Anshul Pradhan say what we're witnessing is a raising of the bar on the reflation trade. The slide in yields "reflects the fact that expectations for growth, inflation and the hiking cycle have all been significantly revised higher." There's no clear grounds to assume at this point that economic data are going to get much worse, but with expectations for the recovery already pretty high, it's hard to see how they can keep up the pleasant surprises.  So don't expect the Street to be rushing too quickly to trim yield forecasts, which many only just revised up in the last couple of months as the benchmark blew through year-end predictions. While this latest decline in yields is "puzzling, frankly," said Goldman Sachs rates strategist Praveen Korapaty, he's not ready to move his estimate for a 10-year yield at 1.8% at midyear. "We have at least another month or two of really strong data." And the Fed, for its part, may be just starting to warm up a discussion of a timeline for trimming asset purchases, which could well buoy yields. The Chairman made it clear, in this week's chat hosted by the Economics Club of Washington, that a taper will come "well before" policy makers start considering raising interest rates. Korapaty is looking for the process to start in January. China credit travails China has drawn a lot of interest over the past year as something of a global bond investor's paradise. While yields in the major developed markets plummeted, foreign buyers piled in record numbers into China's government debt, spurred by its recent inclusion in flagship global indexes. This week brought a "tarnish" to that sheen, as Natixis put it, saying that "the uncertainties around Huarong Asset Management add to the growing list of potential credit events in China." And few events were as riveting this week as those surrounding state-owned enterprise China Huarong Asset Management Co. -- a distressed debt manager that's given new meaning to the phrase since its chief was executed for corruption earlier this year. The company's failure to report results by the April deadline led to talk of default that sent its bonds plummeting. Spreads on Asia's investment-grade corporate bonds widened and the cost of insuring them against default rose this week by the most since September.  That strain has subsided, however. The firm's bonds rebounded from record lows on news that a full repayment of debt due this month will be made. Conditions calmed sufficiently by the end of the week for Tencent to launch a massive four-part deal. However, our reporters Sofia Horta e Costa and Rebecca Choong Wilkins calculate that China Huarong has some $7.4 billion worth of bonds needing to be repaid or refinanced this year. And its largest shareholder, the Ministry of Finance, has yet to pledge government support. China's top administrative body, the State Council, released a statement this week as concerns around the embattled asset manager deepened, making it clear that struggling state-backed companies shouldn't rely on government support. It urged local government financing vehicles to restructure or enter liquidation if they can't repay their debts. And that stance, which has pushed a state-owned enterprise to the brink, has investors laser-focused on what other steps officials are taking to curb leverage in the system. The expectation is that they'll deploy a range of levers to avoid roiling markets. But unease remains, reflected in a pullback in China's stocks this week, that the central bank may drain too much cash from the system while the recovery remains incomplete. Stephen Chang, a Pimco portfolio manager focused on Asia credit, sees policy makers sticking to an incremental process: "The overall situation to us is still that liquidity conditions are quite flush." "What we're seeing from China is that they're tightening, albeit in small magnitudes, but across different segments. It's small enough that it satisfies their 'no sharp turn' directive. There is room for them to adjust and calibrate."

"A number of these steps added together make for less-loose conditions. That certainly contrasts with what is transpiring in the U.S., where fiscal is going gangbusters and the Fed is staying put."

Bonus pointsMore on China's very bad bank. The moon landing is a great blueprint for modern miracles. The future of capitalism, with Slavoj Zizek -- Odd Lots gets seriously highbrow This glacier in Alaska is moving 100 times faster than normal |

Post a Comment