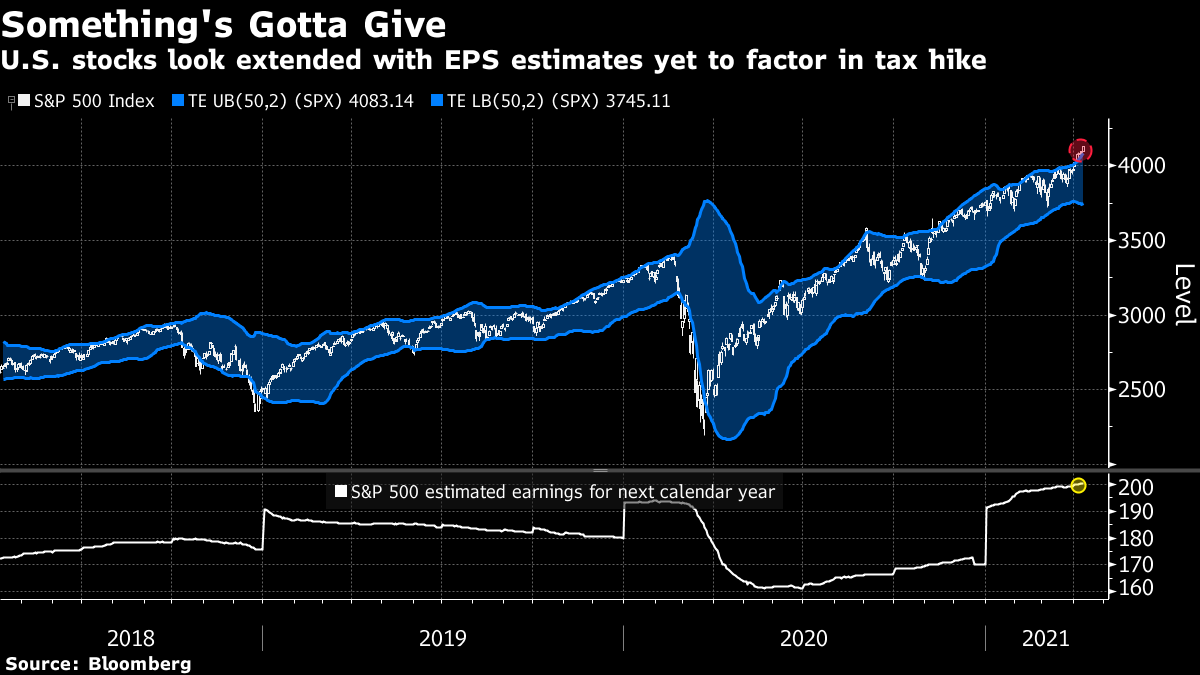

| China hits Alibaba with a record $2.8 billion fine. Blinken warns Beijing against encroaching on Taiwan. Inside Singapore's unusually shaky leadership transition. Here's what people in markets are talking about today. U.S. Secretary of State Antony Blinken warned China against encroaching on Taiwan. "It would be a serious mistake for anyone to try to change the existing status quo by force," Blinken said on Sunday, adding that he wouldn't speculate about possible U.S. responses. He also said China's secrecy had helped to hasten the spread of Covid-19. Turning to Russia, Blinken said troops deployed at the border with Ukraine are at the highest level since the country's invasion of eastern Ukraine in 2014, and that he had been in contact with European allies over the matter. Separately, the Biden administration is stepping up scrutiny of China's plans for a digital yuan. China slapped a record $2.8 billion fine on Alibaba Group after an anti-monopoly probe found it abused its market dominance, as Beijing clamps down on its internet giants. The company must initiate "comprehensive rectifications," from protecting merchants and customers to strengthening internal controls, China's antitrust watchdog said on Saturday. Then Alibaba did an unusual thing: It thanked regulators, a move it's hard to imagine Mark Zuckerberg or Tim Cook making if Facebook or Apple had faced a 10-figure fine. Read on for more about the many ways China's tech crackdown is out of the ordinary. Asian stocks look poised for a steady start Monday after a third straight weekly Wall Street advance, with Federal Reserve Chair Jerome Powell flagging the prospect of stronger growth and hiring. Futures in Japan and Hong Kong were in the green and Australian contracts climbed. The dollar was steady. Key events to watch this week include U.S. banks and financial firms reporting first-quarter earnings, Chinese trade data on Wednesday and Chinese economic growth figures on Friday. Meanwhile, the allure of Asian stocks is fading after beating global peers last year. Grab Holdings and Traveloka are poised to become public companies in coming months, kickstarting a coming-out party for Southeast Asia's long-overlooked internet scene. Grab will this week unveil a listing via a U.S. special purpose acquisition company, that values the ride-hailing giant at more than $34 billion, people familiar with the matter said. Indonesia's Traveloka will follow suit, listing at a valuation of about $5 billion via a SPAC, sources said. Terms on both deals could still change. The mega deals will front a chain of initial public offerings from the region's most valuable startups from 2021. Singapore's ruling party won 89% of seats in last year's election. What would be a fantastic outcome in most places was the worst parliamentary performance ever for the People's Action Party, which has been in power since the country's independence in 1965, one of the longest uninterrupted stretches for any party around the world. Afterward, some insiders privately expressed concerns to other ministers about Heng Swee Keat, heir apparent to Prime Minister Lee Hsien Loong. Heng shocked Singaporeans last week with the news that he was bowing out of contention. Here's an inside look at the city-state's unusually shaky leadership transition. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in todayIt's getting harder and harder to justify the current valuations of U.S. stocks and that's because of — not in spite of — a turbocharged American economy. While the $4.1 trillion in recent stimulus will inevitably fuel a historic rebound in the economy, the stock market is different. It has discounted the benefits but hasn't taken into account three side effects that could weigh on the earnings underpinning its record: higher taxes, rising input costs and increased financing expenses. Goldman Sachs calculated last month the taxes planned to fund the stimulus, if fully implemented, could cut earnings by as much as 9% in 2022.  Yet so far analysts have been loath to bring down forecasts, with S&P 500 estimates for 2022 sitting at their highest this year. Companies are already seeing higher input costs and March data from IHS Markit suggested pressure on margins is developing. The S&P 500 trades on 20.6 times next year's earnings, a figure rarely seen since the internet bubble. For those who argue we are in a new age of valuations, the average equivalent multiple since 1998 is 15.5 times. That was the year the Fed stepped in to manage LTCM's collapse, to many the beginning of the central bank backstop era. To arguments there's no alternative to U.S. stocks — the MSCI World ex-U.S. Index is on just over 15 times next year's estimates. On technicals too, the rally looks extended: The S&P is more than two standard deviations above its 50-day moving average. Yes, the U.S. economy is growing at its fastest since 1984 and that should counteract some of the pressures mentioned above. But there's a strong case to be made that U.S. stocks just don't look appealing at current levels. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment