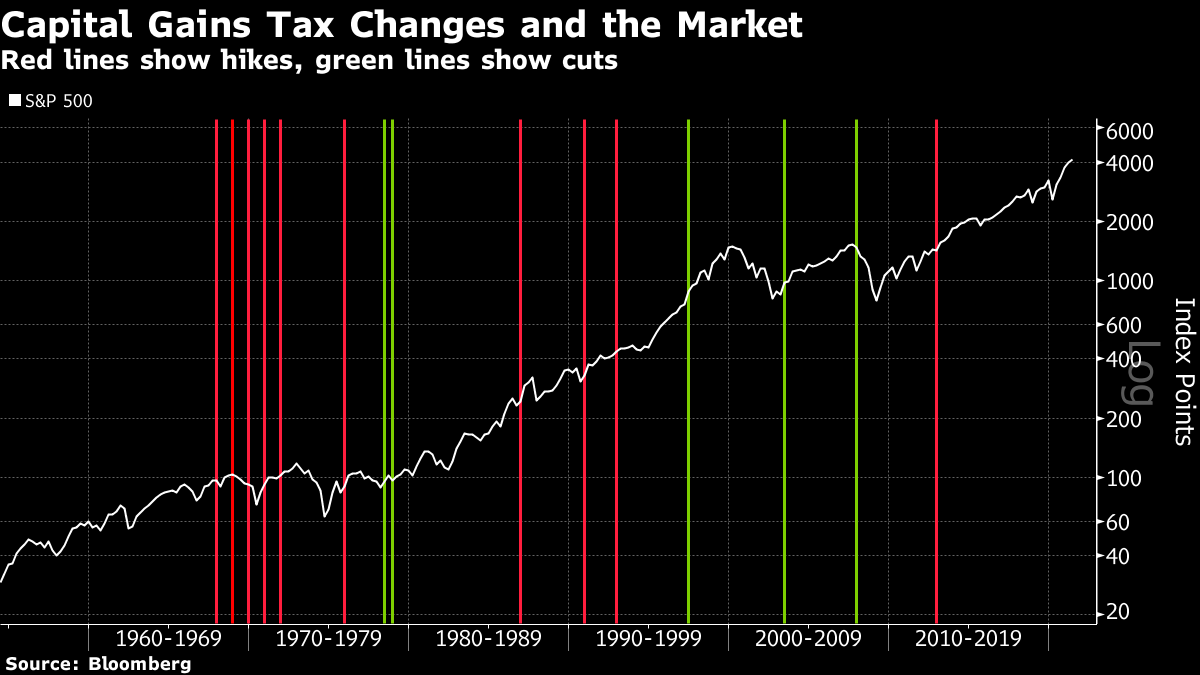

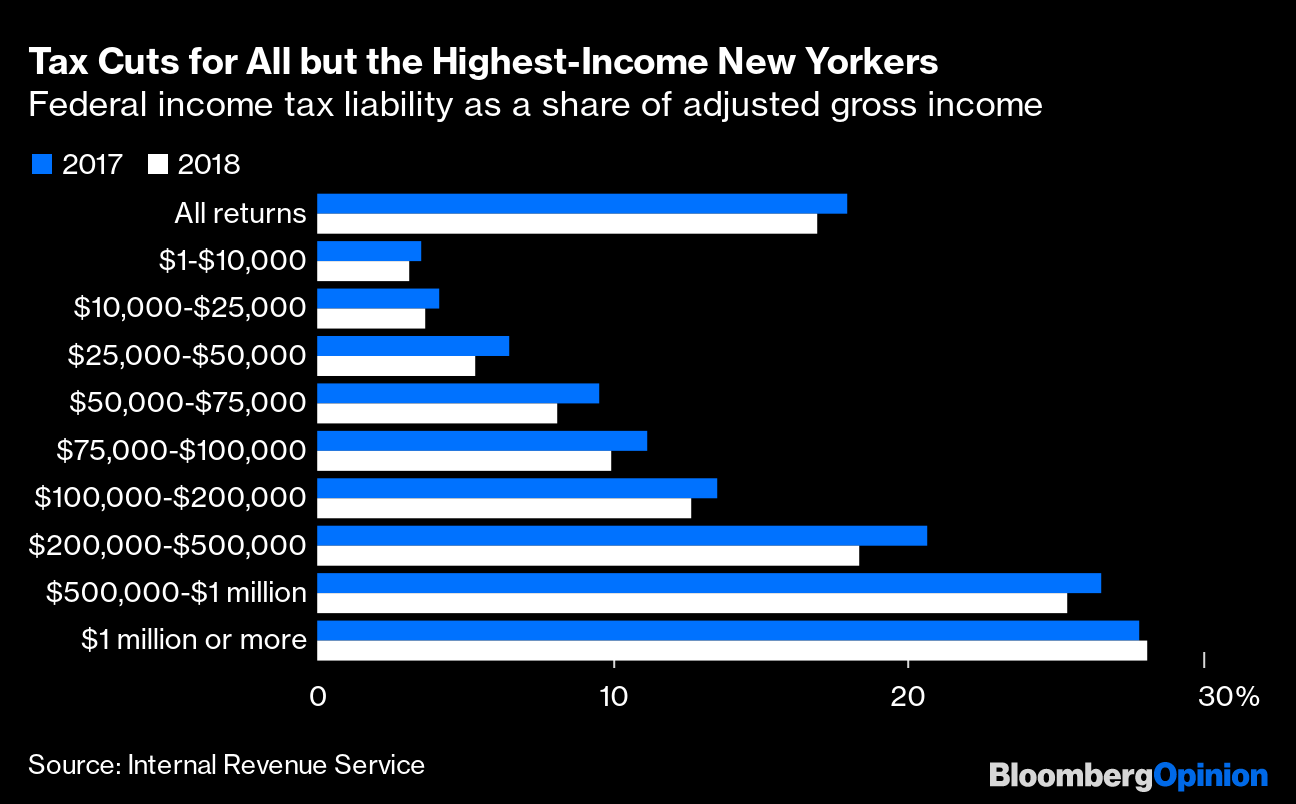

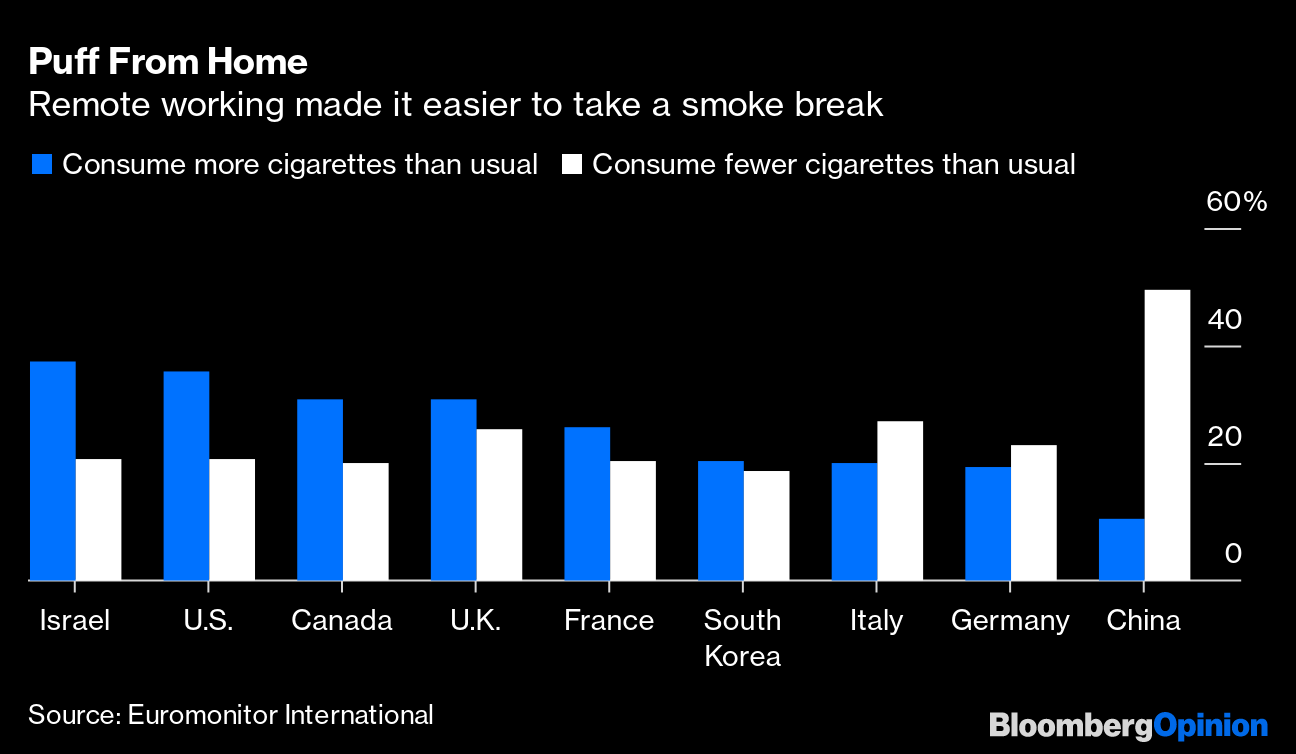

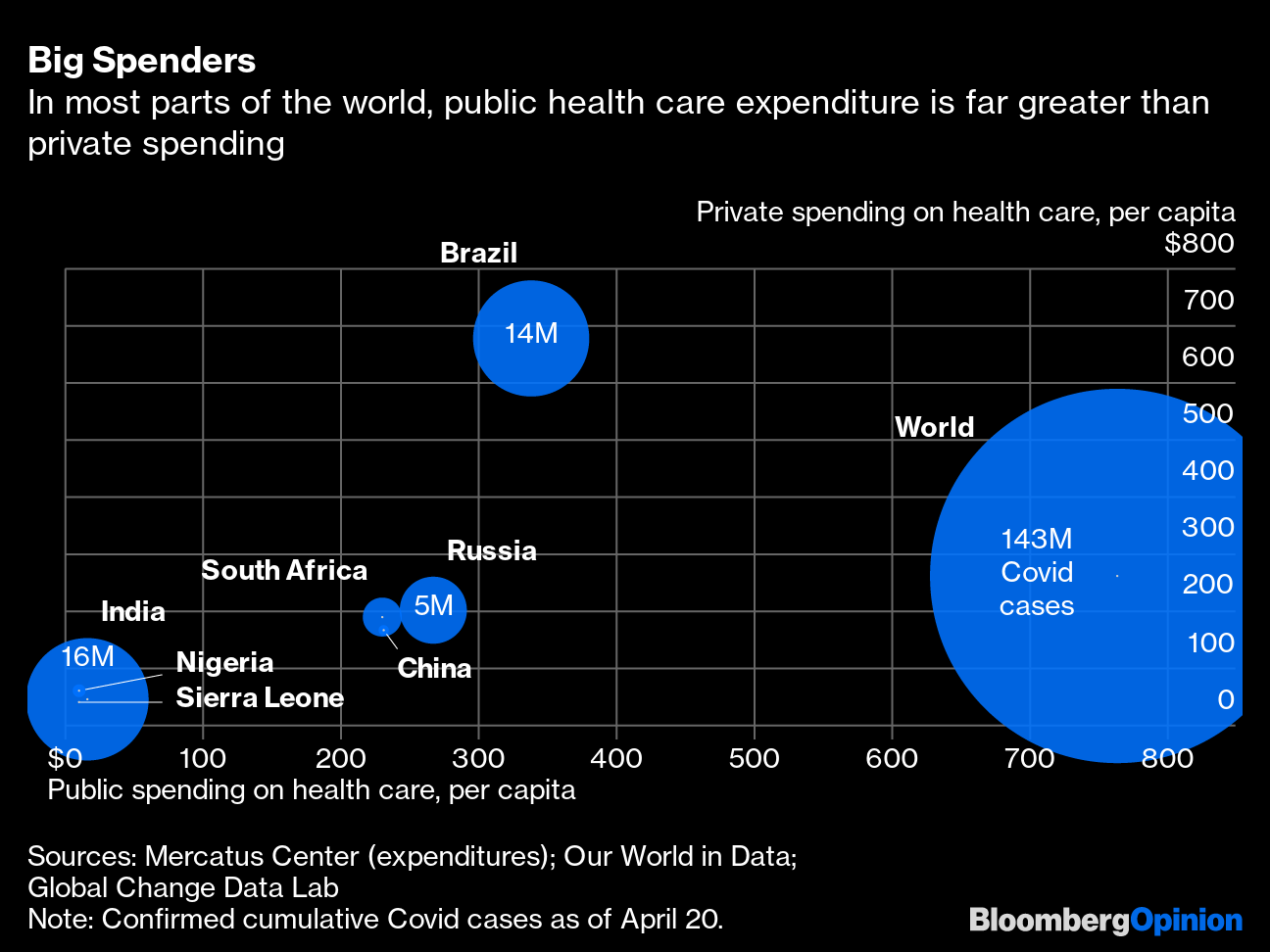

| This is Bloomberg Opinion Today, a capital-gains tax plan of Bloomberg Opinion's opinions. Sign up here. Today's AgendaDon't Fear the Tax ManThere was a moment before Donald Trump was elected when people thought his election would crash the stock market. Then he was elected, and people quickly realized he would lead a unified Republican government that would cut taxes, and stocks were happy again. Market people get it wrong sometimes is the point here, and those times often involve taxes somehow. Yesterday stocks had themselves a little panic attack on news that Trump's replacement, who has also not yet crashed the stock market, was going to raise capital-gains taxes. This should have surprised nobody, as President Joe Biden has promised for many months he would do just this, notes John Authers. Also we defy you to pinpoint the impact of capital-gains tax increases, or cuts, anywhere on this chart of the stock market:  You can't do it! In fact, if correlation were causation, then that series of tax cuts around the turn of the century apparently hurt the stock market. Of course that's ridiculous. But so too is the idea that higher capital-gains tax rates will necessarily hurt the market. Biden's plan targets the top 0.3% of earners. The rest of us should be OK. What they will hurt is actively managed mutual funds, which are subject to capital-gains taxes, writes Nir Kaissar. Passive investments such as ETFs will now get even more customers. This is terrible news for active fund managers, but wonderful news for all the rest of us. We'll be better off in cheaper investments that don't constantly fail to beat benchmarks. You can even build ETFs to mimic active managers, if that's your thing. To be fair, everybody's extra-antsy about taxes here in Wall Street's metropolitan vicinity. Only four years ago, as part of that same tax plan Wall Street cheered, Congress capped the SALT deduction, a boon to those of us who own houses in high-tax areas. It felt kind of like the end of the world, with talk of people fleeing for greener, less tax-y pastures such as Florida. Justin Fox has crunched the numbers, though, and discovered that, unless you made more than $1 million a year, the whole 2017 tax overhaul actually saved you tax money. And even the millionaires didn't suffer that much:  For something that's supposed to be as certain as death, we sure do get taxes wrong a lot. Bonus Markets Reading: Well, what do you know? Bonds are rallying again. — Brian Chappatta Please Don't Smoke 'Em If You Got 'EmEvery single one of us in 2020 was Steve McCroskey from "Airplane!" Except instead of having just one bad week to quit [fill in the blank], we had 52 bad ones.  Boredom and anxiety are perfect reasons to smoke cigarettes, and man were we ever bored and anxious last year, recalls Andrea Felsted.  But Big Tobacco is not run by dum-dums. It knows the trends are not in its favor and that it must keep investing in safer alternatives to cancer sticks. In fact, the FDA may be about to ban menthol cigarettes, which Big Tobacco has marketed to Black smokers for decades and which make it easier to get kids hooked. The agency has dragged its feet on this decision for years, though, and Bloomberg's editorial board writes it's time to finally make the move. For our health. Putin Out-Soviets the SovietsThose of us who grew up at the end of the first Cold War but lacked fully developed prefrontal cortexes at the time may remember the Soviet Union as an unbeatable Evil Empire, just a vast nation filled with Ivan Dragos. But the late-era Soviet Union was a model of gentle restraint next to Vladimir Putin, writes Leonid Bershidsky. He may not have the USSR's reach, but he still has the nukes, and he's apparently less afraid to use them to back up a level of smack-talking that would have made Gorbachev's contemporaries nervous. He also has a relatively stronger economy and life tenure, meaning he will keep doing this until somebody really confronts him, which may be never. Bonus Problematic-Regime Reading: Iran nuclear talks are hopeless without a new regime. — Eli Lake Telltale ChartsIndia's overreliance on private health care helps explain why it's failing to protect its people. — Anjani Trivedi  Further Reading Business travel could bounce back faster than you think. — Brooke Sutherland Apple's new privacy controls will make it harder for apps to track you, but will also boost Apple, Facebook and Google while hurting upstarts. — Tae Kim Landing Simone Biles is a big win for up-and-coming women's athletic brand Athleta, owned by Gap. — Sarah Halzack Drive-thrus and online ordering are making expensive dining rooms less vital for fast-food restaurants. — Conor Sen Creating vaccine hierarchies makes it a cultural thing, which isn't helping overcome vaccine hesitancy. — Tyler Cowen Here are four things companies can do to fight inequality, which ultimately hurts them, too. — Dambisa Moyo Bankers should stop whining about stress. A little stress is good for you. — Jared Dillian ICYMIBiden will call the Armenian massacre a genocide. Billionaire discovers psychedelic drugs are gateways to SPACs, Bitcoin. Scientist makes Covid vaccines in the kitchen. KickersArea dog enters race, beats humans. (h/t Scott Kominers) Newly discovered pterosaur was adorable. We're going to have to learn to live with germs again. How NASA's bet on SpaceX's Starship will change space travel. Notes: Please send fast dogs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment