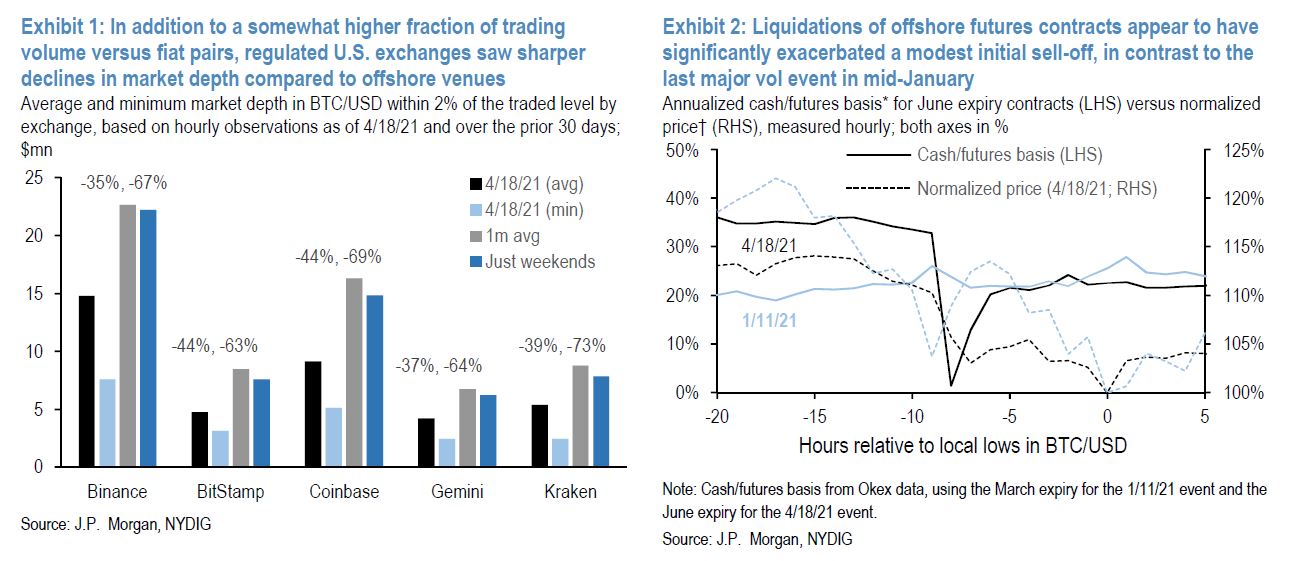

| Stocks slide and Bitcoin falls on reports that capital gains taxes for wealthy Americans may double. Record deaths may underplay the scale of India's coronavirus surge. How to build a portfolio that outperforms for a century. Here's what you need to know to start your day. Even a record death toll may hide the true extent of India's Covid-19 crisis. Bodies piling up at crematoriums and burial grounds are sparking concerns that official records don't accurately represent the impact of a ferocious new Covid-19 wave. Singapore and UAE have barred most flights from India, and Australia will lower the overall number. Elsewhere the head of the World Health Organization, Tedros Ghebreyesus, called on governments and companies that "control the global supply" of vaccines to share doses and know-how to increase equitable distribution. In the U.S. signs of a post-pandemic recovery increased as jobless claims fell and airlines signaled the worst of the travel downturn is over. Stocks look set to slip in Asia following broadbased declines in U.S. benchmarks as investors mulled a proposal for higher capital gains taxes. Futures pointed lower in Japan, Hong Kong and Australia. Speculation arose that traders may sell shares preemptively as Bloomberg News reported the Biden administration is considering a capital gains tax hike that could take the top rate for those earning $1 million or more as high as 43.4%. The dollar strengthened and Treasury yields dipped. Credit Suisse has moved to contain the fallout from two of the worst hits in its recent history with a surprise capital increase and a sweeping overhaul of its business with hedge funds. Switzerland's second-largest bank is raising $2 billion from investors to shore up capital depleted by $5.5 billion in losses from the collapse of Archegos. Meanwhile, analysts are asking if Nomura will quit certain businesses over the Archegos fallout and whether heads will roll. The setback adds to a list of stumbles for the Japanese finance giant as it takes on global risk to offset slower growth at home and vies to compete with its larger, more agile U.S. rivals. And the $6 trillion family office world now faces the greatest challenge to its privacy in a decade. Bitcoin declined for the sixth time in seven days, extending losses after Joe Biden's capital gains proposal. The slide pushed the cryptocurrency down as much as 8% to about $50,500, sending it below the low of $51,707 reached Sunday. U.S. investors already face a capital gains tax if they sell the cryptocurrency after holding it for more than a year. But the coin's been one of the best-performing assets in recent years — anyone who bought a year ago is sitting on a 625% gain. Meanwhile the founder of one of Turkey's largest crypto exchanges flees the country. China's insatiable demand for luxury goods is getting its own cargo route. Alibaba's logistics arm is launching direct cargo flights between Singapore and China's Hainan Island, seeking to bolster the supply of goods such as handbags and watches for shoppers unable to travel due to the pandemic. Cainiao Smart Logistics Network plans to run seven return flights a week on the route, while looking to open additional freight routes with destinations like Japan and South Korea. The first direct freight flight from Singapore to the city of Sanya will fly on Sunday, carrying duty free cosmetics from brands including Estée Lauder and Clarins. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayVolumes in Bitcoin futures have exploded in recent months, and are now at the point where they've become an important part of the market that can exacerbate price swings in the underlying cryptocurrency itself. Bitcoin's sudden drop earlier this week was said to coincide with a large liquidation in futures contracts, for instance, and the event itself illustrates some of the biggest growing pains in the crypto market. These involve fragmentation and execution risk.  Bloomberg Bloomberg The range of prices for futures contracts across the biggest exchanges spiked to a record when Bitcoin plunged over the weekend, according to research by JPMorgan's Josh Younger. In other words, depending on whether you were trading on Binance or Kraken or whatever, the price for what is basically the same thing varied by as much as 4%. The basis (or spread) between the price of spot Bitcoin and futures contracts also blew out. In theory, these types of spreads should be arbitraged by market players who can come in and make easy money. In practice, however, that type of activity is much harder to do in the crypto market. Even if there's money to be made from individual trades, setting up transaction capability across different exchanges and geographies can be difficult and costly. It's also harder to get financing for crypto trades since banks are still wary of the market. And arbitrageurs tend to stay away if there's a risk that they might not be able to shift collateral in time to make good on the trade (the weekend's plunge in prices coincided with a huge drop in the Bitcoin hash rate — said to be the result of a power outage in Xinjiang — and higher transaction costs). All of which means you can get big liquidity shocks in the market. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment