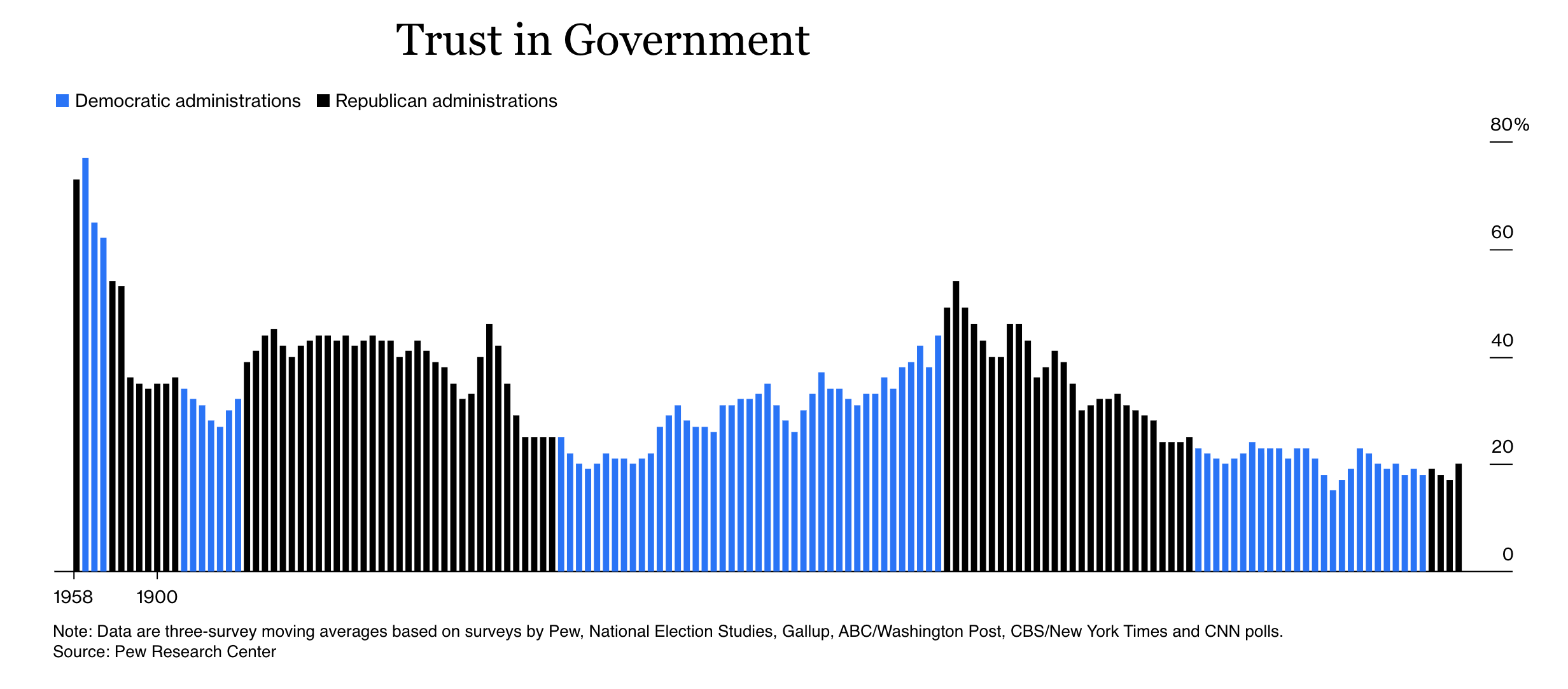

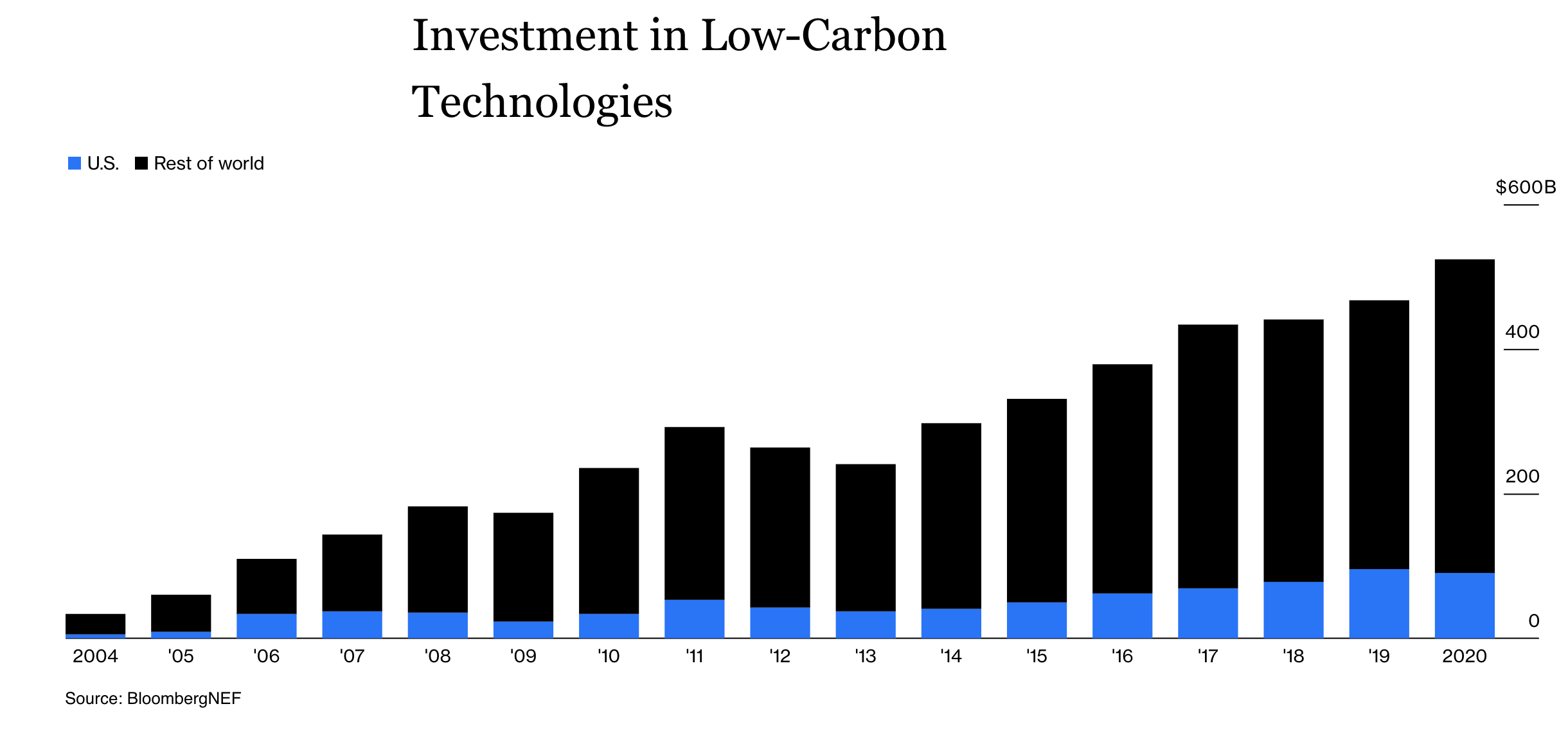

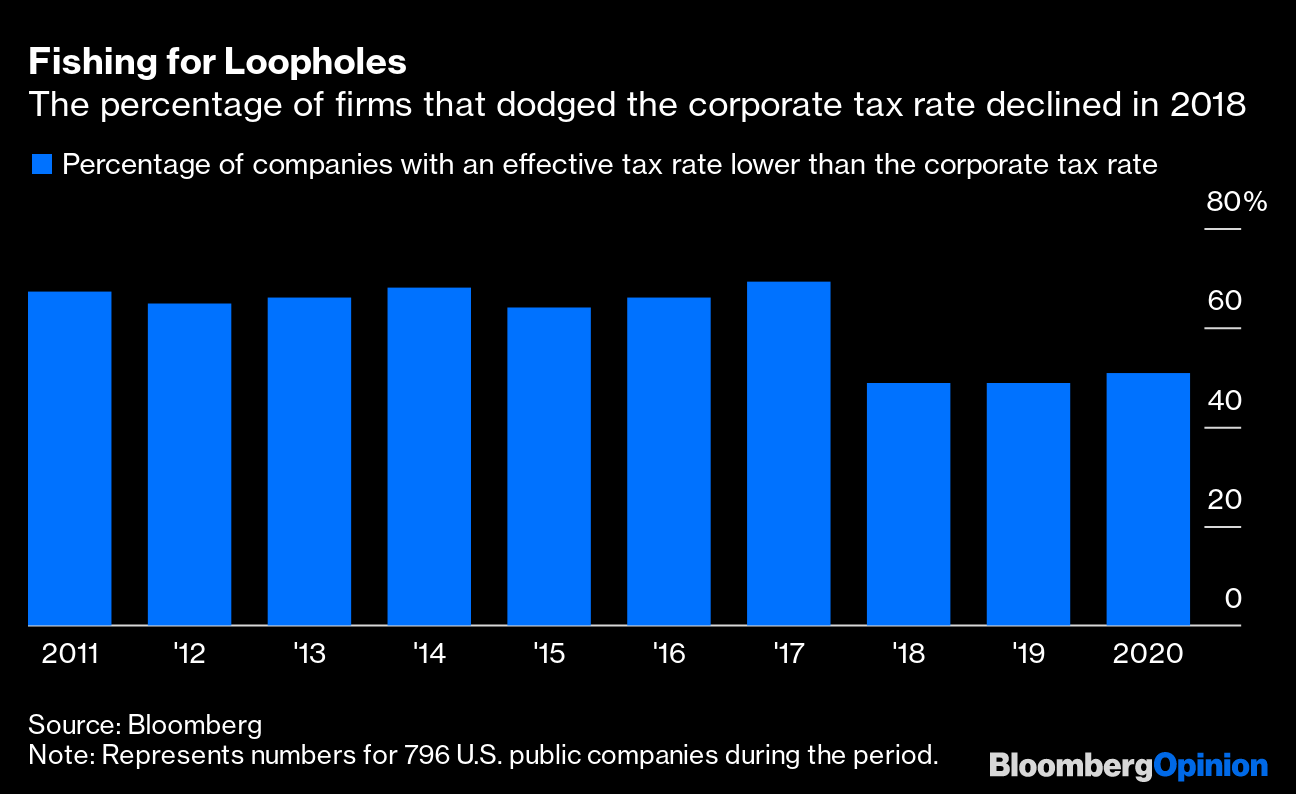

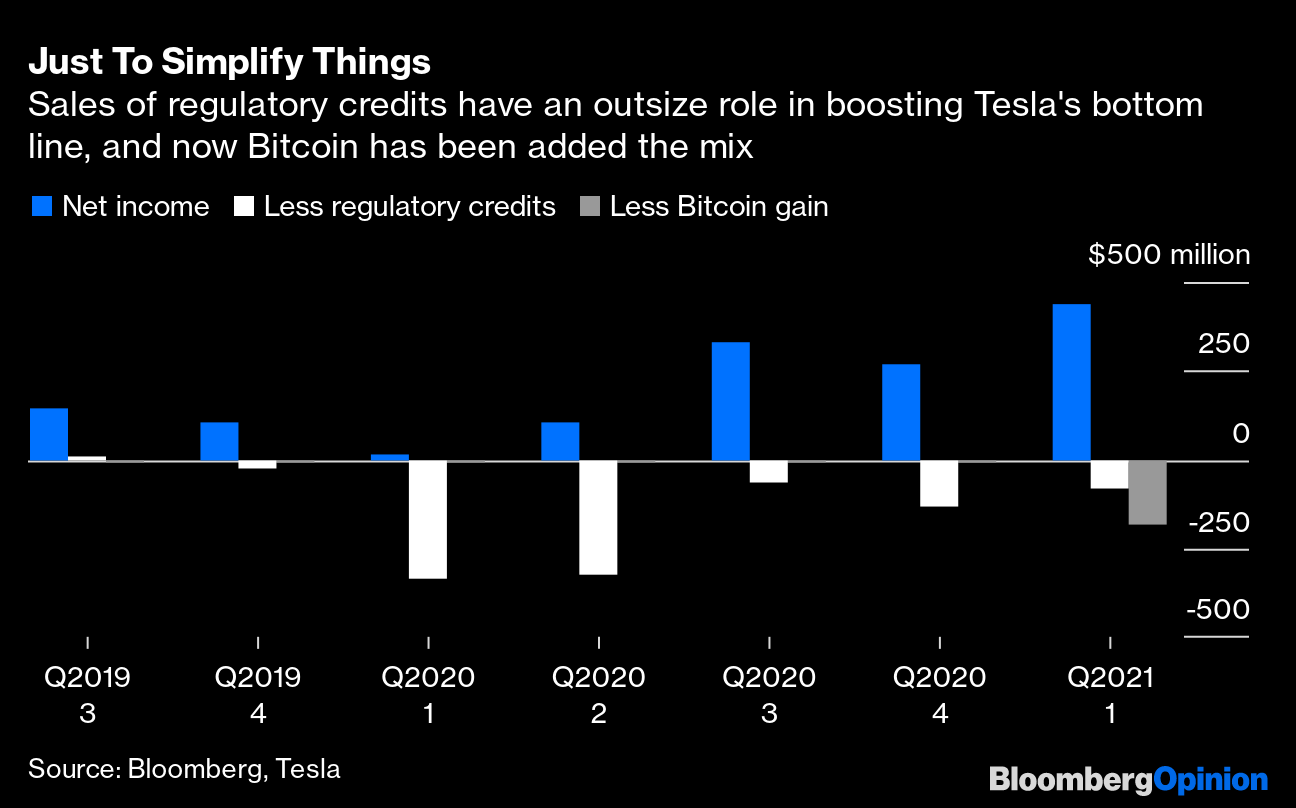

| This is Bloomberg Opinion Today, a charticle of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Chart of the MatterThese days we measure everything: steps, likes, gender-reveal destructive capacity. But our measures of presidential performance are woefully primitive. Approval ratings, jobs and stock prices? Please. Save it for the kindergartners. Actually, uh, those are still pretty good measures. But Bloomberg Opinion writers swim in deeper data waters. To mark President Joe Biden's first 100 days, they have hauled up from the abyssal depths 17 shiny metrics that will tell a much fuller story of the next 1,366 days of Biden's term. From Rhonda Vonshay Sharpe's gender-wage gap to Tyler Cowen's used-car prices, Karl Smith's visa backlog to Stephen Mihm's trust in government, these are the real numbers to watch and discuss with friends, if you want to be and, more important, sound smart. And your steps, of course. Gotta keep up with those. Behold all 17.  Further Biden Reading: What to expect from Biden's address to Congress tomorrow. — Jonathan Bernstein The Climate Needs All the Help It Can GetOne of the metrics in the opus above, picked by Liam Denning, is investment in clean technology. This has risen steadily for years but needs to do much more of that, and quickly — up to $2 trillion per year, or more than triple today's spending, by decade's end:  And not all of this can be government money. Private capital has to fill in some big gaps. Now, if you picture private capital as a large swimming pool, then holding court in the VIP grotto of that pool would be Bloomberg and Goldman Sachs. So it's encouraging they're now working together to funnel bucketfuls of capital to green projects, write Bloomberg LP founder Mike Bloomberg and Goldman CEO David Solomon. This will be especially helpful in developing nations, where capital is scarce but some of the biggest green gains await. Read the whole thing. Bonus Editorial: China's digital yuan is no threat to the global financial order and can even help guide the birth of FedCoin. Archegos Blowup WatchQuite a bit of capital has been vaporized, or at least redistributed, by the blowup of Archegos Capital Management. Today we learned the debacle will cost UBS $860 million, which buys quite a lot of solar panels these days. The bank and its investors mostly brushed off this spot of bother, writes Elisa Martinuzzi, when really they should have been wondering, Hey, how can we maybe not lose $860 million on one client again? At least UBS could say it didn't lose $5.5 billion the way Credit Suisse did or $2.9 billion like Nomura will. The latter bank's CEO just wrapped up his first year in the job, writes Andy Mukherjee. Needless to say, his second year has room for improvement. Of course, despite all this bloodshed, big banks still can't get enough of being prime brokers for the Archegoses of the world, writes Mark Gilbert. There's just too much money in it. Telltale ChartsClosing corporate tax loopholes should raise a lot more cash than just hiking the tax rate, writes Nir Kaissar. Corporate behavior after the latest tax cut proves it.  Tesla is almost becoming a Bitcoin and carbon-credits trader that sells cars on the side, writes Liam Denning.  Further ReadingThe industrial recovery may still be iffy, but at least inflation pressures are real. — Brooke Sutherland The Fed can't just avoid the talk — about tapering support — forever. — Brian Chappatta European tourist spots don't rely on American travelers; they need other Europeans. — Andrea Felsted In India, the only correct price for a vaccine should be zero. — Andy Mukherjee Corporate America is increasingly looking to hire people with criminal records. — Brooke Sutherland and Brian Chappatta Atlanta is a vision of our post-pandemic future: people living in "15-minute cities." — Conor Sen The pandemic has made ghost kitchens and online-only, small-menu restaurants the hot new thing. — Sarah Halzack There's new evidence Russia undermined the 2015 Iran nuclear talks. It has no business being involved now. — Eli Lake Oxygen, a key tool in fighting the pandemic, has a long history of skepticism and quackery. — Stephen Mihm ICYMIBiden wants to give $80 billion to the IRS to do more audits. The very rich are worried about their loopholes. The CDC says the vaccinated can go maskless outdoors. Iterable fired its CEO for microdosing LSD at work to help him focus. KickersBored area dad turns his basement into a video store. We should name more moon craters after women. (h/t Ellen Kominers for the first two kickers) Archaeologists find a 1,600-year-old mosaic. Free will is an illusion, science is starting to think, because it must. Notes: Please send videos and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment