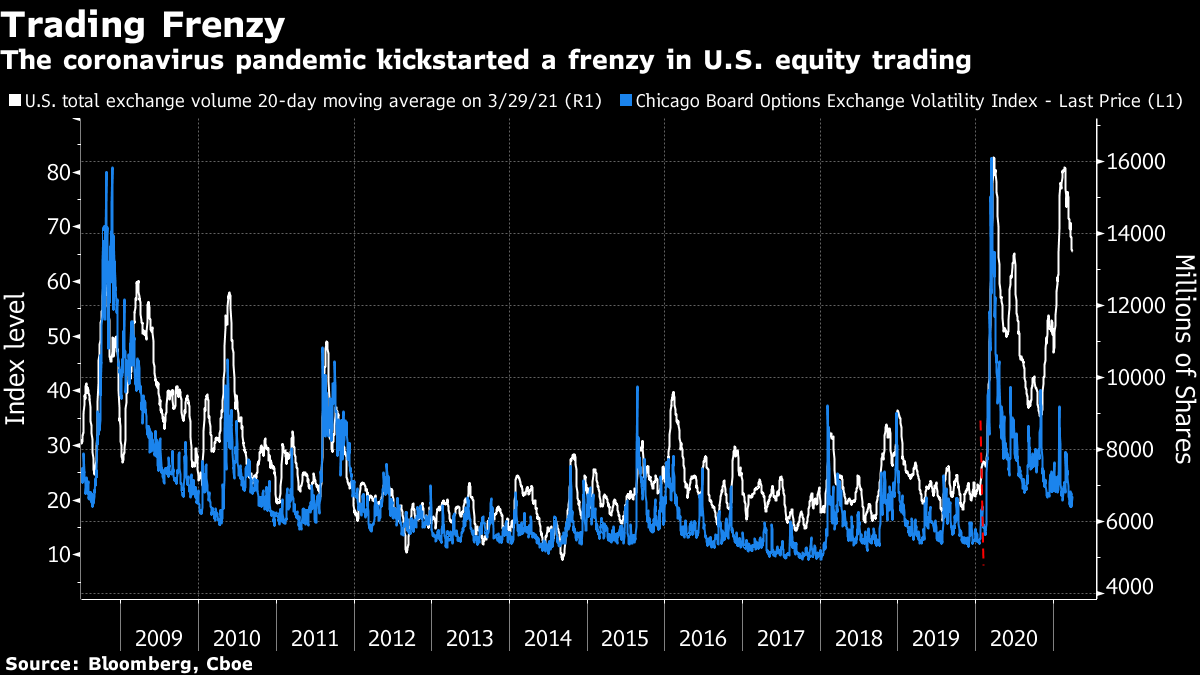

| China's economy edges closer to overtaking the U.S. Family office debacle ends Nomura CEO's bumper first year. The WHO's chief says a study on Covid's origins is too quick to dismiss the theory of a lab leak. Here's what people in markets are talking about today. Japan's biggest bank is one of a growing list of global financial firms to take a hit from the forced unwinding of bets by Bill Hwang's Archegos Capital Management. Nomura CEO Kentaro Okuda's was just days away from his first anniversary in the job when the company warned of a "significant" loss from an unnamed U.S. client. That's tied to the massive unwinding of leveraged bets by Archegos, according to people familiar with the matter. The debacle triggered a record 16% drop in Nomura's shares on Monday, wiping $3.5 billion from its market value and threatening the firm's turnaround. A $2 billion claim on a single client risks largely erasing Nomura's pretax profits for the second half of the year ending March 31, a Jefferies report says. Nomura is far from the only Archegos casualty: Banks may see total losses in the range of $5 billion to $10 billion, according to JPMorgan. Read more on the superrich's love of leverage here, and find a handy glossary to help explain the fiasco here. Most Asian stocks look set to gain on the last trading day of the quarter as investors look to more U.S. stimulus, while wary of upward pressure on bond yields. Rates on the U.S. 10-year benchmark touched a 14-month high. Futures rose in Australia and Hong Kong, and dipped in Japan. The dollar strengthened for a second day and gold slipped below $1,700 per ounce to multi-month lows. Oil halted a two-day rally before the April 1 meeting of OPEC and its allies. China's recovery from the pandemic means it could eclipse the U.S. economy by 2028, two years earlier than expected. In 2000, China's GDP was just 11.8% of U.S. GDP. The country had recently launched a private housing market. Fast-forward to 2012 and China had joined the WTO, launched a huge infrastructure investment drive and Xi Jinping had come to power. With the exception of 2016, when China's currency depreciated in value, the country has made steady gains on the U.S. each year. The coronavirus pandemic is the latest inflection point. China was the only major economy to expand in 2020 and its recovery from the virus meant it increased its share of global output at the quickest pace this century. Experts fear the Tokyo Olympics could trigger a global super spreader event. Organizers have released six "playbooks" detailing how they intend to pull off the world's biggest sporting event safely in the middle of a pandemic. Even with the decision to exclude foreign spectators, more than 60,000 athletes and other essential attendees will converge on Tokyo from more than 200 countries — each with different rates of transmission, vaccination and viral variants. Tokyo has ruled out using two core tenets of containment: quarantines and vaccinations. Without those, experts say infections could spread. Meanwhile, the WHO's chief says a report into the origins of Covid in China was too quick to dismiss the theory of a lab leak. An annual human rights report released by the U.S. State Department accused the Chinese government of "crimes against humanity" and reaffirmed a decision to label the country's treatment of minority Uyghurs in the Xinjiang region as "genocide." The publication signaled continued tensions with China under Biden, who has maintained many of the Trump's hard-line policies against Beijing. With China endorsing a boycott against retailers like H&M and slapping sanctions on organizations, the choice for companies is clearer than ever: Avoid commenting on controversial subjects or risk losing access to the world's second-largest economy. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in todayAcademics have quantified what many have long suspected: Retail investors are punching well above their weight in the stock market. Individual investors had an impact five times the size of their estimated assets in the second quarter of 2020, according to a study from the Swiss Finance Institute. Retail investors added 1% to the aggregate stock market valuation in that period, and 20% to the value of small cap shares, Philippe van der Beck and Coralie Jaunin wrote in a paper published on SSRN, a repository of academic research. The researchers found that despite an estimated share of 0.2% of aggregate U.S. market capitalization, traders on the popular retail trading app Robinhood accounted for 10% of the variation in stock returns in the second quarter of last year, when the rebound from the pandemic selloff began in earnest. That's because the smaller investors react more strongly to price changes than their institutional counterparts.  While the impact of Robinhood traders is concentrated in small-cap stocks and the consumer staples industry, they are also able to affect the price of some large companies held primarily by passive investors, according to the study. The outsized activity of retail investors provided "considerable" liquidity to the U.S. stock market during the crash, but growth in the cohort could lead to a higher level of equity volatility in the future, the study concluded. "If — facilitated by novel fintech solutions — the retail sector continues to grow its wealth share, the extraordinary volatility observed during the pandemic may turn out to be the new normal," the researchers said. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment