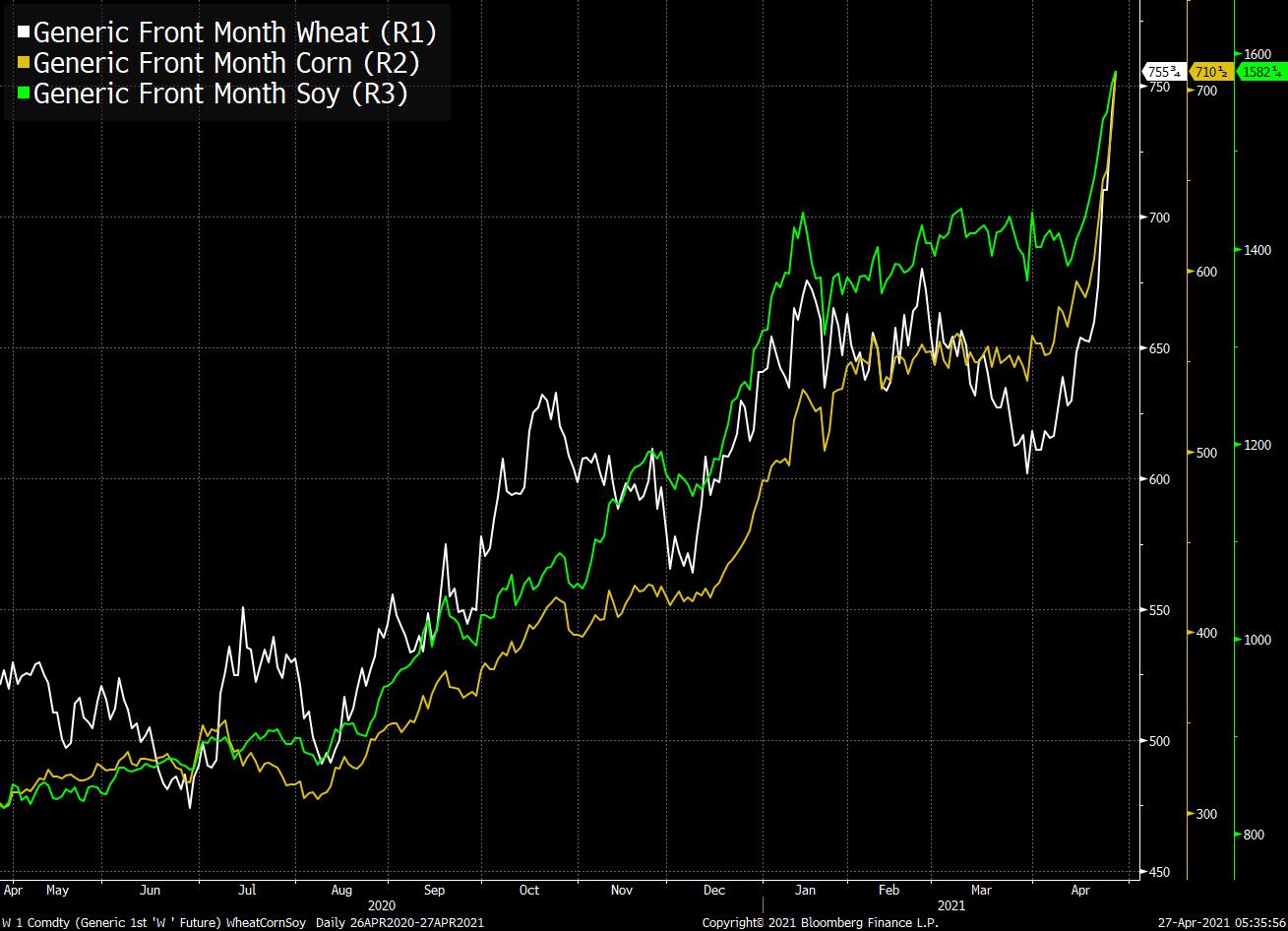

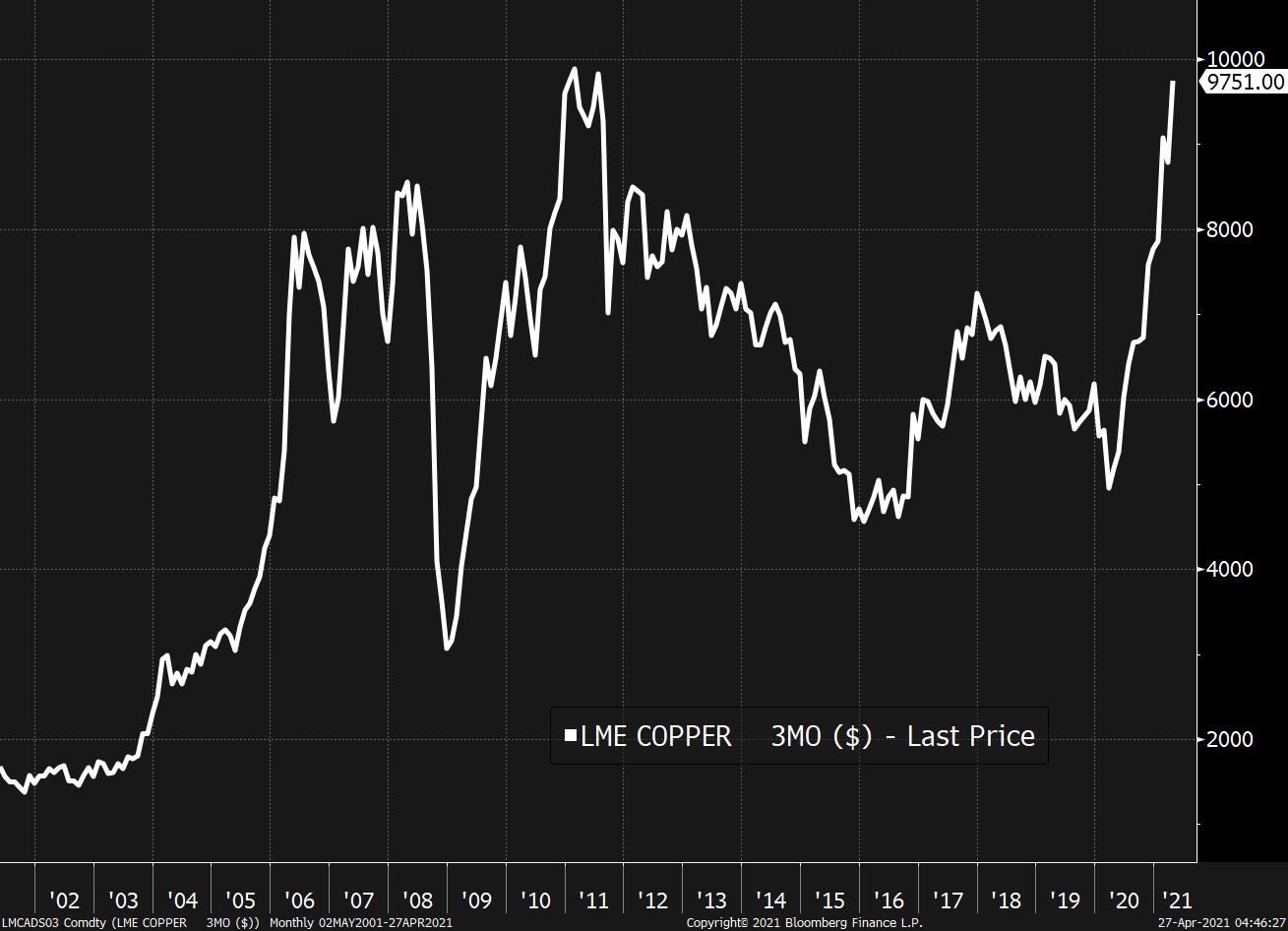

| Earnings meet optimism, tech giants report, and more easing of virus measures. Beating It's another great quarter, guys, with four out of five companies that have reported so far either meeting or beating expectations. The lack of a meaningful response from equity investors may well suggest the market has been harboring hopes for an even stronger performance. Tesla Inc. yesterday showed this when record profit -- even $101 million on Bitcoin holdings -- was met with relative indifference. The stock was more than 3% lower in pre-market trading. EarningsMicrosoft Corp. and Google parent Alphabet Inc. report after the bell today, with the former expected to see solid demand thanks to the IT spending recovery, and the latter benefitting from the strength in digital ad spending, according to Bloomberg Intelligence. In Europe this morning, there was a surprise in UBS Group AG's quarterly report that showed a previously undeclared $861 million loss from the implosion of Archegos Capital Management. Easing There are signs that vaccinated Americans may soon be told they will no longer have to wear masks outside. An announcement could come as soon as today as total vaccinations administered in the U.S. climb past 230 million. Signs are more mixed for the rest of the world, with Europe seeming to have regained control of its recent spike, while things continue to be very bad in India. Investors, on balance, remain bullish about the prospects for a global recovery as can be seen from the price of copper nearing record highs. Markets mixedIt's another day of muted moves on global stock gauges so far, with investors digesting earnings ahead of tomorrow's Fed decision. Overnight the MSCI Asia Pacific Index slipped 0.3% while Japan's Topix index closed 0.8% lower. In Europe the Stoxx 600 Index was down 0.2% with travel companies the notable outperformers. S&P 500 futures were little changed, the 10-year Treasury yield was at 1.579%, oil was higher and gold was flat. Coming up... S&P CoreLogic House Prices and the FHFA House Price Index for February are at 9:00 a.m. U.S. consumer confidence and the Richmond Fed Manufacturing Index for April are at 10:00 a.m. The two-day Federal Reserve meeting begins. Eli Lilly & Co., United Parcel Service Inc., Starbucks Corp., General Electric Co. and Pinterest Inc. are among the many, many companies reporting. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe price of agricultural commodities like wheat, corn and soy have been absolutely soaring lately.  There are a number of factors driving the move, though one contributor is simply the lack of a robust supply response so far to all the demand. Yesterday on TV we spoke with Scott Irwin an agricultural economist at the University of Illinois, who cited surprisingly moderate planting intentions as being a driver of the huge move up in prices since the beginning of April.

Meanwhile, if you haven't noticed, copper is getting close to trading at $10,000 a ton on the London Metals Exchange.  And as Thomas Biesheuvel reported today, companies and investors are still reluctant to expand mining despite the surge, making the types of long-term bets that would bring on more supply. This of course has the effect of making futures markets tighter, pushing up prices all else equal.

Yesterday I wrote about how prices are high on many goods today because of past choices that reduced supply. But it's clear that those choices are still being made right now, whether it's reluctance to invest in new mining capacity, or farmers remaining conservative in their planting decisions. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment