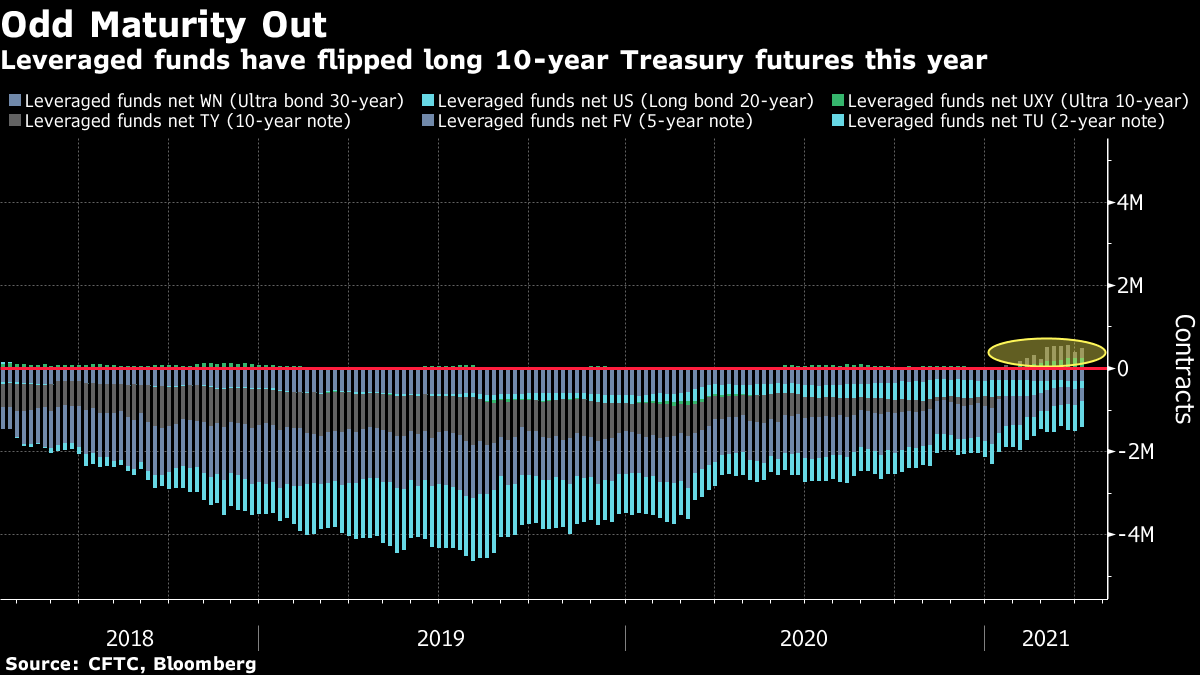

| Good morning. Ominous signals from European case numbers, sanctions on Russia and a lending slump for U.S. banks. Here's what's moving markets. European CasesFrance has passed an ominous milestone as it surpassed 100,000 dead from Covid-19 and the German health care system is being stretched to the brink, with many hospitals overwhelmed and rising case numbers indicating tougher days are to come. In the U.K., where the country is in the process of reopening, senior medics urged caution and said social-distancing rules must be followed given the "dangerous wave" of infections being seen in neighboring countries. In Italy, meanwhile, the country's debt is set to exceed the previous record amassed in the wake of the First World War as the costs of Covid rack up. Russia RelationsRelations between the U.S. and Russia took a turn on Thursday as President Joe Biden's administration imposed a raft of new sanctions in retaliation for alleged misconduct related to efforts to disrupt the U.S. election and the SolarWinds hack. Russia broadly shrugged off the move and, though saying it was ready to retaliate, added it remains open to the White House offer of a summit between Biden and President Vladimir Putin. Biden, for his part, said he wants a "stable, predictable relationship" with Moscow. Lending SlumpThe earnings season for U.S. banks has provided insight into what investors watch most closely. Despite reporting big beats in their investment banks, lenders like Bank of America and Citigroup have left markets worried by the slump in levels of lending. Households flush with savings stashed during the pandemic not only don't need new loans, but are also paying down existing debts. Morgan Stanley will round out the season on Friday. All the lenders are, however, expressing confidence in an economic recovery and the latest data backs that up, with U.S. retail sales soaring and jobless claims easing. Coinbase DebateIt's been a major week for cryptocurrencies and the debate around Coinbase's IPO is set to continue into Friday. Shares in the newly-listed crypto exchange seesawed on Thursday, with its market capitalization some way from the $112 billion it hit on its debut -- dealing a blow to retail investors -- and the market struggling to place a value on the business. Coinbase's boss said its listing marks a shift in legitimacy for the sector and another major hedge fund has said it will start buying cryptocurrencies, the latest sign of digital assets going mainstream. Coming Up…European and U.S. stock-futures are mixed heading into Friday's session, following a mostly flat day for Asian stocks after China's record economic growth failed to inspire new investment in the region's equity markets. Oil is heading for a third weekly gain and iron ore prices are on track for the best week since March. European earnings are relatively quiet, but German carmaker Daimler said overnight that it expects its earnings to beat expectations. In the U.S., the White House will welcome Japanese Prime Minister Yoshihide Suga, the first foreign leader to meet Biden in person since his inauguration in January. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWhen trying to figure out who shot Treasury yields on Thursday, any detective will tell you to look for motive, means and opportunity. The slump in bond yields -- which came despite blowout U.S. economic data -- looks technical, a professional hit as it were. The chief suspects after canvassing the neighborhood seem to be hedge funds or Japanese investors. Hedge funds are net short Treasuries, albeit not to the extremes of recent years, but this at least gives them motive. The fact that 10-year Treasury yields were worst hit muddies the evidence a little bit though, as this is the one maturity where leveraged funds are net long -- seemingly to arbitrage the gap between Treasury futures and cash bonds. Japanese investors have both the means and the motive -- attractive currency-hedged Treasury yields -- and also the opportunity, having just started a new fiscal year. Data Thursday showed they bought the most foreign debt since November in the first full week of April. Investors will soon get a chance to "question" some of them, with Japan's life insurers set to announce annual investment plans next week. Still, the market forensics team is sure to present further evidence in the coming days, which may uncover fresh suspects for the hit on yields. For now though, traders are watching to see if Treasury yields will pull through, and after a quick recovery resume their march higher.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment