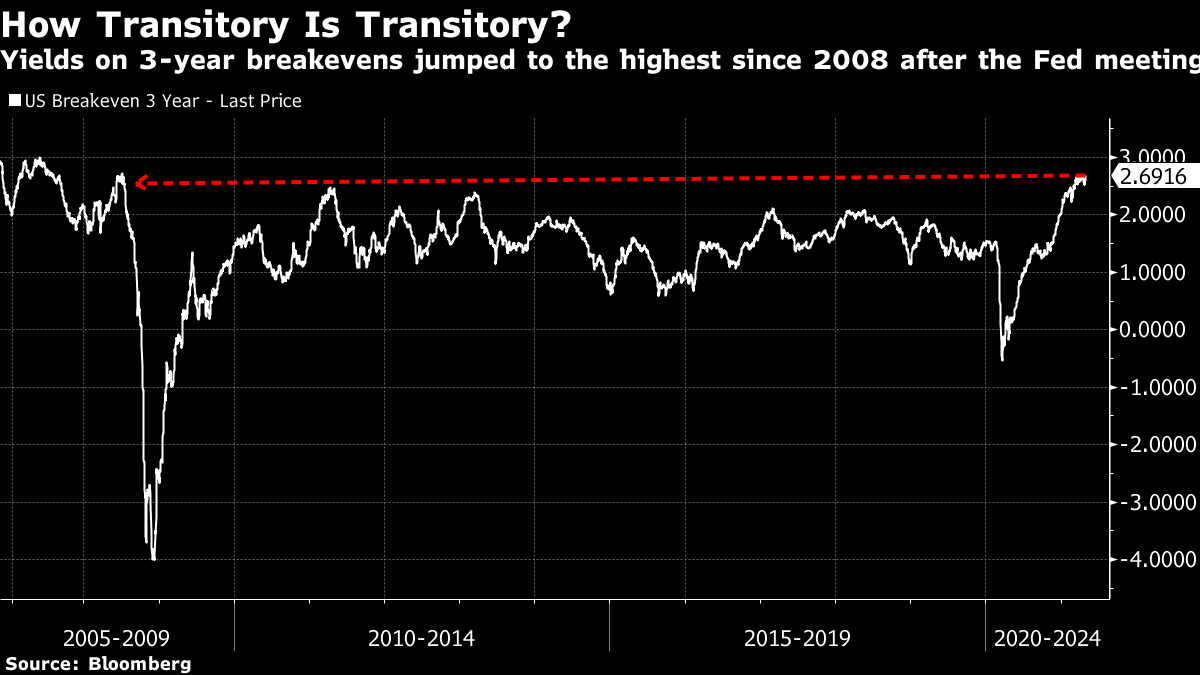

| The Fed upgrades its view of the U.S. economy. Hong Kong passes a tax concession bill to protect its edge as a finance hub. Bitcoin may be facing a make-or-break moment. Here's what you need to know to start your day. Federal Reserve Chair Jerome Powell and his colleagues upgraded their assessment of the U.S. economy but said they were not yet ready to consider scaling back pandemic support. "Indicators of economic activity and employment have strengthened," the Federal Open Market Committee said in a statement Wednesday after holding its key interest rate near zero and maintaining a $120 billion monthly pace of asset purchases. Growing optimism for the U.S. recovery has been helped by widening vaccinations and aggressive monetary and fiscal support. President Joe Biden will unveil on Wednesday a sweeping $1.8 trillion plan to expand educational opportunities and child care, hot on the heels of a $1.9 trillion pandemic relief plan and a proposed $2.25 trillion infrastructure plan. Asia stocks look set to climb at the open after the Federal Reserve's assessment of the U.S. economy. The dollar retreated with bond yields. Futures pointed higher in Australia and Hong Kong, while Japan is closed for a holiday. All U.S. stock benchmarks ended lower, with the S&P 500 Index failing to hold gains on Jerome Powell's assertion that asset purchases aren't about to be trimmed. The central bank's reiteration that inflation pressures are likely "transitory" helped Treasuries rally. An exchange-traded fund tracking the Nasdaq 100 Index jumped in late trading after Apple crushed Wall Street revenue estimates and Facebook reported gains in sales and users. Alphabet rose to a record after its results showed a surge in ad sales, while Microsoft dropped after undershooting the blockbuster figures some analysts had anticipated. New global coronavirus cases rose for the ninth consecutive week, by a record 5.7 million, as a 52% surge in India outweighed declines in most regions, the World Health Organization said. "It's like a war," said Sanoj Chacko, a manager in the nurse unit at Moolchand Hospital in central Delhi. On Wednesday morning, the city had just 13 intensive care beds available in a city of more than 16 million people. In Europe, moves to restart travel are gathering pace. In Japan, athletes at this summer's Tokyo Olympic Games will be required to take daily coronavirus tests. Meanwhile, as Deutsche Bank considers one of the most flexible return-to-office policies among large international banks, here's a look at the post-Covid world of work. Bitcoin is facing a make-or-break moment following a recent bout of selling, according to technical analysis. Though the cryptocurrency has rebounded above its average price over the past 100 days, it's still trading below its 50-day moving average (about $57,042). Such a dynamic typically indicates an asset is nearing an inflection point. Trading in the world's largest digital asset has been choppy in recent days, although positive news, including comments from Tesla's chief financial officer, have helped support the price. Columnist Matt Levine has some thoughts on Tesla's relationship to Bitcoin. Meanwhile, Dogecoin has shot up in price thanks to memes, hopes for a big score... and not much else. Hong Kong has passed a tax concession bill designed to preserve its edge as a financial center in a race against Singapore and Shanghai. The bill grants tax concessions for carried interest distributed by private equity funds operating in the city, and also applies to related remuneration paid to employees of such firms. On Wednesday the government also passed a new immigration bill that has raised concerns among some sections of society that it could be used to prevent dissidents from leaving the city. The newly passed bill, which takes effect on August 1, will expedite the process of handling refugees and gives the city's immigration director power to prevent any passengers or crew members from boarding a flight. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayJon Turek, the author of the Cheap Convexity blog, wrote in late 2020 that the Federal Reserve was at an interesting juncture. "The middle of next year is setting up as a 'cage match' between the Fed's new reaction function and the upside risk of a faster than expected cyclical normalization," he wrote. Here we are four months later, and after Wednesday's Fed meeting it's clear that the reaction function is winning. As a reminder, that new reaction function is one in which the Fed is much more willing to overshoot on inflation in the pursuit of its dual mandate, with board member Lael Brainard describing the shift in policy last year as moving from "stabilization to accommodation." When it comes to the other side of the dual mandate (unemployment), things have changed there too. The focus no longer seems to be on a single measure like the natural rate of unemployment, but a move towards a "broad and inclusive" labor market.  In other words, the changes to the reaction function are bigger than many may have expected, resulting in a Fed that can withstand inflation pressures for much longer and one that requires a heavyweight version of full employment in order to shift it from its current accommodative stance. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment