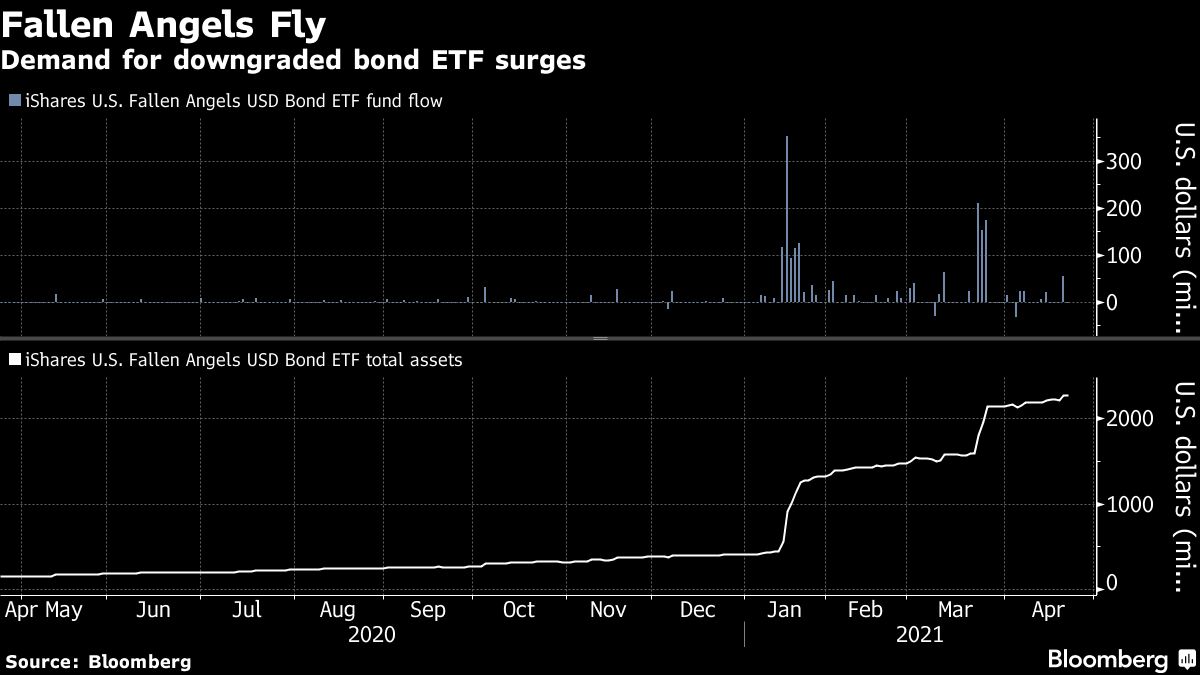

| Biden goes big on tax, Bitcoin plunges, and it's PMI day. Doubling President Joe Biden plans to propose raising the capital gains tax rate for the highest earners to 39.6%, rising to 43.4% when Obamacare surtaxes are included. Biden, following through on a campaign promise to tax the wealthy more, is betting the policy will be popular enough to win passage through Congress. While stocks slumped on the Bloomberg News report yesterday, Wall Street is reacting relatively calmly to the plan, with many pointing to the likelihood of long negotiations. UBS Group AG warned of a 7% hit to stock valuations as a higher rate dulls sentiment. Bitcoin A fresh bout of selling this morning drove Bitcoin down almost 8% to $47,525 as the largest cryptocurrency heads for its worst week in more than a year. Fears of higher capital gains taxes have only added to the volatility in the currency. Bitcoin is not alone in suffering a selloff, with both the second biggest digital coin, Ether, and joke coin Dogecoin tumbling this morning. Growth There has been a positive note in much of the Purchasing Managers Index data published today. Japan's manufacturing activity expanded for the third month in a row ahead of much of the country entering a state of emergency. The euro area saw its recovery gain ground with services returned to growth in April and manufacturing expanding at a record pace. PMI data for the U.K. showed the economy growing at the fastest in seven years. Manufacturing and services PMI numbers for the U.S. are at 9:45 a.m. Markets mixedHigher taxes, continued fears about the Covid situation and earnings are in focus for global equity markets. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 0.4% lower. In Europe the Stoxx 600 Index was 0.3% lower at 5:50 a.m. with the gauge set for its first weekly decline in eight weeks. S&P 500 futures pointed to small bounce at the open, the 10-year Treasury yield was at 1.551%, oil was flat and gold rose. Coming up... U.S. new home sales data for March is at 10:00 a.m. ECB President Christine Lagarde and Treasury Secretary Janet Yellen speak at 10:30 a.m. Biden's climate summit continues. The Baker Hughes rig count is at 1:00 p.m. Honeywell International Inc., Schlumberger NV, and American Express Co. are among the companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningSo from inflated asset prices, to junk. Is the credit cycle dead? Lisa Abramowicz observed in her column this week: "Almost all fear of bankruptcy has been obliterated from debt markets even though the global economy is still struggling under the worst health crisis in a century." We've written before about how high yield spreads have fallen to their lowest point since the leadup to the 2008 financial crisis. More than $12 trillion of stimulus certainly appears to have heavily sedated the market for now. Whether or not that wave will simply lead to a steeper crash further down the track is yet to be seen. After all, as the recent debacles of Greensill, Archegos and Huarong remind us, firms can implode in the most benign possible conditions. (Bronte Capital's John Hempton has a lot to say about this on the latest OddLots podcast.)  But clearly the shakier credits in the spectrum are far better off than most people would have thought only a few months ago. Just look at the Lazarus of the car-rental set, Hertz Global, which has emerged from almost a year in bankruptcy with its bonds trading well above par. Bloomberg Opinion's Brian Chappatta wrote this week that an investor in Hertz's 2022 and 2028 bonds at the lows has by now earned a return of roughly 1,000%. And ratings companies are adjusting their rose-colored spectacles accordingly. Fitch Ratings now says high-yield corporate bond defaults could amount to just 1% this year, the lowest rate since 2013, our credit reporter Caleb Mutua notes. S&P Global Ratings also sees defaults declining, contradicting some bleak predictions from the depths of the pandemic last year. (Moody's Investors Service expects defaults to fall to 4.2% over the next year, from an actual rate of 7.5% for the 12 months through March.) These riskier balance sheets don't seem to be losing their taste for leverage. Junk-rated U.S. companies set a record on Thursday for the most bonds ever sold in April, at close to $40 billion, Alex Wittenberg reports. This is the third straight banner month, and it's taken this year's volume to nearly $190 billion. That's 44% of the full-year total for 2020 -- which was the biggest year ever for junk issuance. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment