| Welcome to the New Economy Daily, our new daily newsletter with the latest on the fast-changing world economy and what it means for businesses, policy makers and investors. If you were subscribed to our NEF Turning Points email, you'll see this in your inbox instead — but you can manage your subscriptions here. Andrew Browne will continue to write his weekly column on Saturdays. Today, we look at the regime change in U.S. economic policy, a massive looming transfer of American wealth and the rising power of global corporate giants. The Dynamic Duo

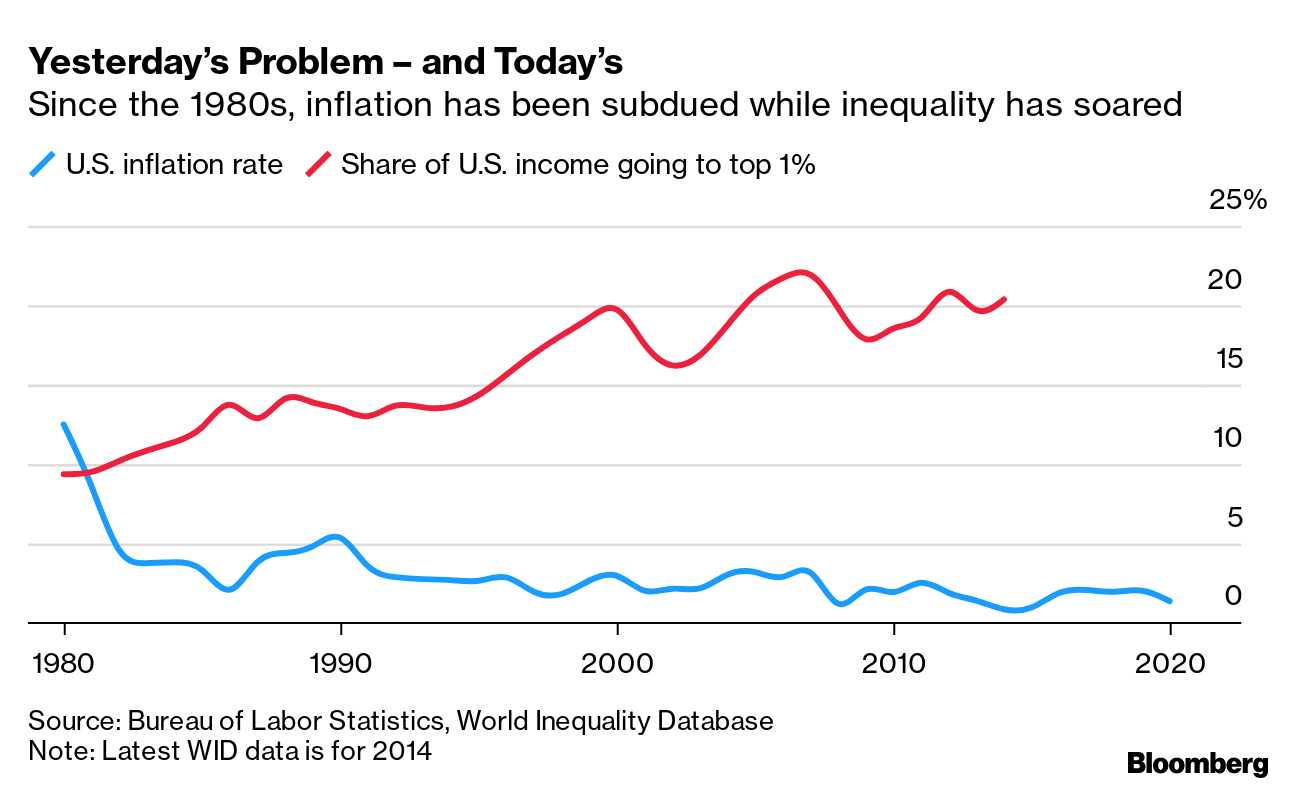

President Joe Biden and Federal Reserve Chair Jerome Powell were once known for uncontroversial middle-of-the road economic views. Now, they're each pursuing a radical restructuring of America's economy. In his third major economic package, Biden on Wednesday made it three-for-three by again unveiling a spending total that topped initial expectations. His latest $1.8 trillion social-program focused plan follows a $2.25 trillion infrastructure-led package and the now-enacted $1.9 trillion in pandemic relief. It's a combined spending blitz that makes it hard to tell he ran as the moderate Democratic candidate in 2020.  At the same time, Powell is saying his Fed will continue to keep delivering super-easy monetary policy in the form of cheap interest rates and massive bond-buying. The time still hasn't come "for us to talk about talking about" slowing asset purchases, he said on Wednesday. It's a change of heart from when the Fed was last raising rates in 2018 to head off inflation pressures. As Rich Miller writes on Thursday, what's under way is the basis of a new era in economic management and a mirror image of the 1980s macro-policy overhaul carried out by Ronald Reagan and Paul Volcker. While Reagan fought to limit the role of government and Volcker to contain prices, Biden is championing a muscular assault on poverty and inequality and Powell is signaling that he won't get in the way. It's a grand experiment aimed at escaping the period of weak long-term economic growth and slow income gains seen for the past two decades. "The parameters of the economic system and of public policy went through profound changes" in the 1980s, said Paul McCulley, the former Pimco executive who now teaches at Georgetown University. "We're fundamentally going through exactly the same thing now."

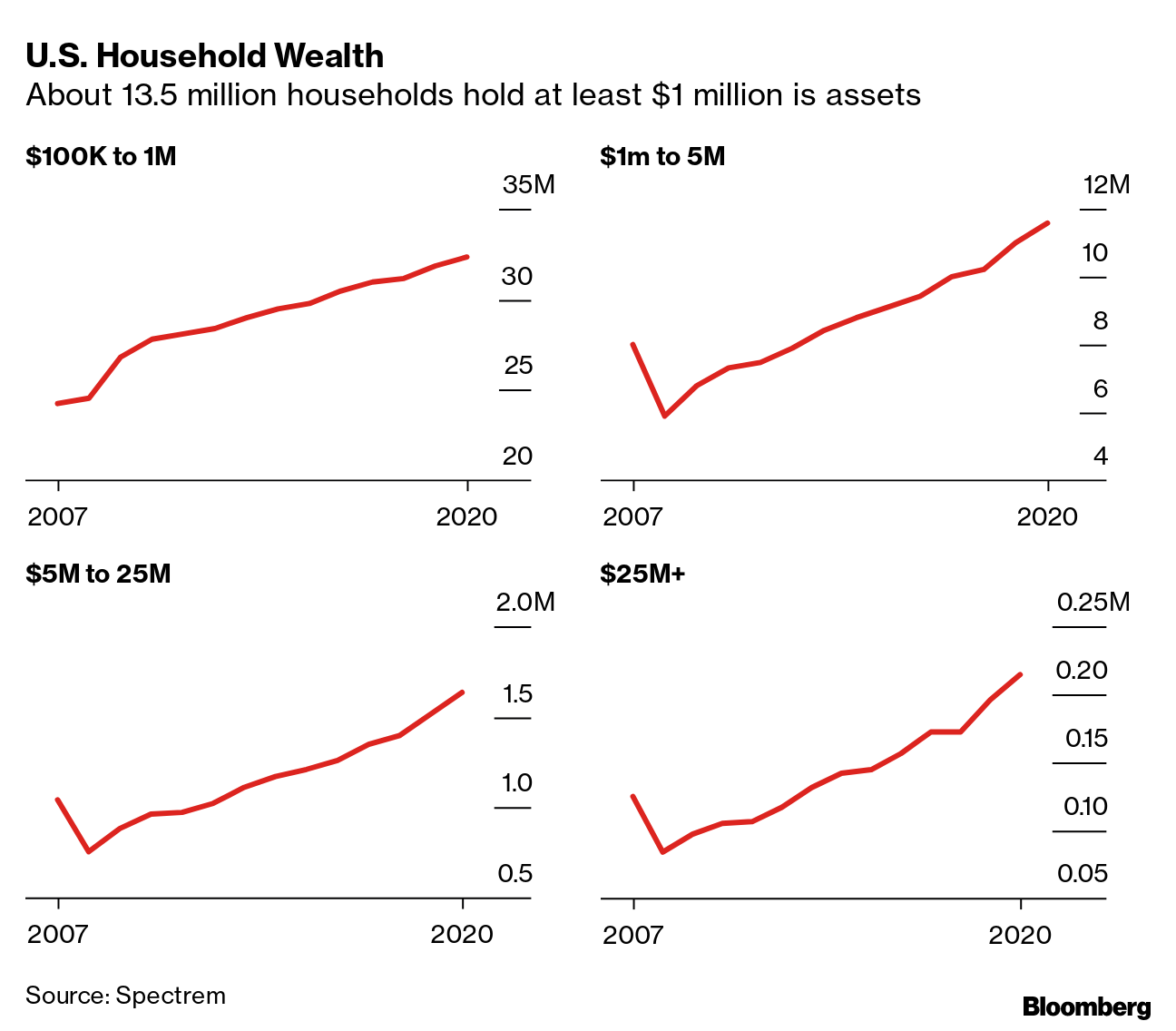

Critics bemoan the return of big government and say the risk is a damaging surge in inflation, as seen before Reagan-Volcker. For now, markets are giving Biden and Powell the benefit of the doubt, with Treasury yields stabilizing in recent weeks. Their next potential hurdle: a faster pick-up in economic data that spurs bond investors to test the rationale for zero rates and supersized spending programs. Stay tuned for the Friday's snapshot on the improving jobs market. —Chris Anstey in Boston The Economic Scene The handover of assets from U.S. Baby Boomers to their children, expected to rank among the biggest wealth transfers in history, is well under way, according to a new survey by Spectrem. The research firm found that 66% of households with a net worth of more than $25 million in 2020 attributed their wealth to inheritance. That's up from 22% in 2007. Today's Must Reads - New data scheduled for release on Thursday is predicted to show the U.S. economy surged around 6.7% in the first three months of the year, fueled by government stimulus and a reopening of offices and shops.

- There are still hiring concerns globally. Germany reported unemployment unexpectedly rose in April, while Treasurer Josh Frydenberg said Australia's jobless rate will "need to have a four in front of it" to generate faster wage growth.

- In what would be an historic turning point, China's population may peak as early as 2022, state media reported ahead of a once-in-a-decade census. That may slow growth and make it harder for the government to meet pensions and healthcare bills although hundreds of millions are still set to climb into the middle class.

- Last year, Indian Prime Minister Narendra Modi made "Vocal for Local" the mantra to beat the coronavirus, aiming to boost domestic manufacturing of everything from personal protective equipment to ventilators. Now, he's relying on overseas help to fight the world's worst Covid-19 crisis.

- Central bankers are thinking about the future of office-work too. European Central Bank President Christine Lagarde said her institution will probably adopt a mix of home- and office-based work given the crisis showed how much can be done remotely.

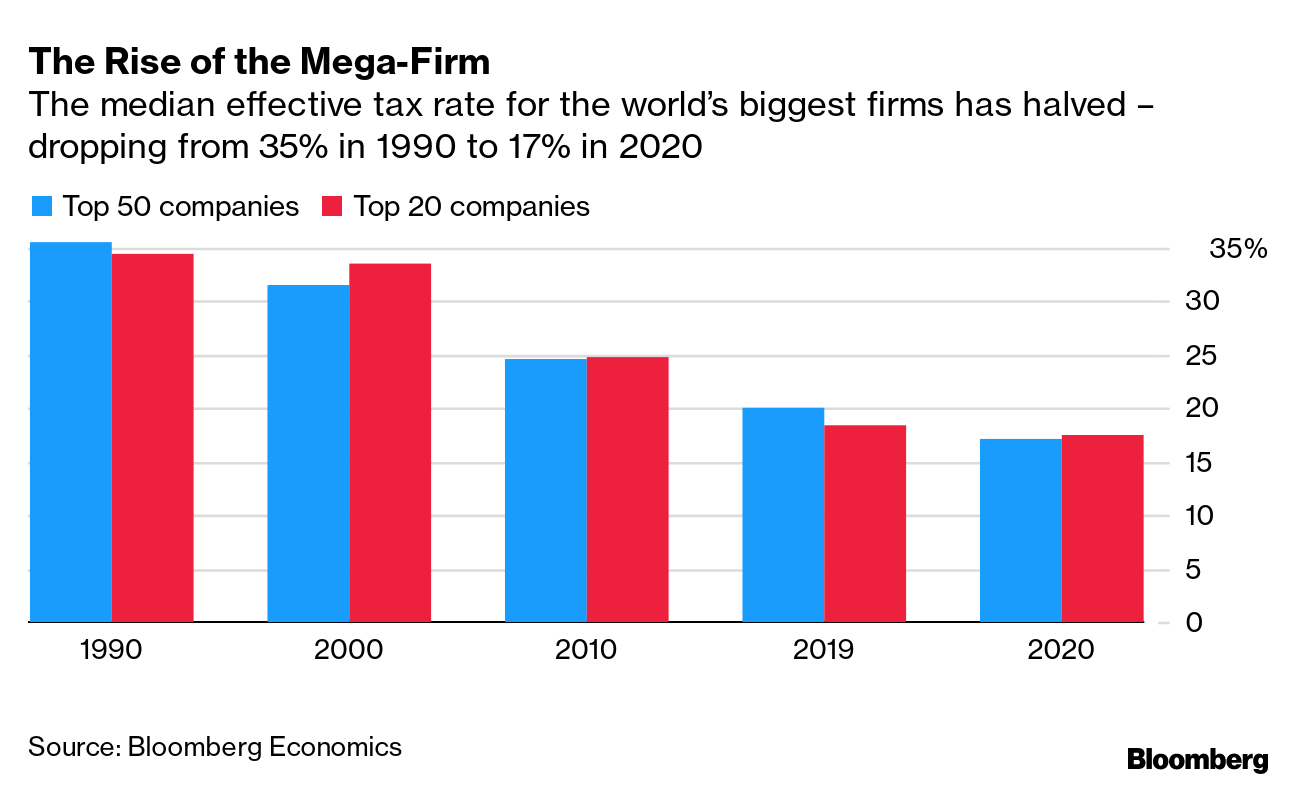

Need-to-Know ResearchA trawl of 30 years of market and company data shows that the world's biggest firms are doing great — but that might not be such good news for everybody else, according to Bloomberg Economics' Justin Jimenez and Tom Orlik. One expression of the rising power of corporate giants is greater ability to resist the call of the taxman. Reflecting the combined impact of lower tax rates and ruthless tax optimization strategies, the median effective tax rate for the world's biggest firms has halved — dropping from 35% in 1990 to 17% in 2020.  Read the full research on the Bloomberg Terminal Over on #EconTwitterThe Onion takes its own approach to reporting on the push to tax the wealthy more..  Read more reactions on Twitter Enjoy reading the New Economy Daily?Click here for more economic stories Tune into the Stephanomics podcast Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter Follow us @economics Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment