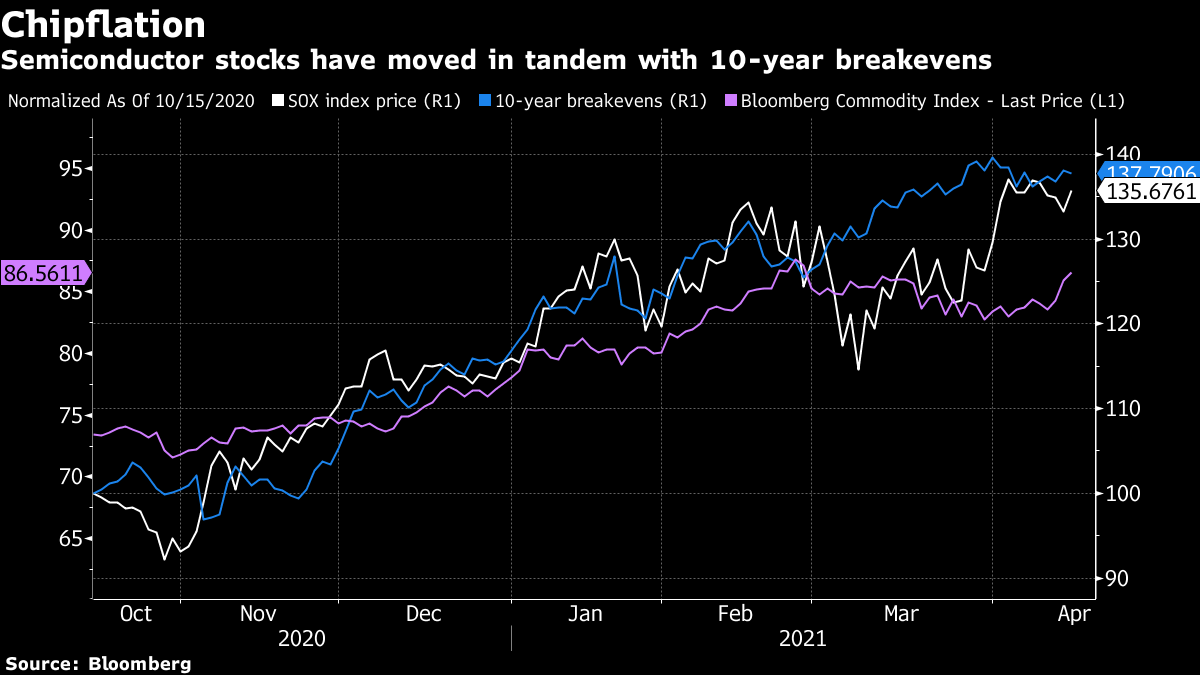

| Bitcoin tumbles the most since February. The historic oil glut that amassed during the pandemic is almost gone. If you've had Covid-19, you may only need one vaccine dose. Here's what you need to know to start your day. The mania that drove crypto assets to records turned on itself over the weekend, sending Bitcoin tumbling the most since February. The world's biggest cryptocurrency plunged as much as 15% just days after reaching a record. Ether, the second-biggest, dropped as much as 18%, and Binance Coin, XRP and Cardano each lost more than 12%. Dogecoin, the token started as a joke, was the only gainer among the 10 largest coins. The weekend carnage came after the direct listing of Coinbase Global, the largest U.S. crypto exchange. Elsewhere in crypto: China's digital yuan is not intended to replace the dollar, a central bank official said Sunday. Stocks are set to kick off the week at record highs, with investors focusing on the economic recovery despite mounting concerns about new Covid-19 variants. Futures pointed higher in Japan and Australia after U.S. stocks ended the week at all-time peaks, with the S&P 500 Index capping its fourth straight weekly advance. After two weeks of relentless losses, China Huarong Asset Management bonds rallied after China's financial regulator said the bad-debt manager had ample liquidity. If you've had Covid-19, you may only need one of the two vaccine doses recommended by Pfizer and Moderna, according to a new study. It's a striking finding at a time when global supplies are under strain. Over the weekend the virus death toll climbed past 3 million. Elsewhere, CanSino Biologics says it is monitoring its shot more carefully after cases of blood clots forced other suppliers to suspend inoculations, while Hong Kong will ban flights from India, Pakistan and the Philippines for 14 days starting April 20, after the city reported the first two virus variant cases in the community. It's another indication that a rebound in air traffic will take time. Here's how we're tracking the world's return to the skies, and this is the effect the virus is likely to have on the global economy, even after the recovery. The Biden administration's goal of focusing resources on China and the Covid-19 pandemic meshes with withdrawing troops from Afghanistan, U.S. Secretary of State Antony Blinken said. "The terrorism threat has moved to other places," Blinken said in a TV interview on Sunday. "And we have other very important items on our agenda, including the relationship with China, including dealing with everything from climate change to Covid. And that's where we have to focus our energy and resources." The U.S. and China are committed to cooperating to tackle climate change, they said in a joint statement after meetings last week. The unprecedented oil inventory glut that amassed during the pandemic is almost gone. That's keeping crude prices near $67 a barrel, a boon for producers but an increasing concern for motorists and governments wary of inflation. The re-balancing comes as OPEC and its allies keep vast swathes of production off-line and a tentative economic recovery rekindles global fuel demand. Barely a fifth of the surplus remained as of February, according to the International Energy Agency. "What's left of the surplus is almost entirely concentrated in China," said Ed Morse, Citigroup's head of commodities research. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne concept that's soon to join inflation as something everyone is talking about is pricing power. This is the degree to which companies can actually pass on higher input costs to their customers (thereby preserving their profits), and will basically dictate whether the higher prices we're already seeing for basic materials and components actually translate into broader inflation. But pricing power isn't evenly distributed across companies or industries, and figuring out how much of the recent jump in base costs will be passed on is tougher than it looks. There is arguably already a significant amount of pricing power in semiconductors, where a shortage in supply means producers like TSMC and Samsung can charge more for their wares. If you've listened to our Odd Lots series on the topic then you'll know that chips really do power the global economy, so it's worth looking at what they are telling us about inflation right now.  The chart above shows the Philadelphia Stock Exchange Semiconductor Index basically moving in tandem with the market's inflation expectations in recent months. If you think about semiconductors as a commodity —they're a vital building block for so many modern goods — then that trend makes some sense. Demand has far outstripped supply, and semiconductor companies have the ability to charge more. Not every industry or company is going to be able to do the same thing, and most companies will be reluctant to be the first to fire the shot on higher prices. Still, semiconductors are make a good example of pricing power in action. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment