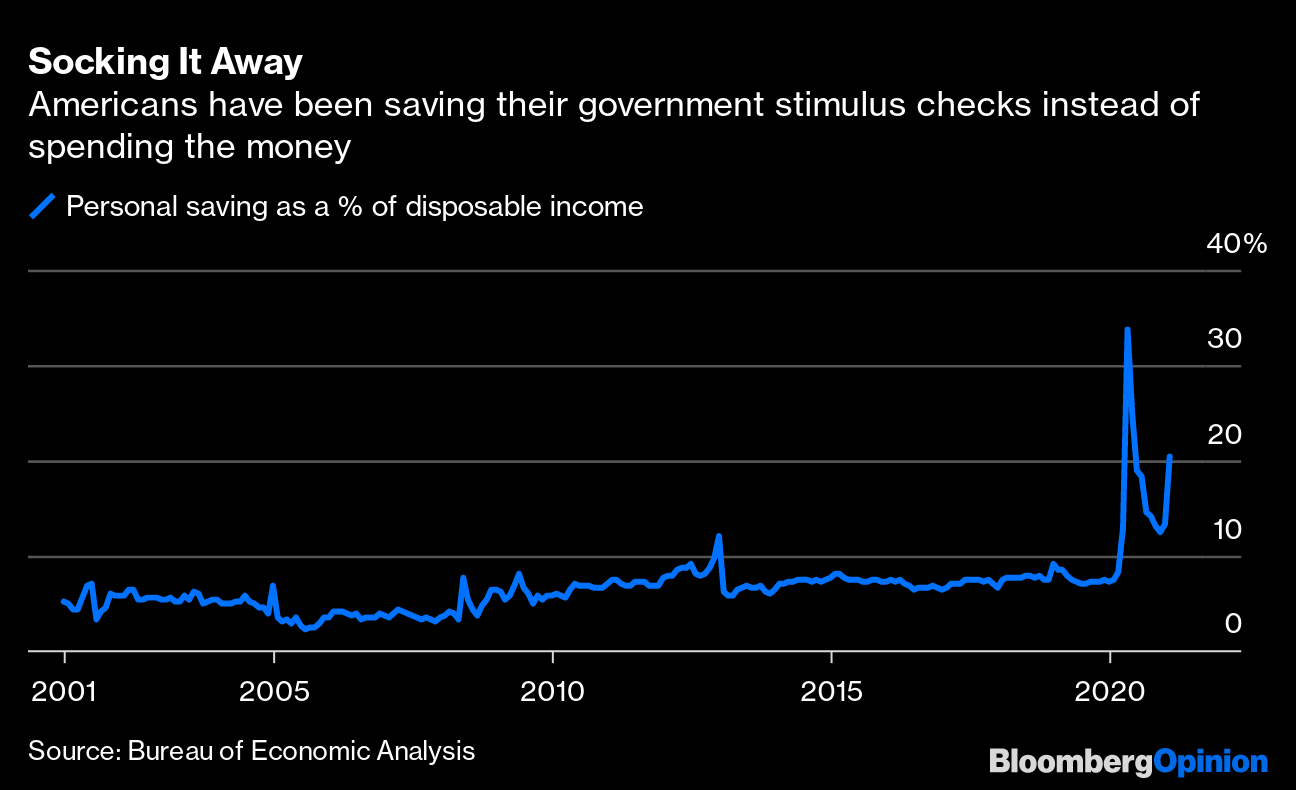

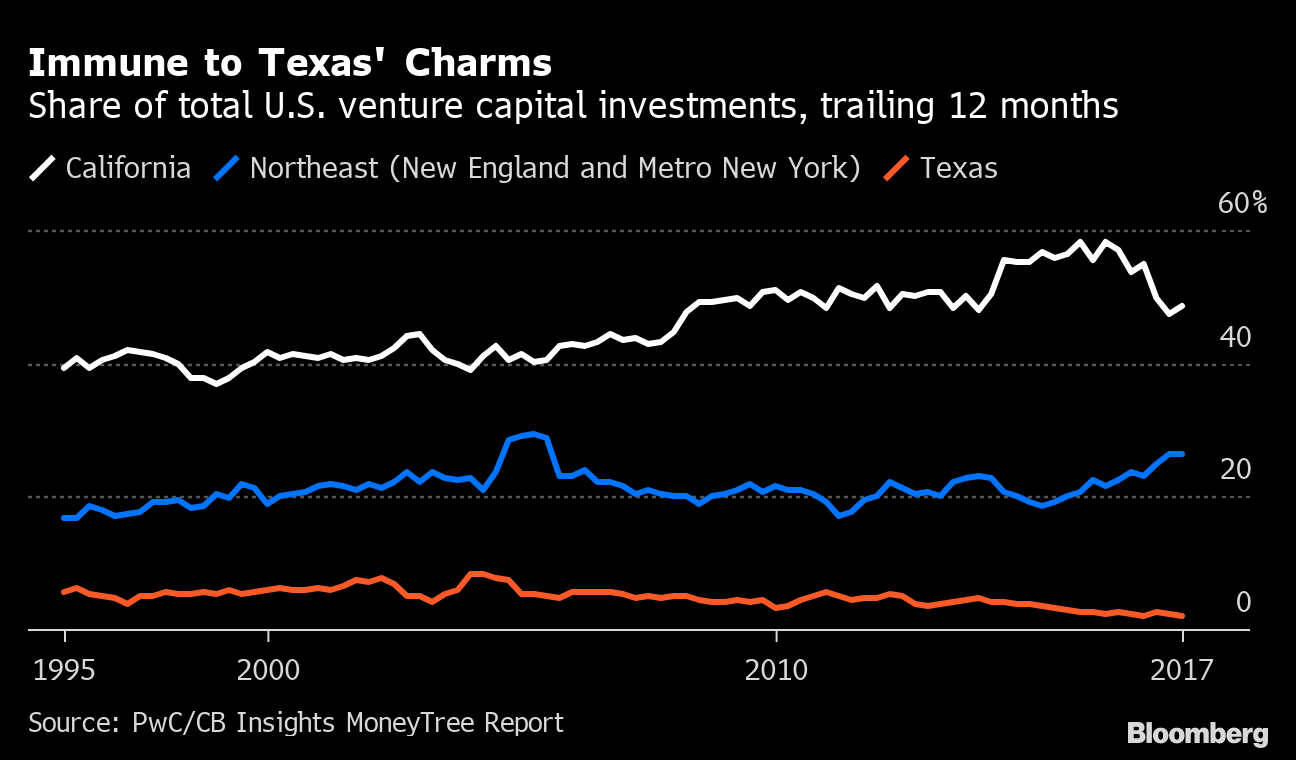

| This is Bloomberg Opinion Today, a price index of Bloomberg Opinion's opinions. Sign up here. Today's AgendaInflation Watch! Or, Still No InflationThe House today passed the final, Senate-approved version of the $1.9 trillion Covid relief package, and President Joe Biden will sign it into law on Friday. The only question now is: How long until the crash? We kid, but some market observers understandably fear the bill — coming on top of gazillions of dollars in relief that has already been passed and alongside a Fed with its foot firmly on the gas pedal — will trigger apocalyptic inflation. Michael R. Strain warns it could force the Fed to not only ease up on the gas but also throw the car abruptly into reverse, flinging low-wage workers from the vehicle. The stock market is definitely pricing in the reflation part, writes John Authers, by rotating briskly away from companies that thrived in our low-price, low-leaving-the-house recent past. And it's such a lumbering, dimwitted dinosaur that it still hasn't fully registered the pain being delivered to its extremities by the raptor-like bond market. But the mythical inflation T-Rex many have feared for the past 20 years is not yet making any water glasses shake. The latest consumer price index was as anemic as ever. This is a lagging indicator. But it's possible the glut of global savings that has locked inflation securely in its paddock for a generation will just keep doing that job, writes Gary Shilling. Vaccinated American consumers, meanwhile, might blow some of their extra cash on Disneyland, the movies, apple-bobbing and the like. But they may also keep stashing the bulk of it in savings or using it to pay down their towering debt loads.  Forget the crash; we might not even get the high. Relief Bill to Save Restaurants, If Not BipartisanshipSome also worry the purely partisan nature of the relief bill, which got zero (0) Republican votes, means Biden has blown his shot to craft future bipartisan compromises for the good of the country. Jonathan Bernstein posits that maybe this display of muscle in service of a popular bill will actually make some Republicans more likely to compromise. And if that's not the case, then Biden lost nothing anyway. The bill should at least be a hit with restaurants and people who like to eat safely inside of them, writes Joe Nocera. In last December's stimulus bill, the former president and his Republican-controlled Senate tossed out direct financial relief for restaurants in favor of a break on three-martini lunches, which were not, and continue to not be, a thing. The new bill finally gives the restaurants that have survived this pandemic so far hope of making it to the end. These Threats Never Went AwayWhenever the Covid nightmare begins to fade, we'll still have plenty of other deadly scourges to confront, some of which have only gotten worse while we were distracted. The opioid crisis — which has killed roughly as many Americans in 21 years as Covid killed in one — got even grimmer last year, as addicts lost support networks and dangerous fentanyl circulated more widely. Biden and Congress must do more to confront this old plague, Bloomberg's editorial board writes, and states should use some of their opioid settlement money to help, too. Meanwhile, air pollution kills far more than Covid and opioids ever will, writes Tyler Cowen: possibly 10 million people globally each year. Though pandemic lockdowns briefly improved air quality last year — nature healing and all that — the relief didn't last long. Telltale Charts Texas is starting to steal business from California, but if it wants this trend to continue, Noah Smith writes, it must upgrade its power grid and its universities and liberalize its housing market, for starters.  Netflix has a mountain of intellectual property but isn't mining it nearly enough for cash, writes Tara Lachapelle. It should take a note from Disney, HBO and others and turn to merchandising. I for one would be glad to return to work with a "The Crown" lunchbox.  Further Reading GE's sale of its jet-leasing business simplifies the company but also leaves it less room for error. — Brooke Sutherland The Fed's in a jam about whether to extend last year's exemptions on bank capital requirements. — Brian Chappatta The ECB must buy bonds more aggressively or risk rising rates getting out of control. — Marcus Ashworth Libor is taking its sweet time dying, and regulators can't let it linger forever. — Mark Gilbert With new election rules, China keeps making Hong Kong increasingly less democratic. — Clara Ferreira Marques The royal family can't stay silent about accusations of racism. — Therese Raphael ICYMIThe U.S. tax code is racist. Merrick Garland will be the attorney general. European travel this summer is not impossible. Some Wall Streeters are ready to come back from Florida. KickersFujitsu builds the world's fastest supercomputer. (h/t Scott Kominers) How the pandemic has changed baby names. Update: Extinct Tasmanian tiger actually still extinct. Two words: COCAINE BEAR. That's right: cocaine bear. Notes: Please send baby names and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment