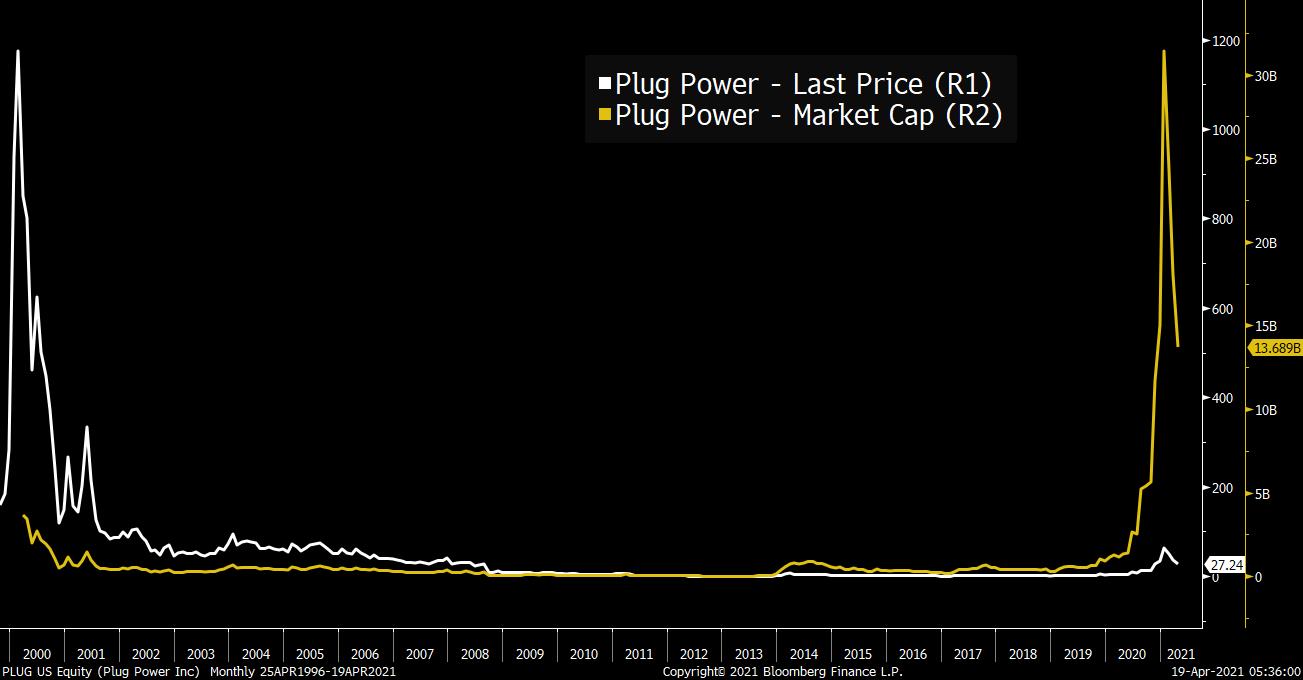

| Record number of virus cases, crypto assets rattled, and a turning point for crude. Uneven The recovery from the global pandemic remains very uneven. In the U.S., the Centers for Disease Control and Prevention yesterday reported that half of American adults have now received at least one vaccine dose. A decision on how to resume use of the Johnson & Johnson is expected by the end of this week. For all the progress in the U.S., the global picture seems to be markedly worsening with a record number of new cases reported in the last week, topping 5.2 million worldwide. Total deaths from the virus passed 3 million, with the burden falling heaviest on lower income countries. Crypto Bitcoin dropped as much as 15% in Sunday trading before paring those losses to trade close to $57,000 this morning. Most other cryptocurrencies were lower, with the exception of joke token Dogecoin which was up another 25% according to pricing on Coinmarketcap. Premarket trading pointed to Coinbase Global Inc. opening close to 4% lower. The moves at the weekend have done little to dampen enthusiasm for the asset class, with fans rejecting fears the sector has peaked. End in sight The unprecedented build-up of oil inventories during Covid-19 lockdowns last year is almost gone. While the amount of stored oil moves close to its five-year average, the outlook still remains uncertain. OPEC and its allies are looking to revive some halted supplies and there are concerns about a surge in U.S. production. There are also worries about the demand outlook, with the worsening Covid situation in India, a key crude importer, keeping a lid on prices today. Markets mixedLast week's stock run to new records is struggling to maintain momentum this morning as investors looked for a fresh catalyst for more gains. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 0.2% lower. In Europe, the Stoxx 600 Index was less than 0.1% higher at 5:50 a.m. Eastern Time. S&P 500 futures pointed to a drop at the open, the 10-year Treasury yield was at 1.561% and gold gained. Coming up... There are chances of a further deterioration in U.S.-Russia relations as the Biden administration warned of "consequences" if opposition leader Alexey Navalny dies. NASA plans to fly its helicopter on Mars this morning. Canada releases its 2020 budget at 4:00 p.m. Coca-Cola Co., Industrial Business Machines Corp. and United Airlines Holdings Inc. are among the many companies reporting results. What we've been readingHere's what caught our eye over the weekend. And finally, here's what Joe's interested in this morningI've been kind of obsessed with fuel-cell stocks for a long time, because I remember them from over 20 years ago during the tech bubble, and how people went crazy for them. But something crazy I hadn't appreciated before is what's happened to Plug Power shares since then. Fund manager and short-seller John Hempton described how they're just a tiny sliver of what they were back in 2000 on the latest episode of Odd Lots, down literally over 95% from their old highs (white line). But the Plug Power market cap (yellow line) is *massively* above what it was back then.  It speaks to the incredible pace of share issuance this company has had over the years that its market cap ballooned while the price has collapsed. Anyway, that was just one fascinating nugget and observation from John. We also talked Greensill, Archegos, Reddit, and a bunch of other things in the market right now. Check it out at the link above, or on iTunes here. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment