| Reassessing the reopening, tech companies in Congress, and a Bitcoin warning. Resurgence Financial markets in Asia are taking the brunt of a risk reassessment by investors as Covid-19 cases surge in the region. India reported a record of more than 2,000 deaths on Wednesday and Japan is moving towards declaring a state of emergency. While investors expect markets with high vaccination rates to avoid the worst of the setback, the global reflation trade has certainly paused for now. Corporate Apple Inc. and Alphabet Inc.'s Google will face the Senate Judiciary Committee's antitrust subcommittee today, with lawmakers concerned over the way both companies run their app stores. Another tech giant, Amazon.com Inc., is becoming a headache for efforts to reach a global tax accord as the company would likely escape the new rules as its margins are too small. Netflix Inc.'s shares dropped after the company reported its worst quarter in eight years. Weakness Strategists at JPMorgan Chase & Co. are warning that if Bitcoin doesn't make a break back above $60,000 soon, momentum signals for the digital asset will collapse. The largest cryptocurrency is trading close to $55,000 this morning, still not having made a full recovery from Sunday's plunge. Despite the move lower in recent days, and competition for attention from meme coins, Bitcoin is up 90% year to date, and more than 700% from a year ago. Markets mixedHeightened fears about a slowdown in the recovery were allayed somewhat by strong corporate earnings. Overnight the MSCI Asia Pacific Index dropped 1.4% while Japan's Topix index closed 2% lower. In Europe, those corporate results helped keep the Stoxx 600 Index 0.3% higher by 5:50 a.m. Eastern Time. S&P 500 futures were little changed, the 10-year Treasury yield was at 1.573%, oil was lower and gold was flat. Coming up... The Bank of Canada is expected to announce it's paring back asset purchases when the latest decision is published at 10:00 a.m. Governor Tiff Macklem speaks at 11:00 a.m. Crude oil inventory data is at 10:30 a.m. The U.S. sells $24 billion of 20-year bonds at 1:00 p.m. Verizon Communications Inc., Las Vegas Sands Corp., Chipotle Mexican Grill Inc. and Baker Hughes Co. are among the many companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningDogecoin is an awkward embarrassment to the crypto industry, so if you say anything at all positive about it, its critics respond fast. However, the two most common attacks on it are surprisingly weak.

The first is that unlike with Bitcoin, which has a had cap of 21 million coins, Dogecoin's issuance is unlimited. This sounds bad, but it's completely irrelevant and misleading. It's true that new coins are scheduled to be issued in perpetuity, but what matters is that the number of coins is finite right now and that its schedule of new coin issuance is known and predictable. And ultimately, as a percentage of total Dogecoins in existence, the creation of new coins will continue to trend downwards. (10,000 are created with each block.) So this is a total red herring. In fact, Dogecoin's so-called "monetary policy" may be better than Bitcoin's. The way it works with Proof Of Work coins like these is that miners secure the network and process transactions, and the miners make money by transaction fees and a reward of new coins for each block they mine (the block reward). But at some point, all 21 million Bitcoin will be mined, and then there is the question of whether the transaction processing fees will be enough to sustain miner activity and keep the network secure. Most Bitcoiners aren't worried about it. But there are numerous articles on the topic of what happens to network security once the block reward is gone, showing it is a source of some consternation. With Dogecoin, the reward for mining a new block will be here forever, so there is an argument that moderate perpetual issuance is in fact a superior system for maintaining hash power, and therefore network security.

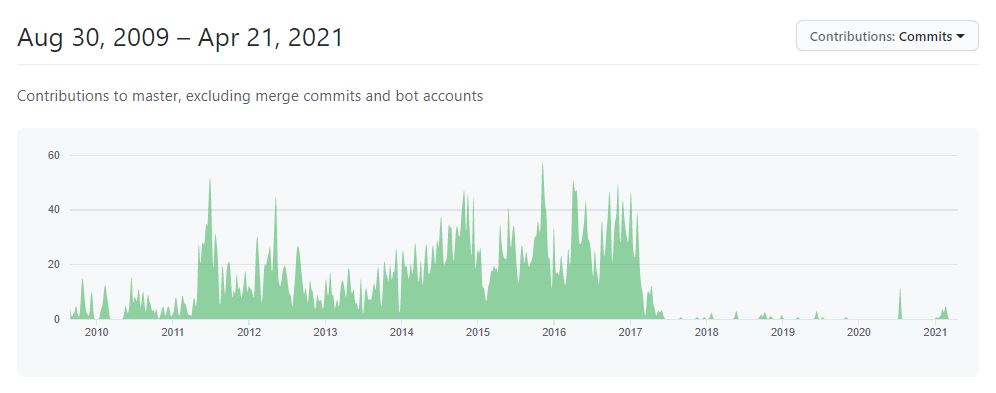

The other big criticism from Bitcoiners is that there's no real developer activity working on Dogecoin. This is true. If you look at Dogecoin's GitHub repository, you can see that there's basically been no new contributions to the code since 2017.  But while the page is largely inactive, this is a weird criticism coming from Bitcoiners. The thing is, digital currencies are supposed to be money not products or software. Yes, in the world of tech, of course you're always supposed to be iterating all the time and evolving and competing. But in the world of money, what you want is stability and predictability and, frankly, a conservative attitude towards change. Any innovation with respect to money needs to be very carefully considered, which is not the case with, say, a mobile app, where if you do something and it's not great, you can just roll back to a prior version, or fix it in the next update. That kind of mentality of always developing is antithetical to any would-be store of value and money that's going to stand the test of time. So hardly anyone contributes to Dogecoin. So what? It already works fine as advertised! I can send Dogecoin to someone else, the transaction goes through, and then we all laugh about it. Done. What more needs to be developed? Of course there are important ways Dogecoin is still inferior. It has less miner activity so its less secure. And it's probably more centralized, with fewer people running their own nodes or holding Dogecoins in their own wallets (as opposed to on exchange). So there are good reasons to think it will never be the world's reserve currency. But the knee-jerk attacks fall flat. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment