| This is Bloomberg Opinion Today, a block — and also a chain — of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Megan Thee Stallion, who has a Grammy but not yet a coin. Photographer: Kevin Winter/Getty Images North America How Do You Solve a Problem Like Bitcoin?Let's say you run a sovereign nation that has the world's biggest economy and the world's reserve currency to boot, but one day a rival arises. Let's call it MeganTheeStallionCoin. It promises to do away with fusty old dollars like yours by being unregulated and secured by something called "the blockchain," which burns the annual energy consumption of a large Texas family every hour. It also disappears forever if you lose your password, and you'd never use it as actual currency because the MeganCoin you spend on a pizza today could be worth $60,000 tomorrow. But people ignore all that in hopes of making $60,000 and also it's endorsed by not only Megan Thee Stallion but Elon Musk. Do you: - Say, "Oh well, money had a good run," and convert all your sovereign debt into MeganCoin;

- Use the mighty fist of the state to crush MeganCoin, its users and all other cryptocurrencies like it; or

- Create your own competing digital coin that solves not only most of MeganCoin's problems but also the drawbacks of your own currency that made people turn to MeganCoins in the first place.

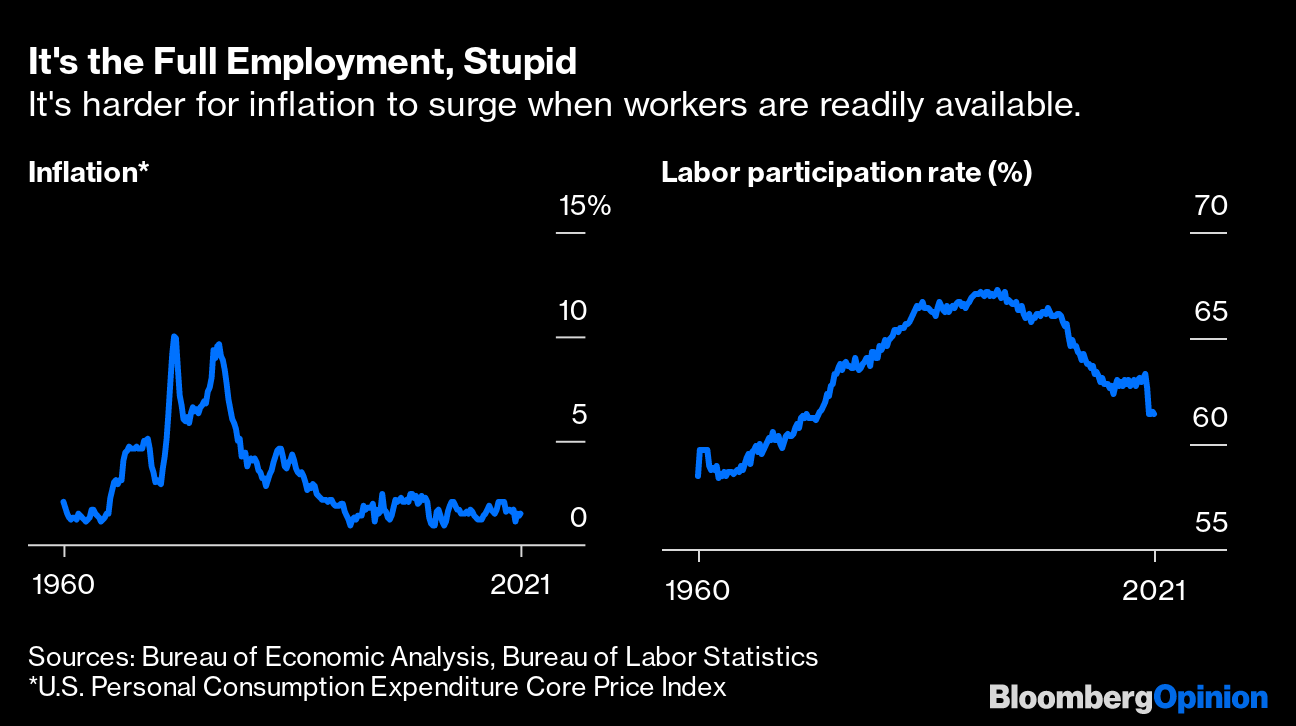

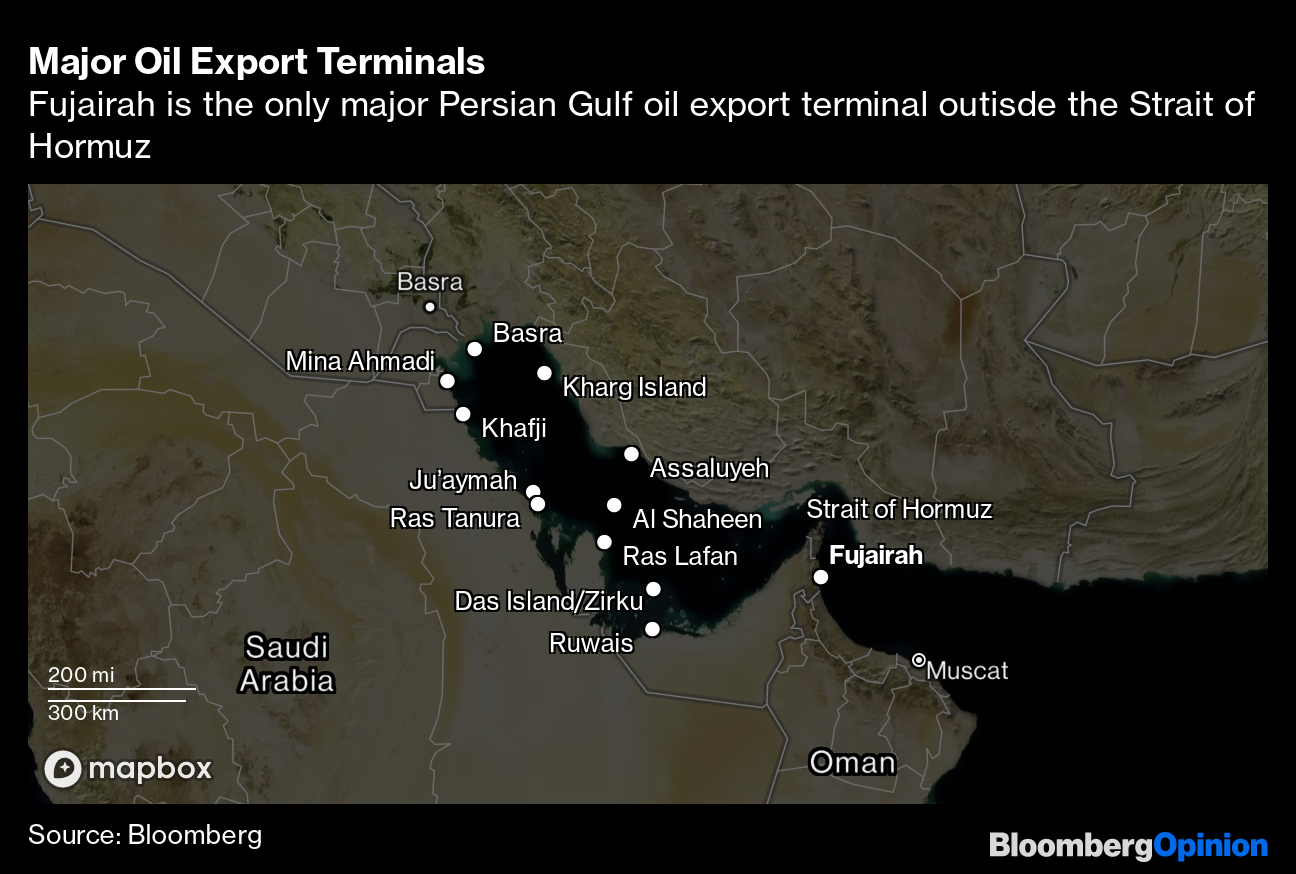

If you chose "c," then you're thinking like Bloomberg's editorial board. It suggests the U.S. Federal Reserve and other central banks respond to the crypto eruption by mostly letting people have their BitFun but then using what it learns from crypto to create digital rivals that don't fluctuate wildly, ruin the planet or leave people digging through landfills for lost millions. There would be risks, including that of government spying and a whole payments industry going up in smoke. But those can be managed, and the upside could be a truly secure and global digital payment system with, uh, JayPowellCoin at its heart. JanetYellenCoin? The name still needs some work. Read the whole thing. Further Free Advice for Financial Regulation Enthusiasts: Pick Your Post-Covid Poison: Taiwan War, Measles or InequalityEverybody assumes the pandemic's end will bring one long V-E Day-style orgy of communal drinking, loud group singing and public displays of affection. But the world doesn't stop manufacturing new horrors just because we're done with the current one. Even as we speak, the risk of armed conflict between China and the U.S. over Taiwan is growing, warns Max Hastings. Beijing has become increasingly belligerent on the subject, and President Joe Biden faces a dilemma: how to make a full takeover of the island painful and difficult without triggering a world war. Meanwhile, all the masking and social-distancing we've done to slow Covid-19 has also kept a more-virulent disease, measles, in check, writes Mark Buchanan. Even as we wind down the fight against Covid, we must ramp up global vaccinations for measles, or risk a new pandemic that's as deadly as this one. And though massive Fed stimulus and fiscal relief have prevented a depression and kept many people out of poverty, Mohamed El-Erian warns the Covid recession has widened already yawning economic inequalities, setting the stage for many more crises if unaddressed. Further Crisis Reading: Hong Kong is quarantining babies in a nonsensical reaction to a Covid outbreak. — Anjani Trivedi Do We Really Want to Raise Taxes?Biden's next trick after passing a $1.9 trillion Covid relief bill is an even bigger infrastructure bill, and he's apparently planning major tax hikes on the wealthy to help pay for it. This might win over those such as Joe Manchin who say they're worried about the federal debt. But it's exactly the wrong way to fund infrastructure improvements, writes Noah Smith. The government should borrow while it's cheap to bolster future growth, which makes paying debts easier. Boosting the economy's potential will probably help markets better digest massive debt, writes Lena Komileva. Beyond how you pay for infrastructure, though, there's the problem of what you can actually build, warns Matthew Yglesias. It's a dilemma that has ruined Infrastructure Weeks for many past presidents, as knotty conflicts and hidden costs frustrated big plans. At least some of our infrastructure problems may be solved locally, thanks to a relief bill that has put tons of cash in the pockets of state and local governments. Their fiscal troubles hurt the recovery from the Great Recession, Brian Chappatta notes, but now they've got the money to keep building, hiring and avoiding default. Further Tax-and-Spend Reading: Telltale ChartsDespite 40 years of worry, inflation keeps not being a problem, notes Matthew Winkler.  The UAE keeps breaking with OPEC, most recently on letting customers resell its oil. It's a bad sign for the cartel's future cohesion, writes Julian Lee, and evidence the UAE hopes to use its well-placed Fujirah port to make its oil more important to Asia.  Further ReadingThe West should help Turkey end Syria's civil war. — Recep Tayyip Erdogan How Dianne Morales would run New York. — Howard Wolfson Elon Musk declaring himself "Technoking" is just the latest sign not all is normal at Tesla. — Liam Denning Big ad agencies must respond to a crackdown on consumer data they get from Apple and Google. — Alex Webb David Solomon's Goldman Sachs treats its bankers less like assets. — Matt Levine Foxconn could still salvage its Wisconsin plans by shifting to making electric cars. — Tim Culpan During Women's History Month, remember the inventions that gave women more time and freedom. — Virginia Postrel ICYMIPeople are yelling at banks about not getting stimulus checks. Better Covid vaccines may be possible. The IRS has failed to collect $2.4 billion from millionaires. KickersZoo animals seem glad visitors are back. (h/t Ellen Kominers) Meet all the species that have come back from near-extinction. (h/t Scott Kominers) Scientists want to store DNA in tubes on the Moon, just in case. (h/t Mike Smedley) People are stealing NFTs. Notes: Please send NFTs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment