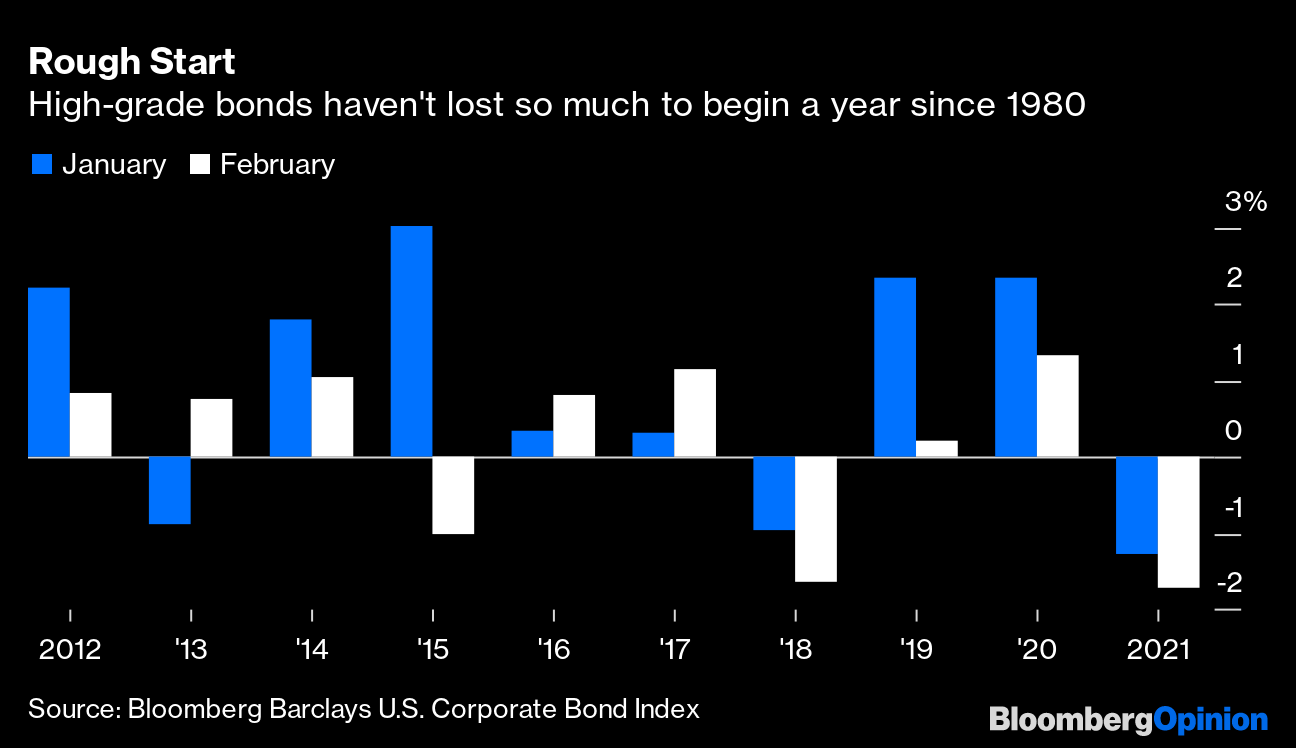

| This is Bloomberg Opinion Today, a supply-chain finance company of Bloomberg Opinion's opinions. Sign up here. Today's AgendaHow Greensill Was My ValleyMaybe the four private jets alone should have told us something was up. Financial history is littered with predictable blowups: the dot-com bust; the housing crisis; and, still in early development, the coming collapse in carbon-belching cryptoart. Lex Greensill is not as well-known as those things, but he is, or was, extremely wealthy and is also in the middle of a very expensive blowup touching banks, companies and investors around the world. With the help of more-famous people such as Masa Son and David Cameron, he had been moving fast and breaking things in the sleepy business of supply-chain finance, which at its simplest is lending money to companies to pay their invoices on time. Greensill added enough complexity — including bundling his loans into securities — to pay for not one, not two, not three, but four private jets. As mentioned, his blowup is very expensive, but it was also very predictable, writes Elisa Martinuzzi. Regulators in the U.K. and Germany had been furrowing their brows over Greensill's business model for months, and some even advanced to ominous throat-clearing and finger-raising. But none really took action before it was too late, a pattern that is by now depressingly familiar. Greensill himself should have seen this coming, as Chris Bryant has written: He had become too reliant on credit insurance, which he knew was an unreliable crutch. His business had also become dangerously concentrated on one client, metals magnate Sanjeev Gupta, who in turn relied too much on Greensill for financing. You might say this is just healthy creative destruction and private-jet redistribution; fun to read about, but nothing much to worry about. But there are also thousands of real jobs on the line. And maybe there's a cautionary tale here, of bigger blowups to come. Judging Biden's Relief BillFor the past week or so, people on Twitter have been finding Easter eggs in the massive Covid relief plan President Joe Biden just signed into law. For example, did you know the bill means COBRA payments are covered through September? We're still unpacking an Amazon warehouse worth of goodies, a process that could go on for months before we even begin to figure out if it's working. For now, the thing's sheer size is what most people are focusing on — always a risk when something costs $1.9 trillion. But Tim O'Brien and Nir Kaissar write that complaints about the bill's bulk miss the point entirely. It rivals wartime spending because we are at war, against a deadly pandemic and its devastating economic effects. Worries this might trigger inflation are purely speculative and may misdiagnose the causes of stagflation of the 1970s. Michael R. Strain is someone who has warned the package will cause inflation and backfire by forcing the Fed to tighten policy too early. He writes he's watching prices, inflation expectations and job gains, among other metrics, to see if his fears become reality. Further Biden-Bill Reading: You Could Use a VacationDespite, or maybe because of, all the viral videos we've seen of people refusing to wear masks on airplanes, Americans really have not been all that much into traveling over the past year. That's about to change. Vaccinations and falling case counts have Americans actively making vacation plans en masse for the first time in a year, Sarah Halzack writes. But though some of us are already starting to make out in restaurant bathrooms, most of us will still want hotels to at least pretend like they're keeping rooms nice and Covid-free for us. What we could all use a vacation from is constantly judging other people's Covid mistakes, writes Sarah Green Carmichael. It's exhausting and does us no good to stay angry with, say, people who wear their masks like this:  Further Pandemic Reading: Don't freak out about reports of blood clots from the AstraZeneca vaccine. — Sam Fazeli Telltale ChartsAside from aerospace, which makes planes nobody has wanted to fly in, the factory sector has held up fairly well throughout this pandemic. And now the end of the nightmare could mean booming factory business all around, writes Brooke Sutherland. Even for plane-makers.  The investment-grade corporate bond selloff hasn't really been bad, and an economic recovery will help these companies, writes Brian Chappatta.  Further ReadingGulf states are getting one last oil boom. They should use it to prepare for a future without oil booms. — Karen Young The rotation out of FANGs is creating opportunities for stock pickers to finally shine again. — John Authers Consider alternative investments if the 60/40 stocks/bonds portfolio won't cut it for a while. — Mark Gilbert The IRS must delay the tax filing deadline again this year. There's too much confusion around stimulus bills. — Alexis Leondis ICYMIItaly is locking down again. Mar-a-Lago is now the GOP's center of gravity. Elizabeth Holmes is pregnant. Gautam Adani is getting richer faster than Jeff Bezos or Elon Musk. KickersYou're not losing it; science explains why you sometimes forget why you entered a room. Massive asteroid to buzz Earth this month. (h/t to Ellen Kominers for the first two kickers) That's just great, man: glow-in-the-dark sharks. Scientists are just starting to understand a 2,000-year-old calculator they found in the sea. Hockey goalies are too big now. Notes: Please send calculators and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment