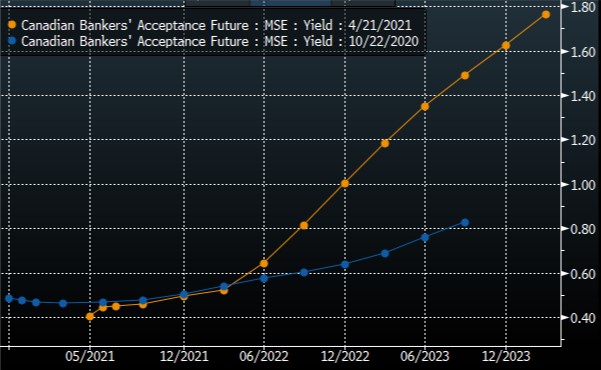

| Welcome to The Weekly Fix, the newsletter that has its roots in Canada and so will apologize in advance for any offense potentially caused in the following. -- Emily Barrett, Asia cross asset editor/reporter Taper TiffThe dreaded taper is here... in Canada. Governor Tiff Macklem officially broke it to the market this week that the central bank is slowing the pace of its bond purchases. Which investors are being very cool about. No tantrums to discuss here -- global bond yields barely fluttered, since there's no real risk of that sort of thing catching on in the developed world's largest markets*. The European Central Bank just said it's not even on their minds. The Bank of Canada got ahead of its major developed-world peers this week. Alongside sharp increases to its growth and inflation forecasts, the BOC cut its bond-purchase target to $3 billion a week from a minimum of $4 billion. And it said a rate hike may be warranted as soon as the second half of 2022. While the loonie surged, Canadian bonds weakened only a touch. That said, investors do seem to expect rather a lot more from Canada. Check out this curve as a proxy for domestic rate expectations: Relative to six months ago, the outlook for tightening has ramped up aggressively.  The fact that traders have built in a full hiking cycle is astonishing given the shocking rebound in Covid-19 infections in Ontario. Not to mention spikes in cases around the world, which remind us the pandemic is nowhere near contained. (This piece from Bloomberg Opinion's David Fickling makes that point with devastating clarity.) Against this backdrop the BOC's step may seem foot-forward, but the central bank also has its eye on the dwindling slack in the economy as the rebound gathers momentum, and notably the country's pressure-cooker of a housing market. Last month was the hottest ever for home sales, and prices rose again after February's record. "While the resulting house price increases are rooted in fundamentals, we are seeing some signs of extrapolative expectations and speculative behavior," Macklem said. Hot HousingCanada's not the only one with problems on the home front. The Reserve Bank of Australia, which doesn't expect to raise interest rates for at least another couple of years, has sounded a tad uncomfortable about home prices. The latest figures show the fastest gains since 1988. New Zealand's government took matters into its own hands last month to rein in a sizzling property sector, including tax adjustments to curb investor demand, as the central bank signaled it's in no rush to pull back stimulus. The response in the local bond market was an 18-basis-point drop in the 10-year government yield, as investors cheered the removal of one key incentive for the central bank to raise interest rates. Which just shows what a game of Whac-a-Mole asset-price inflation targeting can turn out to be, unless it's done with the brutally blunt instrument of monetary policy. Central banks and particularly the Fed have long been leery of anything that smacks of asset price targeting, and newly-minted Chairman Ben Bernanke dismissed the concept pretty soundly six years before the Great Financial Crisis. But prolonged periods of low interest rates and expanding debt will force policy makers to a reckoning with the destabilizing effects of soaring asset prices in the years ahead, says Janus Henderson portfolio manager Jay Sivapalan. "We've got inflated asset prices in equities, house prices, and infrastructure, how do you normalize that? You need revenue growth and you need inflation....But at some point in the future, growth may need to be traded off for financial stability.

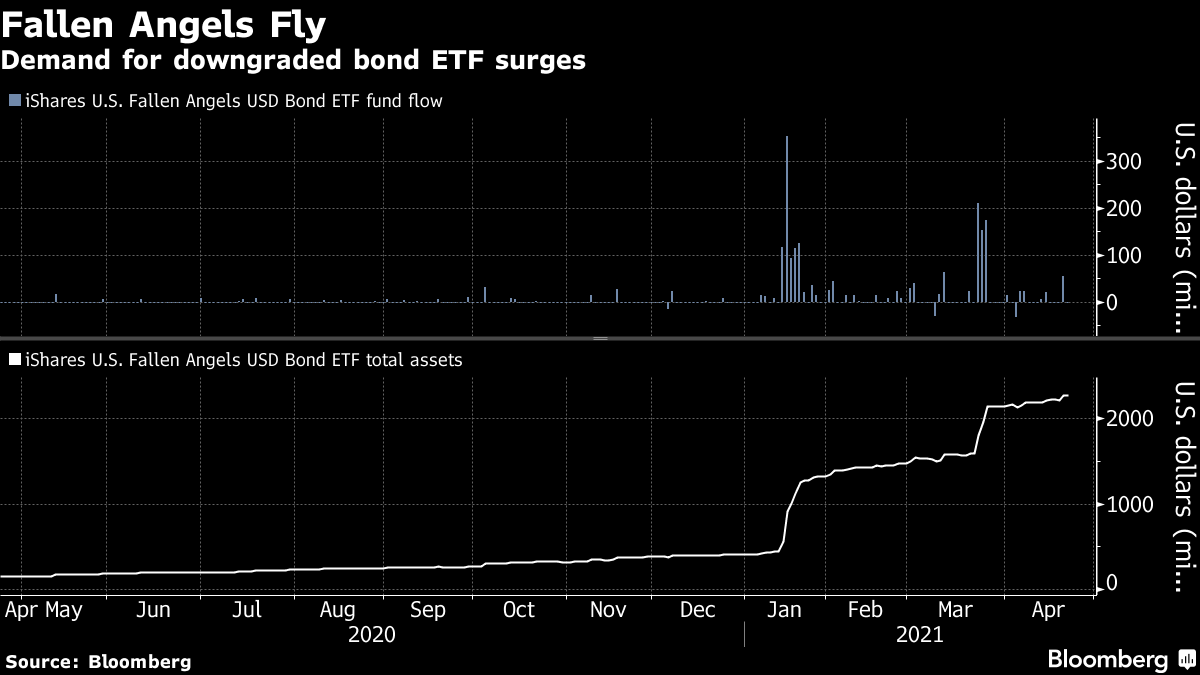

Not all countries have the luxury of being able to run a very large mount of debt. The U.S. does today -- they didn't have the inflated values in the housing market to begin with because they had the GFC, they had the great reset. Perhaps in the U.S. where the vulnerabilities lie is how much debt junk companies have amassed. That's not going to show up in the near term because we're in the midst of a very strong econ recovery, but if not dealt with in the next downturn or crisis, that might be where it shows up for the U.S."

*The Fed is in its blackout period now ahead of the April 27-28 meeting, but we're not exactly expecting any major change of tack next week. Among those who've nailed their forecasts to the mast, Goldman's David Mericle expects the Fed to drop hints of tapering in the latter half of this year. He sees the process starting in early 2022 and to take a full year, with a $15 billion reduction in purchases at each meeting. That would put a rate hike on the table around mid-2023, Goldman reckons. Junkyard top-dogSo from inflated asset prices, to junk. Is the credit cycle dead? Lisa Abramowicz observed in her column this week: "Almost all fear of bankruptcy has been obliterated from debt markets even though the global economy is still struggling under the worst health crisis in a century." We've written before about how high yield spreads have fallen to their lowest point since the leadup to the 2008 financial crisis.  More than $12 trillion of stimulus certainly appears to have heavily sedated the market for now. Whether or not that wave will simply lead to a steeper crash further down the track is yet to be seen. After all, as the recent debacles of Greensill, Archegos and Huarong remind us, firms can implode in the most benign possible conditions. (Bronte Capital's John Hempton has a lot to say about this on the latest OddLots podcast.) But clearly the shakier credits in the spectrum are far better off than most people would have thought only a few months ago. Just look at the Lazarus of the car-rental set, Hertz Global, which has emerged from almost a year in bankruptcy with its bonds trading well above par. Bloomberg Opinion's Brian Chappatta wrote this week that an investor in Hertz's 2022 and 2028 bonds at the lows has by now earned a return of roughly 1,000%. And ratings companies are adjusting their rose-colored spectacles accordingly. Fitch Ratings now says high-yield corporate bond defaults could amount to just 1% this year, the lowest rate since 2013, our credit reporter Caleb Mutua notes. S&P Global Ratings also sees defaults declining, contradicting some bleak predictions from the depths of the pandemic last year. (Moody's Investors Service expects defaults to fall to 4.2% over the next year, from an actual rate of 7.5% for the 12 months through March.) These riskier balance sheets don't seem to be losing their taste for leverage. Junk-rated U.S. companies set a record on Thursday for the most bonds ever sold in April, at close to $40 billion, Alex Wittenberg reports. This is the third straight banner month, and it's taken this year's volume to nearly $190 billion. That's 44% of the full-year total for 2020 -- which was the biggest year ever for junk issuance. Earth DayKind of feels like we need more than one day on this one. And clearly many now have a similar view. President Joe Biden's virtual summit for Earth Day kicked off Thursday with 40 world leaders -- a pitch to show America's renewed resolve to fight climate change, spurring the efforts of both its allies and adversaries. His opening pledge, to cut U.S. greenhouse gas emissions by at least 50% below 2005 levels by the end of the decade. But beyond the symbolism of the goal, it may have fallen flat. This target may not even be compatible with the Paris Agreement, according to an analysis published by Climate Action Tracker. The independent research group said that "an emissions reduction target of 57% to 63% below 2005 levels by 2030 would be consistent with" preventing the worst consequences of climate change. And only two U.S. allied boosted previous pledges. Prime Minister Yoshihide Suga raised Japan's target to the equivalent of a 41% cut by 2030, based on a 2005 reference point. Canada's Justin Trudeau raised his country's target for greenhouse gas reductions to as much as 45% over the same period, exceeding a previous goal of a 30% reduction from 2005 levels. For more on the summit and its goals, see our reporting from Leslie Kaufman and Eric Roston, and check here for how the various pledges stack up. Bonus PointsPBOC Governor Yi Gang has a plan for the central bank's role in battling climate change Climate change will hit the world's cities hardest |

Post a Comment