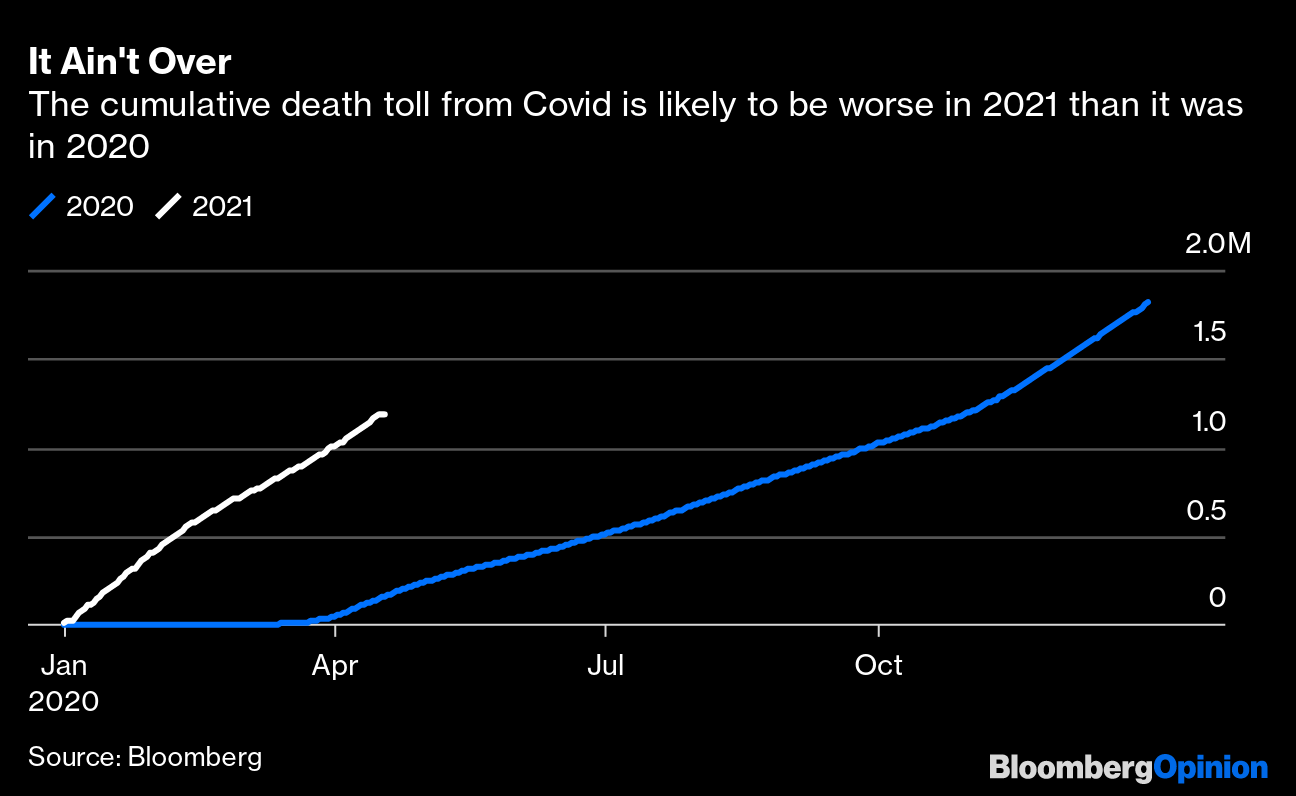

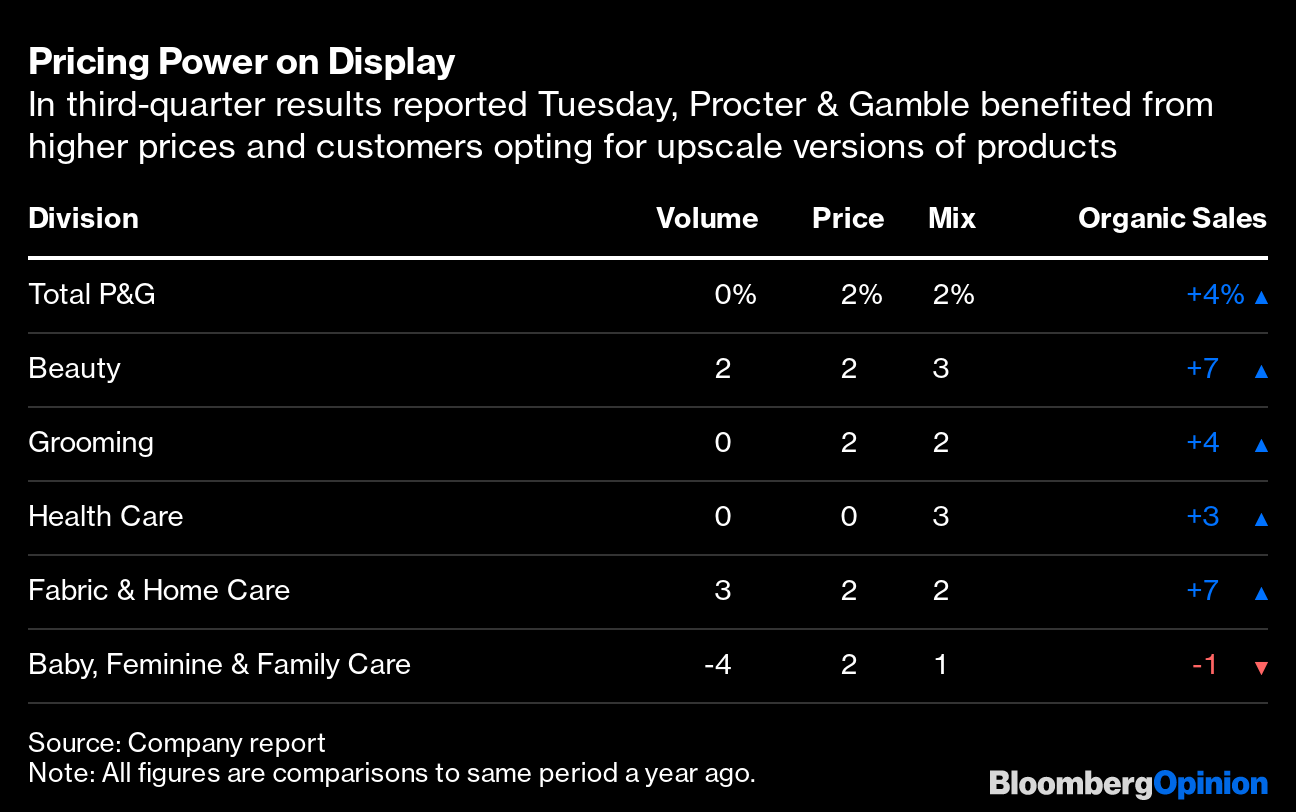

| This is Bloomberg Opinion Today, a $100 million New Jersey deli of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Ebenezer Scrooge would appreciate this deli. Photographer: Scott Gries/Getty Images North America Bull Markets in Delis and RailroadsOK, we get it, people: You came here to chew bubble gum and invest comically large amounts of money, and you're all out of bubble gum. You're already diamond-handsing GameStop and Dogecoin. So what's next? How about a $100 million deli in Middle of Nowhere, New Jersey? Or actually, as Matt Levine points out, the deli in Paulsboro (pop. 6,097) worth $2 billion because of warrants and math and a butterfly flapped its wings in Nutley or something. As Matt mentioned yesterday, the main reason people are buying this deli now is for the fun of annoying David Einhorn. For the most part the $100 Million Deli isn't a result of easy Fed cash gone wild so much as it is a depressingly familiar example of the shenanigans people get up to in the wilderness of the pink sheets, writes Barry Ritholtz. Long, long ago, in 2015, when Eru Illuvatar had just spoken the world into existence, there was a $100 million grilled-cheese truck. It made very good grilled cheese, legend tells, and probably moved more sandwiches than the Paulsboro deli. But it still had no business being worth $100 million. What did it have in common with the $100 million deli? It too traded on the pink sheets. If you must blow your Fed cash/Dogecoin billions on something novel before the rest of the WallStreetBets crowd catches on, there's still time to get in on the bidding war for Kansas City Southern. This is not an NFT or a New Jersey deli but an actual, real-life railroad. A couple of Canadian firms are fighting over it, hoping to build an empire stretching across North America. The bidding today reached $33.7 billion. You get one guess as to whether or not this is a reasonable amount of money, and the only choice is "no." As Brooke Sutherland describes it, such numbers are based on "notoriously squishy revenue benefits" and "emotion and egos." Sounds perfect! Further Ludicrous-Valuation Reading: Crypto billionaires will do philanthropy differently than old-school billionaires. — Tyler Cowen Jair Bolsonaro Is Up to SomethingIt wasn't as if Brazil didn't have enough crises already. Covid-19 is out of control, killing thousands daily. The economy is in shambles. But President Jair Bolsonaro is brewing up a third crisis that's at least equally alarming, Bloomberg's editorial board warns. As his popularity has crumbled along with his country's fortunes, he has grown increasingly coup-curious (couprious?). He's even warning of a Jan. 6-style insurrection if he doesn't win the next election. The country's best hope is for its fractured centrists to pick a champion to fend off both Bolsonaro and his far-left populist rival, former president Luiz Inácio Lula da Silva. What Biden Owes to Trump We tend to think of the divides between epochal presidents and their predecessors as yawning. If you ask most people "What's the opposite of Franklin Roosevelt?" they'll probably say "Herbert Hoover." The opposite of Ronald Reagan is Jimmy Carter. The opposite of Lincoln is … oh, pick from about 10 nightmarish presidents that preceded him. But, as with everything in life, it's not that simple, Noah Smith writes. FDR's government activism was first taken for a spin by Hoover. Reagan's deregulation was kicked off by Carter. President Joe Biden may not be an epochal president — it hasn't even been 100 days yet! But if he gets his way on infrastructure spending, industrial policy and the like, he could start to get that new-epoch smell about him. And he will get the credit for it. But Noah points out Trump's break with GOP orthodoxy on free trade and government largesse foamed the runway to make Biden's plans much easier to pass. He'll probably be fine with not getting any credit for it. Further Bidenomics Reading: Corporate taxes are going up, but stocks don't reflect that yet. — John Authers Telltale ChartsThe pandemic was a nightmare for the developed world in 2020. It will be far worse for the developing world this year, writes David Fickling.  Procter & Gamble has been quietly raising prices on household staples, with implications for the whole retail industry, writes Sarah Halzack.  Further ReadingBillionaire soccer owners trying to de-risk via a Super League only hurt their clubs by alienating the sport and fans. — Chris Hughes Our decision not to help the rental car industry last year means consumers face exorbitant rates now. — Conor Sen The racist "Anglo-Saxon political tradition" myth has deeper, wronger roots than the "America First" crowd realizes. — Noah Feldman Barclays learned the hard way that even underwriting a private prison deal is bad for its rep. It should have known better. — Brian Chappatta The euro's digital currency would protect users' privacy, a huge draw for consumers. — Andy Mukherjee RIP to Walter Mondale, one of the last of his kind. — Jonathan Bernstein ICYMIA Minnesota jury found Derek Chauvin guilty of murdering George Floyd. Democrats are fighting about the SALT cap. Chelsea and Manchester City dropped out of the Super League. KickersHester Ford, once America's oldest person, has died, leaving 120 great-great-grandchildren. (h/t Ellen Kominers) FINALLY, scientists solve the "Brazil nut" puzzle. (h/t Mike Smedley) Prank your friends into thinking they have Windows XP. How to make 1,300-year-old cookies. Notes: Please send ancient cookies and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment