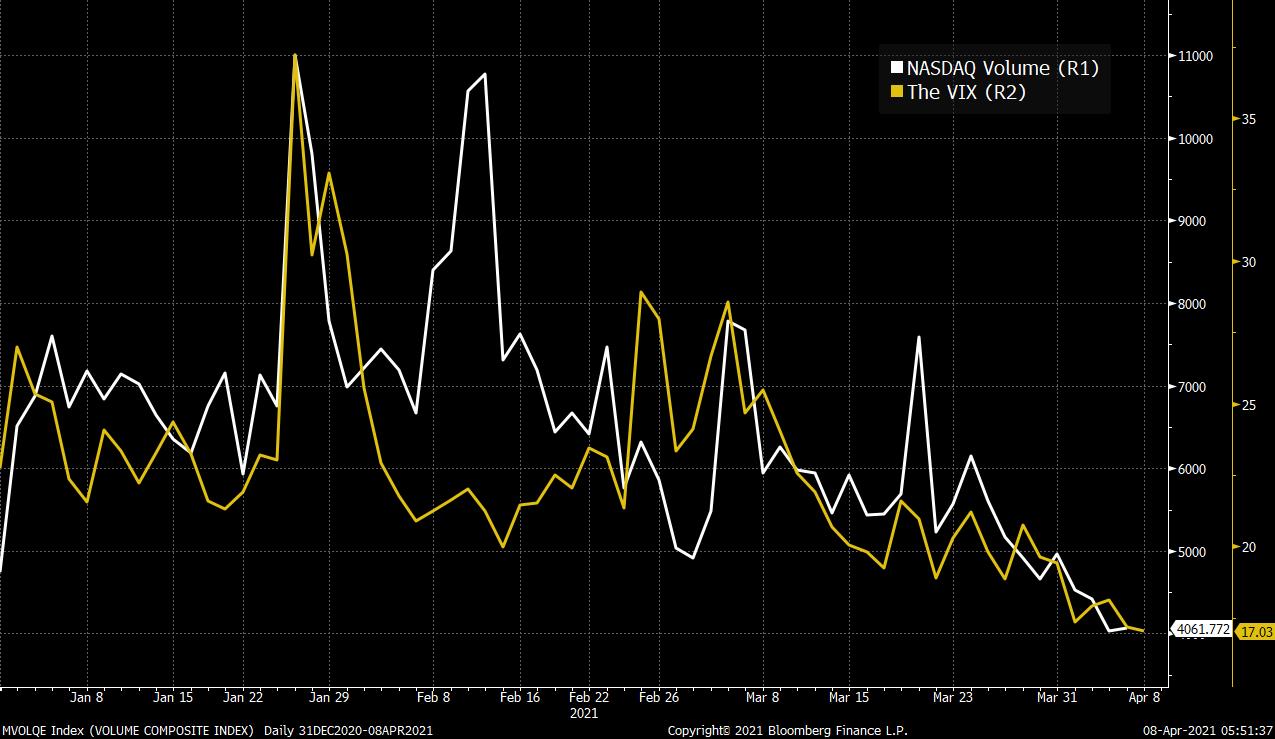

| Economic optimism, tax changes, and more Covid hot spots. DovishFederal Reserve policy makers were united in the view that the U.S. economic recovery was far from complete when they met last month, according to the minutes of the meeting. While recent data has shown a strong improvement in the labor market, the economy remains far from the bank's goal of maximum employment and sustainable 2% inflation. There will be another check on the labor market at 8:30 a.m. this morning when weekly jobless claims numbers are released. Tax man Treasury Secretary Janet Yellen expanded on the tax proposals released last week in President Joe Biden's $2.25 trillion plan. The proposal includes the already telegraphed corporate tax rate hike to 28% and the removal of incentives for companies to shift investments and profits abroad. The Treasury said the latter would add about $700 billion to federal revenue over the next decade. The U.S. is also trying to unblock talks at the Organization for Economic Cooperation and Development over global taxation of digital revenues. The proposal calls for taxing rights to be allocated based on revenue generated within a specific country, and does not target tech companies in particular. Hot spots New infections in India rose to a daily record of more than 126,700 cases, with the country's fight against the virus beset by vaccine shortages. Canada's biggest province, Ontario, declared a state of emergency including a four week stay-at-home order. In the U.S., the U.K. variant is now the most common strain, according to the Centers for Disease Control and Prevention. The number of vaccinations delivered globally passed 700 million in the countries tracked by Bloomberg. Markets mixedThe dovish outlook from the Fed is keeping investor optimism alive amid the regular reminders that the pandemic is far from done. Overnight the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed around 0.8% lower. In Europe the Stoxx 600 Index was 0.3% higher at 5:50 a.m. with energy the biggest laggard as oil remained under pressure. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 1.653% and gold was higher. Coming up... Minutes from the most recent European Central Bank meeting at 7:30 a.m. could be interesting for the bond market looking for clarity on the bank's asset purchase plans. St. Louis Fed President James Bullard and Minneapolis Fed President Neel Kashkari speak later. But the main event today for monetary policy watchers will be Fed Chair Jerome Powell's contribution to a panel on the global economy at the IMF Spring Meeting at 12:00 p.m. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIf it feels like perhaps this week has been a little quiet and more subdued than you've been used to, don't worry, you're not alone. Here's a chart of NASDAQ trading volumes as well as the VIX. Maybe everyone's just taking a break due to nicer weather.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment