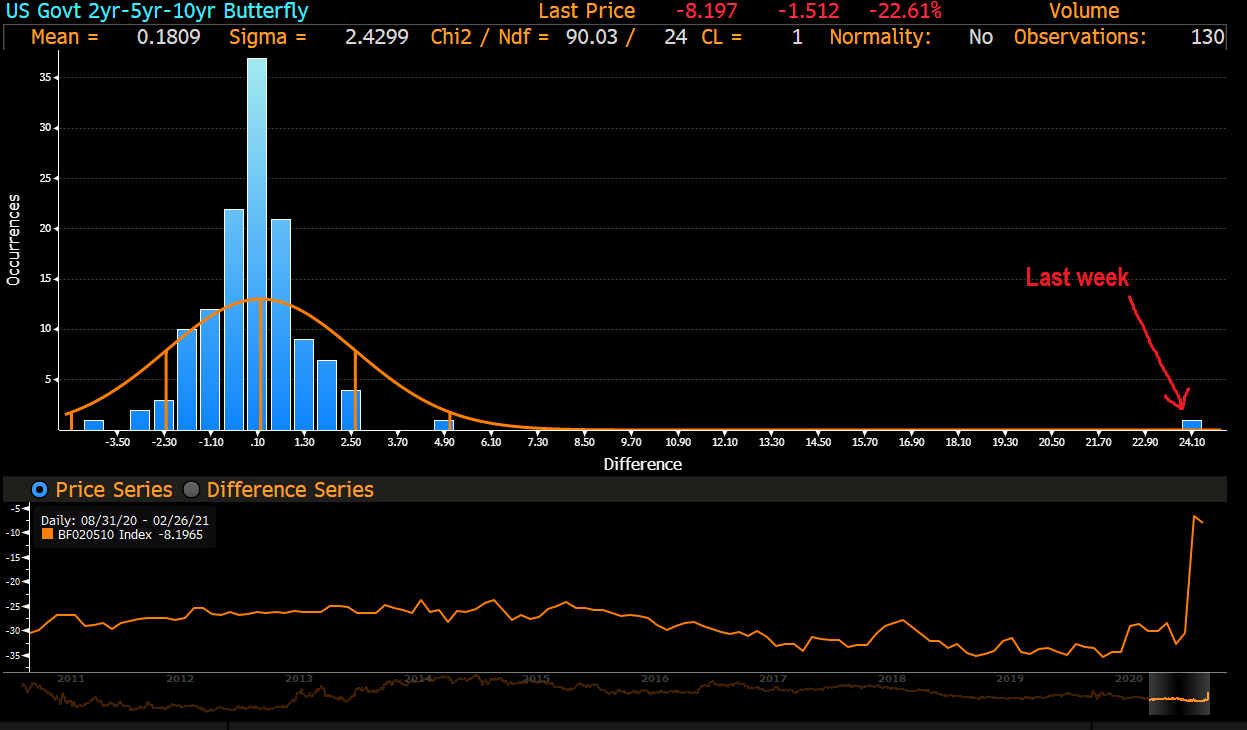

| Trump makes his first appearance since leaving the White House — and teases a comeback. Bond markets are in the spotlight. The Hang Seng Index may be in for a major reconstruction. Here are some of the things people in markets are talking about today. Australian bonds rallied strongly in early Asia trading with investor focus firmly on yields after last week's turmoil. Asian stocks looked set for a muted start. Ten-year Australian yields fell over 20 basis points, paring some of last week's 48 basis point surge. Equity futures were little changed in Japan and Australia. U.S. tech stocks staged a modest rebound on the last day of a tumultuous week as a global bond rout eased. The S&P 500 Index closed lower, while Bitcoin fell below $45,000. Former President Donald Trump rejected the idea of starting a third political party and instead teased the idea of a 2024 run in his first public appearance since leaving office 39 days ago. In a speech to close the Conservative Political Action Conference in Orlando, Florida, Trump rattled off the accomplishments of his term in the White House, repeated his false claim that he won the 2020 election, and added: "Who knows? I may even decide to beat them a third time." In a straw poll, 97% of attendees approved of his leadership of the party, 70% want him to run again and 55% said he was their preferred candidate in 2024. Investors will soon discover if Hong Kong's Hang Seng Index will undertake one of the biggest overhauls in its 51-year history, a move that would impact tens of billions of dollars in funds tracking the stock benchmark. On Monday, Hang Seng Indexes Co. will offer its conclusion after an industry consultation over proposed changes to the city's stock benchmark, which if approved would increase the number of member constituents, cap weightings of individual companies and fast-track new listings. China's economic recovery slowed in February as factories shut during the Lunar New Year holidays and virus restrictions dampened what's usually a busy travel season. The official manufacturing purchasing managers' index fell to a nine-month low of 50.6 from 51.3 in January as export orders plunged, the National Bureau of Statistics said Sunday. That was lower than the median estimate of 51 in a Bloomberg survey of economists. Myanmar saw its deadliest day since the Feb. 1 coup, with the United Nations saying at least 18 protesters were killed in a stark escalation of violence to quell persistent demonstrations against military rule.The deaths came after soldiers and police officers fired live ammunition into crowds in six cities across Myanmar, which also left more than 30 people wounded, UN Human Rights Office Spokesperson Ravina Shamdasani said in a statement on Sunday. Myanmar's government said 12 people died. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayAbout a week ago, I wrote in this very space that it was possible that commodities trading advisors — the trend-following systemic funds known as CTAs — might "take an early or excessive step to position themselves for economic recovery, shedding U.S. Treasuries as a way to balance their portfolios and unexpectedly intensifying selling momentum in the debt." I hope you all were paying attention, because the sell-off in U.S. Treasuries arrived just a few days later. Last week saw the yield on the benchmark 10-year jump from 1.36% to as high as 1.6% before recovering slightly on Friday. There are a few things that point to CTAs as a decisive culprit in the bond market sell-off. JPMorgan's flows and liquidity analysts write that momentum signals for U.S. Treasuries turned bearish on Feb. 16, suggesting "the bond market sell-off has likely been amplified by CTAs as momentum signals shifted." Perhaps the biggest clue is that the sell-off was focused on the five-year U.S. Treasury, which jumped from 0.59% to 0.82%. The 2/5/10-year butterfly — a popular trade involving two-, five- and 10-year U.S. bonds — moved by an astonishing 24 basis points (one of those events which, when measured by standard deviations, is only supposed to happen once in a billion years, etc.). While many have accused mortgage investors (who must dump Treasuries as yields) for exacerbating the sell-off, it's unlikely they would have concentrated their selling on the five-year bond alone. As Bespoke Invest notes: "Mortgage hedgers wouldn't have been so exclusively focused on 5s with other similar maturities available."  Bloomberg Bloomberg What does it matter who drove the bond market turmoil? If the sell-off was driven by market technicals rather than a fundamental repricing of inflation expectations, then it suggests the chaos might be short-lived. As my Bloomberg colleague Stephen Spratt noted over the weekend: "The bond market's divergence from a fundamental backdrop was most evident at the shorter-end of the curve," with eurodollar contracts showing the market suddenly moving from pricing just one rate hike from the Federal Reserve between 2021 and 2023, to as many as four. The good news is that routs driven by trend-following CTAs can stop as quickly as they start, and an unwind of this magnitude looks excessive indeed. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment