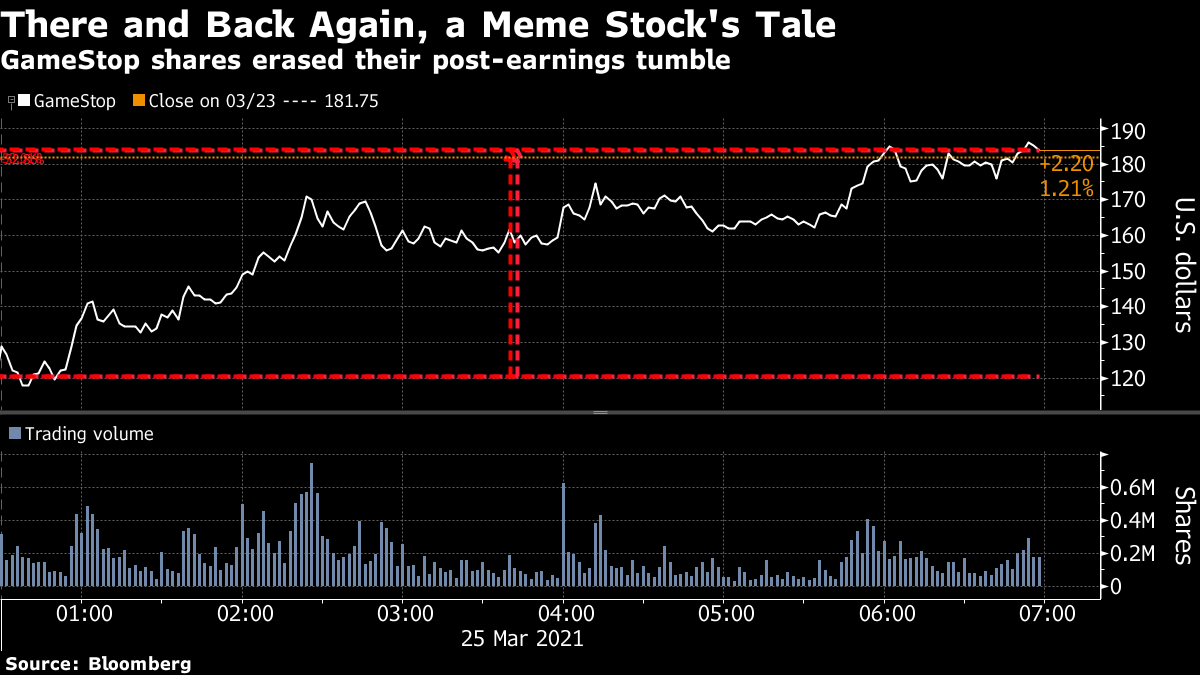

| Container ships consider Suez Canal alternatives as the Ever Given remains stuck. Biden sets out his position on China and North Korea. South Korea's chip industry is caught between two economic powers. Here's what people in markets are talking about today. Happy Friday Asia. At his first news conference since becoming U.S. president, Joe Biden promised to outspend China on innovation and infrastructure to help the U.S. retain its place as the world's most powerful country. He also said he's open to diplomacy with North Korea but warned that recent missile tests could prompt a response if Pyongyang continues. On the domestic front, he promised a new paradigm for America's middle class, set a goal of administering 200 million Covid-19 vaccine doses by the end of April — doubling the existing target for his first 100 days in office — and topped it all off with plans to run for re-election in 2024. The big ship is still stuck in the Suez Canal. The Ever Given showed no signs of budging for a third day, forcing other container vessels to weigh costly and time-consuming voyages around Africa that threaten to destabilize the already fragile underpinnings of global trade. A back-of-the-envelope calculation shows there's about $9.6 billion worth of daily marine traffic halted, with about about 185 vessels waiting to transit the waterway, data compiled by Bloomberg show. A super suction dredger is the new tool being used in the efforts to dislodge the Ever Given. Meanwhile shipping rates are surging and the crisis may be about to hit your coffee. Asian stocks look set to climb following U.S. gains, with equity futures pointing higher in Japan, Hong Kong and Australia. Oil reversed its rally as crews intensify efforts to clear the Suez Canal. U.S. equities are again eying record highs as investors assess progress in the fight against Covid-19 and the risks of inflation as heavy stimulus boosts growth. U.S. data Thursday showed a bigger-than-forecast drop in weekly jobless claims. U.S. 10-year yields rose only slightly after another lackluster auction of seven-year notes, and Bitcoin fell as much as 6.7%, to trade below $53,000. As Washington and Beijing square off over technology, South Korea is stuck in the middle. The semiconductor powerhouse has long relied on the U.S. for security and on China for trade, but with chips at the heart of the conflict between the world's two biggest economies, its geopolitical balancing act is becoming increasingly untenable. South Korea's advanced semiconductor industry is witnessing soaring global demand as consumer electronics sell out during the pandemic, with exports by Samsung and SK Hynix leading what is shaping up to be the strongest quarter of economic growth since 2018. The downgrade of a major Chinese property firm is deepening investor concern about the country's debt-laden real estate sector. Yuzhou Group's dollar bonds have plunged and its shares spiraled into the longest streak of losses in nearly a decade. Declines accelerated after a company profit warning and Moody's Investors Service cut its rating on the firm, citing funding concerns. Property developers are most likely to be affected by a fresh government drive to deleverage: A debt binge has been a driver of rising house prices and signs of stress with be a concern to regulators keen on reining in excessive credit. Corporate defaults soared to what could be a monthly record of 32.4 billion yuan ($5 billion) in March. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayPeople tend to think of the crypto market as being on a path towards something like the stock market. Sure, it's fragmented now, with volatile moves and what can be huge spreads between different regions or platforms. But as more people get into the market, the expectation is that liquidity will improve and a lot of these growing pains will get arbitraged out. In other words, the market will mature and become closer to equities. But what if stocks are on a path towards being more like crypto?  It's a point brought up by Sam Bankman-Fried in a forthcoming episode of the Odd Lots podcast. He points out that trading in meme stocks looks a lot like trading in lesser-known cryptocurrencies: It can be pretty arbitrary, and is mostly based on gauging interest and excitement. We saw exactly that type of behavior this week with GameStop. The company missed earnings estimates and its shares dropped by 34% on Wednesday. By Friday, however, that drop had been completely erased by a 53% rebound. Despite lackluster earnings and little in the way of near-term catalysts, retail investors still like the stock. In that sense trading something like GameStop is a lot like trading a random token. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment