| Good morning. Lots of big earnings, a Federal Reserve rate decision, Europe resisting China and a U.S.-Iran scuffle. Here's what's moving markets. Mega Tech EarningsGoogle parent Alphabet reported better-than-anticipated quarterly sales after an increase in digital ad spending by businesses looking to expand during the pandemic reopening. The firm's shares gained as its board also authorized the repurchase of up to $50 billion of stock. Microsoft's revenue jumped too, amid firm demand for cloud services and the strongest gain in personal computer shipments in more than two decades. Some on Wall Street wanted more, though, and the shares slipped. Apple and Facebook report later. Fed AheadIt's a Federal Reserve decision day and while policymakers are likely to acknowledge a continued acceleration in the economic recovery, they will "stop well short" of providing guidance on the conditions which would warrant a tapering of asset purchases, Bloomberg economists write. Still, news on tapering is expected this year. Interest rates are set to remain as they are, for now. Here's a decision day guide. Resisting ChinaThe European Commission is seeking powers to levy fines or block deals by foreign state-owned firms amid the growing economic threat posed by China. The proposed new rules, obtained by Bloomberg, don't mention the Asian nation directly but try to answer complaints from European businesses that China's companies get support they can't match.

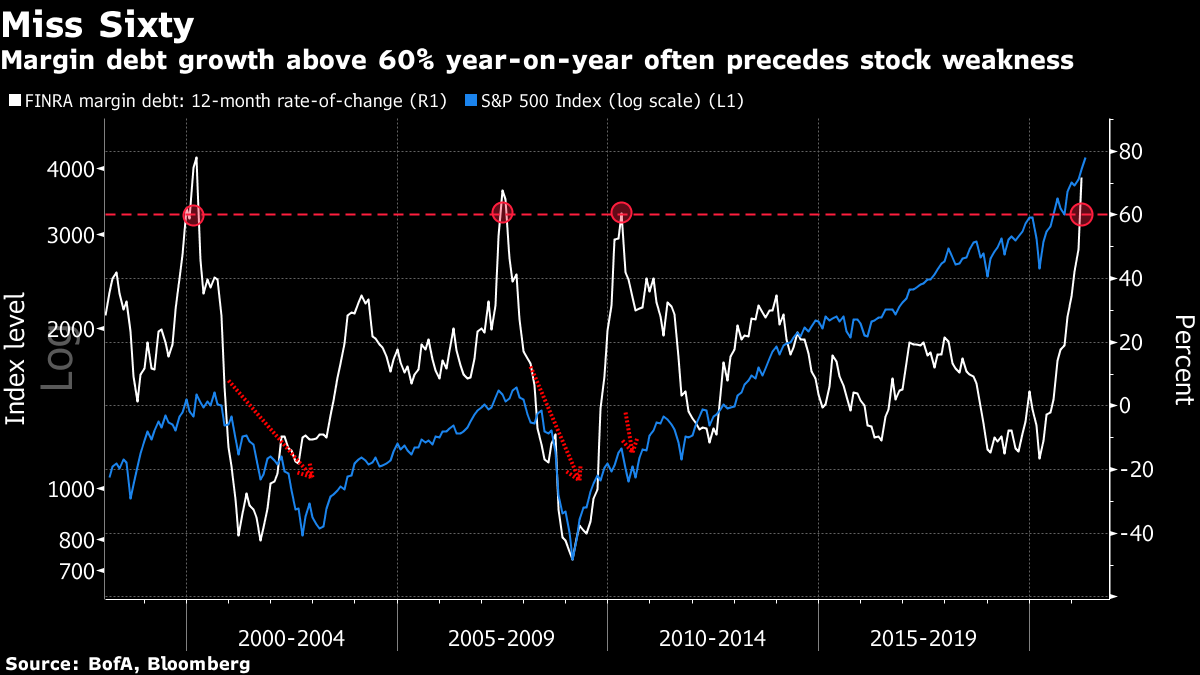

Chinese business groups have already complained about the plans, which will need support from European Union governments to progress. Warning ShotsAn American warship fired warning shots when vessels of Iran's paramilitary Revolutionary Guard came too close to a patrol in the Persian Gulf, the U.S. Navy said Wednesday, according to a Washington Post report. The incident Monday marked the second time the Navy accused the Guard of operating in an "unsafe and unprofessional" manner this month, the report says. It also comes as Iran negotiates with world powers over Tehran and Washington returning to the 2015 nuclear deal. Coming Up…Stock futures were pointing to a higher open in Europe, with lenders Deutsche Bank and Lloyds, lockdown food savior Delivery Hero, beer maker Carlsberg, and drugmakers GlaxoSmithKline and Sanofi all updating on earnings. The latter company is set to help make Moderna's Covid-19 vaccine. Elsewhere, Joe Biden delivers his first address as president to a joint session of Congress - here's what to watch. Finally, oil is steady, with OPEC and its allies set to proceed with plans to gently revive production. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe explosion in margin debt has triggered an alarm bell for the stock market. The pace of growth in the amount of money borrowed to buy shares has hit levels synonymous with periods of equity weakness in the past, according to an analysis by Bank of America. Strategist Stephen Suttmeier noted that the S&P 500 Index tends to struggle after the 12-month rate of change for margin debt peaks above 60% -- it's currently running at 72%. Margin debt hit a record $823 billion at the end of March, according to data compiled by the Financial Industry Regulatory Authority. However the value of stocks has been rising too so at 1.7% of total U.S. market cap, margin debt is actually below a recent peak of 2.2% in 2014, according to data compiled by Bloomberg. That may lead some to dismiss the implications of the borrowing surge. But as the recent Archegos Capital Management blowup showed, margin calls can come out of nowhere and hit hard.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment