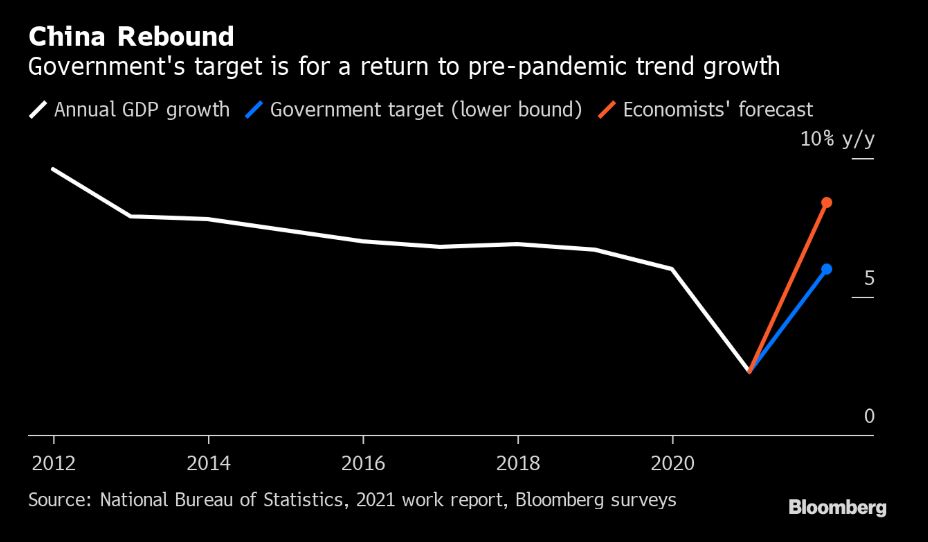

| Biden signs the $1.9 trillion stimulus bill ahead of schedule — stocks surge. A Harvard dropout delivers the largest U.S. IPO since Uber. Here's what people in markets are talking about today. Happy Friday Asia. President Joe Biden signed the $1.9 trillion pandemic-relief bill into law, ahead of schedule so he can promote the benefits of the new law during his prime-time address to mark the one-year anniversary of the day the World Health Organization declared a pandemic. He is planning to announce that he will direct states to ensure all adults in the U.S. are eligible for coronavirus vaccines by May 1. Americans can expect to see their stimulus checks arrive as early as the weekend. Asian stocks looked set to advance Friday, after their U.S. peers surged to an all-time high on the passing of Washington's $1.9 trillion stimulus package. Futures pointed to modest gains in Japan, Australia and Hong Kong. In the U.S., tech shares led a broad-based rise that drove the S&P 500 to an historic close. The Nasdaq 100 Index rebounded more than 2% from losses that took it 11% below its February record. Key bond sales went smoothly, easing concerns about another possible spike in yields. The 10-year Treasury benchmark pared an increase after an auction of 30-year notes. E-commerce giant Coupang delivered the biggest U.S. initial public offering since Uber and then rose to become — albeit briefly — a $100 billion company in its trading debut. It's Korea's largest listing and the biggest by an Asian company on a U.S. exchange since Alibaba. While it's still loss-making, revenue almost doubled last year as the pandemic boosted online shopping. The company handpicked fewer than 100 investors to participate in its IPO, a rare move that shut out many potential shareholders from getting in on the action. Read more about how the Harvard dropout behind Coupang rose up to join the billionaires' club. As Biden seeks to shore up ties with allies in Asia, he's reshaping the message to avoid spooking them about U.S. intentions when it comes to China. Australia, Japan and India all fret about Beijing's expanding economic and military heft, but they're wary of being pulled into an anti-China bloc, especially given their trade ties. Meanwhile, the U.S. and China laid out differing expectations for their first date next week, when Secretary of State Antony Blinken and National Security Advisor Jake Sullivan will come face-to-face with their Chinese counterparts in Alaska. It seems both want to avoid looking weak while navigating the complex international superpower dating game. The posturing illustrates the high stakes for a meeting that could set the tone for the world's most important diplomatic relationship. Chinese money is always seeping into foreign countries via various loopholes, despite explicit rules that forbid citizens from using any of their $50,000 annual foreign exchange quota to directly purchase offshore property or securities. There's barely a global asset that isn't touched by Chinese money, from the latest hot Hong Kong IPO to luxury apartments in Vancouver. Despite the rules and associated risks, for ordinary middle-class families exploiting these loopholes is all about making money, while for the rich it's about protecting empires. Some would argue finding ways around the rules is something of a national pastime. These are just some of the tactics people are employ to shift their cash out of China. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todaySo China's biggest political gathering of the year has ended with a new target for economic growth and a raft of new policies aimed at getting there. It's clear that China is pursuing a very different type of stimulus than places like the U.S., where Joe Biden just signed a $1.9 trillion economic recovery bill that includes direct $1,400 payments to Americans. It's a curious state of affairs. China has long talked of rebalancing its economy towards consumption and the Covid-19 crisis would in theory present the perfect opportunity to do that, and yet Beijing has so far appeared reluctant to undertake policies that would actually boost people's incomes. So why does China find it so difficult to do demand-side policies? I asked this question to long-time China watcher Michael Pettis, a Finance Professor at Peking University and Senior Fellow at the Carnegie-Tsinghua Center, in an Odd Lots podcast released this week. He points to China's political incentives and institutional framework as being perhaps underappreciated roadblocks in boosting domestic consumption. "Some people argue that china has really never developed an institutional framework for doing that. For 40 years the only thing it's really known how to do is boost the supply-side." In other words, you can say "we're going to rebalance," but actually doing so is pretty difficult when your entire political-economy has been built around supply-side policies.  Bloomberg Bloomberg By Pettis's estimates, Chinese households' current share of GDP sits at about 50%. In other countries, it's closer to 70% or 80%. Boosting households' share of GDP would therefore mean decreasing the share of businesses and government, and that's clearly a politically-sensitive undertaking. As Pettis put it in a Twitter follow-up on Thursday: "For reforms not to be politically disruptive, they must fit into existing institutions, and they must evolve in ways that do not threaten current relations of political and economic power." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment