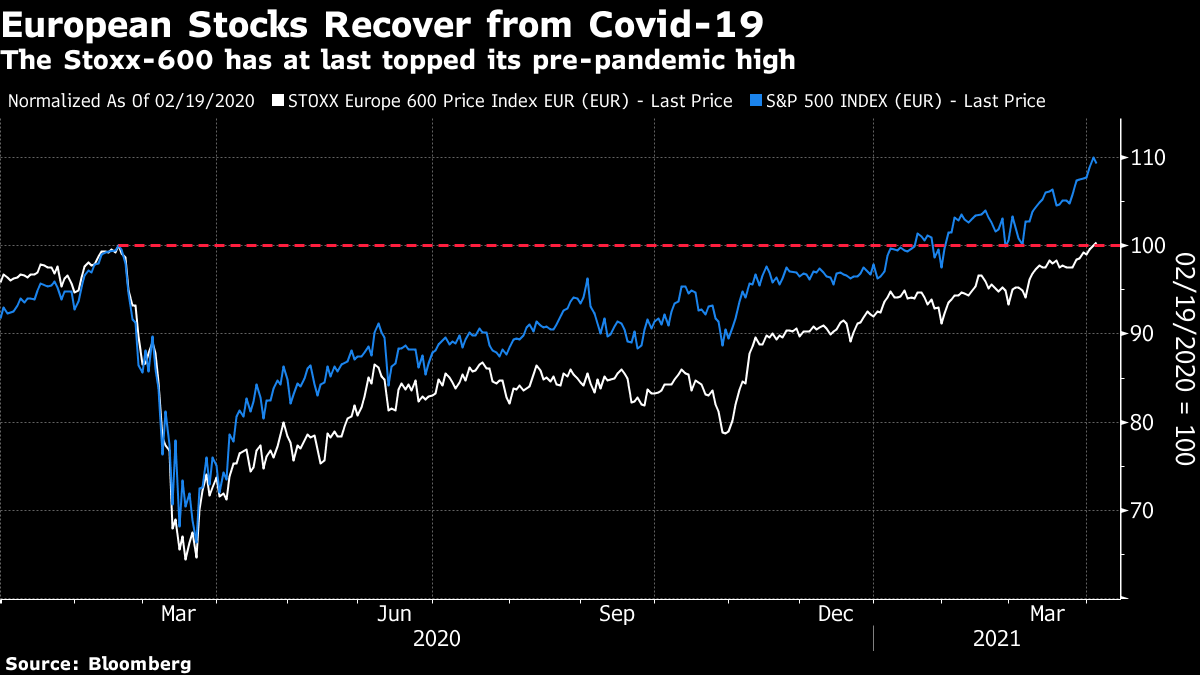

| To get John Authers' newsletter delivered directly to your inbox, sign up here. Euro-ComebackWe have another landmark, this time in Europe. The Stoxx-600, the most widely quoted broad index of western European stocks, has made up all its losses from the pandemic. It has done so months after the S&P 500 (shown in the chart in euro terms for a direct comparison), but also far earlier than anyone would have thought likely this time last year:  This leads to a perennial question. The U.S. market has been leading EU stocks so far this year; is this now at last the time to go hunting for bargains in Europe? Let's look at it two ways:

From the Bottom Up

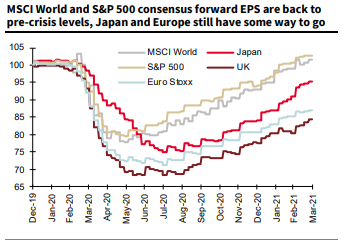

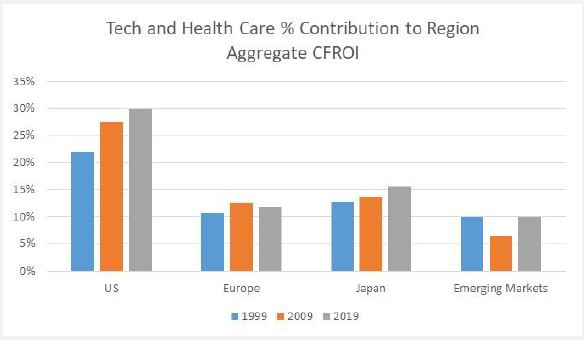

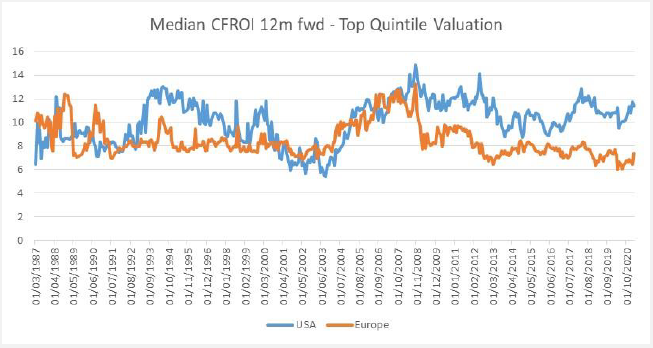

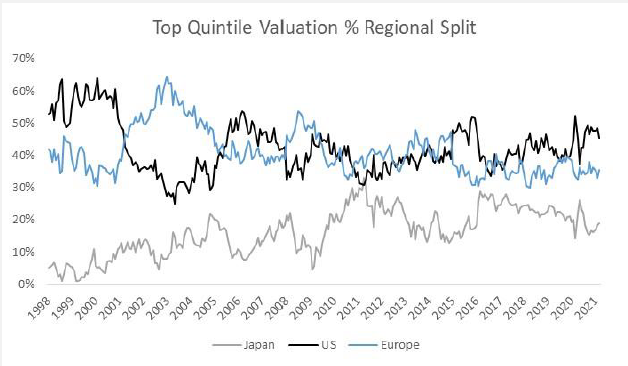

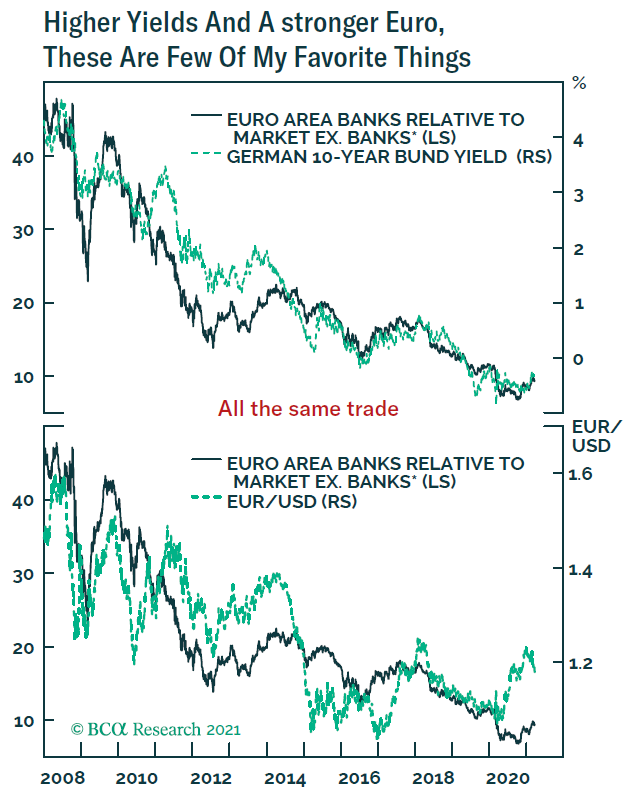

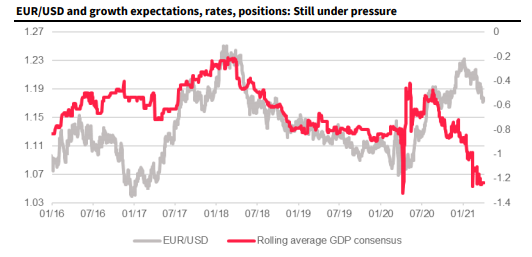

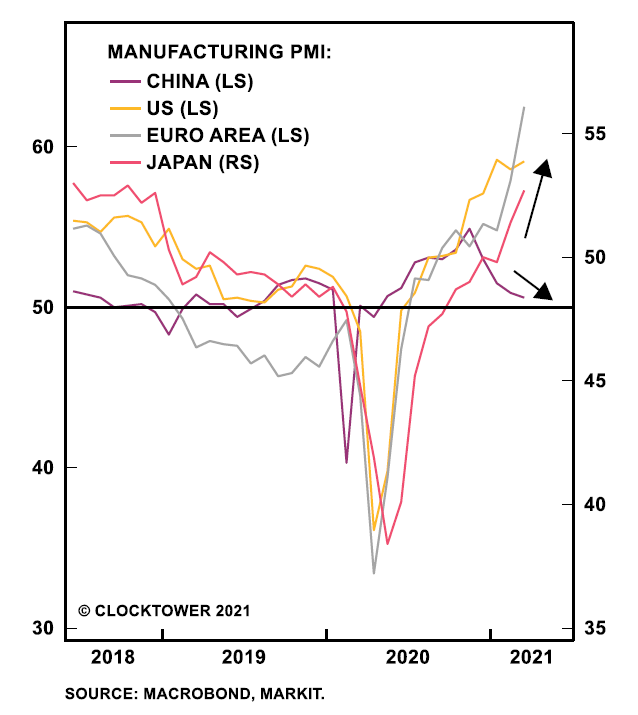

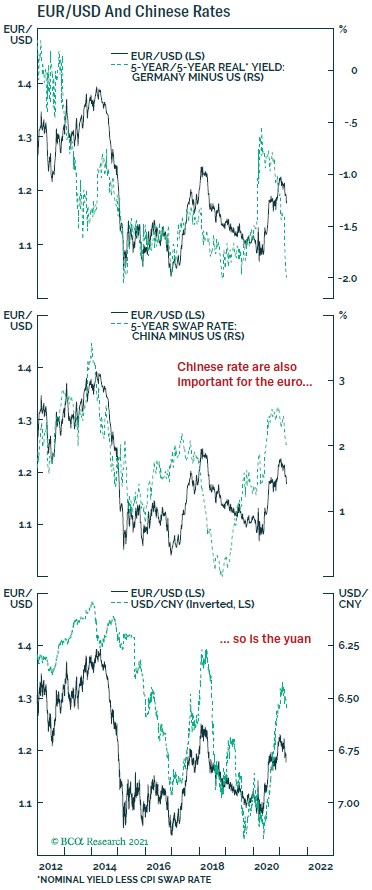

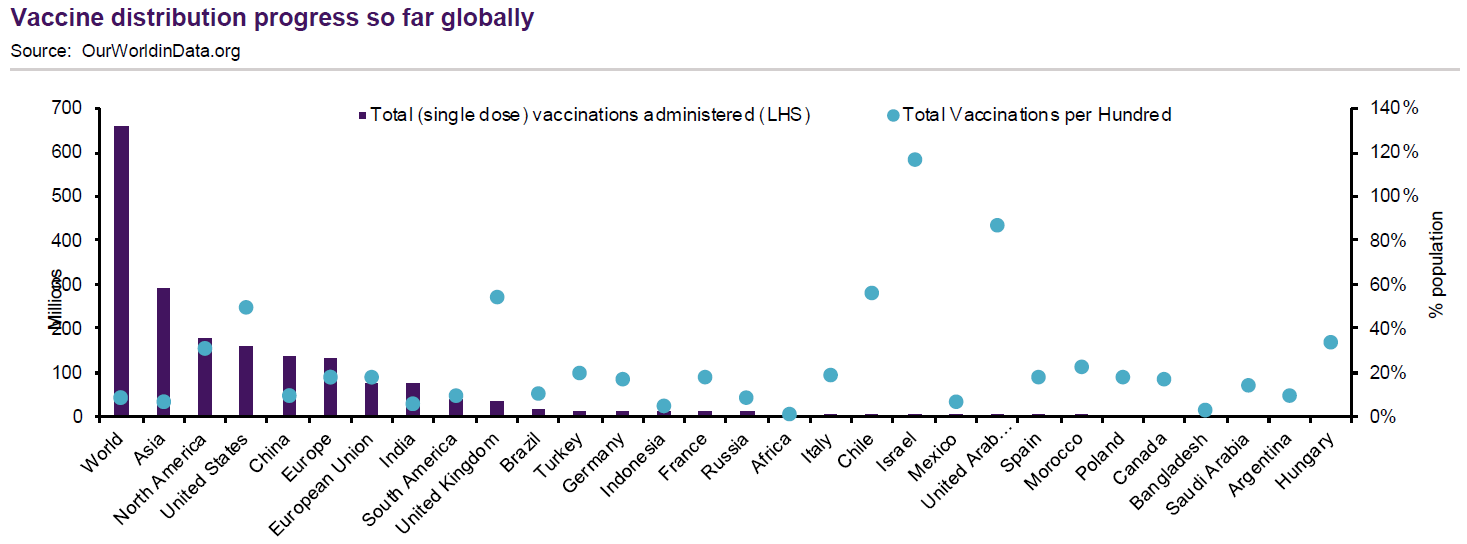

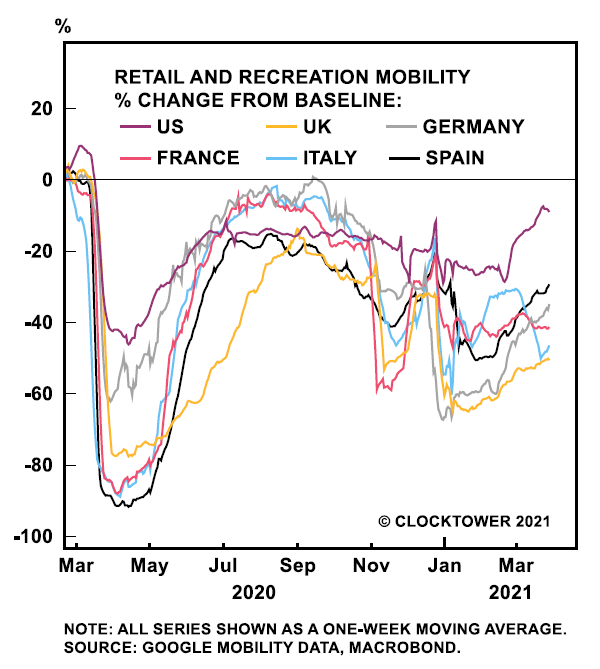

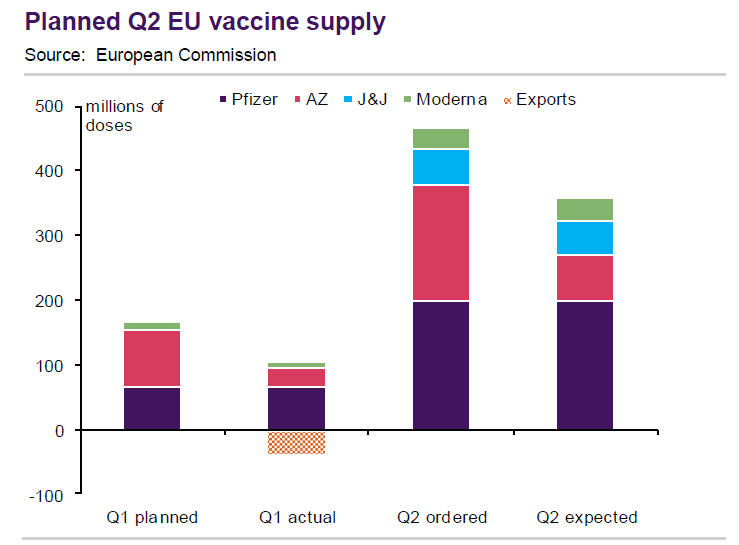

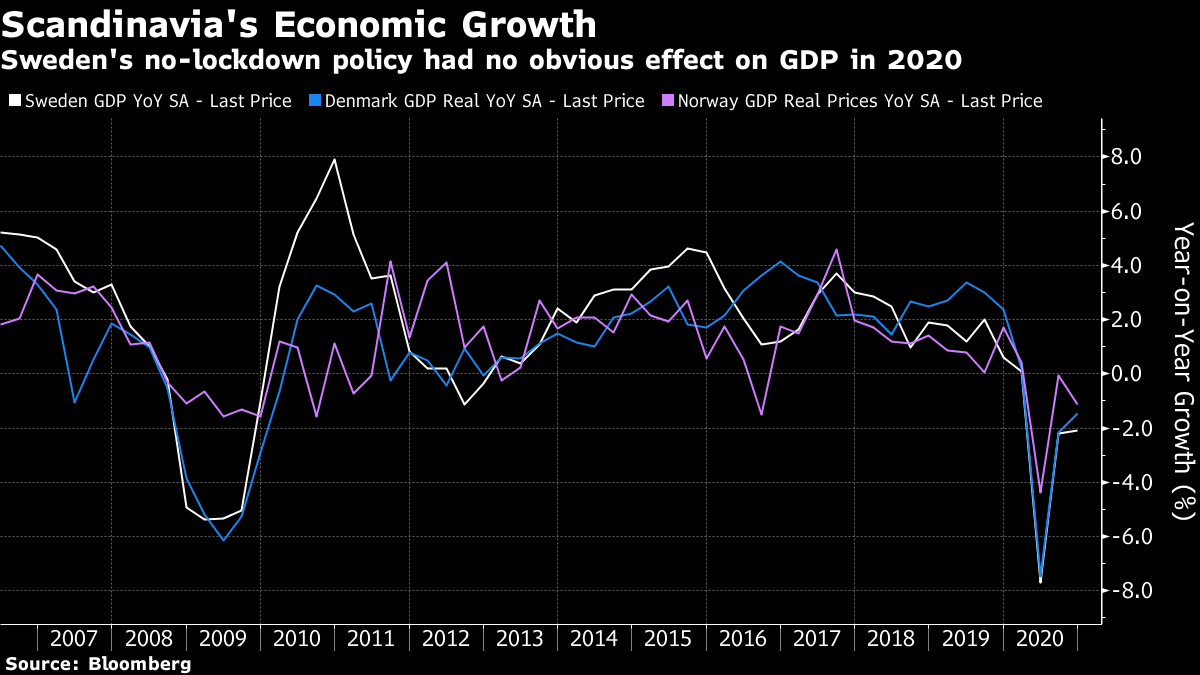

Naturally, the U.S. market trades at a much higher multiple to earnings than Europe does, thanks to the presence of the FANG internet platform stocks such as Apple Inc. But even if we exclude technology and telecommunications, the remainder of the S&P still trades at a premium to the Stoxx, in terms of forward earnings multiples, and this has widened since the pandemic:  There is also notably more bearishness about European stocks' prospects. This chart shows forward earnings forecasts for the Stoxx, compared to the S&P, and the MSCI indexes for Japan, the U.K., and the developed world, as compiled by Societe Generale SA:  This looks like a recipe for contrarians: Europe is trading at a lower multiple of more bearish earnings forecasts. But number-crunching shows that it isn't that simple. The HOLT service run by Credit Suisse Group AG, which uses an investment method based around "cash flow return on investment" — an attempt to extract an accurate version of companies' profitability from their accounts — suggests that there may actually be more bargains in the U.S. It is true that the booming technology and pharma sectors account for a much larger chunk of economic profits, as measured by HOLT, than in Europe or Japan, and this helps to make the overall market look more expensive:  However, looking at the cheapest 20% of stocks in both the U.S. and Europe reveals that the American contingent tends to be considerably more profitable. In other words they present a truer value proposition:  And despite the expensiveness of the overall U.S. market, it accounts for almost half of the cheapest companies in the developed world, again as measured by HOLT's methodology. American companies account for a slightly higher proportion of bargains than they did before the pandemic:  None of this suggests that there aren't some good buys to be had in Europe. But it isn't the happy hunting ground that raw market-wide valuations might suggest. From the Top Down If we take a macro view, things look slightly different. Particularly for Europe's beleaguered banking sector, whose weakness was central to the sovereign debt crisis that swept the euro zone a decade ago, macro conditions appear to be everything. The following chart was produced by Mathieu Savary, chief European investment strategist for BCA Research Inc. When bund yields fall, as they have tended to do in recent years, so do bank shares. The same is true, although with a less tight relationship, of the euro. When it falls against the dollar, bank shares also decline:  This implies that EU banks should be a nice geared play on reflation. If the economy regains its vigor, and bund yields rise, that should be good for the banks (and many other European stocks besides). But what to do about the currency? Entering this year, a weak dollar was an overwhelming consensus call. So of course the dollar has strengthened, largely on the back of far higher yields in the U.S., aided by surprisingly expansive fiscal policy, and far better American news on the pandemic (which I'll cover lower down). If we look at expectations for growth, it certainly looks as though the euro has further to drop. The following chart was compiled by Kit Juckes of SocGen by subtracting Bloomberg's consensus expectations for GDP growth in the U.S. from those for the euro zone. The single currency has generally tracked the deficit in hopes for the euro zone compared to the U.S. until recently — which leaves looking it very overbought:  Juckes suggests that hopes for the EU economy don't have much further to decline from here, but the exercise reveals that there is a lot of optimism embedded in the current relative strength of the euro. Is it justified? China matters here. Europe's manufacturing exporters are uncomfortably exposed to the country, which means they have benefited from its post-pandemic expansion. ISM purchasing manager surveys show U.S. manufacturing roaring back, but the EU, on the same scale, is doing even better — and Germany is doing better than that. This chart was produced by Marko Papic of Clocktower Group:  And if we look at bonds and foreign exchange, this ingenious triple-decker chart from BCA demonstrates that the EU is at least as sensitive to China as it is to the U.S.:  So Europe's manufacturing sector is doing better than many realize, but if China goes through with an attempt to rein in credit later this year, as seems quite possible, Europe stands to be an indirect casualty. The Biden administration's ambitions to go on an even bigger spending splurge — that Europe is highly unlikely to match — also complicate things. A big top-down bet on Europe, then, does require making some bold assumptions about the U.S. and China. It also requires some medical assumptions. That leads to one more unavoidable issue. The Viral View Hope for the euro at this point ultimately is rooted in the belief that it is safe to look through all the problems with the vaccine rollout, and assume that the region can put the pandemic to rest long before the end of the year. If the vaccination effort turns around, then the euro might find some reserves of strength. How safe an assumption is that? This chart from NatWest Markets shows progress so far, with continental European countries lagging well behind:  With few Europeans vaccinated, and a third wave sweeping the continent (which looks as though it may now be cresting), this has resulted in limited economic mobility, both from choice and from governmental compulsion. (Note that the U.K., whose vaccine program has been far more successful, still has the most restrictive lockdown; if anything, it is now erring on the side of conservatism.) Meanwhile, the U.S. has seen a sharp upturn in activity and is almost back to pre-pandemic normal. This is another chart from Papic of Clocktower:  Is this rock bottom for the EU? It might just be. Doubts over the safety of the AstraZeneca Plc shot have hampered the vaccination program so far, and these exacerbated already strong suspicions about vaccines in the population. EU politicians have also been enthused to point out that many vaccines manufactured in Europe have been exported elsewhere. But these problem should soon be solved. By the end of this quarter, the continent will be swimming in vaccine, and will be far less dependent on AstraZeneca. This chart was produced by NatWest from European Commission data:  There is more to its slow start to vaccinations than supply, and the pandemic has surprised on several occasions already. It is true that Europe's apparent weakness would dissipate quickly if it can vanquish the virus. But on balance, it doesn't look like a compelling opportunity on either a top-down or a bottom-up basis. Sadly. Herd ImmunityThat brings us to a fascinating tale that has unfolded over the last year in Scandinavia. Sweden took a different approach to most other developed nations, eschewing school closures and strict lockdowns in favor of protecting the most vulnerable and allowing the virus to spread relatively unchecked among the rest of the population. The difference between Sweden's approach and the rest of the world's can be, and was, exaggerated. Swedish measures still involved much limitation on economic activity, and those most at risk complained that they were being locked down even more thoroughly than people in other countries. But in much of the rest of the world, the Swedish model was hailed as a great and evident success. The idea was that by letting the disease rip, enough people would gain resistance to prevent it from running rampant again. Having taken the hit the first time, the hope was that Sweden would have a level of protection while other countries had to suffer further waves. This was a huge debate, which I covered in detail in three newsletters last October, which you can find here, here and here. Plenty in the investment community took seriously the notion that herd immunity was already close, and so did I. At that point, with Europe's second wave beginning to take shape, there was an uncomfortable feeling that the theory was about to be tested. Scandinavia provided the closest approach we had to a controlled experiment. Sweden's neighbors Denmark and Norway, culturally and economically very similar countries, both adopted straightforward lockdowns. Their joint population is 11.1 million, compared to 10.2 million Swedes, so direct comparisons aren't difficult. Now we have the results of the controlled experiment, and unfortunately for Swede, the numbers are shocking. I smoothed the following chart by looking at the rolling five-day death total, and then taking the seven-day moving average for the Swedish data, which tend to be very volatile from day to day. The total figures show 13,533 deaths in Sweden and 3,110 deaths in Denmark and Norway. The second wave took a heavier toll on Sweden than the first:  Moreover, Sweden gained no obvious economic benefit. Here is year-on-year GDP growth for the three countries, which tend over time to be very similar. Sweden's economy suffered a slightly deeper contraction last year than those of its neighbors:  This doesn't end the issue. Epidemiologists will spend decades studying this subject, and in any case there are complicated ethical choices involved. Swedish children didn't suffer an interrupted education on the scale of their counterparts in many countries, and this may have great positive results in years to come. But only six months ago, many sensible people sincerely believed that Sweden had done something very clever and provided a uniquely positive model for the rest of the world. I think we can now say with some certainty that that was wrong. Survival TipsAll this talk of Europe brings to mind that great pan-continental institution, the Eurovision Song Contest. For non-Europeans, this has become an annual festival of camp that is ever more difficult to take seriously. But there is something about the sheer awfulness of the songs that makes it great. As there are many languages spoken across the continent, winning songs often tend to have very simple lyrics. Winners include La La La, Boom Bang-a-Bang, Dinge Dinge Dong, A-Ba-Ni-Bi and Diggi-Lou Diggi-Ley. I challenge you to listen to them all. I just did. And there is always an exception that proves the rule. Abba, the pride of Sweden, enjoyed their big break by winning Eurovision with Waterloo. It still sounds good — although the sexist commentary from the announcer who introduced them back in 1974 hasn't aged so well. And for another great example of European televisual cooperation try the 1970s gameshow Jeux Sans Frontieres, in which teams from towns across the continent would compete in fancy dress. It defies further description, but I dug up an entire episode, which I recommend. The whole thing was so bizarre it inspired Peter Gabriel's masterpiece Games Without Frontiers. It even has Kate Bush on backing vocals, singing "jeux sans frontieres"; I'd go so far as to say that it's better than Dinge Dinge Dong. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment